Press release

Booming CAGR 0f 55.23% | P2P Lending Market is Projected to Reach $558.91 billion by 2027 - LendingClub, Funding Circle, Prosper Marketplace

Latest released the research study on Global P2P Lending Market, offers a detailed overview of the factors influencing the global business scope. P2P Lending Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the P2P Lending. The study covers emerging player's data, including: competitive landscape, sales, revenue and global market share.The current market players are adopting various strategies, such as strategic alliances, to expand their regional footprint in growing economies. Major Players in This Report Include: LendingClub Corporation (United States), Funding Circle Limited (United Kingdom), Prosper Marketplace, Inc. (United States), Daric (United States), Social Finance, Inc. (United States), Zopa Limited (United Kingdom) , Avant, Inc. (United States), onDeck Capital, Inc. (United States), RateSetter (United Kingdom) , Kabbage, Inc. (United States),

Note: This content doesn't contain all the Information of the Report please fill the form (via link) and get all interesting information just one click in PDF with the latest update with chart and Table of Content

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/34384-global-p2p-lending-market

Keep yourself up-to-date with latest market trends and changing dynamics due to COVID Impact and Economic Slowdown globally. Maintain a competitive edge by sizing up with available business opportunity in P2P Lending Market various segments and emerging territory.

P2P Lending Market Overview:

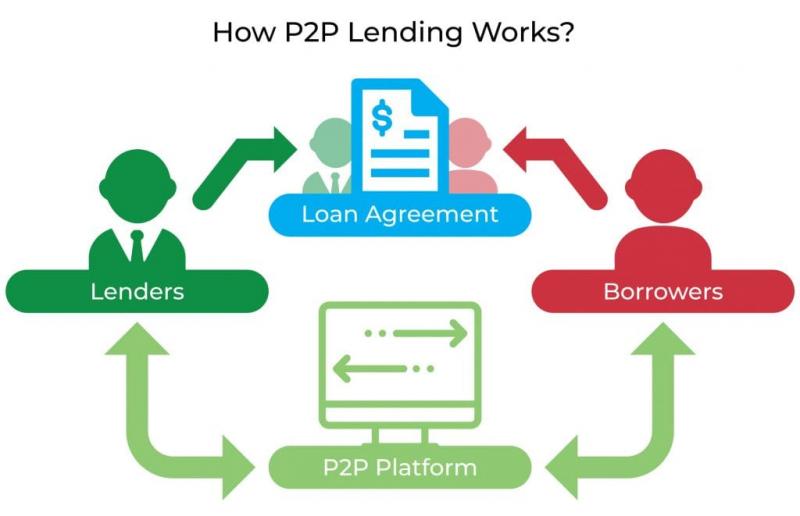

P2P lending is referred to peer-to-peer lending, is the process of giving money or lending money for a particular instance to businesses or individuals through online services. Prosper, SoFi, Funding Circle, Peerform, and Upstart is the popular website for P2P lending. The P2P lending services are more transparent and cheaper as compared to the traditional process. Growing demand from developing economies due to low market risk & operating cost and high transparency between lender and borrower in P2P lending system due to technical advancement is the major driver for the market. Additionally, the rising trend in investing and digital technologies and rising awareness of P2P lending across the globe is supplementing overall growth of the market. However, strict government regulation & risk of losing all money and lack of awareness regarding benefits associated with P2P lending is limiting the growth of the market. Moreover, burgeon number of startups globally may increase the usage of peer to peer lending platforms.

P2P Lending Market Segmentation: by Interest Rate (4.99 percent, 5.22 percent, 5.77 percent, 7.78 percent, 11.49 percent, 13.48 percent, 11.74 percent, Others), Business Model (Alternate Marketplace Lending, Traditional Lending), Loan Type (Personal Loans, Auto Loans, Business Loans, Mortgages and Refinances, Student Loans, Bad Debt Loans, Medical Loans), End User (Lenders, Borrowers)

Market Trend:

• Millennials have been attracted towards P2P Lending Services due to rising Trend in Investing and Digital Technologies

Market Drivers:

• Growing Demand from Developing Economies due to Low Market Risk and Operating Cost

• High Transparency between Lender and Borrower in P2P Lending System due to technical advancement

Challenges:

• Lack of Awareness regarding Benefits Associated with P2P Lending

Make an Enquiry for Customization@: https://www.advancemarketanalytics.com/enquiry-before-buy/34384-global-p2p-lending-market

LET US HELP YOU!

• What are the Known and Unknown Adjacencies Impacting the P2P Lending Market?

• What will your New Revenue Sources be?

• Who will be your Top Customer; what will make them switch?

• Defend your Market Share or Win Competitors

• Get a Scorecard for Target Partners

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Strategic Points Covered in Table of Content of Global P2P Lending Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the P2P Lending market

Chapter 2: Exclusive Summary – the basic information of the P2P Lending Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges of the Algorithm Trading

Chapter 4: Presenting the P2P Lending Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the P2P Lending market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

finally, P2P Lending Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology:

The primary sources involves the industry experts from the Global P2P Lending Market including the management organizations, processing organizations, analytics service providers of the industry's value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/34384-global-p2p-lending-market

Analytical Market Highlights & Approach:

Report provides the rigorously studied and evaluated data of the top industry players and their scope in the market by means of several analytical tools. The analytical tools such as Porters five forces analysis, feasibility study, SWOT analysis, and ROI analysis have been practiced reviewing the growth of the key players operating in the market.

What benefits does AMA research study is going to provide?

- Latest industry influencing trends and development scenario

- Open up New Markets

- To Seize powerful market opportunities

- Key decision in planning and to further expand market share

- Identify Key Business Segments, Market proposition & Gap Analysis

- Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@advancemarketanalytics.com

Connect with us at

https://www.linkedin.com/company/advance-market-analytics

https://www.facebook.com/AMA-Research-Media-LLP-344722399585916

https://twitter.com/amareport

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enable clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Booming CAGR 0f 55.23% | P2P Lending Market is Projected to Reach $558.91 billion by 2027 - LendingClub, Funding Circle, Prosper Marketplace here

News-ID: 2257974 • Views: …

More Releases from AMA research & Media

Fortified Wine Market is set for a Potential Growth Worldwide: Excellent Technol …

Advance Market Analytics published a new research publication on "Global Fortified Wine Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Fortified Wine market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Healthcare Financial Analytics Market Giants Spending Is Going to Boom | IBM ,Or …

Latest released the research study on Healthcare Financial Analytics Market, offers a detailed overview of the factors influencing the global business scope. Healthcare Financial Analytics Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Healthcare Financial Analytics. The study covers emerging player’s data,…

Organic Rice Market Will Hit Big Revenues In Future | Doguet's Rice ,Randallorga …

Latest released the research study on Organic Rice Market, offers a detailed overview of the factors influencing the global business scope. Organic Rice Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Organic Rice. The study covers emerging player’s data, including: competitive landscape,…

Commercial Credit Cards Market Is Booming So Rapidly | Top Players - Comdata ,BM …

Latest released the research study on Commercial Credit Cards Market, offers a detailed overview of the factors influencing the global business scope. Commercial Credit Cards Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Commercial Credit Cards. The study covers emerging player’s data,…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…