Press release

Global Debt Financing Market Growth and Industry Analysis Post Covid-19 Pandemic (2021–2027) Barclays Bank PLC, CREDIT SUISSE GROUP AG

Latest Published Report by Allied Market Research Titled,”Debt Financing Market by Sources (Private, and Public), Types (Bank loans, Bonds, Debenture, Bearer bond, and Others), Duration (Short-Term, and Long-Term): Global Opportunity Analysis and Industry Forecast, 2020–2027”.The report offers an extensive debt financing market analysis focusing on key growth drivers, key market players, stakeholders, and forecast of revenue based on past data. This helps the existing as well as potential market players in framing long term profitable strategies. It provides detailed analysis with presentable graphs, charts and tables.

Download Free Sample PDF Including COVID19 Impact Analysis (Graphs, Charts and Tables) @ https://www.alliedmarketresearch.com/request-sample/6657

The latest news related to industry developments in terms of market expansions, acquisitions, growth -strategies, joint ventures, collaborations, product launches, market expansions etc. are included in the report for the better understanding of the stakeholders in framing strategic decisions to gain long term profitability and market share.

Major Key Players Profiled in the Report:

Bank of America Corporation, Royal Bank of Canada, Citigroup, Inc., Barclays Bank PLC, CREDIT SUISSE GROUP AG, Deutsche Bank AG, Morgan Stanley, Goldman Sachs, JPMorgan Chase & Co., UBS

Segmental Analysis:

In the report, the debt financing market is divided into various segment, which makes the analysis efficient and easily understandable. The report offers an in-depth insight for each segment in the debt financing industry. Segregating the large problem into smaller parts makes it easy to solve even the complex problems. Similarly, to analyze the debt financing market effectively and efficiently. The related graphs and data tables have made the analysis much impactful and easily understandable. The interested parties can surely rip the benefits of the report on the debt financing market.

Highlights of the Report:

1. Competitive landscape of the debt financing market.

2. Revenue generated by each segment of the debt financing market by 2027.

3. Factors expected to drive and create new opportunities in the debt financing market.

4. Strategies to gain sustainable growth of the market.

5. Region that would create lucrative business opportunities during the forecast period.

6. Top impacting factors of the debt financing market.

Debt financing Key Market Segments and Subsegments Includes:

Geographically the debt financing market covers provinces such as North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa).

The charts and tables related to each segment make the analysis easily understandable and provide a visual representation of the related data. These insights help to devise strategies and create new opportunities to achieve exceptional results. The research offers an extensive analysis of key players active in the global debt financing industry. Detailed analysis on operating business segments, product portfolio, business performance, and key strategic developments is offered in the research.

Fill the Pre-Order Enquiry Form for the report@ https://www.alliedmarketresearch.com/purchase-enquiry/6657

Market Scope and Structure Analysis:

Market Size Available for Years: 2019–2027

Base Year Considered: 2019

Forecast Period: 2020–2027

COVID-19 Scenario Analysis:

1. To subdue the spread of COVID–19, respective governments have shutdown day-to-day business operations by implementing a full-scale lockdown. Labour shortages and delays in project completion are a few factors hindering the global debt financing industry, resulting in a decline in production.

2. The global debt financing market forecast has been significantly impacted by the outbreak. New projects throughout the world have stalled, which have significant demand for debt financing market.

3. The global factories have struggled to manufacture and assemble new devices as workers have stayed in their homes while the already available devices in various warehouses cannot be transported due to current rules & regulations, which disrupted the global supply chains.

4. The impact of COVID-19 on debt financing market is temporary as just the production and supply chain is stalled. Once the situation improves, production, supply chains, and demand for these products are gradually going to increase. This is expected to provide opportunities for companies operating in the market to think about ways of increasing production, research about technologies, and improve current products.

Get Customization of the Report with COVID-19 Impact Analysis@ https://www.alliedmarketresearch.com/request-for-customization/6657?reqfor=covid

Key Benefits of the Report:

1. The report provides a qualitative and quantitative analysis of the current debt financing market trends, forecasts, and market size from 2020 to 2027 to determine the prevailing opportunities.

2. Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

3. Top impacting factors & major investment pockets are highlighted in the research.

4. The major countries in each region are analyzed and their revenue contribution is mentioned.

5. The market report also provides an understanding of the current position of the market players active in the market.

Access this Report and Get Free COVID-19 Impact Analysis @ https://www.alliedmarketresearch.com/debt-financing-market-A06292

Chapters of the Report are Mentioned Below:

Chapter 1: Introduction

Chapter 2: Executive Summary

Chapter 3: Market Landscape

Chapter 4: Debt financing Market By Sources

Chapter 5: Debt financing Market By Duration

Chapter 6: Debt financing Market By Region

Chapter 7: Company Profiles

For Any Query Talk to our Industry Expert @ https://www.alliedmarketresearch.com/connect-to-analyst/6657

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web:https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Debt Financing Market Growth and Industry Analysis Post Covid-19 Pandemic (2021–2027) Barclays Bank PLC, CREDIT SUISSE GROUP AG here

News-ID: 2237060 • Views: …

More Releases from Allied Market Research

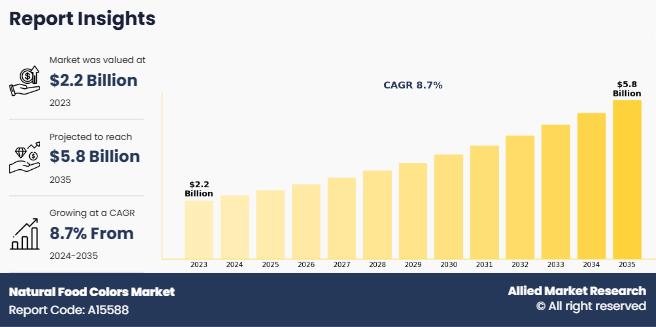

Natural Food Colors Market Size Worth USD 5.58 Billion By 2035 | Growth Rate (CA …

The natural food colors market was valued at $2.2 billion in 2023, and is estimated to reach $5.8 billion by 2035, growing at a CAGR of 8.7% from 2024 to 2035.

The rising demand for functional and nutraceutical foods is significantly driving the natural food colors, as consumers increasingly seek products that offer both health benefits and visual appeal. Natural colors derived from ingredients like turmeric, beetroot, spirulina, and blueberry not…

Combat Self-Defense Management Systems Market Rapidly Growing Dynamics with Indu …

Combat management system is a computer system which integrates the ship sensors, radars, weapons, data links, and other equipment into a single system. The combat management system provides situational awareness & intelligence to the crew and enables them to perform combat missions effectively. A combat management system comprises the central command & decision-making element of vessel combat system. The combat management system is used in combat missions for several purposes…

Ice Cream Coating Market Research Overview, Share, Size, Analysis, and Forecast …

Ice cream is a sweetened frozen product with either an artificial sweetener or natural sugar. Ice cream is eaten as a desert or snack. Increase in consumption of ice cream is highest in summer. Ice cream coating is made from coconut, cashew, almond milk, dairy milk or cream, soy, and is flavored with sugar. Ice cream coating contains thin layers that are manufactured from inexpensive fats such as hydrogenated palm…

Aviation Crew Management System Market Size Worth $5.61 Billion by 2032 With CAG …

According to the report, the global aviation crew management system market size was valued at $2.61 billion in 2022 and is projected to reach $5.61 billion by 2032, registering a CAGR of 8.16% from 2023 to 2032.

The growing demand for sophisticated software designed to improve crew operations across a range of aviation industries will experience significant growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/A177928

The global aviation crew management system market is driven by factors…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…