Press release

Surety Market Size, Analysis and Business Opportunities 2027 - Crum & Forster, CNA Financia, American Financial Group, AmTrust Financial Services, The Travelers Indemnity Company and Hartford Financia

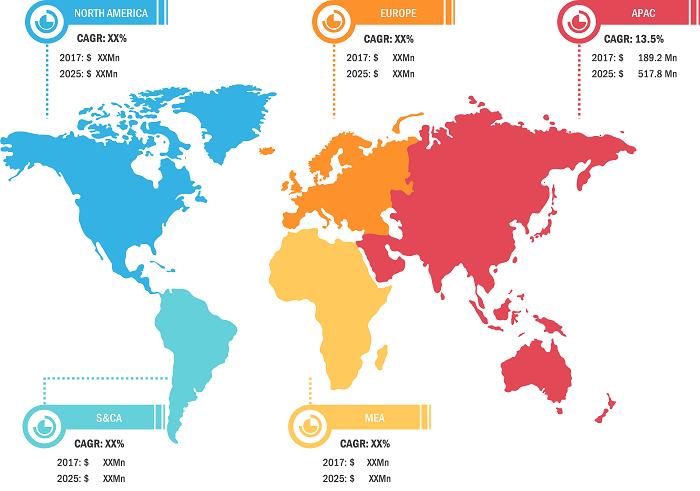

Surety Market was valued at US$ 16.07 billion in 2019 and is projected to reach US$ 25.18 billion by 2027; it is expected to grow at a CAGR of 6.4% from 2020 to 2027.The study report on Global Surety Market 2020 to 2027 would cover every big geographical, as well as, sub-regions throughout the world. The report has focused on market size, value, product sales and opportunities for growth in these regions. The market study has analyzed the competitive trend apart from offering valuable insights to clients and industries. These data will undoubtedly help them to plan their strategy so that they could not only expand but also penetrate into a market.

Download sample PDF Copy at: https://bit.ly/3iyMLUR

Top Dominating Key Players:

1. AmTrust Financial Services, Inc.

2. Crum & Forster

3. CNA Financial Corporation

4. American Financial Group, Inc.

5. The Travelers Indemnity Company

6. Liberty Mutual Insurance Company

7. Hartford Financial Services Group, Inc.

8. HCC Insurance Holdings

9. IFIC Surety Group

10. Chubb Limited

Our expert team is consistently working on updated data and information of key player’s related business processes which values the market. For future strategies and predictions, we provide special section regarding covid-19 situation.

The gaining popularity of PPP (public private partnership) in both developed as well as emerging economies worldwide is one of a major driver for surety market. Infrastructure investment and development are the main concern for governments across the world. With increasing urbanization, the emerging economies are witnessing a need to develop their critical infrastructure, while developed economies are in need to expand or reconstruct their existing infrastructures.

The enduring evolution in PPP model is noticed with increased demand for infrastructure development as well as growing fiscal constraints, to support governments’ to fulfill these escalating infrastructure challenges. For instance, EU member countries have aided wide-ranging pan-national initiatives to enhance the adeptness of PPP financing, which include measures such as the Europe 2020 Project Bond Initiative.

This initiative is intended to allow eligible infrastructure project developers; generally, PPP, to attract private finance from institutional investors including insurance companies as well as pension funds.

The recent outbreak of the COVID-19 has significantly affected the world and is continuing to shatter several countries. The construction industry across the world was witnessing significant growth prior to the emergence of COVID-19 in late 2019. The outbreak of COVID-19 has led the construction industry players to temporarily call off their respective projects. The unprecedented impact of COVID-19 and uncertainty in economic conditions of developedand developing countries, the construction industry is expected to witness a slower growth till 2021. Attributing to the fact that surety market is heavily driven by construction industry, the slowdown in growth of construction industry is reflecting downfall in surety market globally.

Several associations in the surety market and construction industry are extensively seeking a positive approach to build a growth path for the construction industry and thereby catalyzing the surety market in a short span of time. The imposition of lockdown measures by majority of the countries have been negatively affecting construction industry irrespective of residential, commercial, or industrial. This factor is adversely affecting the growth of surety market.

The Report Segments the Global Surety Market as Follows:

By Bond Type

Contract Surety Bond

Commercial Surety Bond

Court Surety Bond

Fidelity Surety Bond

Purchase This Report at: https://bit.ly/3o4jBxZ

What our report offers:

Learn about the driving factors, affecting the market growth.

Imbibe the advancements and progress in the market during the forecast period.

Understand where the market opportunities lies.

Compare and evaluate various options affecting the market.

Pick up on the leading market players within the market.

Envision the restrictions and restrains that are likely to hamper the market.

Contact Us:

The Insight partners,

Phone: +1-646-491-9876

Email: sales@theinsightpartners.com

Website: www.theinsightpartners.com

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market Size, Analysis and Business Opportunities 2027 - Crum & Forster, CNA Financia, American Financial Group, AmTrust Financial Services, The Travelers Indemnity Company and Hartford Financia here

News-ID: 2228890 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Surety

Surety Bonds Without Private Equity Pressure

As private equity continues to reshape the insurance and surety landscape, White Lion Bonding & Insurance Services is reaffirming its commitment to surety bonds and performance bonds, including site improvement bonds, grading bonds, and utilities bonding, delivered through a founder-led, relationship-driven approach. This focus on surety bonds for site improvements, grading, and utilities has guided the firm from its earliest days to its growth as a nationally respected surety brokerage.

Founded…

Surety Market Size to Reach USD 33146.14 Million by 2032 | Global Surety Bonds I …

The global Surety Market was valued at USD 23462.34 Million in 2025 and is projected to grow at a CAGR of 5.06% from 2025 to 2032, reaching USD 33,146.14 Million by 2032, according to Maximize Market Research.

Market Overview

The Surety Market plays a critical role in global financial risk management by providing guarantees that contractual obligations will be met. In this arrangement, a surety assures an obligee (project owner or client)…

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…