Press release

Banking as a Digital Platform Market is Booming Worldwide | CREALOGIX, ebanklT, Intellect Design Arena, Finastra

Latest Research Study on Banking as a Digital Platform Market published by AMA, offers a detailed overview of the factors influencing the global business scope.Banking as a Digital Platform Market research report shows the latest market insights with upcoming trends and breakdown of the products and services.The report provides key statistics on the market status, size, share, growth factors, Challenges and Current Scenario Analysis of the Banking as a Digital Platform. Demand from top notch companies and government agencies is expected to rise as they seek more information on COVID-19. Check Demand Determinants section for more information.Players Includes:

CREALOGIX (Switzerland), ebanklT (United Kingdom), Intellect Design Arena (India), Finastra (United Kingdom), ETRONIKA (Lithuania), Fiserv (United States), NF Innova (Austria), Oracle (United States), SAB (France), Appway AG (Switzerland), Backbase (Netherlands), SAP (Germany), Sopra (France), Tagit (Singapore), TCS (India), Technisys (United States), Temenos (Switzerland), BNY Mellon (United States) and Worldline (France)

Free Sample Report + All Related Graphs & Charts @ : https://www.advancemarketanalytics.com/sample-report/116731-global-banking-as-a-digital-platform-market

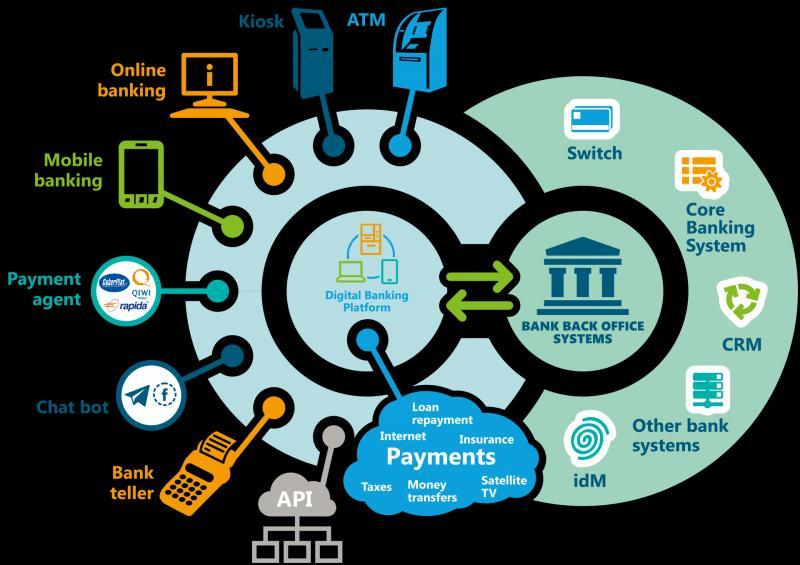

Digital Transformation (DX) is an ongoing trend that has been disrupting nearly all business operations for many businesses, including financial services. Banking and Finance sector is also more generally undergoing tremendous digital transformation across nearly all verticals. The digital platform can then be used to deliver custom solutions, services, and experiences to customers. With the help of digitalization, the financial institutions provide applications, development tools, middleware, operating systems, virtualization, servers, storage and networking to banks and other financial services providers., Though banks are not being hit by the novel coronavirus as directly as other retail institutions, they are at the front of public attention. Business loans, mainly to small and medium enterprises, are at risk due to the forced shutdown. In conditions of social distancing raised by COVID-19, consumers may now divide financial institutions into ones they can use without leaving home. The COVID-19 pandemic could be the most serious challenge to financial institutions in nearly a century. As the economic fallout spreads, retail banks find themselves juggling some main concerns that involve concrete steps to reposition now while also recalibrating for the future. Banking and financial institutions were under immense pressure to ensure business-as-usual amidst the lockdown and health crisis. As per the 2017 global findex report by the World Bank, India is home to the world’s second-largest unbanked population with 190 million adults without access to a bank account. With increased penetration of mobile and Internet, the primary focus would accelerate technology-enabled digital financial inclusion. Banks enable its customers to interact over multiple automated and digital channels to offer the optimal channel mix. Banks have considered important factors such as demographics, access to the internet, last-mile connectivity, customer banking behavior patterns, etc. to enable operative adoption by the Indian banking consumers., Steps to be taken: and In order to encourage customers to use existing remote channels and digital products, institutions can launch positive and safety-oriented messaging aimed at reducing reliance on branches for services that are digitally available. Banks can also improve their current digital offerings, identifying key functionalities that can be improved quickly; for example, they can increase the limit for online activities. Institutions in both Italy and China have found that many people are willingly using remote channels and digital offerings. Banks should carefully draw on the lessons that the current situation offers and use them to inform their digital transformation while building a much higher degree of both operative and financial resiliency.

Market Trend

• Digital platforms are becoming the preferred and dominant business model for banks and financial institutions in the future. Digital platforms offer consumers and small businesses the ability to connect to financial and other service providers through an online or mobile channel as an integrated part of their day-to-day activities. For instance, instead now a days the financial institutions are contributing to a larger digital platform that serves the end-to-end home buying experience.

Market Drivers

• Growing Digitalization and Internet Penetration

• Rising Need across Banks to Deliver Enhanced Customer Experience

• Growing Adoption of Cloud-Based Platforms

Opportunities

• Advancement in Artificial Intelligence

• Incorporation of Blockchain Technology in Banking System

Restraints

• Low Adoption of Digital Banking Services in Rural Areas in Emerging Countries

• Difficulty in Integration of Services with Legacy Systems

Challenges

• Concern Regarding Data Privacy and Cyber Security

• Delivering Quality at Speed and Technology Upgrade

Keep yourself up-to-date with latest market trends and changing dynamics due to COVID Impact and Economic Slowdown globally. Maintain a competitive edge by sizing up with available business opportunity in Digital Asset Management Market various segments and emerging territory. Market size by Revenue is expected to grow xx% in 2020 alone as demand is anticipated to be moderately affected by the outbreak of COVID-19. The downstream companies contend with restricted profit from falling consumer confidence, demand for industry products is expected to slow.

The Global IoT in Education Market segments and Market Data Break Down are illuminated below:

Application (Retail Digital Banking, SME Digital Banking, Corporate Digital Banking), Deployment Mode (On-Premises, Cloud-Based), Components (Software, Service), Banking Type (Retail Banking, Corporate Banking, Investment Banking), Modes (Online Banking, Mobile Banking)

Analyst at AMA have conducted special survey and have connected with opinion leaders and Industry experts from various region to minutely understand impact on growth as well as local reforms to fight the situation. A special chapter in the study presents Impact Analysis of COVID-19 on Banking as a Digital Platform Market along with tables and graphs related to various country and segments showcasing impact on growth trends.

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/116731-global-banking-as-a-digital-platform-market

Table of Content: Covid-19 Impact On Banking as a Digital Platform Market:

1. Study Scope

1.1 Banking as a Digital Platform Market Competition by Manufacturers (Market Share, Y-o-Y Growth, Market Revenue, Rank)

1.2 Market Concentration

1.3 Comparative Market Share Analysis (Leaders and Emerging Players) [2018-2019]

1.2 Banking as a Digital Platform Market Characteristics

1.3 Banking as a Digital Platform Market Scenario by Region

1.4 Banking as a Digital Platform Market Segmentation

1.4.1 Banking as a Digital Platform Historic Market Analysis by Type

1.4.2 Banking as a Digital Platform Historic Market Analysis by Application

1.4.3 Banking as a Digital Platform Historic Market Analysis By ………….

1.4.4. Banking as a Digital Platform Historic Market Analysis by ………….

------

2. Market Company Profiles

2.1 Overview

2.2 Production & Services (2018-2025)

2.3 Financial Performance (2018-2025)

2.4 Strategy

3. Future & Forecast Data

4. Market Opportunities, Challenges, Risks and Influences Factors Analysis (2019-2025)

5. Banking as a Digital Platform Manufacturing Cost Analysis

6. Banking as a Digital Platform Value Chain and Sales Channels Analysis

7. Banking as a Digital Platform Marketing Channel, Distributors and Customers; Post COVID Analysis…

8. Banking as a Digital Platform Value Chain and Sales Channels Analysis (2018-2025)

9. Banking as a Digital Platform Research Finding and Conclusion

10. Banking as a Digital Platform Methodology and Data Source

Finally, Banking as a Digital Platform Market is a valuable source of guidance for individuals and companies in their decision framework.

Data Sources & Methodology

The primary sources involves the industry experts from the Banking as a Digital Platform Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20-50% Discount on This Premium Report:

https://www.advancemarketanalytics.com/request-discount/116731-global-banking-as-a-digital-platform-market

What benefits does AMA research studies provides?

• Supporting company financial and cash flow planning

• Latest industry influencing trends and development scenario

• Open up New Markets

• To Seize powerful market opportunities

• Key decision in planning and to further expand market share

• Identify Key Business Segments, Market proposition & Gap Analysis

• Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Read our Case study and full Outline of Report @

https://www.advancemarketanalytics.com/reports/116731-global-banking-as-a-digital-platform-market

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@advancemarketanalytics.com

Connect with us at

https://www.linkedin.com/company/advance-market-analytics

https://www.facebook.com/AMA-Research-Media-LLP-344722399585916

https://twitter.com/amareport

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enables clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking as a Digital Platform Market is Booming Worldwide | CREALOGIX, ebanklT, Intellect Design Arena, Finastra here

News-ID: 2225519 • Views: …

More Releases from AMA Research & Media LLP

Property Insurance in the Oil and Gas Sector Market Detailed Strategies, Competi …

Advance Market Analytics published a new research publication on "Property Insurance in the Oil and Gas Sector Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Property Insurance in the Oil and Gas Sector market was mainly driven by the…

Textile Reinforced Concrete Market Charting Growth Trajectories: Analysis and Fo …

Advance Market Analytics published a new research publication on "Textile Reinforced Concrete Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Textile Reinforced Concrete market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…

Online TV Streaming Service Market Detailed Strategies, Competitive Landscaping …

Advance Market Analytics published a new research publication on "Online TV Streaming Service Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online TV Streaming Service market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Potato Vodka Market Unidentified Segments - The Biggest Opportunity Of 2025

Advance Market Analytics published a new research publication on "Potato Vodka Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Potato Vodka market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…