Press release

PSD2 and Finance Software Solutions Market to See Major Growth by 2026: Deutsche Bank, Citigroup, Barclays, ICBC

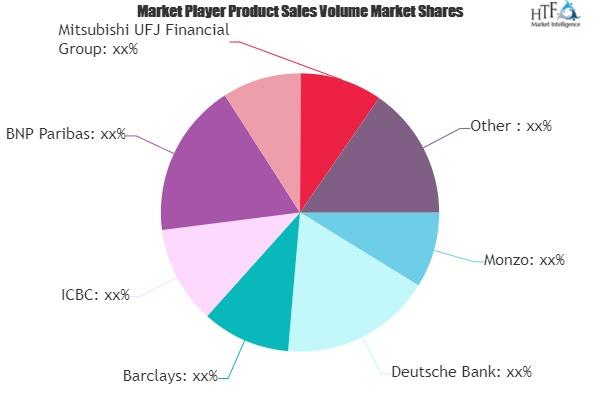

A new business intelligence report released by HTF MI with title "Global PSD2 and Finance Software Solutions Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread)" is designed covering micro level of analysis by manufacturers and key business segments. The Global PSD2 and Finance Software Solutions Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of the key players profiled in the study are Monzo, Deutsche Bank, Barclays, ICBC, BNP Paribas, China Construction Bank, Mitsubishi UFJ Financial Group, HSBC, JPMorgan Chase, Starling, Citigroup, Tandem, Bank of America, Atom & Wells Fargo.What's keeping Monzo, Deutsche Bank, Barclays, ICBC, BNP Paribas, China Construction Bank, Mitsubishi UFJ Financial Group, HSBC, JPMorgan Chase, Starling, Citigroup, Tandem, Bank of America, Atom & Wells Fargo Ahead in the Market? Benchmark yourself with the strategic moves and findings recently released by HTF MI

Get Free Sample Report + All Related Graphs & Charts @ : https://www.htfmarketreport.com/sample-report/2944089-global-psd2-and-finance-software-solutions-market-report-2020-by-key-players-types-applications-countries-market-size-forecast-to-2026

Market Overview of Global PSD2 and Finance Software Solutions

If you are involved in the Global PSD2 and Finance Software Solutions industry or aim to be, then this study will provide you inclusive point of view. It’s vital you keep your market knowledge up to date segmented by Applications [Commercial, Industrial & Others], Product Types [, PSD2, Open Banking & Others] and major players. If you have a different set of players/manufacturers according to geography or needs regional or country segmented reports we can provide customization according to your requirement.

This study mainly helps understand which market segments or Region or Country they should focus in coming years to channelize their efforts and investments to maximize growth and profitability. The report presents the market competitive landscape and a consistent in depth analysis of the major vendor/key players in the market along with impact of economic slowdown due to COVID.

Furthermore, the years considered for the study are as follows:

Historical year – 2015-2020

Base year – 2020

Forecast period** – 2021 to 2026 [** unless otherwise stated]

**Moreover, it will also include the opportunities available in micro markets for stakeholders to invest, detailed analysis of competitive landscape and product services of key players.

Enquire for customization in Report @: https://www.htfmarketreport.com/enquiry-before-buy/2944089-global-psd2-and-finance-software-solutions-market-report-2020-by-key-players-types-applications-countries-market-size-forecast-to-2026

The titled segments and sub-section of the market are illuminated below:

The Study Explore the Product Types of PSD2 and Finance Software Solutions Market: , PSD2, Open Banking & Others

Key Applications/end-users of Global PSD2 and Finance Software Solutions Market: Commercial, Industrial & Others

Top Players in the Market are: Monzo, Deutsche Bank, Barclays, ICBC, BNP Paribas, China Construction Bank, Mitsubishi UFJ Financial Group, HSBC, JPMorgan Chase, Starling, Citigroup, Tandem, Bank of America, Atom & Wells Fargo

Region Included are: North America (Covered in Chapter 6 and 13), United States, Canada, Mexico, Europe (Covered in Chapter 7 and 13), Germany, UK, France, Italy, Spain, Russia, Others, Asia-Pacific (Covered in Chapter 8 and 13), China, Japan, South Korea, Australia, India, Southeast Asia, Others, Middle East and Africa (Covered in Chapter 9 and 13), Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Others, South America (Covered in Chapter 10 and 13), Brazil, Argentina, Columbia, Chile & Others

Important Features that are under offering & key highlights of the report:

– Detailed overview of PSD2 and Finance Software Solutions market

– Changing market dynamics of the industry

– In-depth market segmentation by Type, Application etc

– Historical, current and projected market size in terms of volume and value

– Recent industry trends and developments

– Competitive landscape of PSD2 and Finance Software Solutions market

– Strategies of key players and product offerings

– Potential and niche segments/regions exhibiting promising growth

– A neutral perspective towards PSD2 and Finance Software Solutions market performance

– Market players information to sustain and enhance their footprint

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/2944089-global-psd2-and-finance-software-solutions-market-report-2020-by-key-players-types-applications-countries-market-size-forecast-to-2026

Major Highlights of TOC:

Chapter One: Global PSD2 and Finance Software Solutions Market Industry Overview

1.1 PSD2 and Finance Software Solutions Industry

1.1.1 Overview

1.1.2 Products of Major Companies

1.2 PSD2 and Finance Software Solutions Market Segment

1.2.1 Industry Chain

1.2.2 Consumer Distribution

1.3 Price & Cost Overview

Chapter Two: Global PSD2 and Finance Software Solutions Market Demand

2.1 Segment Overview

2.1.1 APPLICATION 1

2.1.2 APPLICATION 2

2.1.3 Other

2.2 Global PSD2 and Finance Software Solutions Market Size by Demand

2.3 Global PSD2 and Finance Software Solutions Market Forecast by Demand

Chapter Three: Global PSD2 and Finance Software Solutions Market by Type

3.1 By Type

3.1.1 TYPE 1

3.1.2 TYPE 2

3.2 PSD2 and Finance Software Solutions Market Size by Type

3.3 PSD2 and Finance Software Solutions Market Forecast by Type

Chapter Four: Major Region of PSD2 and Finance Software Solutions Market

4.1 Global PSD2 and Finance Software Solutions Sales

4.2 Global PSD2 and Finance Software Solutions Revenue & market share

Chapter Five: Major Companies List

Chapter Six: Conclusion

Complete Purchase of Latest Version Global PSD2 and Finance Software Solutions Market Study with COVID-19 Impact Analysis @ https://www.htfmarketreport.com/buy-now?format=1&report=2944089

Key questions answered

• What impact does COVID-19 have made on Global PSD2 and Finance Software Solutions Market Growth & Sizing?

• Who are the Leading key players and what are their Key Business plans in the Global PSD2 and Finance Software Solutions market?

• What are the key concerns of the five forces analysis of the Global PSD2 and Finance Software Solutions market?

• What are different prospects and threats faced by the dealers in the Global PSD2 and Finance Software Solutions market?

• What are the strengths and weaknesses of the key vendors?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PSD2 and Finance Software Solutions Market to See Major Growth by 2026: Deutsche Bank, Citigroup, Barclays, ICBC here

News-ID: 2223740 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Curated Luxury Home Accents Market: Regaining Its Glory | Company A, Company B, …

Curated luxury home accents are high-end decorative items selected for their aesthetic appeal and quality, aimed at enhancing the beauty and functionality of living spaces, reflecting individual tastes and lifestyles, and increasingly sought after by consumers looking to create personalized and stylish environments in their homes.

Key Players in This Report Include: Company A, Company B, Company C, Company D, Company E, Company F, Company G, Company H, Company I, Company…

Gold Resources Market Seeking Excellent Growth | Wheaton Precious Metals, Royal …

The Gold Resources Market refers to the global industry involved in the exploration, extraction, processing, refining, trading, and investment of gold resources. It encompasses upstream mining activities, midstream refining operations, and downstream distribution across jewelry, investment, central banking, and industrial applications.

Gold resources include both primary gold deposits (mined from underground and open-pit operations) and secondary sources (recycled gold, electronics, and industrial waste). The market is influenced by geological reserves, mining…

Tourism Digitalization Market Is Going to Boom | Major Giants Amadeus IT Group, …

The Tourism Digitalization Market refers to the global industry focused on the adoption, integration, and commercialization of digital technologies across the travel and tourism value chain to enhance operational efficiency, customer experience, marketing effectiveness, and revenue generation.

Tourism digitalization involves the use of advanced technologies such as cloud computing, artificial intelligence (AI), big data analytics, Internet of Things (IoT), blockchain, mobile applications, and digital payment systems to transform how tourism services…

Daily Newsletters Market Hits New High | Major Giants Mailchimp, Sendinblue, Get …

The Daily Newsletters Market refers to the global industry focused on the creation, distribution, monetization, and management of email-based news publications that are delivered to subscribers on a daily basis. These newsletters curate timely content such as news updates, industry insights, financial reports, marketing trends, technology developments, lifestyle topics, and opinion pieces, tailored to specific audience segments.

Key Players in This Report Include: Mailchimp (USA), Constant Contact (USA), HubSpot (USA), Sendinblue…

More Releases for PSD2

PSD2 and Finance Software Solutions Market Review: All Eyes on 2024 Outlook

The Latest published market study on Global PSD2 and Finance Software Solutions Market provides an overview of the current market dynamics in the PSD2 and Finance Software Solutions space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify…

The Growing Importance of PSD2 and Open Banking Market: Today's World

This comprehensive report thoroughly assesses various regions, estimating the volume of the global PSD2 and Open Banking market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role…

EPSM recommends harmonised migration plans on PSD2-SCA

EPSM appreciates the acknowledgement by the European Banking Authority (EBA) that the payments trade needs a flexible approach with the introduction of Regulatory Technical Requirements (RTS) for Strong Customer Authentication (SCA). These will become applicable from 14th September 2019.

EPSM has suggested timeframes for a harmonised migration approach on PSD2-SCA. EPSM is aware that migration plans are currently being negotiated by payment industry participants, together with their respective national authorities,…

Preparing for PSD2 and Open Banking

Summary

The EU’s Directive on Payment Services 2 (PSD2) will accelerate the fragmentation of Europe’s retail banking industry following the global financial crisis. The opportunities brought about by PSD2 will energize banks with strong brand awareness and advanced digital offerings into pushing the boundaries of open banking. Increased competition from card issuers and non-bank third-party providers will prompt steady mid-cap players to fundamentally evaluate their strategies. Banks that are competing on…

2016 PSD2 and Open Banking Market Size, Share, Trends & Analysis Report

The EU’s Directive on Payment Services 2 (PSD2) will accelerate the fragmentation of Europe’s retail banking industry following the global financial crisis. The opportunities brought about by PSD2 will energize banks with strong brand awareness and advanced digital offerings into pushing the boundaries of open banking. Increased competition from card issuers and non-bank third-party providers will prompt steady mid-cap players to fundamentally evaluate their strategies. Banks that are competing on…

PSD2 and Open Banking will energize banks with strong brand awareness

The EUs Directive on Payment Services 2 (PSD2) will accelerate the fragmentation of Europes retail banking industry following the global financial crisis. The opportunities brought about by PSD2 will energize banks with strong brand awareness and advanced digital offerings into pushing the boundaries of open banking. Increased competition from card issuers and non-bank third-party providers will prompt steady mid-cap players to fundamentally evaluate their strategies. Banks that are competing on…