Press release

Retail Core Banking Systems Market Competitive Opportunities with 9.5% of CAGR by 2027 - Intellect Design Arena Ltd, Oracle Corporation, SAP SE, SopraSteria, Tata Consultancy

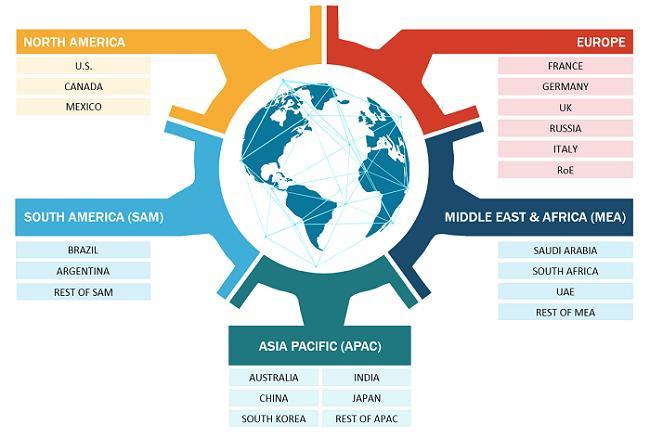

According to our latest market study on “Retail Core Banking Systems Market Forecast to 2027 – COVID-19 Impact and Global Analysis – by Offering (Solutions and Services) and Deployment Type (Cloud and On-Premise),” the market was valued at US$ 5,652.32 million in 2019 and is projected to reach US$ 11,410.83 million by 2027; it is expected to grow at a CAGR of 9.5% from 2020 to 2027.The Big Data analytics is gaining huge popularity in the market as it delivers a wide-range analysis and useful insights about the customers. This technology performs predictive analysis that helps the banks to assess different strategies and tactics, thereby offering them better decision-making abilities; this benefits the banks through the ability to offer better customer service, accompanied with enhanced profitability, increased performance, and reduced costs. The retail core banking system market in other developing regions, such as the MEA and SAM is also projected to grow at a rapid pace due to the increasing government support toward the digitalization of economies in the respective countries.

Get Sample Copy at https://www.theinsightpartners.com/sample/TIPRE00006768?utm_source=OpenPR&utm_medium=10051

Banks in Asia Pacific are leveraging several new technologies for attaining better efficiency and providing enhanced customer experience. Several banks in the region have started experimenting with the Blockchain technology in the process of customer on-boarding. This technology is a single, cryptographically secured, and modified database of each transaction on the network. The technology helps financial institutions gather data from authoritative service providers, enabling them to ease the KYC (i.e., know-your-customer) process. A few of the banks have already started using a prototype of Blockchain-based KYC solutions. For instance, in October 2017, the consortium of OCBC Bank, Mitsubishi UFJ Financial Group, and HSBC in conjunction with the Infocomm Media Development Authority became the first user of the KYC Blockchain concept in Southeast Asia. Also, in August 2020, the Cambodian Central Bank executed the first retail payment system leveraging the Blockchain technology through Bakong, a project that allows individuals to make payments through a smartphone App.

Impact of COVID-19 Pandemic on Retail Core Banking Systems Market

North America is one of the most important regions for the adoption and growth of new technologies due to favorable government policies to boost innovation, the presence of huge industrial base, and the availability of high purchasing power among consumers, especially in developed countries such as the US and Canada. Hence, any impact on the growth of industries is expected to restrain the economic growth of the region. According to the WHO, presently, the US is the world’s worst affected country due to the COVID-19 outbreak, with 14,397,135 confirmed cases and 278,806 deaths. The US is a prominent market for retail core banking systems. However, the pandemic fuels the retail core banking system adoption due to the ongoing consumer shift to online and mobile banking tools. The use of mobile banking app and online banking has increased during the pandemic period.

Strategic Insights

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

- In 2020, Avaloq installed its flagship core banking system at the Bank of the Philippine Islands (BPI) on a software-as-a-service (SaaS) basis.

- In 2020, Oracle won core banking deals in Africa by signing contracts with banks across Sudan, Somalia, and Libya.

The adoption of disruptive technologies enables retail banking customers to have better applicability, more convenience, and greater responsiveness from their banks. The customers, nowadays, are not afraid of switching to alternative banking products and service providers for getting enhanced experience and value for money. Moreover, in developing economies of Asia Pacific, the high penetration of smartphones and easy internet access has resulted in increased demand for emerging technologies by tech-savvy customers. Thus, financial institutions are focused on the use of efficient retail core banking systems complying with stringent regulations.

Buy Complete Report at https://www.theinsightpartners.com/buy/TIPRE00006768?utm_source=OpenPR&utm_medium=10051

The Insight Partners

533, 5th Floor,

Amanora Chambers, East Block, Amanora Township,

Kharadi Road, Hadapsar, Pune-411028

Email :sales@theinsightpartners.com

Phone : +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Core Banking Systems Market Competitive Opportunities with 9.5% of CAGR by 2027 - Intellect Design Arena Ltd, Oracle Corporation, SAP SE, SopraSteria, Tata Consultancy here

News-ID: 2222451 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…