Press release

Global Digital Banking Market Size | Incredible Possibilities and Growth Analysis and Forecast To 2026

A comprehensive report on Digital Banking Market was published by Zion Market Research to understand the complete setup of Digital Banking Market industries. Effective qualitative and quantitative analysis techniques have been used to examine the data accurately. Variable factors that comprise basis for a successful business, such as vendors, sellers, as well as investors are analysed in the report. It focuses on size and framework of global Digital Banking Market sectors to understand the existing structure of several industries. Challenges faced by the industries and approaches adopted by them to overcome those threats has been included. This research report is helpful for both established businesses as well as start-ups in the market. Furthermore, the report is ideally and characteristically punctuated with illustrative presentation. Researchers of this report provide a detailed investigation of the historical records, current statistics, and future predictions.FREE | Request Sample is Available @ https://www.zionmarketresearch.com/sample/digital-banking-market

Profiling Key players: ACI Worldwide, Ally Financial Inc., Backbase, Capital Banking Solution, CR2, Digiliti Money, Inc., Fiserv, Inc., Infosys Ltd., Innofis

Highlights of the report:

Comprehensive assessment of all opportunities and risk in the global market.

Digital Banking Market recent innovations and major events.

Detailed study of business strategies for growth of the Digital Banking Market leading players.

Conclusive study about the growth plot of Digital Banking Market for forthcoming years.

In-depth understanding of Digital Banking Market -particular drivers, constraints and major micro markets.

Favourable impression inside vital technological and market latest trends striking the Digital Banking Market.

In This Study, The Years Considered to Estimate the Size of Digital Banking Market are as Follows:

History Year: 2014-2019

Base Year: 2019

Estimated Year: 2020

Forecast Year 2020 to 2026

Download Free PDF Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/digital-banking-market

Table of Content:

Market Overview

Competition Analysis by Players

Company (Top Players) Profiles

Digital Banking Market Size by Type and Application

US Market Status and Outlook

EU Development Market Status and Outlook

Japan Market Development Status and Outlook

China Market Status and Outlook

India Global Digital Banking Market Status and Outlook

Southeast Asia Market Status and Outlook

Market Forecast by Region, Type, and Application

Market Dynamics

Market Effect Factor Analysis

Research Finding/ Conclusion

Appendix

Lastly, this report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights on the market dynamics and will enable strategic decision making for the existing market players as well as those willing to enter the market.

Inquire more about this report @ https://www.zionmarketresearch.com/inquiry/digital-banking-market

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll Free No.1-855-465-4651

Email - sales@zionmarketresearch.com

Web - http://www.zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digital Banking Market Size | Incredible Possibilities and Growth Analysis and Forecast To 2026 here

News-ID: 2216505 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

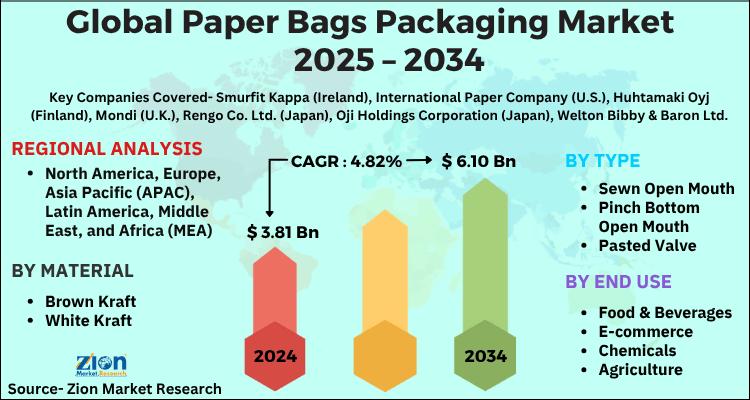

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

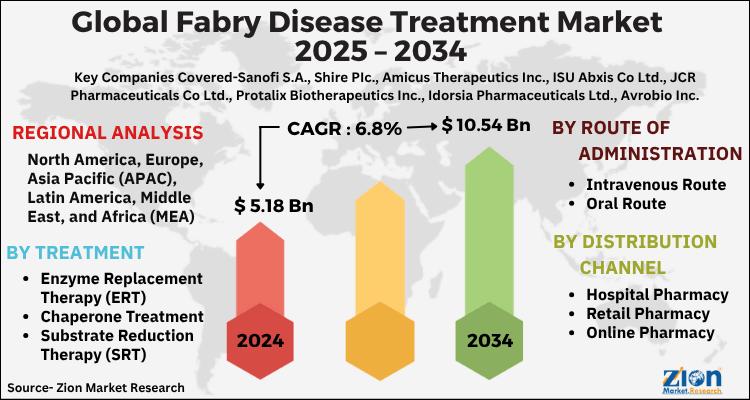

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…