Press release

Futuristic Overview of Insurtech Market 2020-2023 Analysis by Friendsurance, Oscar, Quantemplate, Shift Technology, and more

The InsurTech market is expected to reach US$ 1019.1 million by 2023, growing with a CAGR of 13.8% during the forecast period. The market is witnessing significant growth owing to the growing need for the implementation of automation, better communication between clients and agents, and better-personalized offerings. This helps insurance agents to cater to their customers and at the same time, help customers to choose the best plans available. Moreover, the insurance companies are investing primarily in digitization to improve the payment system's functionality and ease the transaction process. The adoption of InsurTech in various organizations has allowed the insurance companies to reduce the risks associated with the operation, market, liquidity, and counterparty credit. In addition, the InsurTech market is adopting the technologies like embedded analytics to help the insurance companies to understand the market pattern consumer behavior, and make informed business-related decisions.Request for a sample report (including ToC, Tables and Figures with detailed information) @ https://www.alltheresearch.com/sample-request/41

Questions Answered in Insurtech Market Report:

*What will be the Insurtech Market generate by the end of the forecast period?

*What are the major trends expected developing Insurtech Market?

*What are the new major NPD, M&A, acquisitions in the Insurtech Market?

*Which are the opportunities in the Insurtech Market after the COVID-19 pandemic?

*Which segment of the Insurtech Market is likely to have the highest market share by 2023?

*What are the important factors and their effects on the Insurtech Market?

*Which regions currently contributing the maximum market share to overall market?

*What are the major considerations expected to drive the Insurtech Market?

*What are the essential strategies by key stakeholders in the Insurtech Market to expand their geographic presence?

*This report answers all questions and more about the industry, helping major stakeholders and key players in making the right business decisions and strategizing to achieve targeted goals.

In the Insurtech Market research report, following points market opportunities, market risk and market overview are enclosed along with the in-depth study of each point. Production of the Insurtech is analyzed with respect to various regions, types and applications. The sales, revenue, and price analysis by types and applications of market key players is also covered.

Insurtech Market Segment considering Production, Revenue (Value), Price Trend by Product Type:

*By Component (Software and Services)

*By Type (Retail and Commerce)

Market Segment by Consumption Growth Rate and Market Share by Application:

*Health Insurance

*Property and Casualty Insurance

*Life Insurance

*Others

Is there any query or need customization? Ask to our Industry Expert @ https://www.alltheresearch.com/customization/41

Along with Insurtech Market research analysis, buyer also gets valuable information about global Production and its market share, Revenue, Price and Gross Margin, Supply, Consumption, Export, Import volume and values for following Regions:

*North America (US and Canada)

*Europe (UK, Germany, France, and Rest of Europe)

*Asia Pacific (China, Japan, India, and Rest of Asia Pacific)

*Latin America (Brazil, Mexico, and Rest of Latin America)

*Middle East & Africa (GCC and Rest of Middle East & Africa)

Insurtech Market Covers following Major Key Players:

*Quantemplate

*Shift Technology

*Trov

*ZhongAn

*Friendsurance

*GetInsured

*Bayzat

*Claim Di

*CommonEasy

Purchase Full Report for your Business Expansion @ https://www.alltheresearch.com/buy-now/41

Table of Content: Global Insurtech Market

Chapter 1. Research Objective

1.1 Objective, Definition & Scope

1.2 Methodology

1.2.1 Primary Research

1.2.2 Secondary Research

1.2.3 Market Forecast – Estimation & Approach

1.2.4 Assumptions & Assessments

1.3 Insights and Growth – Relevancy Mapping

1.3.1 FABRIC Platform

1.4 Data mining & efficiency

Chapter 2. Executive Summary

2.1 Insurtech Market Overview

2.2 Interconnectivity & Related markets

2.3 Ecosystem Map

2.4 Insurtech Market Business Segmentation

2.5 Insurtech Market Geographic Segmentation

2.6 Competition Outlook

2.7 Key Statistics

Chapter 3. Strategic Analysis

3.1 Insurtech Market Revenue Opportunities

3.2 Cost Optimization

3.3 Covid19 aftermath – Analyst view

3.4 Insurtech Market Digital Transformation

Chapter 4. Market Dynamics

4.1 DROC

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PEST Analysis

4.2.1 Political

4.2.2 Economic

4.2.3 Social

4.2.4 Technological

4.3 Market Impacting Trends

4.3.1 Positive Impact Trends

4.3.2 Adverse Impact Trends

4.4 Porter’s 5-force Analysis

4.5 Market News – By Segments

4.5.1 Organic News

4.5.2 Inorganic News

Chapter 5. Segmentation & Statistics

5.1 Segmentation Overview

5.2 Demand Forecast & Market Sizing

FOR ALL YOUR RESEARCH NEEDS, REACH OUT TO US AT:

Contact Name: Rohan S.

Email: contactus@alltheresearch.com

Phone: +1 (407) 768-2028

About AllTheResearch:

AllTheResearch was formed with the aim of making market research a significant tool for managing breakthroughs in the industry. As a leading market research provider, the firm empowers its global clients with business-critical research solutions. The outcome of our study of numerous companies that rely on market research and consulting data for their decision-making made us realise, that its not just sheer data-points, but the right analysis that creates a difference. While some clients were unhappy with the inconsistencies and inaccuracies of data, others expressed concerns over the experience in dealing with the research-firm. Also, same-data-for-all-business roles was making research redundant. We identified these gaps and built AllTheResearch to raise the standards of research support.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Futuristic Overview of Insurtech Market 2020-2023 Analysis by Friendsurance, Oscar, Quantemplate, Shift Technology, and more here

News-ID: 2213129 • Views: …

More Releases from AllTheResearch

Industry Update: Healthcare IT Integration Market will Reach 7.5 Billion by 2027

Healthcare It Integration Market Analysis 2021 covers the global and regional market with an in-depth analysis of the market's overall growth prospects. Global Healthcare It Integration market growth to reach 7.5 Billion USD in 2027 with a CAGR value 12.2% from 2021 to 2027. Projected and forecast revenue values are in constant U.S. dollars, unadjusted for inflation. Product values are estimated based on manufacturers’ revenue and regional markets for Healthcare…

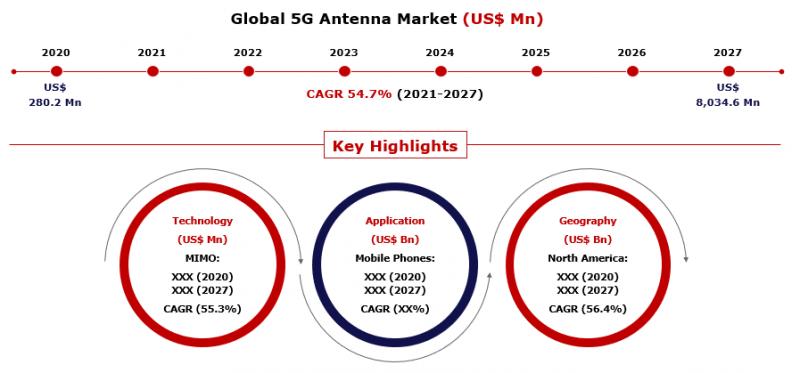

Demand for 5G Antenna Market to Witness Rapid Surge During the Period 2021-2027

5G Antenna Market by Type (Switched Multi-Beam Antenna, Adaptive Array Antenna); by Technology (SIMO, MISO, MIMO); by Application (Mobile Phones, Factory Automation, IoT, Connected Vehicles, Others); and by Region (North America, Europe, Asia Pacific, Latin America, MEA); - Global Forecasts 2021 to 2027

The Global 5G Antenna Market is an emerging market in the present years. The report covers the present and past market scenarios, market development patterns, and is likely…

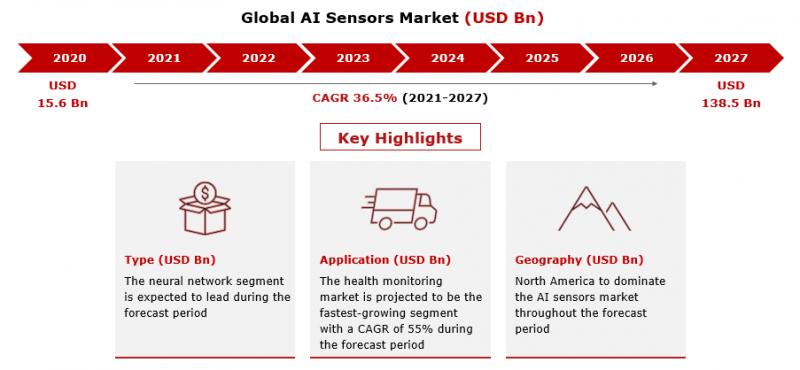

AI Sensors Market to Grow at CAGR of 36.5% Through 2021 to 2027

AI Sensors Market by Type (Case-based Reasoning, Ambient-intelligence, Neural Networks, Inductive Learning, Other); by Application (Biosensor, Health Monitoring, Maintenance and Inspection, Human-computer Interaction, Others); and by Region (North America, Europe, Asia Pacific, Latin America, MEA); - Global Forecasts 2021 to 2027

AI Sensors Market was valued at USD 15.6 Billion in 2020 and is expected to reach USD 138.5 Billion by 2027, with a growing CAGR of 36.5% during the forecast…

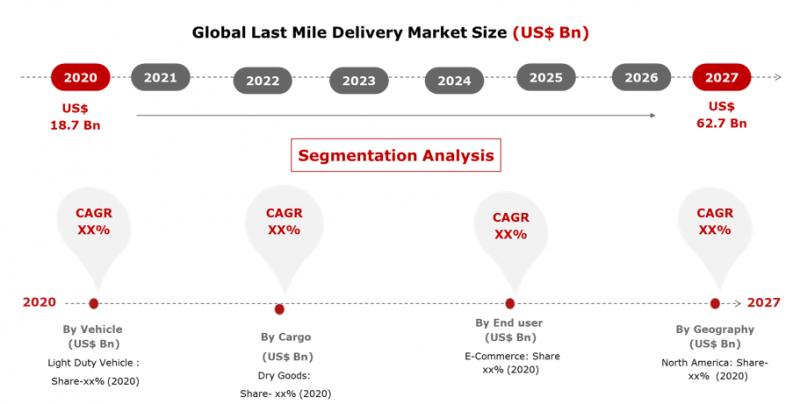

Last Mile Delivery Market Will Expand at CAGR of 18.9% by 2027

Last Mile Delivery Market by Vehicle (Light Duty Vehicle, Medium Duty Vehicle, Heavy Duty Vehicle), by Cargo (Dry Goods, Postal, Liquid Goods), by End User (Chemical, Pharmaceutical and Healthcare, FMCG, E-Commerce) by Region (North America, Europe, Asia-pacific, Rest of the World): Global Forecasts 2021 To 2027.

The global Last Mile Delivery Market was valued at USD 18.7 Bn in 2020, and it is expected to reach USD 62.7 Bn by 2027,…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…