Press release

Trade Loan Services Market Size, Share, Trends, COVID-19 Impact and Business Development Strategies by Top Industry Players 2020-2027

Trade Loan Services Market Outlook - 2027Globally, the trade loan services industry is experiencing growth and is estimated to grow owing to the growing trade activities in trade across the globe. Trade loan is a credit facility provided by different financial firms to companies engaging in exchanging goods and services between entities beyond or out of the region. Such loans typically act more as fully cycle of credit facility that covers the cash difference during the time it needed to pay for goods bought as well as the time it collects the proceeds as from selling of certain goods. Trade credit is useful for anyone who participates in huge number of overseas and domestic trades. In addition, duration of the loan ranges different from one creditor to the other.

Download Report Sample with Latest Industry Insights: https://www.alliedmarketresearch.com/request-sample/8646

Companies covered: Major players analyzed include BNP Paribas S.A., Tradeteq Limited, Abu Dhabi Commercial Bank PJSC, Shinhan Bank, The Bank of New York Mellon Corporation, Commerzbank AG, The Australia and New Zealand Banking Group Limited,Société Générale S.A., Finastra, Asseco Poland SA, The State Bank of India

COVID-19 scenario analysis:

Impact of COIVD on the trade industry is highly adverse.

Major business and ports are being forced to close, upsetting global supply chains, and having a major impact on the international trade. In addition, banks which have been charged with sustaining the influx of trillions of dollars in trade financing, are now forced to work out where to keep trading activities to proceed as normal, in a manner that restricts the transmission of the virus.

Top impacting factors: Market Scenario Analysis, Trends, Drivers, and Impact Analysis:

Rise in need to improve the cash management facility by SMEs and favorable government regulations across the globe to improve and promote lending process will drive the growth of the Trade Loan Services Market. In addition, surge in need to comply multiple lending applications in one system fuels the growth of the market. However, lack of trust lack of trust and transparency in lending process in Asian countries and high interest rate charged by the lenders hampers the growth of the market. Furthermore, emergence of SaaS based loan services across the globe is expected to provide lucrative for the market.

The global trade loan services market trends are as follows:

Tech infusion for effective lending management:

Technology is bringing new shapes to the industry. Presently, much developments in trade finance systems are exclusively focused on digitizing exchange records such as invoices, payment contracts, bills of exchange, airway expenses and credentials of origin to facilitate quicker delivery and more effective monitoring of compliance with international trade regulations and customs.

Interested? Do Purchase Enquiry Now: https://www.alliedmarketresearch.com/purchase-enquiry/8646

Asian Development Bank estimates that 80% of banks agree that digitization would bring down the cost of fulfilling compliance requirements and that emerging technology would make it simpler to assess SME risk more effectively. In order to take advantage of these prospects, a variety of Fintech firms, as well as mainstream technology businesses such as IBM, are developing products or services to help manage the dynamics of foreign trading. Traydstream partnered with banks and companies to digitize operations, reduce costs, and slash expenses.

Regulatory revisions to improve and promote trade lending/finance:

Around 80 to 90% of global exchange depends on trade finance. As business confronts illiquidity problems, several countries and the World Trade Organization have updated rules to resolve issues and promote enhanced lending. Significant global development banks and organizations such as the International Finance Corporation (IFC), the Inter-American Development Bank (IDB), the European Bank for Reconstruction and Growth (EBRD) and the Asian Development Bank (ADB) have recently enhanced their trade facilitation initiatives to effectively improve trade lending. The purpose of the resolutions was to provide short-term loans of working capital and grants of credit to small and medium-sized enterprises. This helps credit lending institutions to safely provide loan to trading agencies as lenders were backed by government guarantees.

Key benefits of the report:

• This study presents the analytical depiction of the global trade loan services market along with the current trends and future estimations to determine the imminent investment pockets.

• The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Trade loan services market share.

• The current market is quantitatively analyzed from 2020 to 2027 to highlight the global trade loan services market growth scenario.

• Porter’s five forces analysis illustrates the potency of buyers & suppliers in the market.

• The report provides a detailed market analysis based on the present and future competitive intensity of the market.

Access Report Summary: https://www.alliedmarketresearch.com/trade-loan-services-market-A08281

Questions answered in trade loan services market research report:

• Who are the leading market players active in the trade loan services market?

• What would be the detailed impact of COVID-19 on the market?

• What current trends would influence the market in the next few years?

• What are the driving factors, restraints, and opportunities in the trade loan services market?

• What are the projections for the future that would help in taking further strategic steps?

Provider Type

• Banks

• Credit Unions

• Others

Enterprise Size

• Large Enterprises

• Small & Medium Enterprises (SMEs)

End User

• Exporters

• Importers

• Traders

Industry Vertical

• BFSI

• Retail & E-Commerce

• Manufacturing

• Healthcare

• IT & Telecom

• Others

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Loan Services Market Size, Share, Trends, COVID-19 Impact and Business Development Strategies by Top Industry Players 2020-2027 here

News-ID: 2210370 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

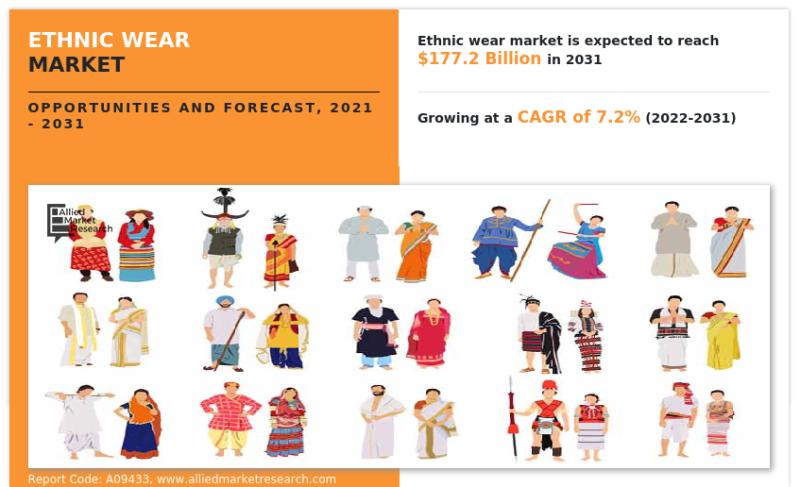

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…