Press release

Given the increasing number of licensing deals and the expected approval of multiple mid-late stage candidates, the encapsulated cell therapies and encapsulation technologies market is anticipated to evolve at a rapid pace over the next decade, predicts R

Roots Analysis has done a detailed study on Cell Encapsulation: Focus on Therapeutics and Technologies, 2019-2030, covering key aspects of the industry’s evolution and identifying potential future growth opportunities.To order this 500+ page report, which features 170+ figures and 395+ tables, please visit this link - https://www.rootsanalysis.com/reports/view_document/cell-encapsulation-focus-on-therapeutics-and-technologies-2019-2030/249.html

Key Market Insights

Presently, over 45 encapsulated cell therapies and encapsulation technologies are being evaluated across different phases of development by stakeholders across the world

Ongoing therapy development programs are evaluating different types of cells, encapsulated in a wide range of biocompatible materials, aiming to offer viable and effective treatment options for various diseases

In fact, majority of the product candidates are being developed for the treatment of metabolic disorders, primarily diabetes; big pharma are driving a significant proportion of research and development activity

Clinical research in this field is growing at a fast pace; encapsulated therapy products are evaluating a number of pre-marketing end points to validate safety / efficacy

Over the years, more than 3,000 patents have been granted / filed related to cell encapsulation technologies, demonstrating the heightened pace of research in this domain

Foreseeing a lucrative future, several private and public investors have made capital investments worth approximately USD 1 billion, across over 100 funding instances, since 2013

Growth in partnership activity reflects the rising interest of stakeholders in this domain; over 70% of deals have been inked related to therapies for metabolic disorders, involving both international and indigenous parties

An evaluation of more than 300+ stakeholders engaged in cell therapies domain reveals the presence of several likely strategic partners spread across different geographical regions

The short term opportunity in this market is likely to be driven by licensing activity and will depend on the untapped potential of novel cell encapsulation technologies in different application areas

As multiple mid-late stage encapsulated cell therapies get commercialized in near future across different regions, the long term opportunity is likely to be distributed across diverse indications and encapsulation materials

The enormous potential of encapsulated cell-based therapies / devices in the treatment of chronic disorders has captured the interest of several stakeholders in the industry

For more information, please visit https://www.rootsanalysis.com/reports/view_document/cell-encapsulation-focus-on-therapeutics-and-technologies-2019-2030/249.html

Table of Contents

1. PREFACE

1.1. Scope of the Report

1.2. Research Methodology

1.3. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

3.1. Context and Background

3.2. An Overview of Cell Therapies

3.2.1. Cell Therapy Manufacturing

3.2.2. Supply Chain

3.2.3. Key Challenges

3.3. An Introduction to Cell Encapsulation

3.3.1. Historical Overview

3.3.2. Cell Encapsulation Approaches

3.3.3. Encapsulation Materials

3.3.4. Advantages and Challenges

3.4. Potential Applications of Cell Encapsulation

3.4.1. Targeted Drug / Therapy Delivery

3.4.2. Immunoprotection

3.4.3. Storage and Transportation

3.5. Key Growth Drivers and Road-blocks

4. CURRENT MARKET LANDSCAPE

4.1. Chapter Overview

4.2. Encapsulated Cell Therapies and Encapsulation Technologies: Developer Landscape

4.2.1. Distribution by Year of Establishment

4.2.2. Distribution by Geographical Location

4.2.3. Distribution by Size of Developers

4.2.4. Distribution by Type of Offering

4.3. Encapsulated Cell Therapies and Encapsulation Technologies: Development Pipeline

4.3.1. Distribution by Target Therapeutic Area

4.3.2. Distribution by Phase of Development

4.3.3. Distribution by Type of Cells and Other Encapsulated Components

4.3.4. Distribution by Type of Encapsulation Material Used

4.3.5. Distribution by Route of Administration

4.3.6. Distribution by Application Areas

4.4. Encapsulated Cell Therapies and Encapsulation Technologies: Initiatives of Big Pharmaceutical Players

5. ENCAPSULATED CELL THERAPIES AND ENCAPSULATION TECHNOLOGIES FOR METABOLIC DISORDERS: COMPANY PROFILES

5.1. Chapter Overview

5.2. Developers with Clinical Candidates

5.2.1. Beta-O2 Technologies

5.2.1.1. Company Overview

5.2.1.2. Financial Information

5.2.1.3. Product Description: ꞵAir Bio-artificial Pancreas

5.2.1.4. Recent Developments and Future Outlook

5.2.2. Diatranz Otsuka

5.2.2.1. Company Overview

5.2.2.2. Financial Information

5.2.2.3. Product Description: DIABECELL®

5.2.2.4. Recent Developments and Future Outlook

5.2.3. Sernova

5.2.3.1. Company Overview

5.2.3.2. Financial Information

5.2.3.3. Product Description: Cell Pouch System™

5.2.3.4. Recent Developments and Future Outlook

5.2.4. ViaCyte

5.2.4.1. Company Overview

5.2.4.2. Financial Information

5.2.4.3. Product Description: PEC-Direct™ and PEC-Encap™

5.2.4.4. Recent Developments and Future Outlook

5.3. Developers with Preclinical Candidates

5.3.1. ALTuCELL

5.3.2. Beta-Cell

5.3.3. Betalin Therapeutics

5.3.4. CellProtect Biotechnology

5.3.5. Defymed

5.3.6. Encellin

5.3.7. Kadimastem

5.3.8. PharmaCyte Biotech

5.3.9. Semma Therapeutics

5.3.10. Sigilon Therapeutics

5.3.11. Seraxis

5.3.12. SymbioCellTech

6. ENCAPSULATED CELL THERAPIES AND ENCAPSULATION TECHNOLOGIES FOR NON-METABOLIC DISORDERS: COMPANY PROFILES

6.1. Chapter Overview

6.2. Developers with Clinical Candidates

6.2.1. Azellon Cell Therapeutics

6.2.1.1. Company Overview

6.2.1.2. Financial Information

6.2.1.3. Product Description: Cell Bandage

6.2.1.4. Recent Developments and Future Outlook

6.2.2. EryDel

6.2.2.1. Company Overview

6.2.2.2. Financial Information

6.2.2.3. Product Description: EryDex System

6.2.2.4. Recent Developments and Future Outlook

6.2.3. Erytech Pharma

6.2.3.1. Company Overview

6.2.3.2. Financial Information

6.2.3.3. Product Description: GRASPA®

6.2.3.4. Recent Developments and Future Outloo

6.2.4. Gloriana Therapeutics

6.2.4.1. Company Overview

6.2.4.2. Financial Information

6.2.4.3. Product Description: EC-NGF

6.2.4.4. Recent Developments and Future Outlook

6.2.5. Living Cell Technologies

6.2.5.1. Company Overview

6.2.5.2. Financial Information

6.2.5.3. Product Description: NTCELL®

6.2.5.4. Recent Developments and Future Outlook

6.2.6. MaxiVAX

6.2.6.1. Company Overview

6.2.6.2. Financial Information

6.2.6.3. Product Description: MVX-ONCO-1

6.2.6.4. Recent Developments and Future Outlook

6.2.7. Neurotech Pharmaceuticals

6.2.7.1. Company Overview

6.2.7.2. Financial Information

6.2.7.3. Product Description: NT-501

6.2.7.4. Recent Developments and Future Outlook

6.2.8. PharmaCyte Biotech

6.2.8.1. Company Overview

6.2.8.2. Financial Information

6.2.8.3. Product Description: Cell-in-a-Box®

6.2.8.4. Recent Developments and Future Outlook

6.3. Developers with Preclinical Candidates

6.3.1. Beta-O2 Technologies

6.3.2. Sernova

6.3.3. Sigilon Therapeutics

7. PATENT ANALYSIS

7.1. Chapter Overview

7.2. Scope and Methodology

7.3. Encapsulated Cell Therapies and Encapsulation Technologies: Patent Analysis

7.3.1. Analysis by Publication Year

7.3.2. Analysis by Geographical Location

7.3.3. Analysis by CPC Classifications

7.3.4. Emerging Focus Areas

7.3.5. Leading Players: Analysis by Number of Patents

7.4. Encapsulated Cell Therapies and Encapsulation Technologies: Patent Benchmarking Analysis (Industry Players)

7.4.1. Analysis by Patent Characteristics

7.4.2. Analysis by Geographical Locatio

7.5. Encapsulated Cell Therapies and Encapsulation Technologies: Patent Valuation Analysis

7.6. Leading Patents: Analysis by Number of Citations

8. CLINICAL TRIAL ANALYSIS

8.1. Chapter Overview

8.2. Scope and Methodology

8.3. Encapsulated Cell Therapies and Encapsulation Technologies: List of Clinical Trials

8.3.1. Analysis by Trial Registration Year

8.3.2. Geographical Analysis by Number of Clinical Trials

8.3.3. Geographical Analysis by Enrolled Patient Population

8.3.4. Analysis by Phase of Development

8.3.5. Analysis by Study Design

8.3.6. Analysis by Type of Sponsor / Collaborator

8.3.7. Most Active Players: Analysis by Number of Registered Trials

8.3.8. Analysis by Trial Focus

8.3.9. Analysis by Therapeutic Area

8.3.10. Analysis by Clinical Endpoints

9. RECENT PARTNERSHIPS

9.1. Chapter Overview

9.2. Partnership Models

9.3. Encapsulated Cell Therapies and Encapsulation Technologies: Recent Collaborations and Partnerships

9.3.1. Analysis by Year of Partnership

9.3.2. Analysis by Type of Partnership

9.3.3. Analysis by Therapeutic Area

9.3.4. Analysis by Type of Cells and Other Encapsulated Components

9.3.5. Most Active Players: Analysis by Number of Partnerships

9.3.6. Analysis by Regions

9.3.6.1. Most Active Players

9.3.6.2. Intercontinental and Intracontinental Agreements

10. FUNDING AND INVESTMENT ANALYSIS

10.1. Chapter Overview

10.2. Types of Funding

10.3. Encapsulated Cell Therapies and Encapsulation Technologies: Recent Funding Instances

10.3.1. Analysis by Number of Funding Instances

10.3.2. Analysis by Amount Invested

10.3.3. Analysis by Type of Funding

10.3.4. Analysis by Number of Funding Instances and Amount Invested across Different Indications

10.3.5. Analysis by Amount Invested across Different Type of Cells and Other Encapsulated Components

10.3.6. Most Active Players: Analysis by Amount Invested

10.3.7. Most Active Investors: Analysis by Number of Instances

10.3.8. Geographical Analysis of Amount Invested

10.4. Concluding Remarks

For more information, please visit https://www.rootsanalysis.com/reports/view_document/cell-encapsulation-focus-on-therapeutics-and-technologies-2019-2030/249.html

11. GRANT ANALYSIS

11.1. Chapter Overview

11.2. Scope and Methodology

11.3. Encapsulated Cell Therapies and Encapsulation Technologies: List of Academic Grants

11.3.1. Analysis by Project Start Year

11.3.2. Analysis by Focus Area

11.3.3. Analysis by Support Period

11.3.4. Analysis by Type of Grant

11.3.5. Analysis by Amount Awarded

11.3.6. Analysis by Study Section

11.3.7. Analysis by Therapeutic Area

11.3.8. Analysis by Type of Cells and Other Encapsulated Components

11.3.9. Analysis by Type of Encapsulation Material

11.3.10. Leading Funding Institutes: Analysis by Number of Grants

11.3.11. Leading Recipient Organizations: Analysis by Number of Grants

12. POTENTIAL STRATEGIC PARTNERS

12.1. Chapter Overview

12.2. Scope and Methodology

12.3. Potential Strategic Partners for Cell Therapy Development

12.3.1. Opportunities in North America

12.3.1.1. Most Likely Partners for Cell Therapy Development

12.3.1.2. Likely Partners for Cell Therapy Development

12.3.1.3. Less Likely Partners for Cell Therapy Development

12.3.2. Opportunities in Europe

12.3.2.1. Most Likely Partners for Cell Therapy Development

12.3.2.2. Likely Partners for Cell Therapy Development

12.3.2.3. Less Likely Partners for Cell Therapy Development

12.3.3. Opportunities in Asia-Pacific and Rest of the World

12.3.3.1. Most Likely Partners for Cell Therapy Development

12.3.3.2. Likely Partners for Cell Therapy Development

12.3.3.3. Less Likely Partners for Cell Therapy Development

12.4. Potential Strategic Partners for Cell Therapy Manufacturing

12.4.1. Opportunities in North America

12.4.1.1. Most Likely Partners for Cell Therapy Manufacturing

12.4.1.2. Likely Partners for Cell Therapy Manufacturing

12.4.1.3. Less Likely Partners for Cell Therapy Manufacturing

12.4.2. Opportunities in Europe

12.4.2.1. Most Likely Partners for Cell Therapy Manufacturing

12.4.2.2. Likely Partners for Cell Therapy Manufacturing

12.4.2.3. Less Likely Partners for Cell Therapy Manufacturing

12.4.3. Opportunities in Asia-Pacific and Rest of the World

12.4.3.1. Most Likely Partners for Cell Therapy Manufacturing

12.4.3.2. Likely Partners for Cell Therapy Manufacturing

12.4.3.3. Less Likely Partners for Cell Therapy Manufacturing

13. MARKET FORECAST

13.1. Chapter Overview

13.2. Forecast Methodology and Key Assumptions

13.3. Overall Cell Encapsulation Technologies Market, 2019-2030

13.3.1. Cell Encapsulation Technologies Market by Upfront Payments, 2019-2030

13.3.2. Cell Encapsulation Technologies Market by Milestone Payments, 2019-2030

13.4. Overall Encapsulated Cell Therapies Market, till 2030

13.4.1. Encapsulated Cell Therapies Market: Distribution by Therapeutic Area

13.4.1.1. Encapsulated Cell Therapies Market for Eye Disorders, till 2030

13.4.1.2. Encapsulated Cell Therapies Market for Metabolic Disorders, till 2030

13.4.1.3. Encapsulated Cell Therapies Market for Neurological Disorders, till 2030

13.4.1.4. Encapsulated Cell Therapies Market for Oncological Disorders, till 2030

13.4.2. Encapsulated Cell Therapies Market: Distribution by Type of Encapsulation Material Used

13.4.2.1. Encapsulated Cell Therapies Market for Alginate-based Microcapsules, till 2030

13.4.2.2. Encapsulated Cell Therapies Market for Cellulose Hydrogels, till 2030

13.4.2.3. Encapsulated Cell Therapies Market for Medical-grade Plastics, till 2030

13.4.2.4. Encapsulated Cell Therapies Market for Red Blood Cells, till 2030

13.4.3. Encapsulated Cell Therapies Market: Distribution by Geography

13.4.3.1. Encapsulated Cell Therapies Market in North America, till 2030

13.4.3.2. Encapsulated Cell Therapies Market in Europe, till 2030

13.4.3.3. Encapsulated Cell Therapies Market in Asia-Pacific, till 2030

13.5. Encapsulated Cell Therapies for Eye Disorders: Distribution by Indication

13.5.1. Encapsulated Cell Therapies Market for Eye Disorders: Macular Telangectasia, till 2030

13.5.1.1. NT-501 (Neurotech Pharmaceuticals)

13.5.1.1.1. Target Patient Population

13.5.1.1.2. Sales Forecast

13.5.1.1.3. Geographical Distribution of Projected Opportunity

13.5.1.1.3.1. Projected Opportunity in the US

13.5.1.1.3.2. Projected Opportunity in EU5

13.5.1.1.3.3. Projected Opportunity in Rest of Europe

13.5.1.1.3.4. Projected Opportunity in Australia

13.5.2. Encapsulated Cell Therapies Market for Eye Disorders: Glaucoma, till 2030

13.5.2.1. NT-501 (Neurotech Pharmaceuticals)

13.5.2.1.1. Target Patient Population

13.5.2.1.2. Sales Forecast

13.5.2.1.3. Geographical Distribution of Projected Opportunity

13.5.2.1.3.1. Projected Opportunity in the US

13.5.2.1.3.2. Projected Opportunity in EU5

13.5.2.1.3.3. Projected Opportunity in Rest of Europe

13.5.2.1.3.4. Projected Opportunity in Australia

13.5.3. Encapsulated Cell Therapies Market for Eye Disorders: Retinitis Pigmentosa, till 2030

13.5.3.1. NT-501 (Neurotech Pharmaceuticals)

13.5.3.1.1. Target Patient Population

13.5.3.1.2. Sales Forecast

13.5.3.1.3. Geographical Distribution of Projected Opportunity

13.5.3.1.3.1. Projected Opportunity in the US

13.5.3.1.3.2. Projected Opportunity in EU5

13.5.3.1.3.3. Projected Opportunity in Rest of Europe

13.5.3.1.3.4. Projected Opportunity in Australia

13.6. Encapsulated Cell Therapies for Metabolic Disorders: Distribution by Indication

13.6.1. Encapsulated Cell Therapies Market for Metabolic Disorders: Type 1 Diabetes, till 2030

13.6.1.1. DIABECELL® (Diatranz Otsuka)

13.6.1.1.1. Target Patient Population

13.6.1.1.2. Sales Forecast

13.6.1.1.3. Geographical Distribution of Projected Opportunity

13.6.1.1.3.1. Projected Opportunity in the US

13.6.1.1.3.2. Projected Opportunity in Japan

13.6.1.1.3.3. Projected Opportunity in EU5

13.6.1.1.3.4. Projected Opportunity in Rest of Europe

13.6.1.1.3.5. Projected Opportunity in Australia

13.6.1.1.3.6. Projected Opportunity in New Zealand

13.7. Encapsulated Cell Therapies for Neurological Disorders: Distribution by Indication

13.7.1. Encapsulated Cell Therapies Market for Neurological Disorders: Ataxia Telangiectasia, till 2030

13.7.1.1. EryDex System (EryDel)

13.7.1.1.1. Target Patient Population

13.7.1.1.2. Sales Forecast

13.7.1.1.3. Geographical Distribution of Projected Opportunity

13.7.1.1.3.1. Projected Opportunity in EU5

13.7.1.1.3.2. Projected Opportunity in Rest of Europe

13.7.1.1.3.3. Projected Opportunity in the US

13.7.1.1.3.4. Projected Opportunity in Australia

13.7.1.1.3.5. Projected Opportunity in India

13.7.1.1.3.6. Projected Opportunity in Israel

13.7.1.1.3.7. Projected Opportunity in Tunisia

13.7.2. Encapsulated Cell Therapies Market for Neurological Disorders: Parkinson’s Disease, till 2030

13.7.2.1. NTCELL® (Living Cell Technologies)

13.7.2.2. Target Patient Population

13.7.2.2.1. Sales Forecast

13.7.2.2.2. Geographical Distribution of Projected Opportunity

13.7.2.2.2.1. Projected Opportunity in New Zealand

13.7.2.2.2.2. Projected Opportunity in the US

13.7.2.2.2.3. Projected Opportunity in Australia

13.7.2.2.2.4. Projected Opportunity in EU5

13.7.2.2.2.5. Projected Opportunity in Rest of Europe

13.8. Encapsulated Cell Therapies for Oncological Disorders: Distribution by Indication

13.8.1. Encapsulated Cell Therapies Market for Oncological Disorders: Pancreatic Cancer, till 2030

13.8.1.1. GRASPA® (Erytech Pharma)

13.8.1.1.1. Target Patient Population

13.8.1.1.2. Sales Forecast

13.8.1.1.3. Geographical Distribution of Projected Opportunity

13.8.1.1.3.1. Projected Opportunity in EU5

13.8.1.1.3.2. Projected Opportunity in Rest of Europe

13.8.1.1.3.3. Projected Opportunity in the US

13.8.2. Encapsulated Cell Therapies Market for Oncological Disorders: Non-Metastatic Pancreatic Cancer, till 2030

13.8.2.1. Cell-in-a-Box® (PharmaCyte Biotech)

13.8.2.1.1. Target Patient Population

13.8.2.1.2. Sales Forecast

13.8.2.1.3. Geographical Distribution of Projected Opportunity

13.8.2.1.3.1. Projected Opportunity in the US

13.8.2.1.3.2. Projected Opportunity in EU5

13.8.2.1.3.3. Projected Opportunity of Cell-in-a-Box in Rest of Europe

13.8.3. Encapsulated Cell Therapies Market for Oncological Disorders: Triple Negative Breast Cancer, till 2030

13.8.3.1. GRASPA (Erytech Pharma)

13.8.3.1.1. Target Patient Population

13.8.3.1.2. Sales Forecast

13.8.3.1.3. Geographical Distribution of Projected Opportunity

13.8.3.1.3.1. Projected Opportunity in EU5

13.8.3.1.3.2. Projected Opportunity in Rest of Europe

13.8.3.1.3.3. Projected Opportunity in the US

13.8.4. Encapsulated Cell Therapies Market for Oncological Disorders: Head and Neck Cancer, till 2030

13.8.4.1. MVX-ONCO-1 (MaxiVAX)

13.8.4.1.1. Target Patient Population

13.8.4.1.2. Sales Forecast

13.8.4.1.3. Geographical Distribution of Projected Opportunity

13.8.4.1.3.1. Projected Opportunity in EU5

13.8.4.1.3.2. Projected Opportunity in Rest of Europe

13.8.4.1.3.3. Projected Opportunity in the US

For more information, please visit https://www.rootsanalysis.com/reports/view_document/cell-encapsulation-focus-on-therapeutics-and-technologies-2019-2030/249.html

14. CONCLUSION

14.1. Cell-based Pharmacological Interventions are Characterized by Diverse Challenges, Most of which can be Mitigated using Various Encapsulation Strategies

14.2. The Pipeline Features Several Mid and Late Stage Encapsulated Therapy Products, Majority of which are intended for the Treatment of Metabolic Disorders

14.3. The Fragmented Developer Landscape Includes a Mix of Small and Mid-Sized Players; at Present, North America and Europe are Major Hubs of Development Activity

14.4. The Heightened Pace of Research in this Domain is Evident from the Rise in the Number of Patents Filed / Granted and the Clinical Studies Conducted in the Recent Years

14.5. Development Efforts in this Field have Drawn Significant Capital Investments from Private and Public Investors; this is Likely to Provide the Necessary Impetus to the Market’s Future Growth

14.6. Growth in Partnership Activity Reflects the Rising Interest of Industry Stakeholders; Most Agreements are Between Technology Providers and Cell Therapy Developers

14.7. Given the Increasing Number of Licensing Deals and the Expected Approval of Multiple Mid-Late Stage Candidates, the Market is Poised to Grow at a Significant Pace in the Coming Years

15. EXECUTIVE INSIGHTS

15.1. Chapter Overview

15.2. Erytech Pharma

15.2.1. Company Snapshot

15.2.2. Interview Transcript: Alexander Scheer, Chief Scientific Officer

15.3. Defymed

15.3.1. Company Snapshot

15.3.2. Interview Transcript: Manuel Pires, Business Developer

15.4. Kadimastem

15.4.1. Company Snapshot

15.4.2. Interview Transcript: Michel Revel, Chief Scientist and Galit Mazooz-Perlmuter, Business Development Manager

15.5. Aterelix

15.5.1. Company Snapshot

15.5.2. Interview Transcript: Mick Mclean, Chief Executive Officer

15.6. Neurotech Pharmaceuticals

15.6.1. Company Snapshot

15.6.2. Interview Transcript: Quinton Oswald, Former President and Chief Executive Officer

15.7. Seraxis

15.7.1. Company Snapshot

15.7.2. Interview Transcript: William L Rust, Founder and Chief Executive Officer

15.8. Beta-O2 Technologies

15.8.1. Company Snapshot

15.8.2. Interview Transcript: Yuval Avni, Former Chief Executive Officer

16. APPENDIX 1: TABULATED DATA

17. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

Contact:

Gaurav Chaudhary

+1 (415) 800 3415

+44 (122) 391 1091

Gaurav.Chaudhary@rootsanalysis.com

Contact:

Gaurav Chaudhary

gaurav.chaudhary@rootsanalysis.com

Roots Analysis

A430, 4th Floor,

Bestech Business Towers, Sector 66, Mohali, India

sales@rootsanalysis.com

+1 (415) 800 3415

+44 (122) 391 1091

Web: https://www.rootsanalysis.com/

LinkedIn: https://in.linkedin.com/company/roots-analysis

Twitter: https://twitter.com/RootsAnalysis

Roots Analysis is one of the fastest growing market research companies, sharing fresh and independent perspectives in the bio-pharmaceutical industry. The in-depth research, analysis and insights are driven by an experienced leadership team which has gained many years of significant experience in this sector. If you’d like help with your growing business needs, get in touch at info@rootsanalysis.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Given the increasing number of licensing deals and the expected approval of multiple mid-late stage candidates, the encapsulated cell therapies and encapsulation technologies market is anticipated to evolve at a rapid pace over the next decade, predicts R here

News-ID: 2209735 • Views: …

More Releases from Roots Analysis

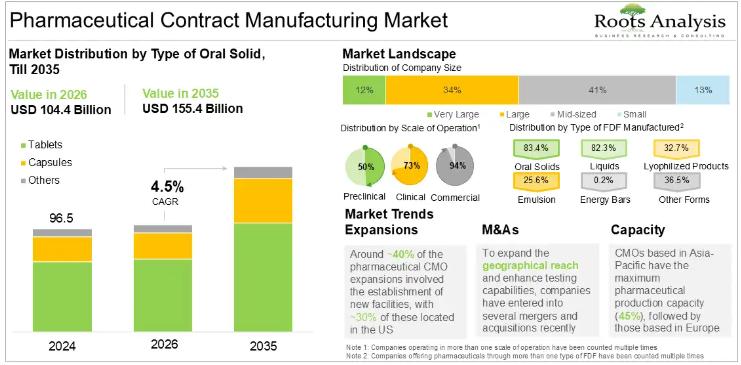

Pharmaceutical Contract Manufacturing Market CAGR To Reach 4.5% between 2025 and …

According to our latest market report "Pharmaceutical Contract Manufacturing Market by Type of Product Manufactured, Type of API, API Potency, Type of FDF, Dosage Form, Type of Oral Solid, Type of Packaging Offered, Scale of Operation, End User, Geographical Regions and Key Players: Industry Trends and Global Forecasts, till 2035", the pharmaceutical contract manufacturing market is estimated to be USD 100.3 billion in 2025. It is expected to reach USD…

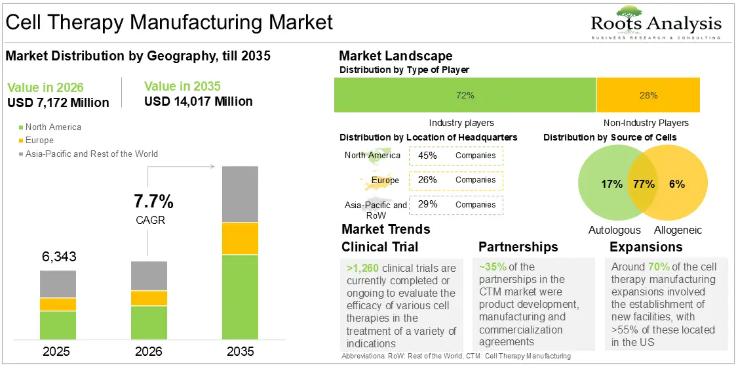

Cell Therapy Manufacturing Market CAGR To Exceed 8.25% by 2035, Due to the Growi …

According to our latest market report "Cell Therapy Manufacturing Market by Type of Cell Therapy, Source of Cells, Scale of Operation, Type of Manufacturer and Key Geographical Regions: Industry Trends and Global Forecasts, 2023-2035", the global cell therapy manufacturing market size is projected to reach USD 14,017 million by 2035 from USD 6,343 million in 2025, growing at a CAGR of 8.25% in the forecast period 2025-2035.

To request quote…

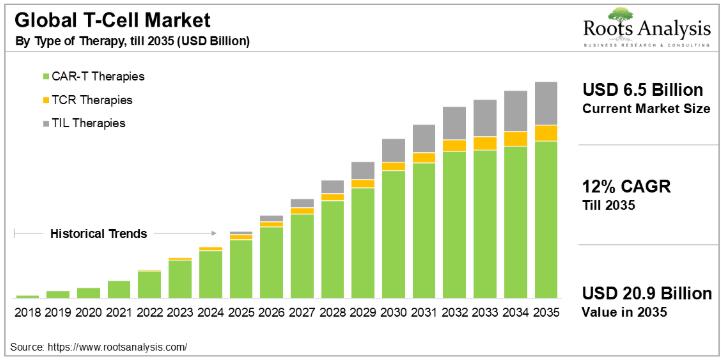

T-Cell Therapy Market Size to Hit USD 20.9 billion by 2035| Exclusive Report by …

Cancer is one of the leading causes of mortality across the world. As per the International Agency for Research on Cancer (IARC), by 2040, there are likely to be 27.5 million new cases and 16.3 million deaths related to cancer, annually. Although cancer therapeutics continue to be one of the most active areas, in terms of drug development, there is still a significant unmet need in this domain. In fact,…

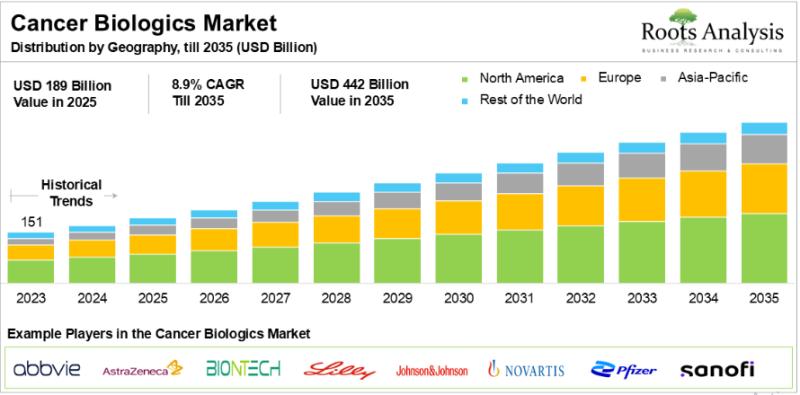

Cancer Biologics Market: Unmet Need and Treatment Guidelines

Owing to the increasing mortality rates and growing need for novel modalities to treat oncological disorders, several researchers and industry stakeholders have shifted their focus on the development of safe and effective biologic therapies. Cancer biologics are the class of therapeutic agents, which primarily modulate immune responses or directly inhibits oncogenic pathways in malignancies. These therapies, such as monoclonal antibodies, specifically target tumor-activating genes, facilitate antibody-dependent cellular cytotoxicity and complement…

More Releases for Cell

Cell Sorting Market Accelerates as Cell Therapy, Immuno-Oncology & Single-Cell R …

The rising focus on precision medicine, immunotherapy, and advanced cell-based research is driving the global cell sorting market into a high-growth phase. With expanding applications in stem cell therapy, CAR-T manufacturing, cancer immunology, and single-cell genomics, demand for accurate, high-purity cell isolation systems is stronger than ever. This release highlights key market trends, segmentation insights, technological innovations, and the factors shaping the future of cell sorting.

Download Full PDF Sample Copy…

Cell Isolation Cell Separation Market Size Analysis by Application, Type, and Re …

According to Market Research Intellect, the global Cell Isolation Cell Separation market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The market for cell isolation and separation is expanding rapidly as a result of sophisticated biotechnological…

Cell Free Protein Synthesis Market Beyond the Cell: Revolutionizing Protein Prod …

Cell-Free Protein Synthesis Market to reach over USD 457.13 Mn by the year 2031 - Exclusive Report by InsightAce Analytic

"Cell-Free Protein Synthesis Market" in terms of revenue was estimated to be worth $265.94 Mn in 2023 and is poised to reach $457.13 Mn by 2031, growing at a CAGR of 7.20% from 2024 to 2031 according to a new report by InsightAce Analytic.

Request for free Sample Pages: https://www.insightaceanalytic.com/request-sample/1445

Current…

Cell Expansion Market - Expand the Boundaries of Cell Therapy: Redefine Cell Exp …

Newark, New Castle, USA: The "Cell Expansion Market" provides a value chain analysis of revenue for the anticipated period from 2022 to 2030. The report will include a full and comprehensive analysis of the business operations of all market leaders in this industry, as well as their in-depth market research, historical market development, and information about their market competitors

Cell Expansion Market: https://www.growthplusreports.com/report/cell-expansion-market/7939

This latest report researches the industry structure, sales, revenue,…

Global GMP Cell Banking Market By Type - Mammalian Cell, Microbial Cell, Insect …

Researchmoz added Most up-to-date research on "Global GMP Cell Banking Market By Type - Mammalian Cell, Microbial Cell, Insect Cell and Others" to its huge collection of research reports.

This report researches the worldwide GMP Cell Banking market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global GMP Cell Banking breakdown data by manufacturers, region, type…

Cell Culture Market Size, Cell Culture Market Share, Cell Culture Market Trends …

According to a new research published by Polaris Market Research the global cell culture market is anticipated to reach more than USD 49 billion by 2026. Cell culture is a rapidly emerging as an implement for analyzing and treating various disease such as Alzheimer’s and cancer.

Request for Sample of This Research Report @ https://bit.ly/2D7pZ5u

Top Key Players: -

Becton,

Dickinson and Company

Biospherix

EMD Millipore

Eppendorf AG

Merck KGaA

Sartorius AG

VWR International

Cell culture is a rapidly emerging…