Press release

Fintech Investment Market Bigger Than Expected | ZhongAn (China) , Oscar , Wealth front , Quefangi

Global Fintech Investment Market Size study, by Application (P2P Lending, Online Acquiring and Mobile Wallets, Personal Finance Management or Private Financial Planning, MSME Services, MPOS, Mobile First Banking, Bitcoin, Crowd Funding, Others) and by Regional Forecasts 2018-2025 , Covid 19 Outbreak Impact research report added by Report Ocean, is an in-depth analysis of market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography. It places the market within the context of the wider Fintech Investment market, and compares it with other markets., market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Fintech Investment market size forecast, market data & Graphs and Statistics, Tables, Bar &Pie Charts, and many more for business intelligence. Get complete Report (Including Full TOC, 100+ Data Tables & Figures, and Chart). - In-depth Analysis Pre & Post COVID-19 Market Outbreak Impact Analysis & Situation by RegionDownload Free Sample Copy of ‘Fintech Investment market’ Report @

https://www.reportocean.com/industry-verticals/sample-request?report_id=16903

Global Fintech Investment Market to reach USD 152.94 billion by 2025.

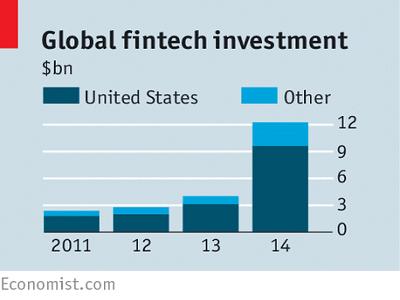

Global Fintech Investment Market valued approximately USD 39.6 billion in 2017 is anticipated to grow with a healthy growth rate of more than 18.40% over the forecast period 2018-2025. The growth of an alternative business model that can both replace and complement traditional payment practices is a key growth driver for the fintech market growth. Major banks are helping to incubate, invest in, or partner with FinTech companies. For instance, Oradian, a software provider caters to organizations that offer financial services to low-income individuals. Oradian develops core systems that help microfinance institutions manage their clients efficiently and facilitates day-to-day operations. The Oradian business model relies primarily on creating a niche in the microfinance industry as developing countries are encouraging microfinance institutions and dispersing credit to small businesses in a bid to revive economic growth. The growing popularity of blockchain is also expected to aid market growth over the forecast period. The blockchain is considered the world's most popular bitcoin wallet. Many banks are opting for this technology to execute different tasks (such as authentication processes) or to verify documents residing within the banking system. Blockchain technology can help complete business-to-business transfers at significantly low costs and with minimal decentralization

The regional analysis of Global Fintech Investment Market is considered for the key regions such as Asia Pacific, North America, Europe, Latin America and Rest of the World. North America dominated the market, accounting for more market share. In this region, the traditional financial services are at risk as there is a vast number of new technology-enabled entrants. This region is also expected to witness a huge number of partnerships, acquisitions, and competition during the forecast period. Many start-ups have started offering student loans and other types of financing through various FinTech platforms. This is anticipated to increase the deal volumes of investment in the Americas during the forecast period.

The objective of the study is to define market sizes of different segments & countries in recent years and to forecast the values to the coming eight years. The report is designed to incorporate both qualitative and quantitative aspects of the industry within each of the regions and countries involved in the study. Furthermore, the report also caters the detailed information about the crucial aspects such as driving factors & challenges which will define the future growth of the market. Additionally, the report shall also incorporate available opportunities in micro markets for stakeholders to invest along with the detailed analysis of competitive landscape and product offerings of key players. The detailed segments and sub-segment of the market are explained below:

The industry is seeming to be fairly competitive. Some of the leading market players include ZhongAn (China), Oscar, Wealth front, Quefangi, Funding Circle, Kreditech, Avant., Atom Bank, Klarna, Our Crowd and so on. Acquisitions and effective mergers are some of the strategies adopted by the key manufacturers. New product launches and continuous technological innovations are the key strategies adopted by the major players.

Target Audience of the Global Fintech Investment Market in Market Study:

Key Consulting Companies & Advisors

Large, medium-sized, and small enterprises

Venture capitalists

Value-Added Resellers (VARs)

Third-party knowledge providers

Investment bankers

Investors

Key Segments Studied in the Global Fintech Investment Market

Professional Key players:

ZhongAn (China) , Oscar , Wealth front , Quefangi , Funding Circle , Kreditech , Avant. , Atom Bank , Klarna , Our Crowd and so on

Market Segmentation:

Global Fintech Investment Market Size study, by Application (P2P Lending, Online Acquiring and Mobile Wallets, Personal Finance Management or Private Financial Planning, MSME Services, MPOS, Mobile First Banking, Bitcoin, Crowd Funding, Others) and by Regional Forecasts 2025

A combination of factors, including COVID-19 containment situation, end-use market recovery & Recovery Timeline of 2020/ 2021

covid-19 scenario Market Behavior/ Level of Risk and Opportunity End Industry Behavior/ Opportunity Assessment Expected Industry Recovery Timeline Business Impact Horizon

Opening of Economy by Q3 2020 xx xx xx xx

Recovery – Opening of Economy extended till Q4 2020 / Q1 2021 xx xx xx xx

A systematic step framework for How to Tackle The Situation… “MITIGATE” | “SUSTAIN” | “GROW”: Business Strategy Recovery, Scenario and Planning

Economic Consequences of the COVID-19 Outbreak on Market: The Study Explore COVID 19 Outbreak Impact Analysis & Conclusion by Economic Impact & Risk Factors

• What should be entry strategies, countermeasures to economic impact, and marketing channels?

• What are market dynamics?

• What are challenges and opportunities?

• What is economic impact on market?

• What is current market status? What’s market competition in this industry, both company, and country wise? What’s market analysis by taking applications and types in consideration?

Geographical Breakdown: The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the impact and recovery path of Covid 19 for all regions, key developed countries and major emerging markets.

Countries: Argentina; Australia; Austria; Belgium; Brazil; Canada; Chile; China; Colombia; Czech Republic; Denmark; Egypt; Finland; France; Germany; Hong Kong; India; Indonesia; Ireland; Israel; Italy; Japan; Malaysia; Mexico; Netherlands; New Zealand; Nigeria; Norway; Peru; Philippines; Poland; Portugal; Romania; Russia; Saudi Arabia; Singapore; South Africa; South Korea; Spain; Sweden; Switzerland; Thailand; Turkey; UAE; UK; USA; Venezuela; Vietnam

In-Depth Qualitative COVID 19 Outbreak Impact Analysis Include Identification And Investigation Of The Following Aspects:

The research includes the key strategic activities such as R&D plans, M&A completed, agreements, new launches, collaborations, partnerships & (JV) Joint ventures, and regional growth of the key competitors operating in the market at global and regional scale.

Key Market Features in COVID-19 Outbreak:

The report highlights market features, including revenue, weighted average regional price, capacity utilization rate, production rate, gross margins, consumption, import & export, supply & demand, cost bench-marking, market share, CAGR, and gross margin.

Market Highlights & Approach

The report provides the rigorously studied and evaluated data of the top industry players and their scope in the market by means of several analytical tools. The analytical tools such as Porters five forces analysis, feasibility study, SWOT analysis, and ROI analysis have been practiced reviewing the growth of the key players operating in the market.

(Get Special Discount Up To: 30% to 40% Discount)

https://www.reportocean.com/industry-verticals/sample-request?report_id=16903

Key questions answered: Study Explore COVID 19 Outbreak Impact Analysis

- Detailed Overview of market helps deliver clients and businesses making strategies.

- Influential factors that are thriving demand and constraints in the market.

- What is the market concentration? Is it fragmented or highly concentrated?

- What trends, challenges and barriers will impact the development and sizing of market?

- SWOT Analysis of each key players mentioned along with its company profile with the help of Porter’s five forces tool mechanism to compliment the same.

- What growth momentum or acceleration market carries during the forecast period?

- Which region is going to tap highest market share in future?

- What Application/end-user category or Product Type may see incremental growth prospects?

- What would be the market share of key countries like United States, France, UK, Germany, Italy, Canada, Australia, Japan, China or Brazil etc.?

- What focused approach and constraints are holding the market tight?

- What impact of COVID-19 lockdown on consumers' awareness, behavior, and attitudes?

Ask Our Expert for Complete Report@:

https://www.reportocean.com/industry-verticals/sample-request?report_id=16903

Key Points Covered in Fintech Investment Market Report:

Chapter 1, About Executive Summary to describe Definition, Specifications and Classification of Fintech Investment market, Applications, Market Segment by Regions North America, Europe or Asia;

Chapter 2, objective of the study.

Chapter 3, to display Research methodology and techniques.

Chapter 4 and 5, to show the Overall Market Analysis, segmentation analysis, characteristics;

Chapter 6 and 7, to show the Market size, share and forecast; Five forces analysis (bargaining Power of buyers/suppliers), Threats to new entrants and market condition;

Chapter 8 and 9, to show analysis by regional segmentation, comparison, leading countries and opportunities; Regional Marketing Type Analysis, Supply Chain Analysis

Chapter 10, focus on identifying the key industry influencer’s, overview of decision framework accumulated through Industry experts and strategic decision makers;

Chapter 11 and 12, Market Trend Analysis, Drivers, Challenges by consumer behavior, Marketing Channels and demand & supply.

Chapter 13 and 14, describe about the vendor landscape (classification and Market Positioning)

Chapter 15, deals with Fintech Investment Market sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

……..and view more in complete table of Contents

Browse Premium Research Report with Tables and Figures at @ https://www.reportocean.com/industry-verticals/sample-request?report_id=16903

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Get in Touch with Us:

Report Ocean

Email: sales@reportocean.com

Address: 500 N Michigan Ave, Suite 600, Chicago, IIIinois 60611 – UNITED STATES

Tel: +1 888 212 3539 (US – TOLL FREE)

Website: https://www.reportocean.com/

Blog: https://reportoceanblog.com/

About Report Ocean:

We are the best market research reports provider in the industry. Report Ocean believe in providing the quality reports to clients to meet the top line and bottom line goals which will boost your market share in today’s competitive environment. Report Ocean is “one-stop solution” for individuals, organizations, and industries that are looking for innovative market research reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Investment Market Bigger Than Expected | ZhongAn (China) , Oscar , Wealth front , Quefangi here

News-ID: 2201558 • Views: …

More Releases from Report Ocean

Japan Internet Advertising Market CAGR of 24.9%, Behind the Scenes Techniques fo …

The Japan Internet Advertising Market has demonstrated remarkable growth, reaching a valuation of USD 29.49 Billion in 2021. With the digital landscape continually evolving, it is forecasted to soar to an impressive USD 112.04 Billion by 2027. This surge represents an anticipated compound annual growth rate (CAGR) of 24.9% over the projected period, highlighting the dynamic and rapidly expanding nature of the digital advertising sector in Japan.

Internet Advertising are set…

Location Analytics Market Through the Looking Glass Techniques for a Profound Un …

This comprehensive market research report offers an in-depth analysis of the global location analytics market from 2019 to 2026. Valued at USD 10,813.6 million in 2019, the market is forecasted to surge to USD 29,878.5 million by 2026, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.6% throughout the projection period. This report delves into the key drivers, restraints, opportunities, and challenges that are shaping the market, providing stakeholders…

Affiliate Marketing Platform Market Eyes Wide Open Maximizing the Value of Obser …

The Global Affiliate Marketing Platform Market, valued at USD 19,217.4 million in 2021, is projected to witness significant growth over the next decade, reaching an estimated value of USD 36,902.1 million by 2030.

This report provides an in-depth analysis of the market dynamics, growth drivers, challenges, and opportunities that will influence the affiliate marketing landscape over the forecast period of 2021-2030. With a Compound Annual Growth Rate (CAGR) of 7.7%,…

Global Clear Brine Fluids Market Growth Forecast and Trends (2022-2030)

The global clear brine fluids market was valued at US$ 0.95 billion in 2021. It is anticipated to experience growth, reaching a valuation of US$ 1.39 billion by 2030. This growth trajectory translates to a compound annual growth rate (CAGR) of 3.1% during the forecast period from 2022 to 2030. Clear brine fluids, crucial in the oil and gas industry for drilling and completion processes, are poised for increased demand,…

More Releases for Investment

ST Investment Co., Ltd: Pioneering the Global Investment Trend

Since its establishment in 2017 in the United Kingdom, ST Investment Co., Ltd has rapidly emerged as a shining star in the global investment sector. Through its diversified business portfolio and exceptional financial services, the company provides a comprehensive wealth growth platform for clients worldwide. Its services span key sectors such as artificial intelligence-based smart contracts, private equity, gold investments, and wealth management, all aimed at delivering stable and diverse…

Lakshmishree Investment: Common Investment Mistakes When Markets Are High

One big mistake many investors make is taking too much risk because they fear missing out.

Stock markets around the world are on fire! From the bustling streets of Wall Street to the vibrant Bombay Stock Exchange (BSE), markets are scaling new highs, leaving many investors excited and bewildered. While this bull run is thrilling, it can also be confusing. Should you jump in and buy more? Hold on tight…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Investment Management Market Growth Improvement Highly Witness | NWQ Investment …

Investment management is designed to help investors or owners to recognize, manage, and communicate the performance and risks of assets and related investments. As an alternative to spending time pursuing data and manually creating reports, fund managers, owners, and operators can focus on maximizing performance.

Investment Management market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report…