Press release

Armenia Banking Market 2020-2027: Current Trends, Market Share, Top Impacting Factors and Growth Opportunities By ARARATBANK OJSC, ArmSwissBank CJSC, Ameriabank CJSC, Converse Bank CJSC, HSBC Armenia, ID Bank and ArmBusinessBank CJSC

Allied Market Research published an exclusive report, titled, “Armenia Banking Market By Sector (Retail Banking, Corporate Banking, and Investment Banking) and Type (Closed Joint-Stock Company [CJSC] and Open Joint-Stock Company [OJSC]): Opportunity Analysis and Industry Forecast, 2020-2027”.The armenia banking market report offers an in-depth analysis of every crucial factor that affects the market growth including recent market developments, key market players, and decisive trends. The study begins with a detailed analysis of major determinants of the market such as drivers, challenges, restraints, and upcoming opportunities.

Download Sample Report (Get Full Insights in PDF - 90 Pages) @ https://www.alliedmarketresearch.com/request-sample/6274

The market is studied based on a variety of factors that impact the performance of the market across various regions such as North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa).

The armenia banking market report includes a thorough study of the top 10 market players active in the industry along with their business overview, financial analysis, business strategies, SWOT profile, and key products and services. Leading market players analyzed in the report include Ameriabank CJSC, ARARATBANK OJSC, ArmSwissBank CJSC, Converse Bank CJSC, HSBC Armenia, ID Bank, ACBA-CREDIT AGRICOLE BANK CJSC, ArmBusinessBank CJSC, Ardshinbank CJSC, and Inecobank CJSC. Moreover, it includes recent industry developments including prime market mergers & acquisitions, new product launches, partnerships and collaborations, and market expansion.

Get Detailed Analysis of COVID-19 Impact on Armenia Banking Market @ https://www.alliedmarketresearch.com/purchase-enquiry/6274

The armenia banking industry report includes growth factors of the market along with major challenges and restraining factors that might hinder the market growth. This analysis aids new market entrants and existing manufacturers to prepare for future challenges and take advantage of opportunities to strengthen their market position.

The report offers detailed information regarding major end-users and annual forecasts from 2019 to 2027. In addition, it presents revenue forecasts for each year along with sales and sales growth of the armenia banking. The forecasts are offered by an in-depth study of the market by skilled analysts concerning sector, type, and geography of the market. These forecasts are beneficial to gain insight on the future prospects of the market.

Access Full Summary @ https://www.alliedmarketresearch.com/armenia-banking-market

Prime Benefits:

1. The report includes Porter’s Five Forces analysis to understand the ability of buyers and suppliers to allow business investors to make strategic decisions.

2. The study offers a detailed analysis of the ongoing market trends, market size, and forecast of the armenia banking market during the period 2019-2027.

3. The report includes the potential of the market across various regions along with revenue contribution.

4. The study provides an in-depth analysis of the major market players in the armenia banking market.

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/6274

Major Offering of the Report:

1. Major impacting factors: An in-depth analysis of driving factors, upcoming opportunities, and challenges.

2. Ongoing trends & forecasts: A thorough study in recent market trends, happenings, and forecasts for the next few years to take a strategic, informed decision.

3. Segmental analysis: A detailed analysis of each segment and driving factors coupled with growth rate analysis.

4. Regional analysis: Insights on the market potential across each region to enable market players to leverage market opportunities.

5. Competitive landscape: An in-depth analysis of every key market player active in the armenia banking market.

Armenia Banking Market Key Segments:

By Sector:

1. Retail Banking

2. Corporate Banking

3. Investment Banking

By Type:

1. Closed Joint-Stock Company (CJSC)

2. Open Joint-Stock Company (OJSC)

CHAPTERS DISCUSSED IN THE REPORT: [Total 90 Pages]

Chapter 1: Introduction

Chapter 2: Executive Summary

Chapter 3: Market Overview

Chapter 4: Armenia Banking Market, By Sector

Chapter 5: Armenia Banking Market, By Type

Chapter 6: Company Profiles

Buy Now @ https://www.alliedmarketresearch.com/checkout-final/bb0ec261d28723c12140d363d41378cf

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Armenia Banking Market 2020-2027: Current Trends, Market Share, Top Impacting Factors and Growth Opportunities By ARARATBANK OJSC, ArmSwissBank CJSC, Ameriabank CJSC, Converse Bank CJSC, HSBC Armenia, ID Bank and ArmBusinessBank CJSC here

News-ID: 2199071 • Views: …

More Releases from Allied Market Research

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Indoor Farming Equipment Market Outlook, Top Key Players Analysis, Current Trend …

The report highlights numerous factors that influence the growth of the global Indoor farming equipment market such as market demand & forecast and qualitative and quantitative information. The qualitative data of market report includes pricing analysis, key regulations, macroeconomic factors, microeconomic factors, key impacting factors, company share analysis, market dynamics & challenges, strategic growth initiatives, and competition intelligence. The study cracks market demand in 15+ high-growth markets in the…

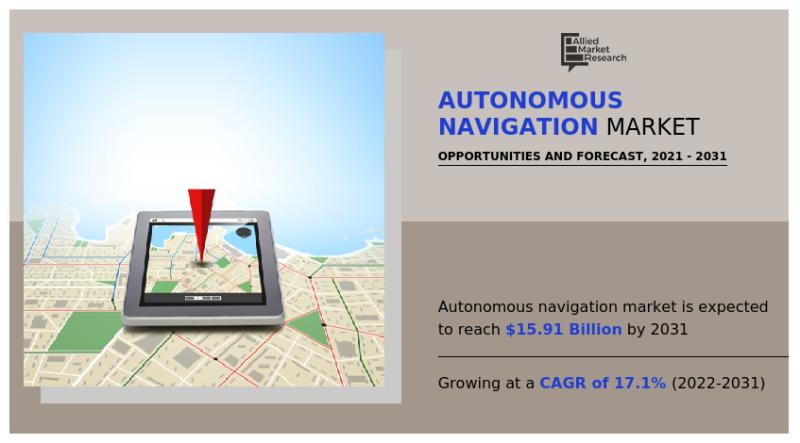

Autonomous Navigation Market Analysis and Forecast with a CAGR of 17.1% (2022-20 …

The global autonomous navigation market garnered $3.27 billion in 2021, and is estimated to generate $15.91 billion by 2031, manifesting a CAGR of 17.1% from 2022 to 2031.

Increase in demand for sense & avoid systems in autonomous system, rise in adoption of autonomous robot in commercial & military applications, and surge in demand for real-time data in military applications drive the growth of the global autonomous navigation market. During…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…