Press release

Global Wealth Management Market Analysis by SWOT, Investment, Future Growth and Major Key Players 2020 TO 2030

The Business Research Company’s Wealth Management Market - Opportunities And Strategies – Global Forecast To 2030Avail up to 50% off on ALL research reports at: https://www.thebusinessresearchcompany.com/global-market-reports. Offer applies until Dec 31st.

The global wealth management market reached a value of nearly $486.78 billion in 2019, having increased at a compound annual growth rate (CAGR) of 6.6% since 2015. The market is expected to decline from $486.78 billion in 2019 to $446.73 billion in 2020 at a rate of -8.2%. The decline is mainly due to lockdown and social distancing norms imposed by various countries and economic slowdown across countries owing to the COVID-19 outbreak and the measures to contain it. The market is then expected to recover and grow at a CAGR of 9.4% from 2021 ad reach $584.99 billion in 2023.

The Key drivers of the wealth management market include:

Rising Demand For Alternative Investments– Going forward, increasing demand for alternative investments is expected to drive the market for wealth management. There has been an increasing preference for alternative investments among the high net worth individuals and ultra-high net worth individuals. Alternative investments are financial assets, which do not fall into the category of conventional financial assets, such as stocks, bonds, and cash. Examples of alternative investments include hedge funds, private equity, commodities, mineral rights, real estate investment trusts (REITs), art and antiquities, intellectual property, and derivatives (futures, options, and swaps), among others. Investors are increasingly becoming interested in alternative investments owing to several benefits offered such as diversification, reduction in portfolio risk, availability in private markets, low correlation with other assets, less regulation, and relatively higher returns.

Browse Complete Report @ https://www.thebusinessresearchcompany.com/report/wealth-management-market

Wealth Management Market Segmentation:-

By Type Of Asset Class-

The wealth management market can be segmented by type of asset class into

a) Equity

b) Fixed Income

c) Alternative Assets and Others

The fixed income market was the largest segment of the wealth management market segmented by type, accounting for 69.3% of the total in 2019. Going forward, the alternative assets and others segment is expected to be the fastest growing segment in the wealth management market, at a CAGR of 8.6% during 2019-2023.

By Advisory Mode-

The wealth management market can be segmented by advisory mode into

a) Human Advisory

b) Robo Advisory

c) Hybrid Advisory

The human advisory market was the largest segment of the wealth management market segmented by type of advisory mode, accounting for 98.6% of the total in 2019. Going forward, the robo advisory segment is expected to be the fastest growing segment in the wealth management market, at a CAGR of 26.1% during 2019-2023.

Request For A Sample Copy Of This Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=2156&type=smp

By Geography - The wealth management market is segmented into

1.North America

2.Western Europe

3.Asia Pacific

4.Eastern Europe

5.South America

6.Middle East

7.Africa

Some of the major key players involved in the wealth management market are

• Wells Fargo & Company

• JPMorgan Chase & Co.

• Bank of America Corporation

• Morgan Stanley

• UBS Group AG

Place a DIRECT PURCHASE ORDER of the report @ https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2156

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on Blog: http://blog.tbrc.info/

About US:

The Business Research Company has published over 1000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets after WHO declared COVID-19 as a pandemic.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Wealth Management Market Analysis by SWOT, Investment, Future Growth and Major Key Players 2020 TO 2030 here

News-ID: 2198514 • Views: …

More Releases from The Business research company

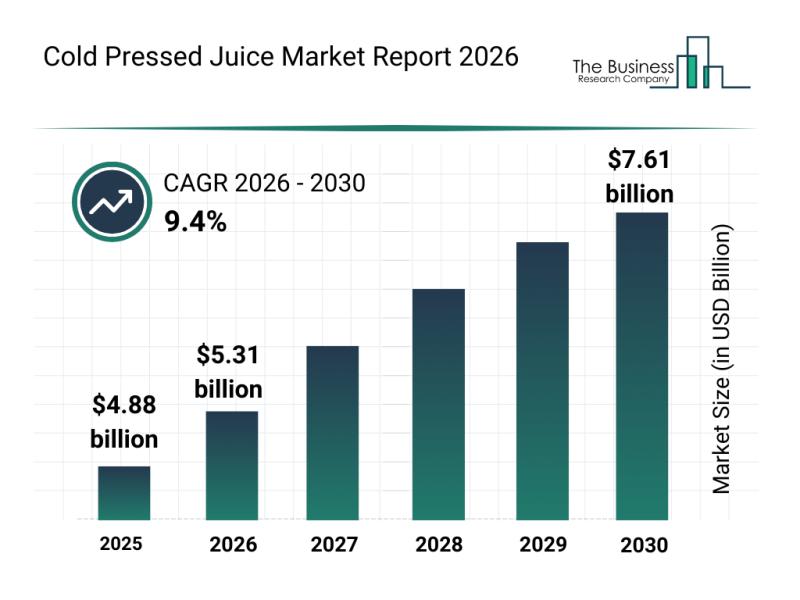

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

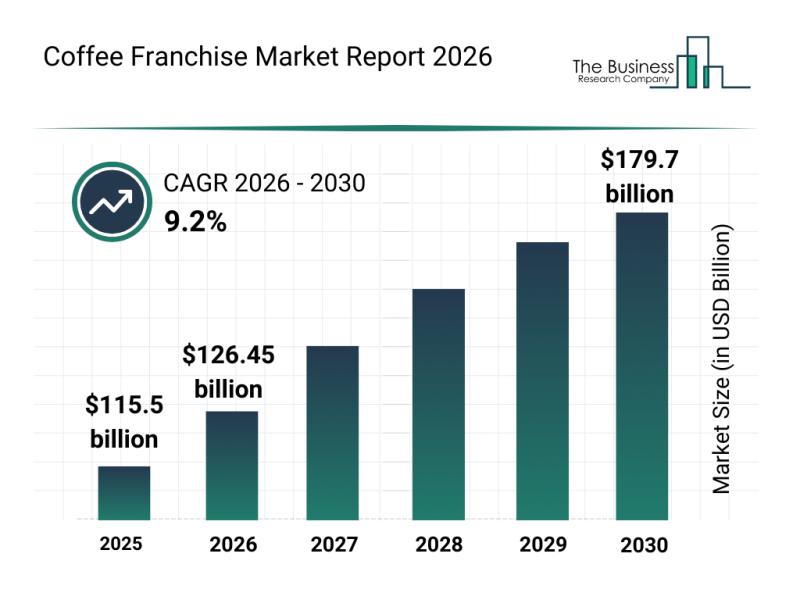

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

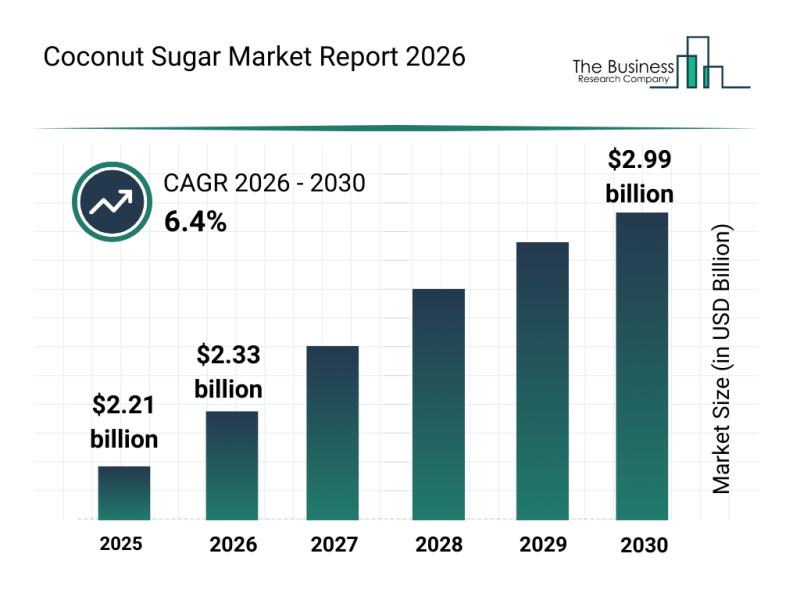

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

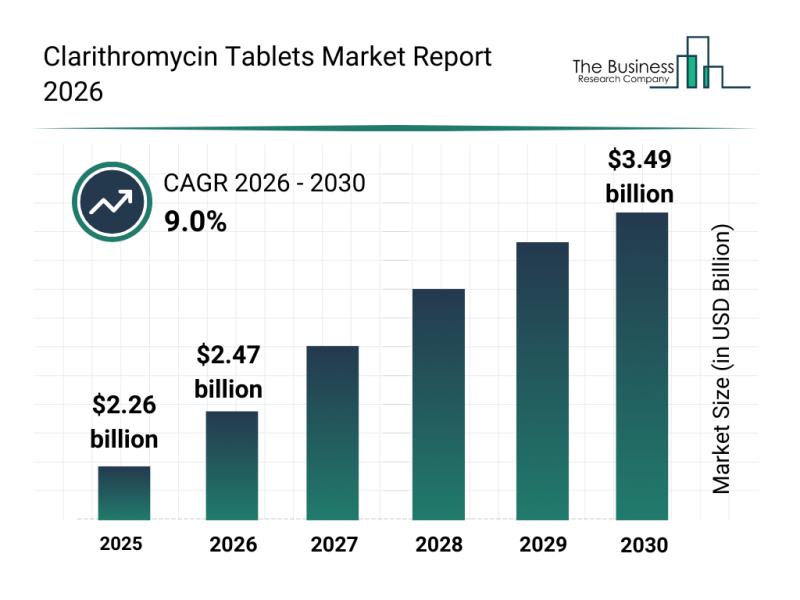

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…