Press release

How Digital Banking Platforms Helping Businesses during COVID-19 Outbreak? Market Scope and Demand 2020-2027

Allied Market Research Published Latest Report titled, “Digital Banking Platform Market by Component (Solution and Service), Deployment Model (On-Premise and Cloud), Type (Retail Banking and Corporate Banking), and Banking Mode (Online Banking and Mobile Banking): Global Opportunity Analysis and Industry Forecast, 2020–2027.”This market research study determines the increase in changes and the aspects which are likely to have an impact on the growth of the Global Digital Banking Platforms Market. Increased demand for the technologies is also one of the factors, which are likely to boost the growth of this industry. The market research study uses several tools and techniques which are used for the determination of the growth of the Global Digital Banking Platforms Market.

Download Report Sample with Industry Insights at https://www.alliedmarketresearch.com/request-sample/5539

Digital Banking Platforms Market Competitive Analysis:

Top 10 Players in this Industry Profiled in the Report Include Appway, COR Financial Solution Ltd., Edgeverve, FIS Global, Fiserv, Inc, nCino, Oracle Corporation, SAP SE, Temenos, and Vsoft Corporation

These players have adopted various strategies including expansions, mergers & acquisitions, joint ventures, new product launches, and collaborations to gain a strong position in the industry.

Covid-19 Impact on the Global Digital Banking Platforms Market:

Digital Banking Platforms Market Research Report provides an overview of the industry based on key parameters such as market size, sales, sales analysis and key drivers. The market size of the market is expected to grow on a large scale during the forecast period (2020-2027). This report covers the impact of the latest COVID-19 on the market. The coronavirus pandemic (COVID-19) has affected all aspects of life around the world. This has changed some of the market situation. The main purpose of the research report is to provide users with a broad view of the market. Initial and future assessments of rapidly.

COVID-19 Scenario:

• Due to the global pandemic all over the world, the medical devices manufacturers are majorly focusing on research and development of new products.

• However, due to the precautionary measures taken by governments in various regions, the supply chain has been hampered. Which may result in shortage of products in certain locations.

Get detailed COVID-19 impact analysis on the Digital Banking Platforms Market @ https://www.alliedmarketresearch.com/request-for-customization/5539?reqfor=covid

The report is also used in the analysis of the growth rates and the threats of new entrants, which are used for the determination of the growth of the market for the estimated forecast period. Moreover, increased demand for the factors influencing the growth of the market is also one of the major aspects which is likely covered in depth in the report.

One of the methods for the determination of the growth of the market is the increased use of the statistical tools, which is used for the estimation of the growth of the market for the estimated forecast period. SWOT analysis is one of the methods for the determination of the growth of the global Digital Banking Platforms Market. These tools are also used for the determination of the major players for the growth of the market for the estimated forecast period.

This report focuses and highlights the strategies and the trends, in which the manufacturer and the company is likely to move. The research study is also known to provide in depth analysis of the reports which is one of the key aspects for the growth of the global Digital Banking Platforms Market.

Interested? Do Purchase Enquiry Now: https://www.alliedmarketresearch.com/purchase-enquiry/5539

The study covers the production, sales, and revenue of various top players in the global Digital Banking Platforms Market, therefore enabling customers to achieve thorough information of the competition and henceforth plan accordingly to challenge them head on and grasp the maximum market share. This report is filled with significant statistics and information for the consumers to attain in-depth data of the Digital Banking Platforms Market growth.

Segment type is also an important aspect of any market research study. Reports are product based, they also includes information on sales channel, distributors, traders and dealers. This helps in efficient planning and execution of supply chain management as it drastically affects the overall operations of any business. The up-to-date, complete product knowledge, end users, industry growth will drive the profitability and revenue. Digital Banking Platforms Market report studies the current state of the market to analyze the future opportunities and risks.

The research offers a detailed segmentation of the global Digital Banking Platforms Market. Key segments analyzed in the research include Applications, Types, and geography. Extensive analysis of sales, revenue, growth rate, and market share of each segment for the historic period and the forecast period is offered with the help of tables.

The Digital Banking Platforms Market is analyzed based on regions and competitive landscape in each region is mentioned. Regions discussed in the study include North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa). These insights help to devise strategies and create new opportunities to achieve exceptional results.

Buy Now at https://www.alliedmarketresearch.com/checkout-final/93fb07d8b20377c32f4db4a7988f7e5e

Our report offers:

• Evaluation of market share for regional and country-level segments.

• Market share analysis of top industry players.

• Strategic recommendations for new entrants.

• All mentioned segments, and regional market forecasts for the next 10 years.

• Market Trends (Drivers, Difficulties, Opportunities, Threats, Challenges, Investment Opportunities and Recommendations)

• Strategic recommendations in the main business segment of the market forecast.

• Competitive landscaping of major general trends.

• Company profiling with detailed strategy, financial and recent developments.

• Latest technological progress mapping supply chain trends.

Key Benefits from this Research Report:

• This report provides a quantitative analysis of the current trends, estimations, and dynamics of the global Digital Banking Platforms Market from 2020 to 2027 to identify the prevailing market opportunities.

• The key countries in all the major regions are mapped based on their market share.

• Porter’s five forces analysis highlights the potency of the buyers and the suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

• In-depth analysis of the Digital Banking Platforms Market segmentation assists in determining the prevailing market opportunities.

• Major countries in each region are mapped according to their revenue contribution to the global Digital Banking Platforms Market. Players positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

• The report includes the analysis of the regional as well as global market, key players, market segments, application areas, and growth strategies.

Key Market Segments

By Component

• Solution

• Service

By Deployment Model

• On-Premise

• Cloud

By Type

• Retail Banking

• Corporate Banking

By Banking Mode

• Online Banking

• Mobile Banking

By Region

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Netherlands

o Rest of Europe

• Asia-Pacific

o China

o India

o Japan

o Singapore

o Australia

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

Key Market Players

• Appway

• COR Financial Solution Ltd

• Edgeverve

• FIS Global

• Fiserv, Inc

• nCino

• Oracle Corporation

• SAP SE

• Temenos

• Vsoft Corporation

Read More at https://www.globenewswire.com/news-release/2020/10/15/2109323/0/en/Digital-Banking-Platform-Market-Size-to-Hit-10-87-Billion-by-2027-at-13-6-CAGR-Says-AMR.html

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Digital Banking Platforms Helping Businesses during COVID-19 Outbreak? Market Scope and Demand 2020-2027 here

News-ID: 2196864 • Views: …

More Releases from Allied Market Research

Precision Fermentation Market Is Expected To Reaching Nearly USD 34.9 Billion By …

The global precision fermentation industry generated $1.3 billion in 2021, and is anticipated to generate $34.9 billion by 2031, witnessing a CAGR of 40.5% from 2022 to 2031.

Increasing protein demand worldwide, changing consumer preferences and tastes, the growing preference for the acceptance of meat-free and vegan lifestyles and rising innovation and investment drive the growth of the global precision fermentation market. However, the high cost of producing protein ingredients by…

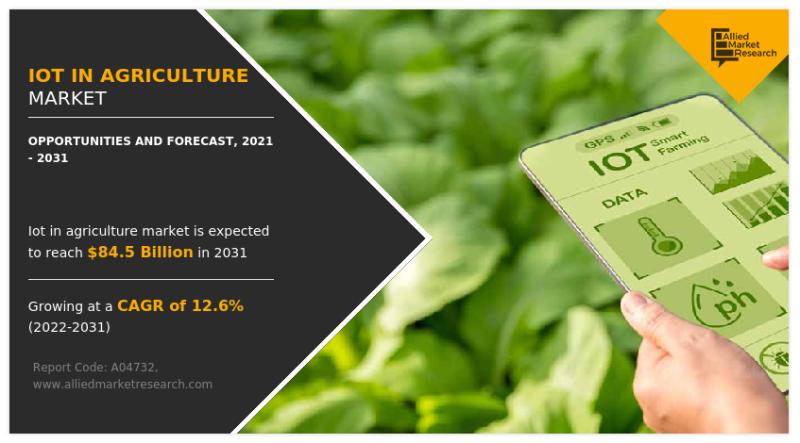

IOT in Agriculture Market Overview, Analysis by Top Key Players and Forecast, 20 …

IOT in agriculture market size was estimated at $27.1 billion in 2021 and is estimated to reach $84.5 billion by 2031, registering a CAGR of 12.6% from 2022 to 2031.

The IoT in agriculture market is experiencing significant growth due to multiple key drivers. These include the increasing need for real-time data analytics, the expanding adoption of cloud-based platforms, and the rising demand for automation and control technologies across various industries…

Aerospace Adhesives Market Size, Trends, Key Insights and Forecast, 2023 - 2032

The aerospace adhesives industry was valued at $0.9 billion in 2022, and is estimated to reach $1.5 billion by 2032, growing with a CAGR of 5% from 2023 to 2032.

The aerospace industry is being transformed with the aid of the adoption of superior production techniques such as additive manufacturing (3-D printing) and automated assembly tactics. In response to this shift, aerospace adhesives can adapt by means of formulating adhesives which…

Anhydrous Milk Fat Market Size Worth $6.0 Billion by 2031 With CAGR of 7.2%

The global anhydrous milk fat industry generated $3.0 billion in 2021 and is estimated to generate $6.0 billion by 2031, witnessing a CAGR of 7.2% from 2022 to 2031.

Rise in disposable income of people, surge in expenditure on high-quality food products, expansion of food and beverage industry, growth in consumer preference for western cuisine, rise in investments in the dairy sector drive the global anhydrous milk fat market. On the…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…