Press release

EzPaycheck Payroll Software Updated To Streamline Paycheck Processing for Both Employees and Contractors

Payroll software provider halfpricesoft.com released the new 2012 ezPaycheck payroll software for small business. This new improved version will help business owners and HR managers handle the paychecks for both W-2 Employees and 1099 contractors.- The latest 3.2.7 release of ezPaycheck payroll software also includes the 2012 federal tax tables, state tables and the latest forms W2, W3, 940 and 941.

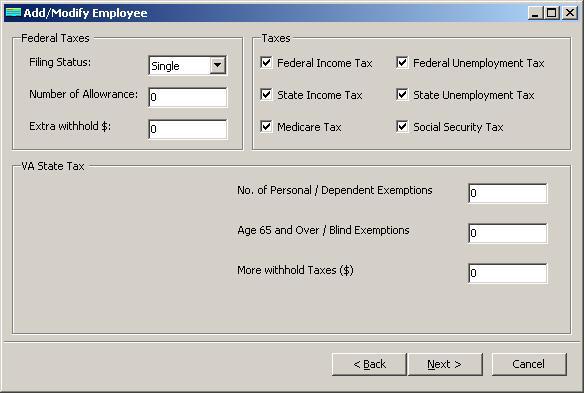

- ezPaycheck payroll application 2012 version offers users the flexible tax options. EzPaycheck can calculate the payroll taxes automatically and print the paychecks for w-2 employees. The new version can also generate the paychecks with no tax deductions for a contractor easily.

- ezPaycheck 2012 can support multiple accounts with no extra charge. So users can set up the separate accounts to handle employees and contractors easily.

“Our goal is to make ezPaycheck as hassle-free and easy to use as possible while still supplying the robust features our customers need,” said Halfpricesoft.com founder Dr. Ge. “This latest round of updates moves us significantly closer to that goal.”

Design with small business users in mind, ezPaycheck ’s interface is so intuitive and user-friendly that first time users can start calculating payroll and printing paychecks immediately. The long learning curve typically associated with financial software is non-existent with ezPaycheck, even if the user does not have an accounting background.

EzPaycheck payroll software is $89 per year per installation and $59 to renew the next year. It can support unlimited companies, employees, paychecks and tax forms with no extra charge. This price already includes all the future update packages for this year's version. For example: If a user purchase ezPaycheck 2012, this user will get all the update packages for ezPaycheck 2012 for free.

Small businesses can try ezPaycheck payroll application for free with no obligation and no cost at http://www.halfpricesoft.com/payroll_software_download.asp. Main features of ezPaycheck in-house payroll software include:

- Up to date tax tables for all 50 U.S. states, Washington D.C. and federal taxes

- Capability for adding local tax rates

- Automatically calculate tips, commissions, federal withholding tax, Social Security, Medicare tax, employer unemployment taxes, and other pre-tax and post-tax deductions

- Print paychecks using a standard laser printer on blank computer checks or preprinted checks

- Use check-in-middle, check-on-top, or check-at-bottom check stock formats

- Able to print MICR numbers on blank check stock to save on pre-printed checks

- Calculate and print daily, weekly, biweekly, semimonthly and monthly payroll periods

- Compile and print forms W2s, W3, 940 and 941

- Unlimited free technical support

During a time of economic uncertainty, how to improve productivity is important for any business. And the absolutely best way to determine if payroll software will work for a company is to try it

To start the no-obligation free test drive, visit the site at: http://www.halfpricesoft.com/index.asp

About halfpricesoft.com

http://www.halfpricesoft.com/index.asp

Halfpricesoft.com is a provider of easy-to-use 1099, W2 and Payroll Software solutions for accountants and small to medium size businesses. ezPaycheck payroll software makes small business accounting a breeze with free trial, no registration, and no obligation.

Casey Yang

Director

halfpricesoft.com 9462 Brownsboro Road #157 Louisville, KY 40241 USA

email: ycasey@halfpricesoft.com

Fax: (866) 909-6448

http://www.halfpricesoft.com/index.asp

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release EzPaycheck Payroll Software Updated To Streamline Paycheck Processing for Both Employees and Contractors here

News-ID: 219601 • Views: …

More Releases for Payroll

Payroll Service Providers IBN Technologies Help U.S. Firms Overcome Payroll Chal …

IBN Technologies delivers payroll outsourcing services that help U.S. businesses reduce errors, ensure compliance, and improve efficiency. With scalable cloud-based systems, expert tax filing, and top-tier data security, their payroll solutions support startups, SMBs, and enterprises in streamlining operations while keeping costs under control and employees satisfied.

Miami, Florida - 04 Sep, 2025 - Payroll service providers [https://www.ibntech.com/payroll-processing/] are being used by businesses to guarantee compliance and operational efficiency as the…

IBN Technologies Affordable Payroll Services Streamline Payroll for Small Busine …

IBN Technologies offers cost-effective payroll solutions tailored for U.S. small firms. With 100% accuracy, expert compliance support, and secure cloud access, firm simplifies payroll processing while reducing internal workload and risk. Businesses benefit from on-time payments, streamlined tax reporting, and scalable systems that grow alongside them.

Miami, Florida - 20 Aug, 2025 - Small business owners seeking cost-effective ways to handle complex payroll tasks are increasingly turning to the firms that…

IBN Technologies Outsource Payroll Services Lead Payroll Innovation Across Flori …

Florida organizations are adopting outsource payroll services to handle growing payroll complexities and changing labor regulations. External providers deliver accurate, timely payroll processing and compliance management, reducing administrative burdens. This transition enhances operational reliability, supports multi-location payroll consistency, and allows internal teams to focus on core financial goals, ensuring business continuity and compliance.

Miami, Florida - 11 June, 2025 - Finance departments across Florida are increasingly leveraging outsource payroll solutions to…

Best Payroll Service for Small Businesses in California Simplifies Payroll Proce …

Small businesses in California face payroll challenges, from tax compliance to wage management. The best payroll service for small businesses in California ensures accurate payroll processing, timely tax filings, and compliance with labor laws. With expert-driven solutions, businesses can reduce payroll errors, avoid penalties, and focus on growth. Reliable payroll management helps businesses streamline operations with precision and efficiency.

Miami, Florida - February 18, 2025 - Small businesses in California face…

Payroll Software: Minop Introduces Advanced Solution to Revolutionize Payroll Ma …

Minop, a leading innovator in cloud-based business solutions, proudly announces the launch of its latest Payroll Software, designed to revolutionize the way businesses manage payroll. This advanced solution is engineered to simplify payroll processes, enhance accuracy, and ensure compliance, catering to the evolving needs of businesses of all sizes.

Revolutionizing Payroll Management with Advanced Features

Minop's payroll management software is built to automate complex payroll tasks, ensuring accurate calculations, timely processing, and…

HR Payroll Software Market: Streamlining Human Resource and Payroll Management

HR Payroll Software Market report 2024-2031 covers the whole scenario of the global including key players, their future promotions, preferred vendors, and shares along with historical data and price analysis. It continues to offer key details on changing dynamics to generate -improving factors. The best thing about the Tax Management report is the provision of guidelines and strategies followed by major players. The investment opportunities in the highlighted here will…