Press release

30 Carmaker Roadmaps to Self-Driving cars 2025-Market Status, Forecasts, Roadmap & Strategy of Leading OEMs to commercialise AD

Carmaker Roadmaps to Self-Driving Cars 2025 Market Status, forecasts, roadmap & strategy of leading OEMs to commercialise AD

We also provide technological roadmaps for the introduction of Level 2, Level 3 and Level 4 driving and parking features by leading OEM by 2025. Finally, you will find penetration forecasts of cars equipped with different levels of autonomy over the next decade in Europe, USA China and Japan.

The democratization of ADAS accelerates fast to meet safety mandates but techno-economic deployment challenges of Level 3 still persist. The model availability of Level 2-Driving features in Europe, such as Traffic Jam Assist and Cruise Assist, reached 91 models in 2019 as Volume brands joined premium carmakers in model supply.

The aggregate sales of Level 3- Driving features in Europe, USA and China will grow from 0.31 million in 2019 to 7.19m in 2025.

Higher levels of vehicle automation will require augmented sensor set, new architecture and innovative validation methods among others. It is estimated that ADAS-Average-Contentper-Vehicle in 2020 will range from €489 for Level 2, with 17 sensors per car, to €960-2,100 for Level 3 depending on the usage of lidar for perception redundancy.

Moreover, it examines the regulatory landscape, technical challenges and their implications on the deployment of a higher level of vehicle autonomy.

This examination results in a technological roadmap for the introduction of L2-4 by leading OEM and penetration forecasts of different levels of autonomy until 2025 in the EU, USA, and China.

The democratization of ADAS accelerates fast to meet safety mandates but techno-economic deployment challenges of Level 3 still persist. The model availability of Level 2-Driving features in Europe, such as Traffic Jam Assist and Cruise Assist, reached 91 models in 2019 as Volume brands joined premium carmakers in model supply.

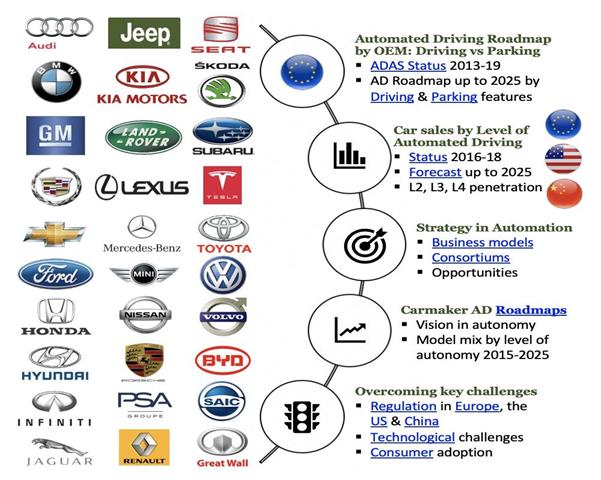

The 30 Carmaker Roadmaps to Self- Driving cars 2025" assesses leading car manufacturers’ ADAS & Automated Driving feature roadmaps, automation portfolio mix, deployment strategies and business models to transition towards full automation.

Feel free to contact us for any inquiry, Download PDF Sample Copy of This Report @ https://www.supplydemandmarketresearch.com/home/contact/1531053?ref=Sample-and-Brochure&toccode=SDMRAD1531053

When will automated driving tech & regulation converge to allow the first L3 & L4 cars to hit the road? How do leading carmakers plan to commercialize automated driving?

We examine the current & future status of automated vehicle deployment until 2025 and analyse the strategy & technological roadmaps of 34 leading carmakers to commercialize automated driving for passenger cars.

• Executive Summary

• Table of Contents

• Sample Pages

• Frequently Asked Questions

Carmaker Roadmaps to Self-Driving cars 2025: Market Status, forecasts, roadmap & strategy of leading OEMs to commercialise AD

Get More Information about Full Report/Talk to our Analyst Regarding This Report @ https://www.supplydemandmarketresearch.com/home/contact/1531053?ref=Talk%20to%20Analyst&toccode=SDMRAD1531053

Partially-automated (SAE Level 2) model offerings expand to the compact segment

At the same time, more carmakers are introducing Level 2 parking & driving capabilities and expand feature availability across their model range. What’s more important though is that L2 expands from premium large cars to the compact car segment. This breakthrough is another indicator that ADAS are no longer the privilege of flagships, premium large cars and luxurious SUVs since regulations, consumer requirements and competition drive fitment of ADAS.

Table of contents:

1. The status of Automated Driving deployment by Level in 2016-19 (21 pages)

2. Regulatory, engineering and other challenges for L3-5 deployment (17 pages)

3. OEM & Tier-1 strategies to commercialize Automated Driving (9 pages)

4. From Assisted to Autonomous: L2-4 roadmap from leading OEMs (22 pages)

5. ADAS & Automated Driving outlook by leading carmakers (48 pages)

6. Appendix (8 pages)

Tables:

• Table 1: Key takeaways from our report

• Table 1.1: Overview of L2-D+P features from the leaders in autonomous driving (as available in 2017-19)

• Table 1.2: Required vs Optional sensor set for L3 Driving and Parking features (radar, camera, Lidar, maps)

• Table 1.3: L2-D comparison: steering assistance speeds; lane change; hands-on detection; stop-in lane

• Table 1.4: 2016-2020 roadmap of ADAS requirements by regulatory authorities or safety rating agencies (NCAP)

• Table 1.5: Marketing names for L0, L1 and L2 ADAS features in Top-7 Premium OEMs (Europe, 2016)

• Table 1.6: Overview of L3 pilots/testing in leading geographies by OEMs, Tier-1s, and mobility service providers

• Table 2.1: Snapshot of the global Autonomous Driving regulatory and legal status in 2019 and many more….

Figures:

• Figure 1.1: Car manufacturers with capability of L2-Driving & Parking in Europe during 2013-18

• Figure 1.2: Level 2 (D+P) model offerings in Europe between 2013 and 2018

• Figure 1.3: Brands and models equipped with Level 2 TJA, SP and RP features in Europe between 2016 and 2018

• Figure 1.4: L3-equipped models, required sensor set and penetration 2019 vs 2020 vs 2025 in Europe (%)

• Figure 1.5: ADAS sensor revenue forecast 2016 & 2020 ($Billion)

• Figure 1.6: Market shares of ADAS sensors (radar, camera, Lidar, ultrasonic in 2020 (%) and many more….

SUPPLY DEMAND MARKET RESEARCH

Mr. Charles Lee

302-20 Misssisauga Valley Blvd, Missisauga,

L5A 3S1, Toronto, Canada

Phone Number: +12764775910

Email- info@supplydemandmarketresearch.com

SDMR has a strong network of high powered and experienced global consultants who have about 10+ years of experience in the specific industry to deliver quality research and analysis. Having such an experienced network, our services not only cater to the client who wants the basic reference of market numbers and related high growth areas in the demand side, but also we provide detailed and granular information using which the client can definitely plan the strategies with respect to both supply and demand side.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 30 Carmaker Roadmaps to Self-Driving cars 2025-Market Status, Forecasts, Roadmap & Strategy of Leading OEMs to commercialise AD here

News-ID: 2192796 • Views: …

More Releases from SUPPLY DEMAND MARKET RESEARCH

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Driving

Driving Driving Simulators Market Growth in 2025: The Role of Impact of Rising R …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Driving Simulators Market Size Growth Forecast: What to Expect by 2025?

The market size for driving simulators has seen significant growth of late. Its value is projected to rise from $2.02 billion in 2024 to $2.18 billion in 2025, at a compound annual growth rate of 7.8%. This surge…

Self-Driving Trucks Industry to Surpass USD 76 Billion by 2032 | Autonomous Driv …

Market Overview and Growth Outlook

The global autonomous trucks market is poised for significant expansion, growing from US$ 27,765.1 million in 2025 to an estimated US$ 76,010.4 million by 2032, at a CAGR of 13.4%. Autonomous trucks are commercial vehicles equipped with advanced systems such as AI, LiDAR, sensors, and optical cameras, which enable them to operate with little or no human intervention. These technologies facilitate essential driving functions like acceleration,…

Lady Driving Instructor Near Me: Comfortable Driving Experience:

For all, it represents freedom, freedom, and personal growth. But deciding on the best operating coach will make most of the difference in how quickly you progress and how comfortable you are feeling behind the wheel. If you've actually searched "lady driving instructor near me" in to a research engine, you're not alone. http://justladiesdriving.co.uk/

In this blog post, we'll investigate why more learners are seeking lady operating instructors, what you may…

Driveline Driving School Introduces Comprehensive Driving Lessons in Dublin

Driveline Driving School is delighted to present a variety of driving lessons, including EDT, pre-test, refresher, intensive, automatic car lessons, and reduced EDT programs, ensuring tailored solutions for all learners. The premium driving school in Dublin boasts world-class instructors who make the learning process smooth and stress-free.

Driveline Driving School is proud to announce its extensive range of driving lessons tailored to meet the needs of all learner drivers in Dublin.…

Raven Driving School Introduces Comprehensive Driving Program in Brampton

Brampton, Ontario - July 8, 2024 - Raven Driving School [https://ravendrivingschool.ca/] is proud to announce the launch of its new comprehensive driving program in Brampton, designed to provide residents with the highest quality driving education and training. This innovative program is set to revolutionize the way driving instruction is delivered, ensuring that new drivers are not only skilled but also confident and safe on the roads.

The Raven Driving School program…

John Nicholson Driving School Delivers the Best Driving Skill Tests

Durham, UK - 24 August 2023 - John Nicholson Driving School issued a driving test cancellation app that streamlines the whole DMV experience in all the right ways.

When it comes to getting your driver's license, chances are, you will be off searching the right way to go - the best way to avoid the hassle as much as it is possible. So, if you are anything like that, you will…