Press release

Fintech Start-up SPARQ Signs Agreement With Banking-as-a-Service Specialist Railsbank

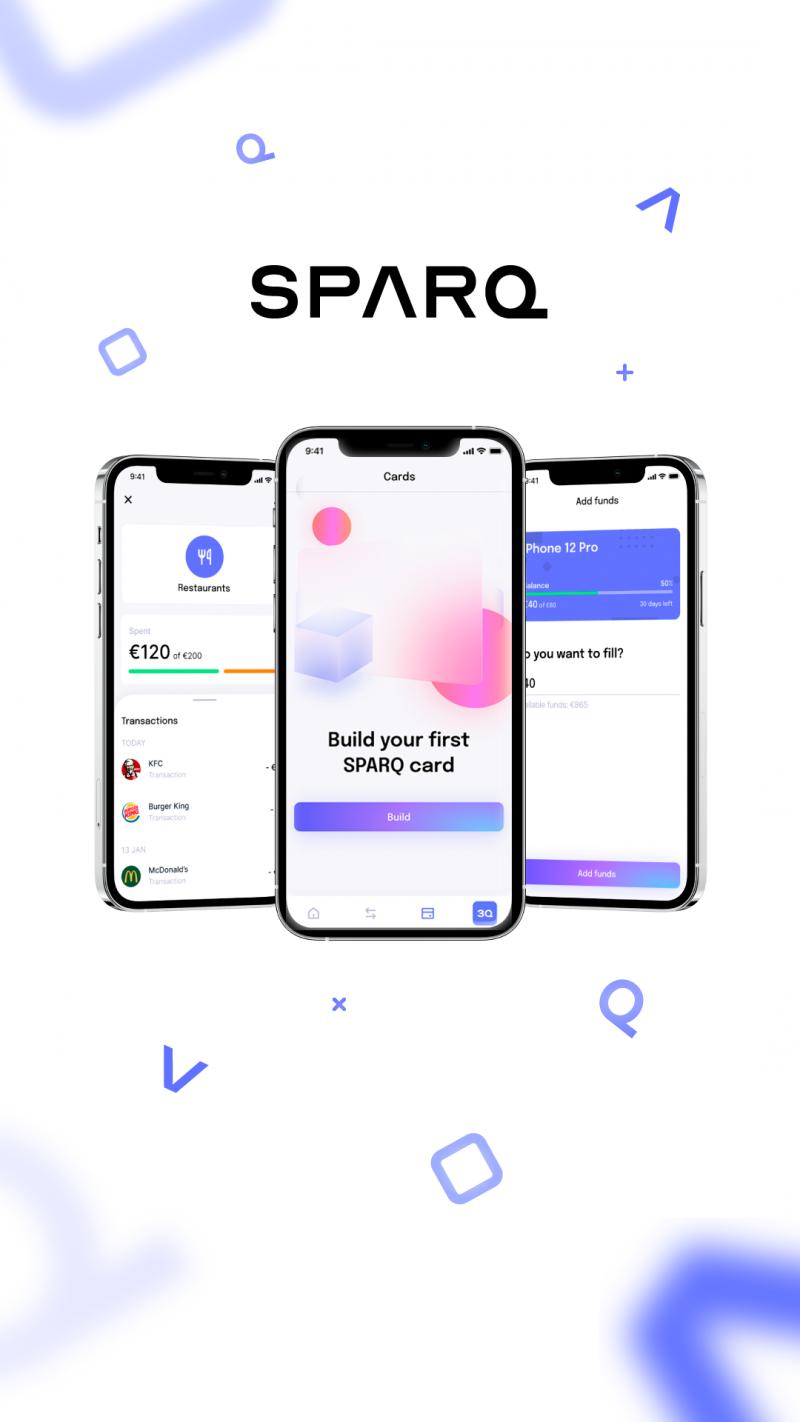

Tallinn, 1 November, 2020. Estonian start-up fintech SPARQ has signed an agreement with Banking-as-a-Service specialist Railsbank which will allow it to fully develop its personal finance platform designed to optimise people’s interaction with money.Already in use with early adopters, SPARQ is for everyday use and aims to make its users feel that they are in control of their own money, and cut through the bureaucracy associated with financial services.

SPARQ is using the Railsbank platform to begin the process of building out its mobile application with a series of offerings and is also launching a prepaid card development project with Visa.

Danila Belokons, CEO at SPARQ, said: “This agreement signifies a very important milestone for SPARQ. We have already released our early adopter pack and we have seen a huge growth in new users to the platform, despite it being in the very early stages of development. Working with the Railsbank platform means we can use a wide range of its functions and draw on the team’s experience we roll out our product.”

Once the full integration of financial services with Railsbank is finished, SPARQ will be able to offer a full financial service pack inside its mobile application. This will allow users, said the company, to better manage their finances as part of the whole SPARQ ecosystem.

Louisa Murray, a VP at Railsbank and Head of Sales: "SPARQ is building a great platform and we are enjoying working with the team as they develop their product. They are making full use of the Railsbank platform functions and making significant in-roads into simplifying financial services for its users. We wish them success as we continue to work together.”

About SPARQ

SPARQ - Personal finance platform for everyday use. Take full control of your finances!

For more information, visit https://early-access-pack.sparq.eu/

About Railsbank

Railsbank (www.railsbank.com) is the only global Banking-as-a-Service platform. It enables any business, or brand to be a fintech.

The company is also a pioneer and innovator in the Banking as a Platform (BaaP) and Financial Services as a Platform (FSaaP) sectors, defining the future of finance for consumers and SMEs.

Railsbank allows marketers, product managers, developers, CEOs and founders to rapidly prototype, launch and scale financial products using its open finance platform which includes operations, regulatory licensing and a rich set of simple APIs.

Railsbank’s APIs are the building blocks that enable customers to build pretty much any financial use-case they can imagine, meaning its customers can deliver delightful finance experiences to consumers and businesses.

It was founded by serial entrepreneurs, and fintech veterans Nigel Verdon and Clive Mitchell in 2016.

SPARQ

Latvia, Riga, Dzirnavu iela 140, LV-4600

Presscontact

Aleksandra Markova

aleksandra.markova@sparq.eu

Personal Finance platform for everyday use. Get the full control of your finances.

Our innovative product is developed for the milennials needs, so they could correctly comprehend the importance of the personal budgeting by using gamification and data-driven approach. We're developing our application so we could deliver a brand new financial approach for the users. A simple user experience that will change the narrative of the modern finances forever.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Start-up SPARQ Signs Agreement With Banking-as-a-Service Specialist Railsbank here

News-ID: 2190752 • Views: …

More Releases from SPARQ

SPARQ AI Partners with OC Cars & Coffee to Offer Free Devices

SPARQ, the cutting-edge automotive diagnostics & servicing AI platform, is excited to announce its partnership with OC Cars & Coffee, one of the largest and most prestigious weekly car meets in Southern California.

Beginning Saturday, April 5, SPARQ will have a dedicated presence at the event every week, offering attendees the opportunity to receive a free SPARQ device and experience the future of connected automotive technology firsthand.

"OC Cars & Coffee…

After months of validating the concept and testing the app, SPARQ’s time has f …

SPARQ, an innovative personal finance platform headquartered in Tallinn, Estonia, is releasing its much-anticipated MVP application. After months of validating the concept and testing the app, SPARQ’s time has finally come! Current users will need to update their application to use the new one.

Smart, engaging and visually appealing, the SPARQ app encourages users to take control of their finances. SPARQ comes with a bank account, gives users the opportunity to…

More Releases for Railsbank

API Banking Platforms Market Hits New High | Major Giants Solarisbank, Railsbank …

HTF MI just released the Global API Banking Platforms Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in API Banking Platforms Market are:

Plaid, Yodlee,…

Banking-as-a-Service (BaaS) Market to Witness Remarkable Growth by 2027 | Starli …

COVID-19 Outbreak-Global Banking-as-a-Service (BaaS) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the COVID-19 Outbreak-Global Banking-as-a-Service (BaaS) Market. Some of the key players profiled in…

Banking-as-a-Service Market May See Big Move | SolarisBank, Starling, RailsBank

The latest released on Global Banking-as-a-Service (BaaS) Market delivers comprehensive data ecosystem with 360° view of customer activities, segment-based analytics-and-data to drive opportunities of evolving Banking-as-a-Service (BaaS) marketplace and future outlook to 2026. It includes integrated insights of surveys conducted with executives and experts from leading institutions across various countries. Some of the listed companies profiled in the report are ClearBank, SolarisBank, Lecca Financeira, BMP Money Plus, Starling Bank, Fidor…

Banking-as-a-Service (BaaS) Market Next Big Thing | Major Giants ClearBank, Sola …

A New business research report released by HTF MI with title Global Banking-as-a-Service (BaaS) Market Study Forecast till 2026 . This Global Banking-as-a-Service (BaaS) market report brings data for the estimated year 2020 and forecasted till 2026 in terms of both, value (US$ MN) and volume (MT). The report also consists of forecast factors, macroeconomic factors, and a market outlook of the Banking-as-a-Service (BaaS) market. The study is conducted by…

Open Banking Market Size 2018; Renowned Players Like OpenWrks, Railsbank, Credit …

Regulatory and technological developments are driving the introduction of open banking, where consumers will have the power to grant third parties the right to access their account and transaction data. Banks that embrace the concept will be able to become one-stop shops for the best products on the market, crowdsource the development of new services, and generate revenue by selling access to their data and capabilities.

The…

Open Banking Market 2018 Future Outlook: Investment Trends, Growth and Competiti …

Regulatory and technological developments are driving the introduction of open banking, where consumers will have the power to grant third parties the right to access their account and transaction data. Banks that embrace the concept will be able to become one-stop shops for the best products on the market, crowdsource the development of new services, and generate revenue by selling access to their data and capabilities.

The…