Press release

Guerilla-Trading Launches First Cloud-based Trading Workstation for Retail Traders

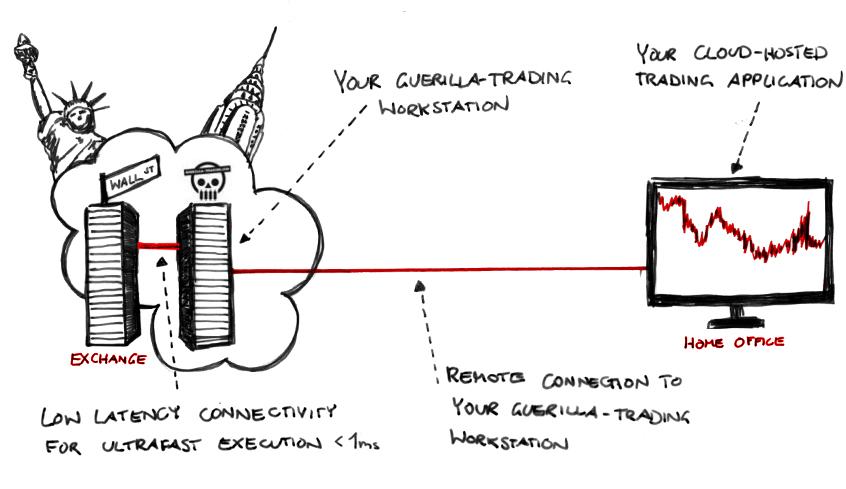

Guerilla-Trading, an international provider of trading infrastructure solutions for traders is pleased to announce the launch of its Cloud-based Trading Workstations at major financial spots worldwide. The co-located Workstations represent the first cloud-based solution specifically designed for retail traders.Hamburg, Germany, April 17, 2012 – Guerilla-Trading serves traders with IT-solutions on a global scale in order to professionalize their trading. From now on, Guerilla-Trading will provide private traders with cloud-based, co-located Trading Workstations in close proximity to important financial centers like New York, Chicago, London and Hong Kong.

By adopting a cloud-based approach in trading, retail traders benefit from lower latency, improved reliability and mobility of their trading applications, which leads to better competitiveness in the financial markets. The Guerilla-Trading Workstations are capable of running various applications like trading platforms, chart software or online trading tools.

"With the ongoing rise of automated trading in the financial markets, the technological drawbacks of private traders are increasing steadily. A Cloud-based Trading Workstation co-located in close proximity to major exchanges can reduce the speed-related disadvantages in trade execution remarkably”, said Andreas Kleineberg, founder of Guerilla-Trading and co-writer of the Guerilla-Trading-blog.

The application of cloud-technology in the financial markets is a logical consequence of the inherent need for optimization in a competitive market environment. Institutions have already recognized the technological opportunities and began to reduce their IT costs by using cloud-based services.

Although traders invest a lot of time and money in trading equipment, software and training, they still face disadvantages to institutional market participants, who are able to benefit from technological improvements and professional IT infrastructure.

Guerilla-Trading is dedicated to give the active trader access to professional IT infrastructure and therefore provides cloud-hosted Workstation packages suitable for beginning as well as advanced and professional traders in direct proximity to various financial spots like Chicago, New York, or London. Faster order execution, lower latency, reliable trading infrastructure and minimized hardware costs are therefore no longer a privilege of institutional traders.

A cloud-hosted trading infrastructure makes perfect sense in a time when flexibility and mobility are important to many traders. A Cloud-based Trading Workstation accounts for these needs, as it is accessible from any device, such as laptops, tablets or phones, anywhere and anytime.

Traders or Investors interested in learning more about Guerilla-Trading’s solutions can visit https://www.guerilla-trading.com for more information.

About Guerilla-Trading

Guerilla-Trading was founded in March 2012 by Andreas Kleineberg and Michael Lehner in Hamburg, Germany, with the vision to provide retail traders with access to professional trading infrastructure in order to improve their competitiveness in the financial markets.

Media Contact

Michael Lehner

Co-Founder

Guerilla-Trading UG

Bernstorffstrasse 128

D-22767 Hamurg

Germany

+49 40 557753020

http://www.guerilla-trading.com

michael@guerilla-trading.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Guerilla-Trading Launches First Cloud-based Trading Workstation for Retail Traders here

News-ID: 218371 • Views: …

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…