Press release

Know How Banking Sector is Bridging Economic Recovery Globally

The Banking Sector Scorecard - Thematic Market study is a perfect mix of qualitative and quantitative information and to get better understanding on how stats relates to growth, market sizing and share, the study is started with market overview and further detailed commentary is showcased on changing market dynamics that includes Influencing trends by regions, growth drivers, long term opportunities and short term challenges that industry players are facing. Furthermore, Market Factor Analysis gives insights on how various regulatory affairs, economic factors and policy action are factored in the past and future growth scenarios by various business segments and applications. The Competitive Landscape provides detailed company profiling of players and draws attention on development activities, swot, financial outlook and major business strategic action taken by players. Players that are in the coverage of this study, some of them are Amazon, Facebook, Apple, Alphabet, Tinkoff Bank, AIB, Capital One, WeBank, MyBank, Monzo, NatWest/RBS, Danske Bank, DBS, TSB, BBVA, Citibank, mBank, Revolut, Credit Agricole, Barclays, La Caixa, CBA, UniCredit, HSBC, Nordea, Intesa Sanpaolo, USAA, BNP Paribas, Deutsche Bank, ING, Nubank, Bank of America, BMO, RBC, JPMorgan Chase, Lloyds.Industries and markets are ever-evolving; navigate these changes with ongoing research conducted by HTF MI; Address the latest insights released on Banking Sector Scorecard - Thematic Market. Browse now for Full Report Index or a Sample Copy @: https://www.htfmarketreport.com/sample-report/2909396-banking-sector-scorecard-thematic-research

Relevant features of the study that are being offered with major highlights from the report :

1) Can Market be broken down by different set of application and types?

Additional segmentation / Market breakdown is possible subject to data availability, feasibility and depending upon timeline and toughness of survey. However a detailed requirement needs to be prepared before making any final confirmation.

** An additional country of your interest can be included at no added cost feasibility test would be conducted by Analyst team of HTF based on the requirement shared and accordingly deliverable time will also be disclosed.

2) How Study Have Considered the Impact of COVID-19 / Economic Slowdown of 2020 ?

Analyst at HTF MI have conducted special survey and have connected with opinion leaders and Industry experts from various region to minutely understand impact on growth as well as local reforms to fight the situation. A special chapter in the study presents Impact Analysis of COVID-19 on Banking Sector Scorecard - Thematic Market along with tables and graphs related to various country and segments showcasing impact on growth trends.

3) Which companies are profiled in current version of the report? Can list of players be customize based on regional geographies we are targeting

Considering heat map analysis and based on market buzz or voice the profiled list of companies in the the report are "Amazon, Facebook, Apple, Alphabet, Tinkoff Bank, AIB, Capital One, WeBank, MyBank, Monzo, NatWest/RBS, Danske Bank, DBS, TSB, BBVA, Citibank, mBank, Revolut, Credit Agricole, Barclays, La Caixa, CBA, UniCredit, HSBC, Nordea, Intesa Sanpaolo, USAA, BNP Paribas, Deutsche Bank, ING, Nubank, Bank of America, BMO, RBC, JPMorgan Chase, Lloyds". Yes, further list of players can also be customized as per your requirement keeping in mind your areas of interest and adding local emerging players and leaders from targeted geography.

** List of companies covered may vary in the final report subject to Name Change / Merger & Acquisition Activity etc. based on the difficulty of survey since data availability needs to be confirmed by research team specially in case of privately held company. Up to 2 players can be added at no additional cost.

Enquire for making customized Report @ https://www.htfmarketreport.com/enquiry-before-buy/2909396-banking-sector-scorecard-thematic-research

Summary

This report assesses the key themes that are transforming the banking market right now, utilizing our thematic scoring methodology to identify which companies will do well in the market in the future - and the companies that will falter as a result of their lack of investment in the key banking themes. In this report, we score over 50 of the world’s leading banking players against the 10 themes that are impacting their industry the most. Our resulting thematic engine helps us identify the strongest and weakest players in the banking sector over the next two years.

It’s not necessary to be a ‘bank’ to disrupt banking. Niche fintechs - highly specialized, free from legacy, and able to bypass bank regulation - have ‘unbundled’ component pieces of financial services, giving consumers more of what they want more quickly than incumbent banks can. Big tech, meanwhile, leveraging platform economics and data-driven business models, have brought new levels of personalization and convenience to payments, lending, product comparison, and money management. However, a banking license does confer the right to hold deposits and earn net interest margin, and the revenue pool associated with those activities exceeded $5tn in 2019. That business is not going away any time soon. Rather, it is being digitally transformed - re-invented, even - by 10 key themes.

2-Page company profiles for 10+ leading players is included with 3 years financial history to illustrate the recent performance of the market. Latest and updated discussion for 2019 major macro and micro elements influencing market and impacting the sector are also provided with a thought-provoking qualitative remarks on future opportunities and likely threats. The study is a mix of both statistically relevant quantitative data from the industry, coupled with insightful qualitative comment and analysis from Industry experts and consultants.

Scope

- Within AI: Leading incumbent banks are spending millions on research institutes and prototypes. The challenge now is identifying and deploying those most ‘proven’ use cases quickly for maximum customer impact, while addressing data dependencies and growing regulatory risks around algorithm-led decision-making. Because AI-driven business models typically have fly-wheel momentum, big-tech companies have significant first-mover advantages that incumbent banks will likely prove unable to make up.

- Within big data: Many banks operate on a heterogeneous application portfolio with fragments of often inaccurate, incomplete, and inconsistent data that reside in various silos. As the Vs of big data increase every day - more data (volume), coming in more quickly (velocity), from different sources and of different types (variety) - legacy processing and storage techniques creak even further.

To ascertain a deeper view of Market Size, competitive landscape is provided i.e. Comparative Market Share Revenue Analysis (Million USD) by Players (2018-2019) & Segment Market Share (%) by Players (2018-2019) and further a qualitative analysis of all players is made to understand market concentration rate.

Competitive Landscape & Analysis:

Major players of Banking Sector Scorecard - Thematic Market are focusing highly on innovation in new technologies to improve production efficiency and re-arrange product lifecycle. Long-term growth opportunities for this sector are captured by ensuring ongoing process improvements of related players following NAICS standard by understanding their financial flexibility to invest in the optimal strategies. Company profile section of players such as Amazon, Facebook, Apple, Alphabet, Tinkoff Bank, AIB, Capital One, WeBank, MyBank, Monzo, NatWest/RBS, Danske Bank, DBS, TSB, BBVA, Citibank, mBank, Revolut, Credit Agricole, Barclays, La Caixa, CBA, UniCredit, HSBC, Nordea, Intesa Sanpaolo, USAA, BNP Paribas, Deutsche Bank, ING, Nubank, Bank of America, BMO, RBC, JPMorgan Chase, Lloyds includes vital information like legal name, website, headquarter, its market position, distribution and marketing channels, historical background and top 4 closest competitors by Market capitalization / turnover along with sales contact information. Each company / manufacturers revenue figures, growth rate, net profit and gross profit margin is provided in easy to understand tabular format for past 3 years and a separate section on market entropy covering recent development activities like mergers &acquisition, new product/service launch, funding activity etc.

Get Latest Edition with COVID Impact Analysis of Banking Sector Scorecard - Thematic Market Study at Revised offered Price

In this study, the years considered to estimate the market size of Banking Sector Scorecard - Thematic are as follows:

History Year: 2014-2019, Base Year: 2019, Forecast Year 2020 to 2025

Key Stakeholders / Target Audience Covered:

In order to better analyze value chain/ supply chain of the Industry, a lot of attention given to backward & forward Integration

- Banking Sector Scorecard - Thematic Manufacturers

- Banking Sector Scorecard - Thematic Distributors/Traders/Wholesalers

- Banking Sector Scorecard - Thematic Sub-component Manufacturers

- Industry Association

- Downstream Vendors

Actual Numbers & In-Depth Analysis of Banking Sector Scorecard - Thematic Market Size Estimation, Business opportunities, Available in Full Report.

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, LATAM, West Europe, MENA Countries, Southeast Asia or Asia Pacific.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Know How Banking Sector is Bridging Economic Recovery Globally here

News-ID: 2182673 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

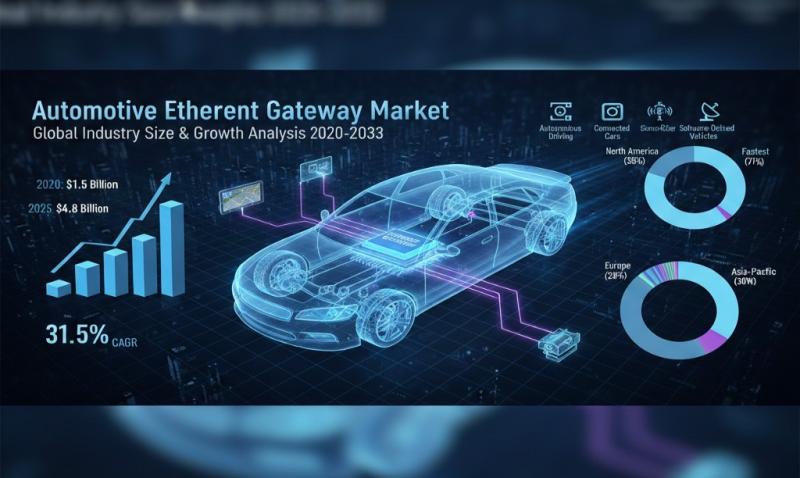

Automotive Ethernet Gateway Market - Global Industry Size & Growth Analysis 2020 …

The latest study released on the Global Automotive Ethernet Gateway Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Automotive Ethernet Gateway study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Aluminum Coils Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Aluminum Coils Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Aluminum Coils study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Hot Honey Drizzle Market Hits New High | Major Giants Nature Nate's, The Honey P …

The latest study released on the Global Hot Honey Drizzle Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Hot Honey Drizzle study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

AI Document Generator Market May See a Big Move | Major Giants Google (USA), SAP …

The latest study released on the Global AI Document Generator Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The AI Document Generator study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…