Press release

Retail Banking Service Market Will Generate Massive Revenue in Coming Years 2025| Top Leaders- Aldermore Bank, Handelsbanken, Masthaven Bank

The Retail Banking Service market 2020 research report is a detailed view of market opportunity by end-user segments, product Type segments, sales channels, key countries. It also provides market credentials such as history, various development and trends, market overview, regional markets and also market competitors. The report estimates the performance of the key players by 2025 .Global Retail Banking Service Market Overview:

The report also reveals in-depth details of shifting market dynamics, pricing structures, trends, restraints, limitations, demand-supply variations, growth-boosting factors, and market variations that have been considered the most important factors in the Retail Banking Service market.

Retail banking is banking service model in which singular customer use local branches of lager commercial banks. The services accessible include saving and current accounts, personal loan, mortgages, debit and credit cards, and certification of deposits. In the retail banking, the focus is on the individual consumer rather than corporates and SMEs.

Retail banking Service provides financial services for individuals and families. First neutral of retail banking is to offer consumer credit to purchase homes, cars, and others. Moreover, it provides various products to customers such as checking account, current account, ATM cards, credit cards, saving and certificates deposits. The anti-money legalizing processes accumulates all the banks consider completely check all the documents that they accept while providing retail banking services. Customer preservation is paramount important for the productivity of the retail banking which in turn enhanced the customer service across the industry. Growth in huge loan losses, shrinking regulation, and sluggish value creation (because of the low deposit margin) are the factors that restrain the market growth.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/241361 .

Additionally, the Retail Banking Service Market report comprises the in-depth study of the market segmentation such as types and applications. However, sub-segments studying in this report are crucial for knowing the preference of the shifting market demands. Likewise, the research Retail Banking Service Market report provides the deep study of the sales medium channels, traders, dealers, distributors at global as well as local level. Moreover, the Retail Banking Service Market report.

Market Key Players

The Retail Banking Service market is highly competitive owing to the presence of several large and small vendors. According to the Retail Banking Service market analysis research report, the level of competition among the players in this market space is intense and the vendors mainly complete based on factors such as price, user-friendly interface, value-added benefits, and service benefits. To attain a competitive advantage over the other players in the Retail Banking Service service market, the vendors have the need to develop new ideas and technologies and they should also integrate new technologies in their product portfolio , Allied Irish Bank (UK), Aldermore Bank, Bank Of Ireland UK, Close Brothers, The Co-Operative Bank, Cybg (Clydesdale And Yorkshire Banks), First Direct

Segmentations

The Retail Banking Service market has been sub-grouped into type and application. The report studies these subsets with respect to the geographical segmentation. The strategists can gain a detailed insight and devise appropriate strategies to target specific market. This detail will lead to a focused approach leading to identification of better opportunities.

Product Type Segmentation : Traditional, Digital Led

Industry Segmentation : Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans

Regional Segmentation

North America (U.S. and Canada)

Latin America (Mexico, Brazil, Peru, Chile, and others)

Western Europe (Germany, U.K., France, Spain, Italy, Nordic countries, Belgium, Netherlands, and Luxembourg)

Eastern Europe (Poland and Russia)

Asia Pacific (China, India, Japan, ASEAN, Australia, and New Zealand)

Middle East and Africa (GCC, Southern Africa, and North Africa)

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Retail Banking Service Report 2020” @ https://www.businessindustryreports.com/buy-now/137800/single .

Global Industry News:

Aldermore Bank : Aldermore offers SMEs practical solutions to support cash flow needs

Aldermore’s ‘Kick Start your Cash flow’ campaign launches by introducing new flexible Invoice Finance solutions aimed at easing SME’s cash flow needs

The offering includes no contract tie-in for first six months, and no set up fee for discounting and factoring products

Smoother onboarding process – secure electronic signing of documents through Adobe Sign

Aldermore bank has announced a range of practical and flexible Invoice Finance solutions to support small and medium-sized enterprises (SMEs) with their cash flow needs1. Recent research2 from Aldermore found the pandemic has caused a 30% loss in monthly business income for the average SME, which has impacted their cash flow along with the other challenges they’re facing.

Ross McFarlane director of Invoice Finance at Aldermore, said: “Whilst the economy has started to open up, and businesses can go back to operating in a ‘new normal’, the Covid-19 pandemic continues to have a profound impact upon the economy and the SME community. The current situation is uncertain, with the threat of further localised lockdowns and concerns over how the closure of the furlough scheme will impact businesses.

“As a result, SME’s face a challenging cash flow dilemma, as they look at different ways to safeguard their business during this period. Invoice Finance offers businesses a practical, flexible finance solution to enable them to protect their cash flow and keep their business operating effectively. Aldermore’s ‘Kick Start your Cash flow’ campaign is aimed at supporting SMEs by providing them with simple and flexible access to the finance they need. Our new Invoice Finance offering is now available to SMEs and will be rolled out across our wide network of business introducers through a range of channels”.

Key Points Covered :

The report Retail Banking Service market provides highlighting new business opportunities and supporting strategic and calculated decision-making. This report recognizes that in this rapidly-evolving and competitive environment, up-to-date marketing information is essential to monitor performance and make critical decisions for growth and profitability. It provides information on trends and developments and focuses on markets capacities and on the changing structure of the Retail Banking Service. The report highlights powerful factors augmenting the demand in the global Retail Banking Service market and even those hampering the market on a worldwide scale. The report provides key statistics on the market status of the Retail Banking Service leading manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/241361 .

Major Points in Table of Contents:

Global Retail Banking Service Market Report 2020

1 Retail Banking Service Product Definition

2 Global Retail Banking Service Market Manufacturer Share and Market Overview

3 Manufacturer Retail Banking Service Business Introduction

4 Global Retail Banking Service Market Segmentation (Region Level)

5 Global Retail Banking Service Market Segmentation (Product Type Level)

6 Global Retail Banking Service Market Segmentation (Industry Level)

7 Global Retail Banking Service Market Segmentation (Channel Level)

8 Retail Banking Service Market Forecast 2020-2025

9 Retail Banking Service Segmentation Product Type

10 Retail Banking Service Segmentation Industry………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Banking Service Market Will Generate Massive Revenue in Coming Years 2025| Top Leaders- Aldermore Bank, Handelsbanken, Masthaven Bank here

News-ID: 2179747 • Views: …

More Releases from Business Industry Reports

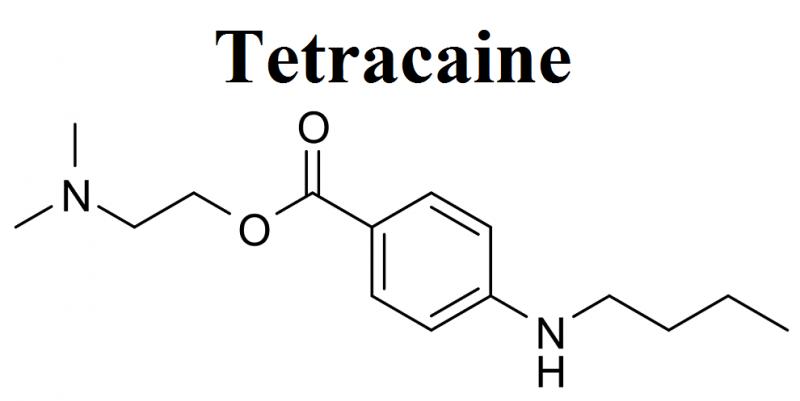

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

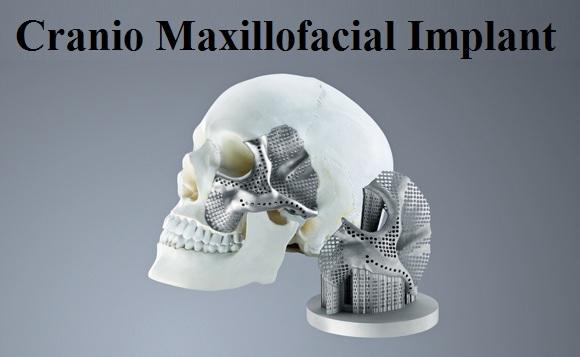

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…