Press release

Mobile Banking Market to Witness Huge Growth By 2025 | Temenos, Infosys, Neptune Software

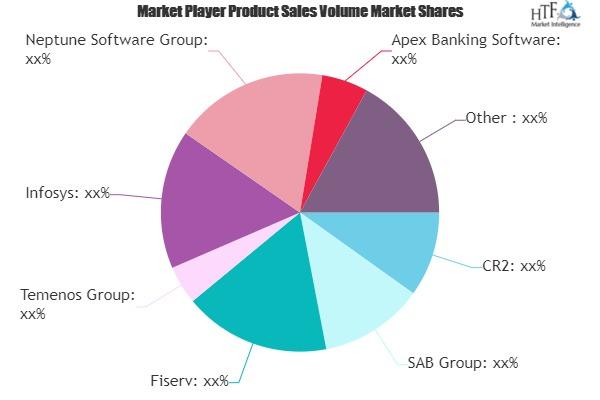

A New business Strategy report released by HTF MI with title Global Mobile Banking Market Study Forecast till 2026 . This Global Mobile Banking market report brings data for the estimated year 2020 and forecasted till 2026 in terms of both, value (US$ MN) and volume (MT). The report also consists of forecast factors, macroeconomic factors, and a market outlook of the Mobile Banking market. The study is conducted by applying both top-down and bottom-up approaches and further iterative methods used to validate and size market estimation and trends of the Global Mobile Banking market. Additionally to compliment insights EXIM data, consumption, supply and demand Figures, raw price analysis, market revenue and gross margins. Some of the companies listed in the research study are CR2, SAB Group, Fiserv, Temenos Group, Infosys, Neptune Software Group, Apex Banking Software, Capital Banking Solutions, EBANQ Holdings & Dais Software etc.Acquire Sample Report + All Related Tables & Graphs of Global Mobile Banking Market Study Now @ : https://www.htfmarketreport.com/sample-report/1788326-global-mobile-banking-market-3

Recent advent of smartphones has changed the scenario and now mobile banking is a web-based service provided through mobile web. Mobile banking must not be confused with other features such as mobile wallet that allow transactions through mobiles at the point of sale. Rising adoption of Smartphones and technological advancements are primary driving factors for this market. Lack of awareness regarding the actual features of a mobile app developed for mobile banking is moderately challenging its adoption.

In 2018, the global Mobile Banking market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2019-2025.

This report focuses on the global Mobile Banking status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Mobile Banking development in United States, Europe and China.

If you are involved in the Mobile Banking industry or intend to be, then this study will provide you complete viewpoint. It’s vital you keep your market knowledge up to date segmented by Applications [Banking Institutions, Credit Unions & Financial Institutions], Product Types such as [Cloud & On-Premise] and some major players in the industry.

Global Mobile Banking Competitive Analysis:

The key players are aiming innovation to increase efficiency and product life. The long-term growth opportunities available in the sector is captured by ensuring constant process improvements and economic flexibility to spend in the optimal schemes. Company profile section of players such as CR2, SAB Group, Fiserv, Temenos Group, Infosys, Neptune Software Group, Apex Banking Software, Capital Banking Solutions, EBANQ Holdings & Dais Software etc. includes its basic information like company legal name, website, headquarters, subsidiaries, its market position, history and 5 closest competitors by Market capitalization / revenue along with contact information.

Resource and Consumption – In extension with sales, this segment studies Resource and consumption for the Mobile Banking Market. Import export data is also provided by region if applicable.

Free Customization on the basis of client requirements on Immediate purchase:

1- Free country level breakdown any 5 countries of your interest.

2- Competitive breakdown of segment revenue by market players.

Enquire for customization in Global Mobile Banking Market Report @ https://www.htfmarketreport.com/enquiry-before-buy/1788326-global-mobile-banking-market-3

Important years taken into consideration in the study are as follows:

Historical year – 2014-2019

Base year – 2019

Forecast period** – 2020 to 2026 [** unless otherwise stated]

Focus on segments and sub-section of the Market are illuminated below:

Geographical Analysis: United States, Europe, China, Japan, Southeast Asia, India & Central & South America,Rest of World etc

On the Basis of Product Types of Mobile Banking Market: Cloud & On-Premise

The Study Explores the Key Applications/End-Users of Mobile Banking Market: Banking Institutions, Credit Unions & Financial Institutions

Buy research study Mobile Banking at Discounted Pricing @: https://www.htfmarketreport.com/buy-now?format=1&report=1788326

Most important Highlights of TOC:

1 Introduction of Mobile BankingMarket

1.1 Overview of the Market

1.2 Scope of Report

2 Exclusive Summary

3 Research Methodology

3.1 Primary Interviews

3.2 Data Mining

3.3 Validation

3.4 List of Statistics

4 Mobile Banking Market Segment & Geographic Analysis [2014 -2026]

4.1 By Type

4.2 By Application

4.3 By Region / Country

5 Mobile Banking Market Outlook

5.1 Overview

5.2 Market Dynamics

5.2.1 Opportunities

5.2.2 Restraints

5.2.3 Drivers

5.3 Five Force Model

5.4 Value Chain Analysis

6 Mobile Banking Market Competitive Landscape

6.1 Overview

6.2 Key Development Policies

6.3 Company Market Standing

Read Detailed Index of Mobile Banking Market report @: https://www.htfmarketreport.com/reports/1788326-global-mobile-banking-market-3

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like LATAM, North America, Europe or Southeast Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Banking Market to Witness Huge Growth By 2025 | Temenos, Infosys, Neptune Software here

News-ID: 2166179 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Pet Taxidermy Service Market to See Drastic Growth - Post 2025 | Forever Pets, E …

The latest study released on the Global Pet Taxidermy Service Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Pet Taxidermy Service market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

Recreation Clubs Market Growth Prospects Are Still Attractive | Northwood Club, …

The latest study released on the Global Recreation Clubs Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Recreation Clubs market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players…

Specialist Behavioral Health Services Market - Massive Growth Opportunity Seen A …

The latest study released on the Global Specialist Behavioral Health Services Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Specialist Behavioral Health Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and…

Back Office Outsourcing in Financial Services Market Is Going to Boom | Major Gi …

The latest study released on the Global Back Office Outsourcing in Financial Services Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Back Office Outsourcing in Financial Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…