Press release

Extensive Research Driving the Automotive Usage Based Insurance Market

Advancement and development of Internet of Things (IoT) has generated a wave of connectivity, which had an influence in almost all industry verticals. The same wave also has significant impact on automotive and insurance industry. Insurance companies are increasingly utilizing IoT data to improve the precision in gauging risk, pricing policies, and estimating other necessary reserve. The advancement of IoT has led to introduction of insurance policies such as Automotive User Based Insurance (UBI). Automotive user based insurance can be defined as pay-as-you drive, pay-how-you drive and distance based insurance.For more insights into the Market, request a sample of this report @ https://www.persistencemarketresearch.com/samples/29038

Automotive usage based insurance is based on telematics, i.e. driving habits such as miles driven, driving speed and hard-braking incidents. Automotive usage based companies’ installs a telematics device to monitor and record the driving habits. Automotive usage based insurance offer sever advantages over traditional insurance, it takes into consideration several factors including past driving history, make and model of vehicle, driving method to determine the insurance premium. Automotive usage based insurance utilizes real-time data to make decisions about insurance pricing and insurance type. Moreover, automotive usage based insurance offers high level of customization and flexibility to the end-users.

Automotive Usage Based Insurance Market: Dynamics

The global automotive user based insurance market is projected to witness significant growth during the forecast period. According to National Association of Insurance Commissioners (NAIC), about one-fifth of auto insurers will offers automotive usage based insurance in the next five years. Some of the key driving factors for the growth of global automotive usage based insurance includes increasing production and sales of automobiles, particularly in the developing countries, changing demographic trend, changing driving habits and increasing number of affluent middle class population. Furthermore, steady growth and advancement of IoT is expected to further augment the growth of automotive usage based insurance market during the forecast period.

For Information On The Research Methodology request here @ https://www.persistencemarketresearch.com/methodology/29038

Automotive usage based insurance offers a win-win situation for both insurance providers and policyholder. Some of automotive usage based insurance companies offers incentives for the driver to adopt safer driving practices this in turn, results in reducing the number of accidents and hence, the number of claims the insurance company has to pay out. Furthermore, among various type of insurances, distance based insurance has been witnessing resurgence in the market place, particularly in the European region. This can be attributed to development of telematics. Furthermore, distance based insurance offers several advantages such as quick to implement, offer more transparency and enables policyholders to effectively choose right insurance meeting their lifestyle needs and values.

Automotive Usage Based Insurance Market: Segmentation

Global Automotive Usage Based Insurance market can be segmented by insurance type, by end-user and by vehicle type

On the basis of insurance type, Automotive Usage Based Insurance can be segmented into:

Pay-how-you drive (PHYD)

Pay-as-you drive (PAYD)

Distance based insurance

Manage-how-you drive (MHYD)

On the basis of vehicle Type, Automotive Usage Based Insurance can be segmented into:

Passenger cars

Compact Cars

Luxury Cars

SUVs

Light Commercial Vehicles

Heavy Commercial Vehicles

On the basis of end-user, Automotive Usage Based Insurance can be segmented into:

Fleet Owners

Individual Owners

Automotive Usage Based Insurance Market: Regional Overview

To receive extensive list of important regions, Request TOC here @ https://www.persistencemarketresearch.com/toc/29038

Europe is expected to hold dominating position in the global Automotive Usage Based Insurance market. The region is expected to dominate the market through the forecast period. The growth in the Automotive Usage Based Insurance market is driven by increasing adoption of automation & advancement of telematics along with increasing popularity of customized insurance. North America is expected to follow the European Automotive Usage Based Insurance market. Asia Pacific is expected to be the fastest growing market for Automotive Usage Based Insurance, with India and China taking the lead.

Automotive Usage Based Insurance Market: Market Participants

Examples of some of the market participants identified across the value chain of the global Automotive Usage Based Insurance Market includes:

Nationwide Mutual Insurance Company

Esurance Insurance Services, Inc.

The Travelers Indemnity Company

Progressive Casualty Insurance Company

Metromile Inc.

Liberty Mutual Insurance

Trak Global Group

Allianz SE

Desjardins Insurance

Insurance Box Pty Ltd

Contact Us

Persistence Market Research

U.S. Sales Office

305 Broadway, 7th Floor

New York City, NY 10007

+1-646-568-7751

United States

USA - Canada Toll-Free: 800-961-0353

E-mail id- sales@persistencemarketresearch.com

Website: www.persistencemarketresearch.com

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance. To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Extensive Research Driving the Automotive Usage Based Insurance Market here

News-ID: 2164740 • Views: …

More Releases from Persistence Market Research

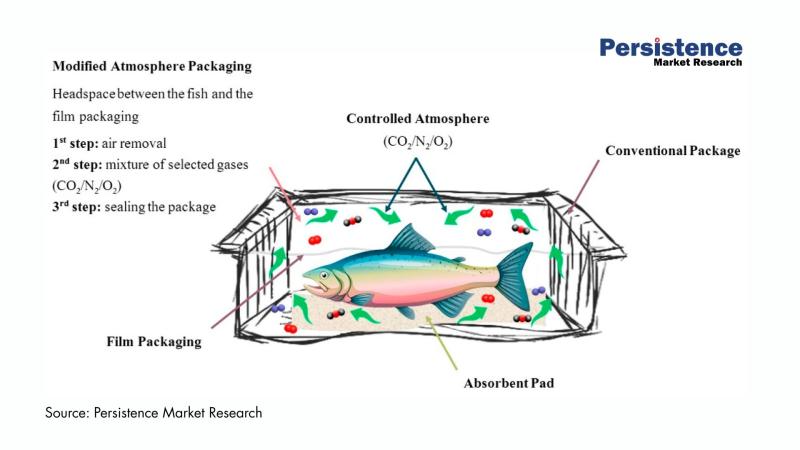

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…