Press release

Third-Party Banking Software Market is Booming Industry in Upcoming Years Due To Global Demand

The Objective of the “Global Third-Party Banking Software Market” report is to depict the trends and upcoming for the Third-Party Banking Software Market industry over the forecast years. Third-Party Banking Software Market report data has been gathered from industry specialists/experts. Although the market size of the market is studied and predicted from 2020 to 2027 mulling over 2019 as the base year of the market study. Attentiveness for the market has increased in recent decades due to development and improvement in the innovation.A third-party banking software can serve as a multi-channel banking software, core banking software, private wealth management software and business intelligence software solution. Commercial banks are installing third-party banking software solutions to connect to a desired interbank network as well as to other modular software. Retail banks and trading banks use it to streamline their operations.

Access Full Summary: https://www.alliedmarketresearch.com/third-party-banking-software-market

Global third-party banking software market is driven by growing necessity to increase productivity and operational efficiency of banking industry. In addition, growing demand for standardized activities in the banking sector and increased adoption of customer-centric core banking propels the growth of the market. However, concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market. Furthermore, increasing implementation of online banking and mobile banking by customers which shows high level of inclination towards accessing their account details and perform financial actions by using their laptops, smartphones, tablets and emerging trends such as patch management is expected to provide numerous opportunities for this market to grow.

The third-party banking software market is segmented on the basis of product type and application. Product type segment covered in this study include core banking software, multi-channel banking software, bi software, private wealth management software. Based on application, the market is segmented into risk management, information security, business intelligence, and training and consulting solutions. Geographically, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Third-Party Banking Software Market By Applications:

1. Risk Management

2. Information Security

3. Business Intelligence

4. Training and Consulting Solutions

Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/3766

Key Market Players Profiled In The Report:

• Microsoft Corporation

• IBM Corporation

• Oracle Corporation

• SAP SE

• Tata Consultancy Services Limited.

• Infosys Limited

• Capgemini

• Accenture.

• NetSuite Inc.

• Deltek, Inc.

Some of the Major Highlights of TOC Covers:

CHAPTER 1 INTRODUCTION

1.1. REPORT DESCRIPTION

1.2. KEY BENEFITS

1.3. KEY MARKET SEGMENTS

1.4. RESEARCH METHODOLOGY

1.4.1. Secondary research

1.4.2. Primary research

1.4.3. Analyst tools & models

CHAPTER 2 EXECUTIVE SUMMARY

2.1. CXO PERSPECTIVE

CHAPTER 3 MARKET OVERVIEW

3.1. MARKET DEFINITION AND SCOPE

3.2. KEY FINDINGS

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. MARKET SHARE ANALYSIS, 2016

3.4. PORTER’S FIVE FORCES ANALYSIS

3.4.1. MARKET DYNAMICS

3.4.2. Drivers

3.4.3. Restraints

3.4.4. Opportunities

For Purchase Enquiry at: https://www.alliedmarketresearch.com/purchase-enquiry/3766

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-446-1141

International: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Third-Party Banking Software Market is Booming Industry in Upcoming Years Due To Global Demand here

News-ID: 2150765 • Views: …

More Releases from Allied Market Research

Drone Communication Market to Reach US$ 15.8 Billion by 2032, with 21.4% CAGR

The global drone communication market size was generated $2.3 billion in 2022, and is anticipated to generate $15.8 billion by 2032, witnessing a CAGR of 21.4% from 2023 to 2032.

The rising demand for advanced drone technology in surveillance, reconnaissance, and various industries, coupled with advancements in satellite and cellular communication technologies, is boosting the growth of the drone communication market. However, the challenges associated with long-distance communication, scalability issues, and…

Biostimulant Market Trends, Strategy, Application Analysis, Demand 2031

Biostimulant Market was valued at $2,572.60 million in 2020, and is estimated to reach $8,004.10 million by 2031, growing at a CAGR of 10% from 2022 to 2031.

Organic biostimulants are gaining popularity among agricultural users due to its natural components that help increase the growth of the crops without any harmful effects, and is expected to drive the biostimulant market growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/2302

Biostimulants are naturally derived fertilizer additives used…

Manual Wheelchair Market Research Report: Unveiling CAGR and USD Projections for …

According to a new report published by Allied Market Research, titled, "Manual Wheelchair Market by Category, Design & Function, and End User: Global Opportunity Analysis and Industry Forecast, 2018 - 2025,"the global manual wheelchair market was valued at $2,609.7 million in 2017 and is projected to reach $4,099.1 million by 2025, registering a CAGR of 5.8% from 2018 to 2025. Manual wheelchairs are specifically designed for use by individuals with…

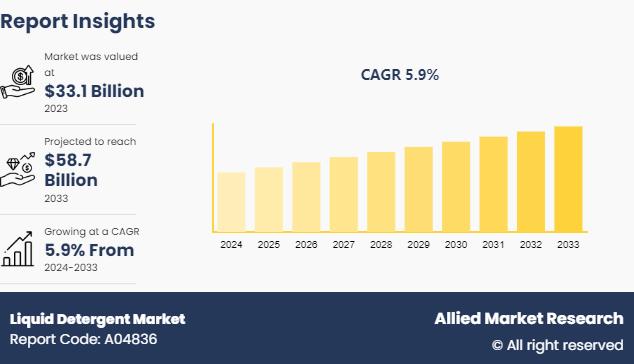

Liquid Detergent Market Research Insights: Uncovering CAGR and USD Growth Driver …

The global liquid detergent market has witnessed substantial growth in recent years, driven by rising consumer demand for convenient and effective cleaning solutions. As households and industries seek more efficient products for their cleaning needs, liquid detergents have emerged as a preferred option due to their ease of use, versatility, and superior cleaning properties compared to traditional powder detergents. The market spans across various sectors, including residential, commercial, and industrial,…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…