Press release

Private Equity Market Size by 2027: Top Investment Analysis and Modules by Blackstone Group, Neuberger Berman Group, Apollo Global Management, The Carlyle Group, KKR & Co., Bain Capital LP, CVC Capital Partners, Warburg Pincus, Vista Equity Partners, EQT

The private equity market is growing subsequently, and is expected to grow during the forecast period, owing to growth in demand for capital funding among large number of startups. Private equity is an alternate class of investment assets, which is usually not listed on the public stock market. The major source of investment capital in private equity comes from high-net worth individuals and institutional investors.Generally, investors and investment firms use different approaches such as leveraged buyouts and venture capital in private equity. In buyouts, a target company is acquired by a private equity fund. This acquisition is funded by debt, while activities and properties of the target company are considered as collateral for the investment provided.

Get Instant Access - Download Sample Now: https://www.alliedmarketresearch.com/request-sample/7314

The main drivers in the private equity market include growth in financial challenges faced by start-up companies and financial troubled firms and increase in public firms seeking funding for buyouts to exit businesses. However, geopolitical situations along with foreign exchange rates and interest rates restrict the market growth.

Furthermore, rise in number of startups and businesses across the globe, which are focused to accelerate their revenue and profitability is expected to offer great opportunities for the market growth.

Read Full Research Report: https://www.alliedmarketresearch.com/private-equity-market-A06949

Key benefits of the report:

-This study presents analytical depiction of the global private equity market along with the current trends and future estimations to determine the imminent investment pockets.

-The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the private equity market share.

-The current market is quantitatively analyzed from 2020 to 2027 to highlight the market growth scenario.

-Porter’s five forces analysis illustrates the potency of buyers & suppliers in the market.

-The report provides a detailed market analysis based on the present and future competitive intensity of the private equity market.

Get Detailed Outlook by Industry Experts: https://www.alliedmarketresearch.com/purchase-enquiry/7314

Top Key Players:

Major players analyzed include The Blackstone Group Inc., Neuberger Berman Group LLC, Apollo Global Management Inc., The Carlyle Group Inc., KKR & Co. Inc., Bain Capital LP, CVC Capital Partners, and Warburg Pincus LLC, Vista Equity Partners, EQT AB

Read Exclusive Articles:

Asset Management Market: https://www.technoinnovationz.com/2020/07/22/asset-management/

Cryptocurrency Market: https://www.technoinnovationz.com/2020/07/24/crypto-currency/

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Equity Market Size by 2027: Top Investment Analysis and Modules by Blackstone Group, Neuberger Berman Group, Apollo Global Management, The Carlyle Group, KKR & Co., Bain Capital LP, CVC Capital Partners, Warburg Pincus, Vista Equity Partners, EQT here

News-ID: 2150084 • Views: …

More Releases from Allied Analytics LLP

Lithium-ion Battery Recycling Market Driven by EV Demand and Sustainability Init …

According to a new report published by Allied Market Research, the lithium-ion battery recycling market size was valued at $1.33 billion in 2020 and is projected to reach $38.21 billion by 2030, growing at a CAGR of 36.0% from 2021 to 2030. The rapid surge in electric vehicle adoption, increasing use of portable electronics, and rising focus on sustainable waste management are key factors driving the growth of the lithium-ion…

Rising EV Demand Boosts Lithium-Iron Phosphate Batteries Market Worldwide

According to a new report published by Allied Market Research, the lithium-iron phosphate batteries market was valued at $5.6 billion in 2020 and is projected to reach $9.9 billion by 2030, registering a CAGR of 5.9% from 2021 to 2030. The steady expansion of electric vehicles, industrial automation, and renewable energy storage solutions is significantly contributing to the growth of the lithium-iron phosphate batteries market globally.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/13422

Growing Electric…

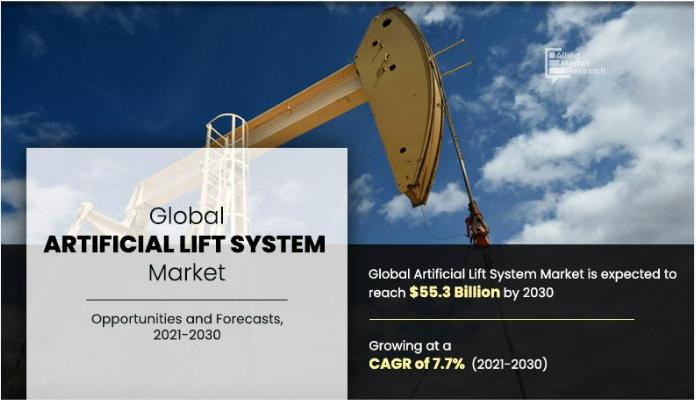

Artificial Lift System Market Growth Driven by Offshore and Shale Oil Demand

According to a new report published by Allied Market Research, the global artificial lift system market was valued at $26.3 billion in 2020 and is projected to reach $55.3 billion by 2030, growing at a CAGR of 7.7% from 2021 to 2030. The increasing demand for oil & gas, growing shale production, and rising offshore exploration activities are key factors driving the growth of the artificial lift system market globally.

Download…

Solar Encapsulation Market Growth Driven by Rising PV Installations Worldwide

According to a new report published by Allied Market Research, the solar encapsulation market size was valued at $2.6 billion in 2020 and is projected to reach $6.1 billion by 2030, growing at a CAGR of 8.7% from 2021 to 2030. The increasing adoption of photovoltaic (PV) systems, rising demand for renewable energy, and advancements in solar module technologies are key factors fueling the growth of the solar encapsulation market…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…