Press release

Mortgage Brokerage Services Market 2020 - 2030: Future Business Experts Ideas by HDFL, Flagstar Bank, United Wholesale Mortgage, Mortgage Choice Limited, Freedom Mortgage Co, The Bank of America, Wells Fargo, JPMorgan Chase Bank, Caliber Home Loans, Penny

A mortgage brokerage serves as an intermediary that connects mortgage buyers & lenders that are best suited to borrower's financial situation and exchange rates in the market. A broker also collects earnings, assets, employment supporting documents, credit reports, and other required details to evaluate the ability of a borrower to secure financing.Moreover, they are also responsible for necessary paperwork from a borrower and forward the same to mortgage lender for underwriting and mortgage approval. Generally, mortgage brokers are regulated to ensure that consumer jurisdiction complies with banking and finance laws.

Download Free Research Sample Report: https://www.alliedmarketresearch.com/request-sample/7064

Growth in mortgage lending industry in Asia-Pacific:

Developing countries in Asia are more inclined toward mortgage loans for home finance and the demand for mortgage brokers has increased in recent years. Mortgage loan growth in countries such as China, India, and South Korea has raised the growth in demand for convenient lending process.

Countries such as Hong Kong faced a strong housing demand and led to significant higher mortgage loan growth rate of 8% in 2017. Similar trends are observed in India, Japan, and Singapore leading to lucrative opportunities for the market.

Ask For Better Understanding of Market : https://www.alliedmarketresearch.com/purchase-enquiry/7064

New technological advancements to flourish the market:

Many mortgage broking firms are adopting new technologies such as artificial intelligence (AI), chatbots, and big data to address their customer needs efficiently. Some brokers use customer service chatbots on websites that could field enquiries, reply frequent questions, and set appointments.

For instance, Mojo Mortgages, a Fintech startup, uses chatbots to assist people on Facebook to address their mortgage broking needs in the market. More number of such advancements are expected to drive the market during the forecast period

Get Access to Full Report: https://www.alliedmarketresearch.com/mortgage-brokerage-services-market-A06699

Growth in preference of individuals to use brokerage services for mortgage lending and increase in awareness toward access to finance services are key drivers in the market. However, several government regulations and fluctuating interest rates hinder the market growth.

Major players analyzed include Housing Development Finance Corporation Limited, Flagstar Bank, United Wholesale Mortgage, LLC, Mortgage Choice Limited, Freedom Mortgage Corporation, The Bank of America Corporation, Wells Fargo & Company, JPMorgan Chase Bank, Caliber Home Loans, Inc., PennyMac Loan Services, LLC

Read Exclusive Articles:

Retail Banking: https://www.technoinnovationz.com/2020/07/16/retail-banking/

Microfinance Market:

https://www.technoinnovationz.com/2020/07/17/micro-finance/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

1-800-792-5285, 1-503-894-6022, 1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Brokerage Services Market 2020 - 2030: Future Business Experts Ideas by HDFL, Flagstar Bank, United Wholesale Mortgage, Mortgage Choice Limited, Freedom Mortgage Co, The Bank of America, Wells Fargo, JPMorgan Chase Bank, Caliber Home Loans, Penny here

News-ID: 2148105 • Views: …

More Releases from Allied Analytics LLP

Lithium-ion Battery Recycling Market Driven by EV Demand and Sustainability Init …

According to a new report published by Allied Market Research, the lithium-ion battery recycling market size was valued at $1.33 billion in 2020 and is projected to reach $38.21 billion by 2030, growing at a CAGR of 36.0% from 2021 to 2030. The rapid surge in electric vehicle adoption, increasing use of portable electronics, and rising focus on sustainable waste management are key factors driving the growth of the lithium-ion…

Rising EV Demand Boosts Lithium-Iron Phosphate Batteries Market Worldwide

According to a new report published by Allied Market Research, the lithium-iron phosphate batteries market was valued at $5.6 billion in 2020 and is projected to reach $9.9 billion by 2030, registering a CAGR of 5.9% from 2021 to 2030. The steady expansion of electric vehicles, industrial automation, and renewable energy storage solutions is significantly contributing to the growth of the lithium-iron phosphate batteries market globally.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/13422

Growing Electric…

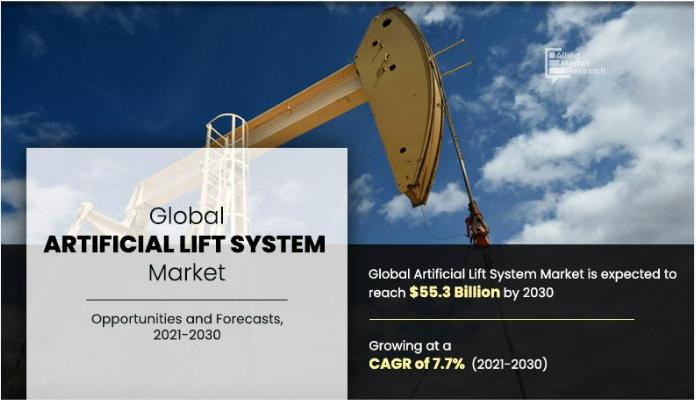

Artificial Lift System Market Growth Driven by Offshore and Shale Oil Demand

According to a new report published by Allied Market Research, the global artificial lift system market was valued at $26.3 billion in 2020 and is projected to reach $55.3 billion by 2030, growing at a CAGR of 7.7% from 2021 to 2030. The increasing demand for oil & gas, growing shale production, and rising offshore exploration activities are key factors driving the growth of the artificial lift system market globally.

Download…

Solar Encapsulation Market Growth Driven by Rising PV Installations Worldwide

According to a new report published by Allied Market Research, the solar encapsulation market size was valued at $2.6 billion in 2020 and is projected to reach $6.1 billion by 2030, growing at a CAGR of 8.7% from 2021 to 2030. The increasing adoption of photovoltaic (PV) systems, rising demand for renewable energy, and advancements in solar module technologies are key factors fueling the growth of the solar encapsulation market…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…