Press release

SME Insurance Market Poised for Growth; Liberty Mutual, Allstate, Farmers Insurance

HTF Market Intelligence released a new research report of 150 pages on title 'Global SME Insurance Market Insights by Application, Product Type, Competitive Landscape & Regional Forecast 2025' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, Europe, Asia-Pacific etc and important players such as Berkshire Hathaway (United States), Liberty Mutual (United States), Allstate Corp (United States), Farmers Insurance Group (United States), Allianz global corporate and specialty (Germany), CNA (Singapore), Zurich (Switzerland), AXA (France), CGI Insurance (England) and State farm (United States).Request a sample report @ https://www.htfmarketreport.com/sample-report/2832182-global-sme-insurance-market-6

Summary

Global SME Insurance Market Overview:

SME insurance helps cover the costs of liability and property damage claims. It can also replace lost income if the business has to close temporarily because of a loss. The coverage includes property damage, legal liability, and employee-related risks. The risks vary according to the environment they are working in. Apart from this business insurance coverage, it provides additional ones. Moreover, the SME insurance protects the financial assets, intellectual and physical properties of the business from events such as lawsuits, thefts, loss of income, employee injuries and others.

Market Drivers

Ability to Distribute Insurance Policies in Small Businesses in a Cost-Effective way that covers Various Risks

Risks Such as Legal Liability, Employee Illness and Natural Disasters to Businesses are leading to Investment in Business Insurance

View Detailed Table of Content @ https://www.htfmarketreport.com/reports/2832182-global-sme-insurance-market-6

Market Trend

Adoption of Automation and Artificial Intelligence in Insurance Processes

Rising Number of InsurTech Firms which are Offering Specific Functionalities or Parts of Value Chain

Restraints

Rise in Inflation Rates are Causing in Cancellation of Policies

Opportunities

Rising Number of Small and Medium Enterprises in Emerging Economies is Boosting the Market Growth

Challenges

Lack of Awareness about the Insurance for Small Businesses

Competitive Landscape:

The SME insurance market is fragmented as the market has a number of companies that offer various insurance such as SME Insurance. The companies are exploring the market by expansions, investments, new service launches and collaborations as their preferred strategies. The players are exploring new geographies through expansions and acquisitions to avail a competitive advantage through combined synergies.

Some of the key players profiled in the report are Berkshire Hathaway (United States), Liberty Mutual (United States), Allstate Corp (United States), Farmers Insurance Group (United States), Allianz global corporate and specialty (Germany), CNA (Singapore), Zurich (Switzerland), AXA (France), CGI Insurance (England) and State farm (United States). The Players having a strong hold in the market are Berkshire Hathaway, Liberty Mutual, Allstate Corp, and Farmers Insurance Group. Additionally, following companies can also be profiled that are part of our coverage like The Travelers Companies (United States), American International Group, Inc. (United States), Nationwide (United Kingdom), AIA Group Limited (China), Chubb Corporation (United States), Progressive commercial (United States), Hartford insurance company (United States), Hanover insurance group (United States) and ICICI Lombard (India). Analyst at HTF MI see United States and European Players to retain maximum share of Global SME Insurance market by 2025. Considering Market by Agent, the sub-segment i.e. Bancassurance will boost the SME Insurance market. Considering Market by Coverage Type, the sub-segment i.e. Short Term will boost the SME Insurance market. Considering Market by End User, the sub-segment i.e. Contractors & Construction will boost the SME Insurance market.

Market Highlights:

In June 2019, Zurich has completed the acquisition of life insurance business of ANZ. This acquisition helps the company to expand its distribution footprint.

Recently, Next Insurance has launched a live certificate, a real-time insurance verification. This includes verifiable additional insurance and policy expiry information.

Available Customization:

Data related to EXIM [Export- Import], production & consumption by country or regional level break-up can be provided based on client request**

** Confirmation on availability of data would be provided prior to purchase

Research Methodology:

The top-down and bottom-up approaches are used to estimate and validate the size of the Global SME Insurance market.

In order to reach an exhaustive list of functional and relevant players various industry classification standards are closely followed such as NAICS, ICB, SIC to penetrate deep in important geographies by players and a thorough validation test is conducted to reach most relevant players for survey in SME Insurance market.

In order to make priority list sorting is done based on revenue generated based on latest reporting with the help of paid databases such as Factiva, Bloomberg etc.

Finally the questionnaire is set and specifically designed to address all the necessities for primary data collection after getting prior appointment by targeting key target audience that includes SME Insurance Providers, Potential Technology Investors, Regulatory & Government Bodies, Downstream Vendors, End Users and Other.

This helps us to gather the data related to players revenue, operating cycle and expense, profit along with product or service growth etc.

Almost 70-80% of data is collected through primary medium and further validation is done through various secondary sources that includes Regulators, World Bank, Association, Company Website, SEC filings, OTC BB, USPTO, EPO, Annual reports, press releases etc.

Get Customization in the Report, Enquire Now @ https://www.htfmarketreport.com/enquiry-before-buy/2832182-global-sme-insurance-market-6

Most important Highlights of TOC:

1 Introduction of SME InsuranceMarket

1.1 Overview of the Market

1.2 Scope of Report

2 Exclusive Summary

3 Research Methodology

3.1 Primary Interviews

3.2 Data Mining

3.3 Validation

3.4 List of Statistics

4 SME Insurance Market Segment & Geographic Analysis [2014 -2026]

4.1 By Type

4.2 By Application

4.3 By Region / Country

5 SME Insurance Market Outlook

5.1 Overview

5.2 Market Dynamics

5.2.1 Opportunities

5.2.2 Restraints

5.2.3 Drivers

5.3 Five Force Model

5.4 Value Chain Analysis

6 SME Insurance Market Competitive Landscape

6.1 Overview

6.2 Key Development Policies

6.3 Company Market Standing

Buy this report @ https://www.htfmarketreport.com/buy-now?format=1&report=2832182

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SME Insurance Market Poised for Growth; Liberty Mutual, Allstate, Farmers Insurance here

News-ID: 2147024 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

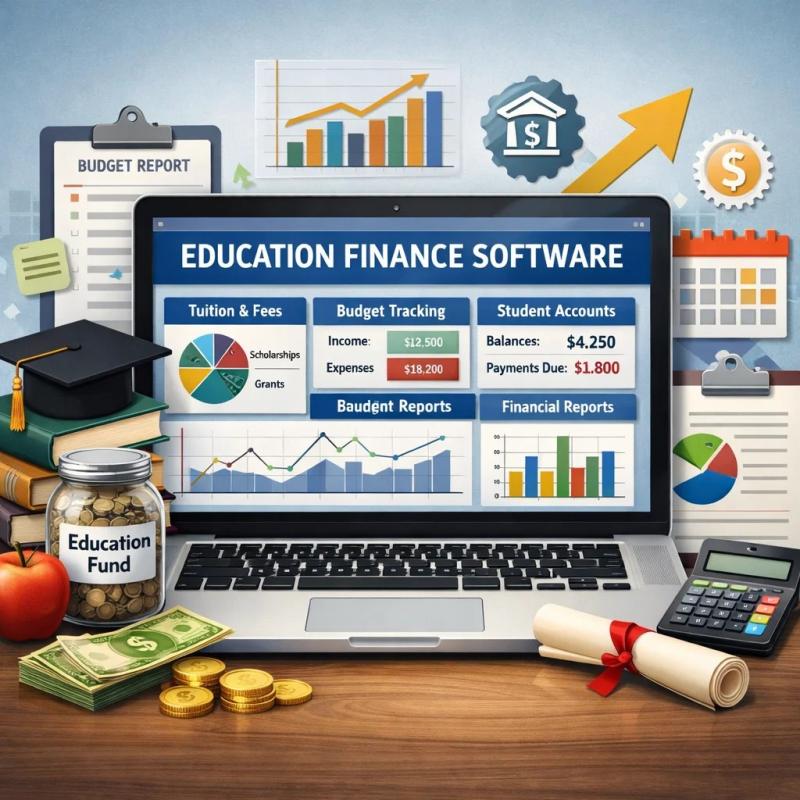

Education Finance Software Market: Regaining Its Glory | PowerSchool Finance, Ty …

The latest analysis of the worldwide education finance software market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The education finance software market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors.

Key Players in This Report Include:

Blackbaud, Ellucian,…

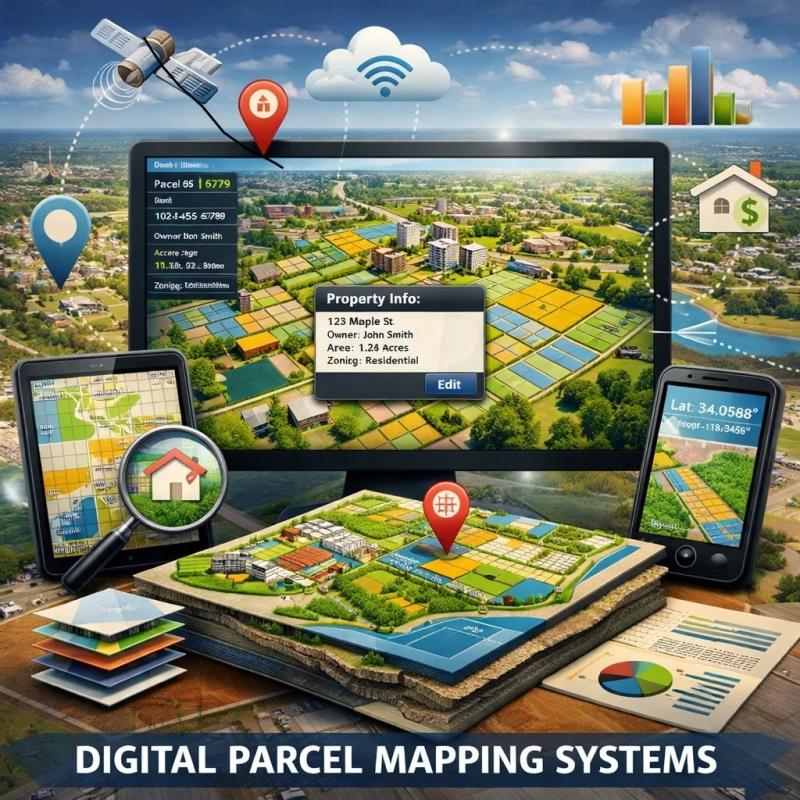

Digital Parcel Mapping Systems Market Is Booming Worldwide | Major Giants Hexago …

The latest analysis of the worldwide digital parcel mapping systems market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The Digital Parcel Mapping Systems market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors' positions.

Key Players in This…

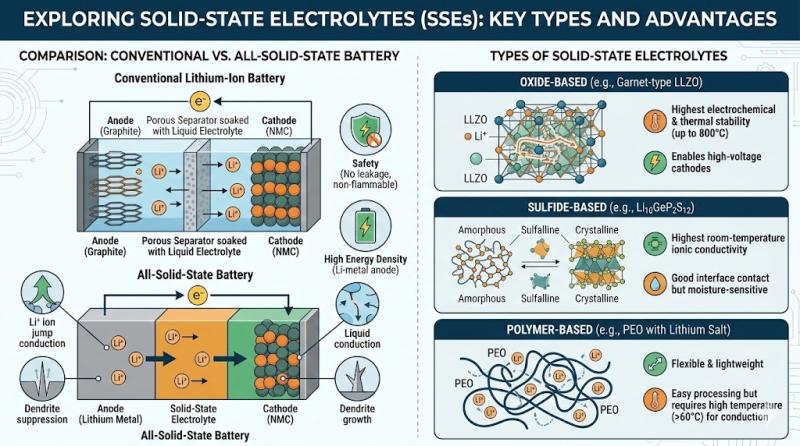

Solid-State Electrolytes Market Likely to Boost Future Growth by 2033 | QuantumS …

HTF Market Intelligence published a new research document of 150+pages on Solid-State Electrolytes Market Insights, to 2033" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Solid-State Electrolytes market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have…

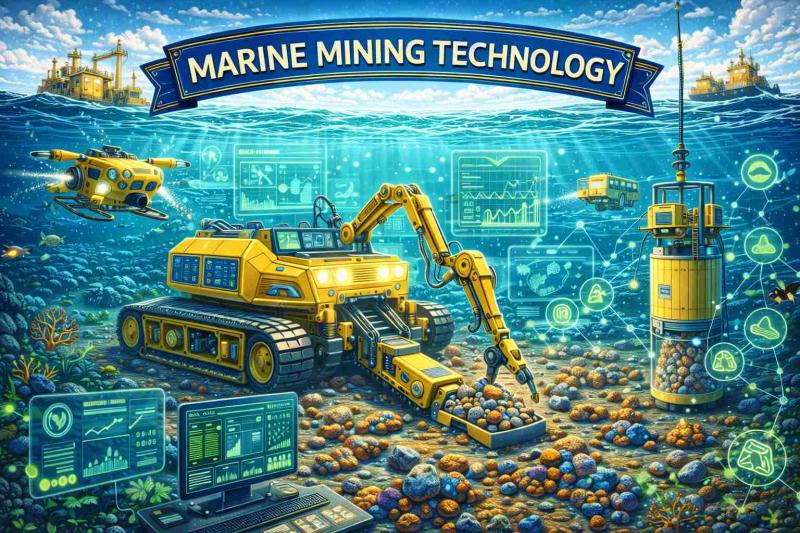

Marine Mining Technology Market Current Status and Future Prospects | Odyssey Ma …

The latest study released on the Global Marine Mining Technology Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marine Mining Technology study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…