Press release

Global sorting cash machine market– Global Industry Size, Share, Opportunity, Trends & Forecast to 2030

The global sorting cash machine market accounted for US$ XXX billion in 2020 and is estimated to be XXX billion by 2029 and is anticipated to register a CAGR of XX.X%. The report. "Global Sorting Cash Machine Market, By Type (Banknote Sorter and Coins Sorter), By Application (Bank and Supermarket), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Trends, Analysis and Forecast till 2029”.Download Free sample copy of this report @

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/4341

Analyst View:

Growth potential from developing economies

Growth related with retail industries and commercial banks among emerging nations is projected to drive the demand to implement note sorters for smooth & hassle-free handling of notes. Cash-intensive environments such as the retail industry offer huge demand for note sorter machines. Additionally, increased in demand for technologically advanced self-service machines and market growth for automated cash handling products are projected to improve the market potential among emerging economies. Therefore, these emerging countries with growth in banked population are anticipated to offer a significant market for the suppliers of all equipment, which makes the entire ecosystem of the note machines.

Growth in market for commercial banks and retail industry

Cash-intensive environments such as retail industry offers a huge demand for small size note sorter. Developing countries of Asia-Pacific and LAMEA witness huge potential for growth of retail industry, which is anticipated to boost the market growth over the forecast period. Moreover, the banking sector is also increasing at a high rate. According to World Bank, financial sector in South Asia is estimated to register a likely growth rate of 7.1% in 2018.

Browse 60 market data tables* and 35 figures* through 140 slides and in-depth TOC on “Global Sorting Cash Machine Market”, By Type (Banknote Sorter and Coins Sorter), By Application (Bank and Supermarket), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Trends, Analysis and Forecast till 2030

Key Market Insights from the report:

The global sorting cash machine market accounted for US$ XXX billion in 2020 and is estimated to be XXX billion by 2029 and is anticipated to register a CAGR of XX.X%. The market report has been segmented on type, application, and region.

By type, the global sorting cash machine market is segmented into banknote sorter and coins sorter.

By application, the target market is classified into bank and supermarket.

By region, North America is projected to lead the overall market over the forecast period, due to its highest adopter of note sorting machines.

Competitive Landscape:

The prominent player operating in the global sorting cash machine market includes Giesecke & Devrient GmbH, Cummins-Allison Corp., Glory Global Solutions Limited, De La Rue plc, Kisan Electronics, Toshiba Infrastructure Systems & Solutions Corporation, GRGBanking, Julong Europe GmbH, and Bcash Electronics Co., Laurel

The market provides detailed information regarding industrial base, productivity, strengths, manufacturers, and recent trends which will help companies enlarge the businesses and promote financial growth. Furthermore, the report exhibits dynamic factors including segments, sub-segments, regional marketplaces, competition, dominant key players, and market forecasts. In addition, the market includes recent collaborations, mergers, acquisitions, and partnerships along with regulatory framework across different regions impacting the market trajectory. Recent technological advances and innovations influencing the global market are included into the report.

Request Discount:-

https://www.prophecymarketinsights.com/market_insight/Insight/request-discount/4341

Explains an overview of the product portfolio, including product development, planning, and positioning

Explains details about key operational strategies with focus on R&D strategies, corporate structure, localization strategies, production capabilities, and financial performance of various companies.

Detailed analysis of the market revenue over the forecasted period.

Examining various outlooks of the market with the help of Porter’s five forces Analysis, PEST & SWOT Analysis.

Study on the segments that are anticipated to dominate the market.

Study on the regional analysis that is expected to register the highest growth over the forecast period

Key Topics Covered

Introduction

Study Deliverables

Study Assumptions

Scope of the Study

Research Methodology

Executive Summary

Opportunity Map Analysis

Market at Glance

Market Share (%) and BPS Analysis, by Region

Competitive Landscape

Heat Map Analysis

Market Presence and Specificity Analysis

Contact Us:

Mr Alex (Sales Manager)

Prophecy Market Insights

Phone: +1 860 531 2701

Email: sales@prophecymarketinsights.com“

About us:

Prophecy is a specialized market research, analytics, marketing and business strategy, and solutions company that offer strategic and tactical support to clients for making well-informed business decisions and to identify and achieve high value opportunities in the target business area. Also, we help our client to address business challenges and provide best possible solutions to overcome them and transform their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global sorting cash machine market– Global Industry Size, Share, Opportunity, Trends & Forecast to 2030 here

News-ID: 2138299 • Views: …

More Releases from Prophecy Market Insights

Stationary Fuel Cell Market Size, Trends, Analysis, and Forecast till 2035

(Oct-2025/Pune) The latest study titled Stationary Fuel Cell Market, published by Prophecy Market Insights, offers comprehensive insights into the global and regional markets projected to expand significantly between 2025 and 2035. The report provides a detailed analysis of market dynamics, value chain, investment opportunities, competitive landscape, and key market segments. It further explores strategic initiatives, technological advancements, and emerging opportunities across the fuel cell industry.

In 2024, the Stationary Fuel Cell…

Bio-identical hormone replacement Trends and Strategic Analysis 2025-2035

The Latest study titled Bio-identical hormone replacement market, published by Prophecy Market Insights, provides valuable insights into both regional and global markets projected to grow in value from 2025 to 2035. The comprehensive research delves into the evolving market dynamics, value chain analysis, prominent investment areas, competitive landscape, regional outlook, and key market segments. It also offers a thorough assessment of the global market's drivers and constraints. Additionally, the report…

Pharmaceutical Drugs Market to Reach USD 3357 Billion by 2035, Growing at a CAGR …

Prophecy Market Insights has released its latest study on the Pharmaceutical Drugs Market, revealing significant growth opportunities driven by innovation in drug discovery, rising healthcare spending, and the global demand for effective therapies. The market, valued at USD 1750 billion in 2024, is expected to grow to USD 3357.0 billion by 2035, at a steady CAGR of 6.8% during the forecast period (2025-2035).

Get Preview (PDF) Here: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/6055

Market Overview

The Pharmaceutical Drugs…

Satellite Data Services Market 2035 Outlook: Key Drivers, SWOT Insights & Top Co …

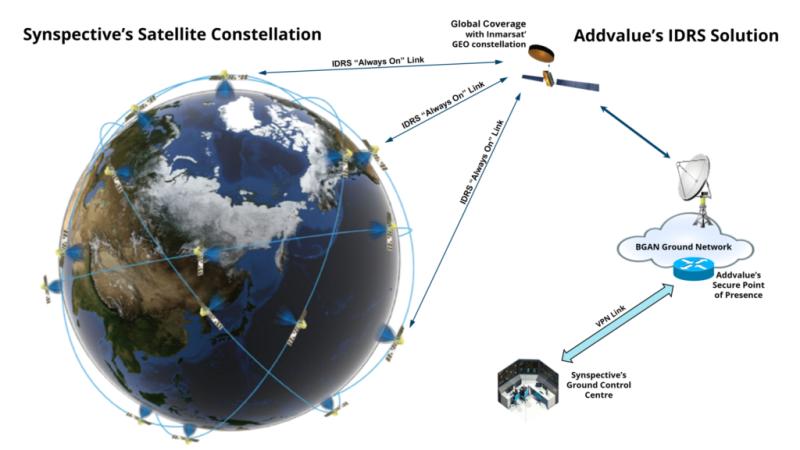

Prophecy Market Insights has recently released a comprehensive research report on the Satellite Data Services Market, highlighting key trends, market dynamics, competitive insights, and growth opportunities expected through 2035. The market, valued at USD 10.6 billion in 2024, is projected to reach USD 52.5 billion by 2035, registering a remarkable CAGR of 17.6% during the forecast period.

Get Sample PDF: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/6053

Market Overview

The Satellite Data Services Market is witnessing rapid expansion, driven…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…