Press release

Insurance Software Market Opportunities, Demand and Revenue Forecast to 2030

Insurance Software Market - IntroductionInsurance software helps insurance companies, brokers, and agencies to manage operational and organizational tasks more efficiently and effectively through a digital insurance platform

Insurance software is a user-friendly and automated software program that helps companies collate large database of the insurers for further business actions. Insurance software enhances the efficiency of the insurance process with database connectivity and policy within the system.

It also helps enhance productivity of the new business, underwriting, claim processing, sales and distribution management, customer services, and predictive analysis process.

Obtain Report Details @ https://www.transparencymarketresearch.com/insurance-software-market.html

Software providers are offering various software modules according to customer requirements in life insurance, accident & health insurance, and property & casualty insurance

Insurance companies are unable cover the untapped market of insurance by using traditional insurance methods. Increased adoption insurance software by insurance companies helps to tap the large customer base of untapped markets.

Key Drivers of Insurance Software Market

Rise in adoption of insurance services in developing countries and by companies in order to enhance their productivity is expected to drive the insurance software market

The solution provider are offering insurance solutions with artificial intelligence technology to boost efficiency of the insurance process and provide more reliable solutions in claim processing and policy management, which in turn is expected to boost the insurance software market

Investors are collaborating with insurance technology companies to consolidate their position in the market and provide advanced solutions in the insurance industry. This is expected to offer significant opportunities to solution providers of insurance software.

Rise in security and privacy issues owing to increased cyber threats and lack of skilled workforce to hinder the market

Lack of awareness and skilled workforce to utilize insurance software are key factors that restrain the insurance software market

Technological advancements in insurance software are driving the threat to security and privacy owing to increased cyber-attacks. This, in turn, is also expected to hamper the insurance software market.

For More Details, Request A Sample Report@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=77357

Impact of COVID 19 on Global Insurance Software Market

Solution providing companies are expanding their customer base in developing countries to consolidate their position in the market due to increasing impact of COVID 19 on business expansion. Health insurance coverage has been increasing due to the growing threat of COVID 19 pandemic in North America and Europe.

Companies are adopting digitalization in the insurance industry due to the lockdown measures and to provide user-friendly and more reliable platforms to manage their insurance plans. Furthermore, the ever-increasing threat of COVID-19 is projected to boost the demand for insurance software solutions during the forecast period.

North America to Hold Major Share of Global Insurance Software Market

North America held a prominent share of the global insurance software market due to an increase in adoption of online platforms by insurance companies to increase their customer base

Increase in demand for insurance software among insurance companies, brokers, and agencies across North America is likely to offer significant opportunities to major players

The insurance software market in Asia Pacific and Europe is expected to expand at a rapid pace during the forecast period due to increasing investment by major players to provide solutions across these regions and also due to the increasing adoption of digital insurance platforms by companies in Asia Pacific and Europe

Contact us:

Transparency Market Research

State Tower,

90 State Street, Suite 700,

Albany NY - 12207,

United States

Tel: +1-518-618-1030

TMR offers meticulously researched market studies. We are leaders in providing cutting-edge market intelligence reports that are brought out of more than 5 million hours of expertize in market intelligence at the global, national, and local levels.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Software Market Opportunities, Demand and Revenue Forecast to 2030 here

News-ID: 2130294 • Views: …

More Releases from Transparency Market Research

Leisure Boat Market Size Forecast to USD 77.6 Billion by 2036 with Growing Deman …

Leisure Boat Market Outlook 2036

The global leisure boat market was valued at USD 54.1 Billion in 2025 and is projected to reach USD 77.6 Billion by 2036, expanding at a steady CAGR of 3.3% from 2026 to 2036. Market growth is driven by rising recreational boating activities, increasing disposable incomes, expanding marine tourism, and growing interest in water sports and luxury lifestyles.

👉 Get your sample market research report copy today@…

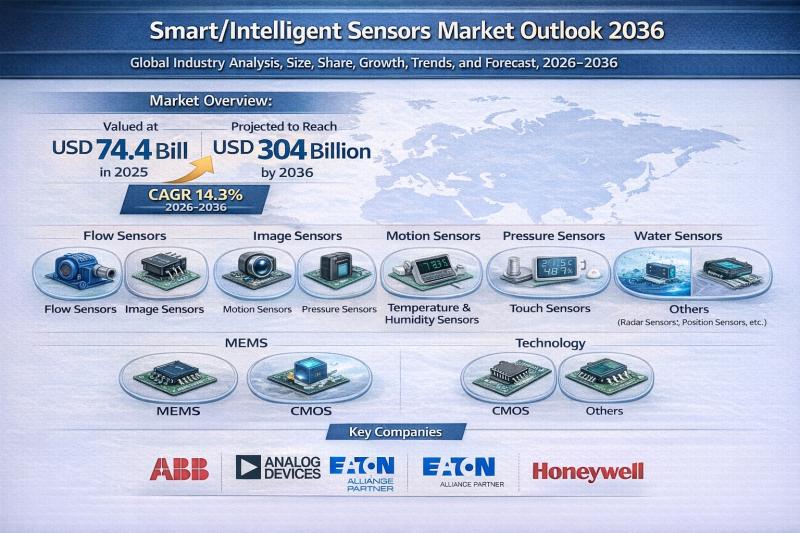

Smart/Intelligent Sensors Market to Reach USD 304 Billion by 2036, Expanding at …

The global smart/intelligent sensors market is witnessing robust expansion as connected ecosystems, automation technologies, and edge computing redefine digital infrastructure worldwide. Valued at USD 74.4 Billion in 2025, the market is projected to surge to USD 304 Billion by 2036, registering a strong CAGR of 14.3% from 2026 to 2036.

Smart or intelligent sensors go beyond conventional sensing capabilities by integrating embedded processing, data analytics, wireless connectivity, and decision-making intelligence directly…

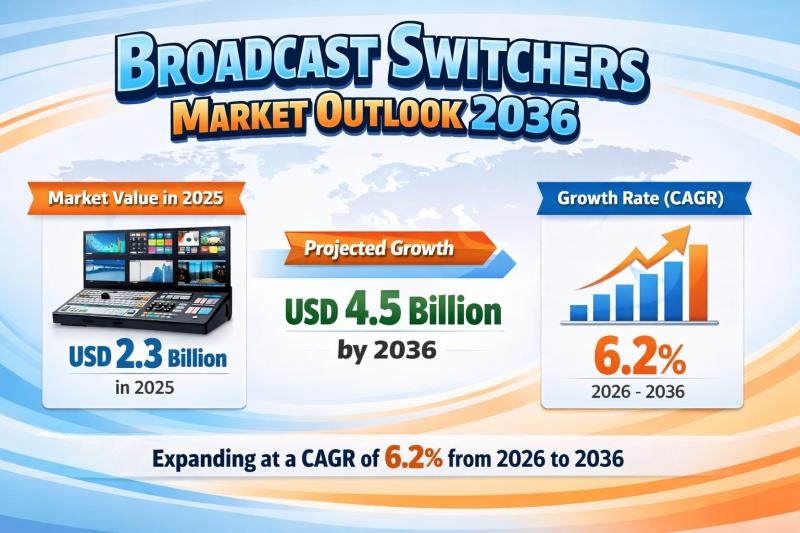

Broadcast Switchers Market to be Worth USD 4.5 Bn by 2036 - By Production, Routi …

The global Broadcast Switchers Market is poised for sustained expansion over the next decade, driven by technological innovation and rising global demand for high-quality live content production. Valued at USD 2.3 Billion in 2025, the market is projected to grow to USD 4.5 Billion by 2036, expanding at a compound annual growth rate (CAGR) of 6.2% from 2026 to 2036.

Review critical insights and findings from our Report in this sample…

Global Tablet Coatings Market Outlook 2031: Projected to Surpass USD 1,543 Milli …

The global tablet coatings market was valued at US$ 824 Mn in 2021 and is projected to expand at a steady CAGR of 5.3% from 2022 to 2031, reaching more than US$ 1,543 Mn by 2031. This consistent growth trajectory reflects the rising consumption of coated pharmaceutical and nutraceutical tablets across developed and emerging markets.

Between 2017 and 2020, the market experienced moderate expansion driven by generics penetration and increasing oral…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…