Press release

Zild Finance’s Quest to Bring Maximum People Under the net of Financial Services

A few banks have monopolized the global finance industry. But has the current financial system been successful in providing financial access to everyone in the world? No, the global banking sector has not been successful in providing financial access to a huge section of the world population. In fact, the current unbanked population stands at 1.7 billion adults globally. So, what may be the reasons for this failure of the global banking industry?What is Zild Finance?

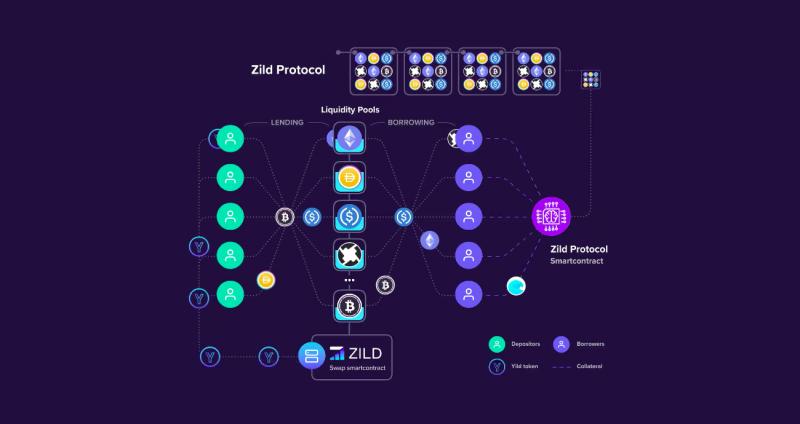

Zild Finance is a DeFi protocol that leverages blockchain and smart contracts technology and combines it with traditional financial instruments. A user can get loans in different cryptocurrencies on Zild Finance’s platform. They can also earn interest by granting a Crypto-based loan through the Zild Finance’s platform. At the same time, the users will receive Zild tokens for contributing to the Zild ecosystem.

There is a big difference between Zild Finance and the banks. The banks have a central hierarchical structure whereas Zild has a decentralized system of operations. The Zild community has the deciding authority over the matters of token circulation. Hence, the individuals and communities that are part of the Zild ecosystem are at the helm of the steering wheel. All Zild users have access to all tools and services within the Zild ecosystem.

You can call Zild’s decentralized lending platform an investment & commercial bank as it operates as a typical investment & commercial bank. It allows its users to lend and borrow tokens on the blockchain. The rate of interest is the one that is mutually agreed upon. The supply and demand method determined the lending rates on the Zild platform. A person without a bank account can earn interest income on their savings through Zild.

It’s about time that non-collateralized lending made its way to DeFi space. With non-collateralized lending, Zild Finance is establishing the next stage of decentralized finance.

Global Gateway 8, Rue de la Perle, Providence, Mahé, Seychelles

Zild Finance is bringing uncollateralized loans to the Decentralized Finance space, also known as DeFi. It will enable a majority of the population to borrow with limited entry requirements. So far, secured loans have played an instrumental role in the DeFi space.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Zild Finance’s Quest to Bring Maximum People Under the net of Financial Services here

News-ID: 2128358 • Views: …

More Releases for DeFi

IO DeFi User Base Surpasses 3 Million as Structured DeFi Participation Gains Glo …

IO DeFi has reached a significant milestone as its global user base surpasses 3 million accounts, reflecting growing interest in structured and simplified participation within the decentralized finance sector.

The expansion highlights a broader shift in how users engage with DeFi. As the ecosystem matures, participants are increasingly prioritizing stability, clarity, and reduced operational complexity over constant manual involvement.

A Milestone Reflecting Changing User Preferences

User growth in decentralized finance is no longer…

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Building Defi Staking Platform with PerfectionGeeks Technologies

With each investment-related research you undertake, whether in mutual funds, stocks or gold, you will likely find legal advice to make money by investing correctly.

Today, with one out of 10 investors investing their money into cryptocurrency, the old saying about holding assets over the long term extends to crypto-related investors. Many ways to look at it, more so considering the volatility of crypto that is frequently traded and bought, which…

DeFi (Decentralized Finance) Tool Market Still Has Room to Grow | MetaMask, Dapp …

The latest research study released by Stratagem Market Insights on the "DeFi (Decentralized Finance) Tool Market" with 100+ pages of analysis on business strategy taken up by emerging industry players, geographical scope, market segments, product landscape and price, and cost structure. It also assists in market segmentation according to the industry's latest and upcoming trends to the bottom-most level, topographical markets, and key advancement from both market and technology-aligned perspectives.…

Banking the Banked: Why Defi

“Bank the unbanked! Banking for the people! Upend the dominant paradigm!” Decentralized finance, or DeFi, is touted as the next big revolution in the world of banking and markets, just like Bitcoin was supposed to be the next big revolution in the world of currency. Oh, wait, one Bitcoin is currently worth over USD 10k, so maybe it isn’t going to replace the dollar, but it’s certainly been a revolution.…