Press release

Global Retail Banking Market: Key Vendors in the Market Space|, BNP Paribas, Citigroup, HSBC

LOS ANGELES, United States: QY Research as of late produced a research report titled, “Global Retail Banking Market Report, History and Forecast 2015-2026, Breakdown Data by Companies, Key Regions, Types and Application". The research report speak about the potential development openings that exist in the worldwide market. The report is broken down on the basis of research procedures procured from historical and forecast information. The global Retail Banking market is relied upon to develop generously and flourish as far as volume and incentive during the gauge time frame. The report will give a knowledge about the development openings and controls that will build the market. Pursuers can increase important perception about the eventual fate of the market.Key Companies/Manufacturers operating in the global Retail Banking market include:

, BNP Paribas, Citigroup, HSBC, ICBC, JPMorgan Chase, Bank of America, Barclays, China Construction Bank, Deutsche Bank, Mitsubishi UFJ Financial Group, Wells Fargo

Get PDF Sample Copy of the Report to understand the structure of the complete report: (Including Full TOC, List of Tables & Figures, Chart) :

https://www.qyresearch.com/customize-request/form/1555760/global-retail-banking-market

Segmental Analysis

The report incorporates significant sections, for example, type and end user and a variety of segments that decide the prospects of global Retail Banking market. Each type provide data with respect to the business esteem during the conjecture time frame. The application area likewise gives information by volume and consumption during the estimate time frame. The comprehension of this segment direct the readers in perceiving the significance of variables that shape the market development.

Global Retail Banking Market Segment By Type:

Transactional Accounts

Savings Accounts

Debit Cards

Credit Cards

Loans

Others

Global Retail Banking Market Segment By Application:

Hardware

Software

Services

Competitive Landscape

Competitor analysis is one of the best sections of the report that compares the progress of leading players based on crucial parameters, including market share, new developments, global reach, local competition, price, and production. From the nature of competition to future changes in the vendor landscape, the report provides in-depth analysis of the competition in the global Retail Banking market.

Key questions answered in the report:

What is the growth potential of the Retail Banking market?

Which product segment will grab a lion’s share?

Which regional market will emerge as a frontrunner in the coming years?

Which application segment will grow at a robust rate?

What are the growth opportunities that may emerge in the Retail Banking industry in the years to come?

What are the key challenges that the global Retail Banking market may face in the future?

Which are the leading companies in the global Retail Banking market?

Which are the key trends positively impacting the market growth?

Which are the growth strategies considered by the players to sustain hold in the global Retail Banking market

For Discount, Customization in the Report Drop Your Query Here: https://www.qyresearch.com/customize-request/form/1555760/global-retail-banking-market

TOC

Table of Contents 1 Market Overview of Retail Banking

1.1 Retail Banking Market Overview

1.1.1 Retail Banking Product Scope

1.1.2 Market Status and Outlook

1.2 Global Retail Banking Market Size Overview by Region 2015 VS 2020 VS 2026

1.3 Global Retail Banking Market Size by Region (2015-2026)

1.4 Global Retail Banking Historic Market Size by Region (2015-2020)

1.5 Global Retail Banking Market Size Forecast by Region (2021-2026)

1.6 Key Regions Retail Banking Market Size YoY Growth (2015-2026)

1.6.1 North America Retail Banking Market Size YoY Growth (2015-2026)

1.6.2 Europe Retail Banking Market Size YoY Growth (2015-2026)

1.6.3 China Retail Banking Market Size YoY Growth (2015-2026)

1.6.4 Rest of Asia Pacific Retail Banking Market Size YoY Growth (2015-2026)

1.6.5 Latin America Retail Banking Market Size YoY Growth (2015-2026)

1.6.6 Middle East & Africa Retail Banking Market Size YoY Growth (2015-2026) 2 Retail Banking Market Overview by Type

2.1 Global Retail Banking Market Size by Type: 2015 VS 2020 VS 2026

2.2 Global Retail Banking Historic Market Size by Type (2015-2020)

2.3 Global Retail Banking Forecasted Market Size by Type (2021-2026)

2.4 Transactional Accounts

2.5 Savings Accounts

2.6 Debit Cards

2.7 Credit Cards

2.8 Loans

2.9 Others 3 Retail Banking Market Overview by Type

3.1 Global Retail Banking Market Size by Application: 2015 VS 2020 VS 2026

3.2 Global Retail Banking Historic Market Size by Application (2015-2020)

3.3 Global Retail Banking Forecasted Market Size by Application (2021-2026)

3.4 Hardware

3.5 Software

3.6 Services 4 Global Retail Banking Competition Analysis by Players

4.1 Global Retail Banking Market Size (Million US$) by Players (2015-2020)

4.2 Global Top Manufacturers by Company Type (Tier 1, Tier 2 and Tier 3) (based on the Revenue in Retail Banking as of 2019)

4.3 Date of Key Manufacturers Enter into Retail Banking Market

4.4 Global Top Players Retail Banking Headquarters and Area Served

4.5 Key Players Retail Banking Product Solution and Service

4.6 Competitive Status

4.6.1 Retail Banking Market Concentration Rate

4.6.2 Mergers & Acquisitions, Expansion Plans 5 Company (Top Players) Profiles and Key Data

5.1 BNP Paribas

5.1.1 BNP Paribas Profile

5.1.2 BNP Paribas Main Business and Company’s Total Revenue

5.1.3 BNP Paribas Products, Services and Solutions

5.1.4 BNP Paribas Revenue (US$ Million) (2015-2020)

5.1.5 BNP Paribas Recent Developments

5.2 Citigroup

5.2.1 Citigroup Profile

5.2.2 Citigroup Main Business and Company’s Total Revenue

5.2.3 Citigroup Products, Services and Solutions

5.2.4 Citigroup Revenue (US$ Million) (2015-2020)

5.2.5 Citigroup Recent Developments

5.3 HSBC

5.5.1 HSBC Profile

5.3.2 HSBC Main Business and Company’s Total Revenue

5.3.3 HSBC Products, Services and Solutions

5.3.4 HSBC Revenue (US$ Million) (2015-2020)

5.3.5 ICBC Recent Developments

5.4 ICBC

5.4.1 ICBC Profile

5.4.2 ICBC Main Business and Company’s Total Revenue

5.4.3 ICBC Products, Services and Solutions

5.4.4 ICBC Revenue (US$ Million) (2015-2020)

5.4.5 ICBC Recent Developments

5.5 JPMorgan Chase

5.5.1 JPMorgan Chase Profile

5.5.2 JPMorgan Chase Main Business and Company’s Total Revenue

5.5.3 JPMorgan Chase Products, Services and Solutions

5.5.4 JPMorgan Chase Revenue (US$ Million) (2015-2020)

5.5.5 JPMorgan Chase Recent Developments

5.6 Bank of America

5.6.1 Bank of America Profile

5.6.2 Bank of America Main Business and Company’s Total Revenue

5.6.3 Bank of America Products, Services and Solutions

5.6.4 Bank of America Revenue (US$ Million) (2015-2020)

5.6.5 Bank of America Recent Developments

5.7 Barclays

5.7.1 Barclays Profile

5.7.2 Barclays Main Business and Company’s Total Revenue

5.7.3 Barclays Products, Services and Solutions

5.7.4 Barclays Revenue (US$ Million) (2015-2020)

5.7.5 Barclays Recent Developments

5.8 China Construction Bank

5.8.1 China Construction Bank Profile

5.8.2 China Construction Bank Main Business and Company’s Total Revenue

5.8.3 China Construction Bank Products, Services and Solutions

5.8.4 China Construction Bank Revenue (US$ Million) (2015-2020)

5.8.5 China Construction Bank Recent Developments

5.9 Deutsche Bank

5.9.1 Deutsche Bank Profile

5.9.2 Deutsche Bank Main Business and Company’s Total Revenue

5.9.3 Deutsche Bank Products, Services and Solutions

5.9.4 Deutsche Bank Revenue (US$ Million) (2015-2020)

5.9.5 Deutsche Bank Recent Developments

5.10 Mitsubishi UFJ Financial Group

5.10.1 Mitsubishi UFJ Financial Group Profile

5.10.2 Mitsubishi UFJ Financial Group Main Business and Company’s Total Revenue

5.10.3 Mitsubishi UFJ Financial Group Products, Services and Solutions

5.10.4 Mitsubishi UFJ Financial Group Revenue (US$ Million) (2015-2020)

5.10.5 Mitsubishi UFJ Financial Group Recent Developments

5.11 Wells Fargo

5.11.1 Wells Fargo Profile

5.11.2 Wells Fargo Main Business and Company’s Total Revenue

5.11.3 Wells Fargo Products, Services and Solutions

5.11.4 Wells Fargo Revenue (US$ Million) (2015-2020)

5.11.5 Wells Fargo Recent Developments 6 North America Retail Banking by Players and by Application

6.1 North America Retail Banking Market Size and Market Share by Players (2015-2020)

6.2 North America Retail Banking Market Size by Application (2015-2020) 7 Europe Retail Banking by Players and by Application

7.1 Europe Retail Banking Market Size and Market Share by Players (2015-2020)

7.2 Europe Retail Banking Market Size by Application (2015-2020) 8 China Retail Banking by Players and by Application

8.1 China Retail Banking Market Size and Market Share by Players (2015-2020)

8.2 China Retail Banking Market Size by Application (2015-2020) 9 Rest of Asia Pacific Retail Banking by Players and by Application

9.1 Rest of Asia Pacific Retail Banking Market Size and Market Share by Players (2015-2020)

9.2 Rest of Asia Pacific Retail Banking Market Size by Application (2015-2020) 10 Latin America Retail Banking by Players and by Application

10.1 Latin America Retail Banking Market Size and Market Share by Players (2015-2020)

10.2 Latin America Retail Banking Market Size by Application (2015-2020) 11 Middle East & Africa Retail Banking by Players and by Application

11.1 Middle East & Africa Retail Banking Market Size and Market Share by Players (2015-2020)

11.2 Middle East & Africa Retail Banking Market Size by Application (2015-2020) 12 Retail Banking Market Dynamics

12.1 Industry Trends

12.2 Market Drivers

12.3 Market Challenges

12.4 Porter’s Five Forces Analysis 13 Research Finding /Conclusion 14 Methodology and Data Source

14.1 Methodology/Research Approach

14.1.1 Research Programs/Design

14.1.2 Market Size Estimation

14.1.3 Market Breakdown and Data Triangulation

14.2 Data Source

14.2.1 Secondary Sources

14.2.2 Primary Sources

14.3 Disclaimer

14.4 Author List

About Us:

QYResearch always pursuits high product quality with the belief that quality is the soul of business. Through years of effort and supports from huge number of customer supports, QYResearch consulting group has accumulated creative design methods on many high-quality markets investigation and research team with rich experience. Today, QYResearch has become the brand of quality assurance in consulting industry.

Contact Us:-

QY Research, INC.

17890 Castleton,

Suite 218,

Los Angeles, CA - 91748

USA: +1 626 295 2442

Email:

enquiry@qyresearch.com

Web:

http://www.qyresearch.com

-

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Retail Banking Market: Key Vendors in the Market Space|, BNP Paribas, Citigroup, HSBC here

News-ID: 2127558 • Views: …

More Releases from QY Research

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

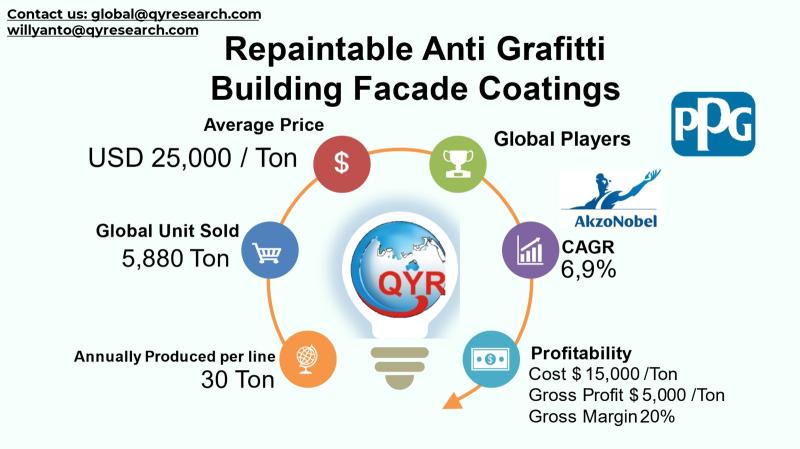

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

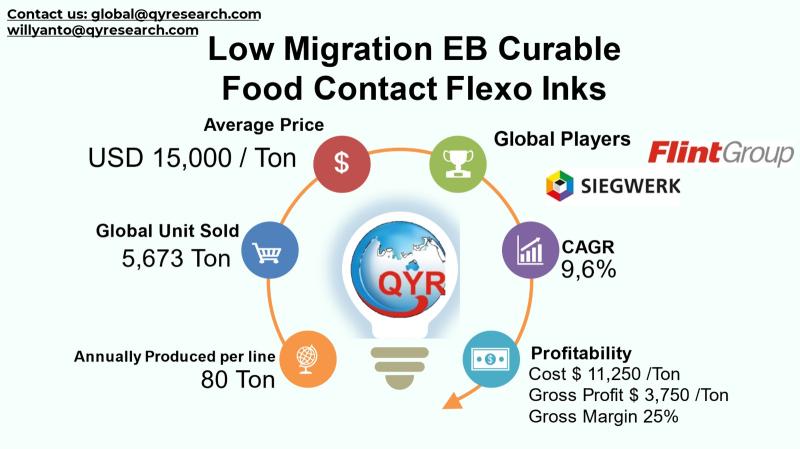

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

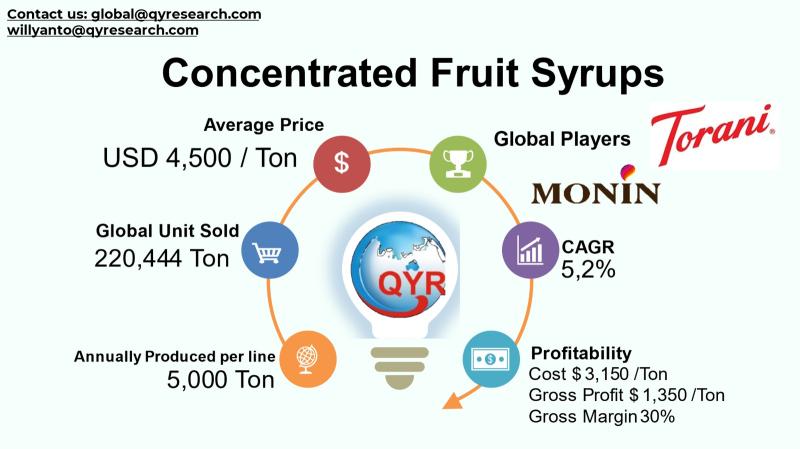

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…