Press release

Indian Insurance Aggregator Industry expected to be worth $621 Mn by FY’24: Ken Research

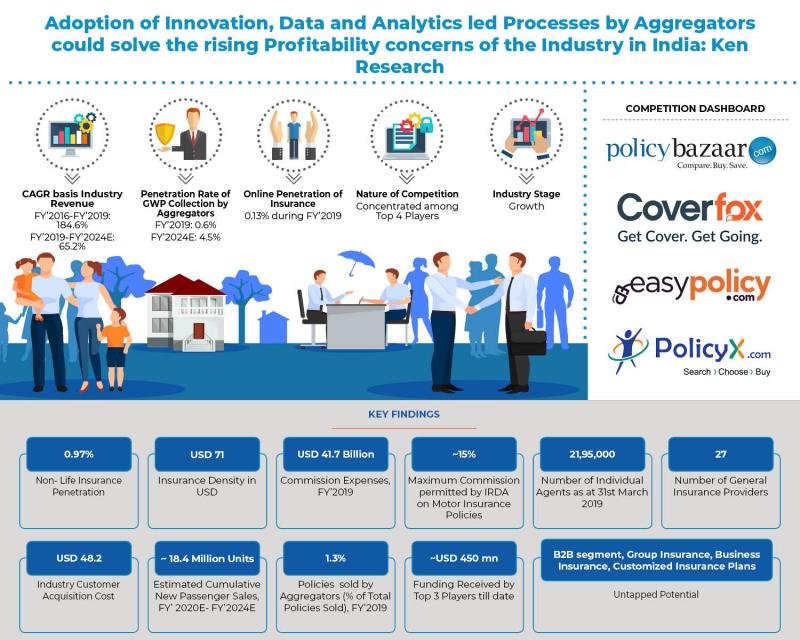

The insurance aggregator industry in India started with the introduction of PolicyBazaar in 2008 and as at 31st July 2020, there were 23 aggregators operating in the industry. Aggregators have proven to be an alternative distribution channel for insurance policies of motor, health, life, term life and other products; as they allow the customers to compare multiple policies from different insurance providers at the same time. Aggregators also act as a one-point customer representative for all their queries ranging from policy guidance to assisting in claim settlement.While earning 8-15% commission on sale of different policies is the major revenue stream, aggregators are struggling to achieve their overall profitability with loss margins reaching over 100% for some players in the industry. As at March 2019, the industry was valued at $54.5 Mn, achieving a growth of 91% compared to FY’2018. PolicyBazaar is the market leader; followed by Coverfox Broking, Easypolicy and others.

Incumbents are leveraging their Omni-channel distribution (majorly through Agents in case of Online Brokers) to increase the traffic on website, leverage customer data and use it for cross-selling loans, investment in mutual funds and credit cards. For instance, PolicyBazaar through its sister company, PaisaBazaar is amplifying the cross-selling opportunities. Similarly, ETInsure is leveraging the established customer base of ETMoney (Loan/Investments platform).

For More Information on the research report, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/insurance/india-web-insurance-aggregator-industry/308537-93.html

To beat the trade off between customer acquisition cost and average revenue attributable from policy sale, aggregators are focussing on expanding their reach domestically and internationally. For instance, Easypolicy merged with Quickbima to increase its presence in specific districts of Haryana while PolicyBazaar has commenced its operations in UAE and plans to expand to more countries internationally.

While geographical expansion focuses on newer customer acquisition, aggregators must strive to increase the ticket size by creating value proposition for customer, post-sale of policy. Incumbents must strive to create a unified ecosystem within their platform offering location of hospitals, clinics, health wellness tracker, real-time tips for health/wellness improvement; rely on more content based marketing allowing customers to re-visit the platforms and replace employee/agent driven sale via chat-bots.

Industry has also witnessed certain M&A deals and participation of foreign investors in various funding rounds of the players. For instance, PolicyBazaar plans to raise another $150 Mn in Q3 2020 and is eyeing an IPO by 2021; acquisition of MyInsuranceClub by Express Group etc. Ken Research expects the industry size to rise to $672 Mn by FY’2024 owing to shift towards online mediums due to outbreak of COVID-19, increasing awareness among customers to have safety net and investment backed trends.

Time Period Captured in the Report:-

Historical Period – FY’2016 - FY’2019

Forecast Period – FY’2019 – FY’2024E

Companies Covered:-

Policy Bazaar

CoverFox

EasyPolicy

PolicyX

ET Insure

Compare Policy

Key Topics Covered in the Report:-

Snapshot on Insurance Industry in India

Distribution of Insurance in India

Overview of Insurance Web Aggregators

Operating Business Models (Online broking V/s Online Aggregators)

Regulations by IRDA for Web Aggregators

India Web Insurance Aggregators Market Size

India Web Insurance Aggregators Market Segmentation

Competitive Landscape of Major Insurance Web Aggregators

Cross Comparison of Major Players on Key Performance and Operational Indicators

Key Trends and Developments

India Web Insurance Aggregators Future Market Size

India Web Insurance Aggregators Future Market Segmentation

Total Addressable Market for the Players, FY’2019-FY’2024E

Analyst Recommendations for New and Incumbent Players

Interview with Mahavir Chopra, Chief Business Officer at Coverfox Insurance

Interview with Naval Goel, CEO at PolicyX, India

Related Reports:-

https://www.kenresearch.com/banking-financial-services-and-insurance/insurance/india-online-insurance-market-research-report/588-93.html

https://www.kenresearch.com/blog/2019/12/interview-of-naval-goel-chief-executive-officer-at-policyx-com-on-insights-of-the-web-insurance-aggregators-market-in-india-ken-research

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. Ken Research provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Serving over 70% of fortune 500 companies globally, some of top consulting companies and Market leaders seek Ken Research’s intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indian Insurance Aggregator Industry expected to be worth $621 Mn by FY’24: Ken Research here

News-ID: 2123328 • Views: …

More Releases from Ken Research Pvt Ltd

Ken Research Stated Saudi Arabia's Corporate Banking Market to Reach USD 33 Bill …

Comprehensive market analysis outlines growth opportunities, key trends, and strategic imperatives for corporate banking players in the Kingdom's evolving financial landscape.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Corporate Banking Market," revealing that the current market size is valued at USD 33 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven…

Egypt FinTech Micro-Lending Apps Market Surpasses USD 260 million Milestone - La …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Egypt's rapidly evolving FinTech micro-lending ecosystem.

Delhi, India - January 22, 2026 - Ken Research released its strategic market analysis titled "Egypt FinTech Micro-Lending Apps Market", revealing that the current market size is valued at USD 260 million, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand,…

Increase in cybercrime results in India Digital Forensic Market to rise, with an …

With the rise in digital threats and cybercrimes, India Digital Forensic Market makes successive changes like integration of Artificial Intelligence, and marking its overall growth.

STORY OUTLINE

Using techniques like Data Recovery, Log Analysis and more, India Digital Forensic Market enhances its Computer Forensics.

Upgrades towards Network and Mobile Forensics are improving in cyber threats prevention, marking its increase in efficiency and security.

With the incorporation of Cloud Based services, advanced methods and easy…

Global Health Insurance market is expected to grow at a CAGR of ~6% by 2028: Ken …

Due to recent pandemic of Covid 19 health insurance market has grabbed growth ensuring economic help to comman man for better health care facilities with easy money handling and increasing awareness especially after COVID 19.

STORY OUTLINE

Launch of new policies, mergers, acquisitions and partnerships to propel growth in future

Covid 19 has a huge impact on the health insurance market on Global level.

Factors, which are responsible for the growth, are the higher…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…