Press release

Cyber Insurance Market Covering Developing Trends, Major Highlights With Global Analysis and Forecast By 2030

Cyber Insurance Market - By Insurance (Standalone, Packaged And Personal), By End Use (It Services, Media), Distribution (Tied Agents And Branches, Direct And Other Channels, Bancassurance), And By Region, Opportunities And Strategies – Global Forecast To 2030 By The Business Research CompanyThe global cyber insurance market reached a value of nearly $6,785.0 million in 2018, having increased at a compound annual growth rate (CAGR) of 37.2% since 2014. Growth in the historic period resulted from the growth in the number of cyber-attacks and increased spending on information security by organizations. Factors that negatively affected growth in the historic period were a lack of awareness of insurance coverage among the general public, low penetration of cyber insurance, and a lack of awareness of potential losses by organizations.

The Key drivers of the cyber insurance market include:-

Growth In Cyber Attacks — During the historic period, the increased number of cyber-attacks targeting financial data of corporates and individuals drove the cyber insurance market. According to Symantec’s Internet Security Threat Report 2019, the number of web attacks in 2018 increased by 56%. Among the cyber-attacks, enterprise ransomware infections, malicious software designed to deny access to the system until a ransom is paid, increased by 12% with the number of Dharma/Crysis infection attempts almost tripling from an average of 1473 attacks per month in 2017 to 4900 attacks per month in 2018.

Browse Complete Report @ https://www.thebusinessresearchcompany.com/report/cyber-insurance-market

Cyber Insurance Market Segmentation:-

By Type Of Insurance:

1. Standalone

2. Package

3. Personal

The standalone market was the largest segment of the cyber insurance market, accounting for 53.1% of the total in 2018. It was followed by package, and personal.

By Size Of Business:

1.Mid

2. Large

3. Small

The mid-sized business market was the largest segment of the cyber insurance market, accounting for 65.0% of the total in 2018. It was followed by large, and small. Going forward, small sized business is expected to be the fastest growing segment in the cyber insurance market.

By Type Of Claim

1. Ransomware

2. Hacker

3. Business Email Compromise

4. Malware/Virus

5. Phishing

6. Others

7. Third Party

8. Rogue Employee

9. Legal Action

10.Paper Records

11. Program ming Error

12. Staff Mistake

13. Lost/Stolen Laptop/Device

The ransomware market was the largest segment of the cyber insurance market, accounting for 32.7% of the total in 2018. It was followed by hacker, business email compromise, malware/virus, phishing, and others. Going forward, business email compromise segment is expected to be the fastest growing segment in the cyber insurance market.

By End-Use:

1. Professional Services

2. Media

3. Healthcare

4. Others

5. Government Bodies (Public)

6. Financial Services

7. Retail And Wholesale

8. Education

9. Manufacturing

10. IT Services

The professional services market was the largest segment of the cyber insurance market, accounting for 17.2% of the total in 2018. It was followed by media, healthcare, others, government bodies (public), financial services, and others. Going forward, education segment is expected to be the fastest growing segment in the cyber insurance market.

Request For A Sample Copy Of This Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=2623&type=smp

By Geography - The cyber insurance market is segmented into

1.North America

2.Western Europe

3.Asia Pacific

4.Eastern Europe

5.South America

6.Middle East

7.Africa

Some of the major key players involved in the cyber insurance market are

1. Chubb Limited

2. AXA Group

3. American International Group, Inc.

4. Beazley Insurance Co, Inc.

5. The Travelers Companies, Inc.

Place a DIRECT PURCHASE ORDER of the report @ https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2623

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on Blog: http://blog.tbrc.info/

About US:

The Business Research Company has published over 1000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets after WHO declared COVID-19 as a pandemic.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Covering Developing Trends, Major Highlights With Global Analysis and Forecast By 2030 here

News-ID: 2120505 • Views: …

More Releases from The Business research company

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the S …

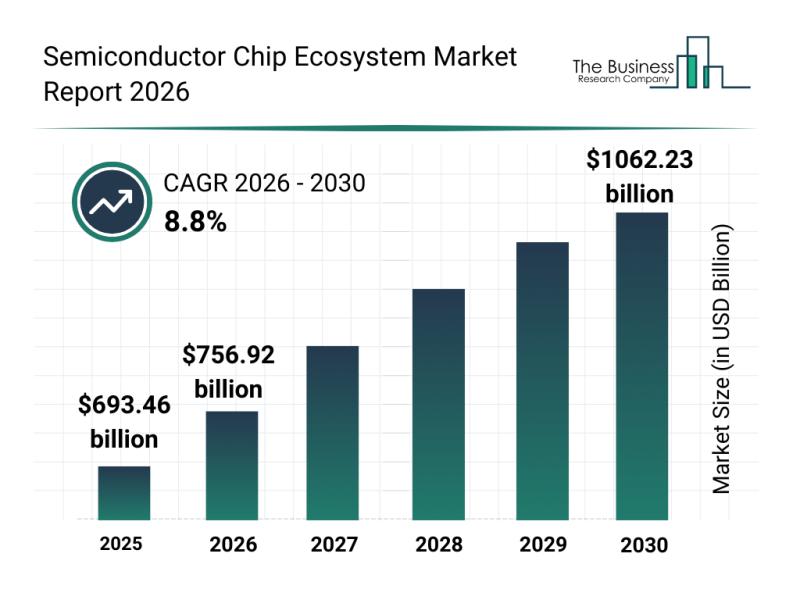

The semiconductor chip ecosystem is rapidly evolving and is set to experience substantial growth in the coming years. Driven by cutting-edge technologies and increasing demand across various sectors, this market is poised to reach impressive heights by 2030. Let's explore the current landscape, key players, emerging trends, and the segments that are steering this expansion.

Projected Growth and Market Size of the Semiconductor Chip Ecosystem

The semiconductor chip ecosystem market is…

Segment Overview and Major Growth Areas in the Self-Cleaning Nanocoating Display …

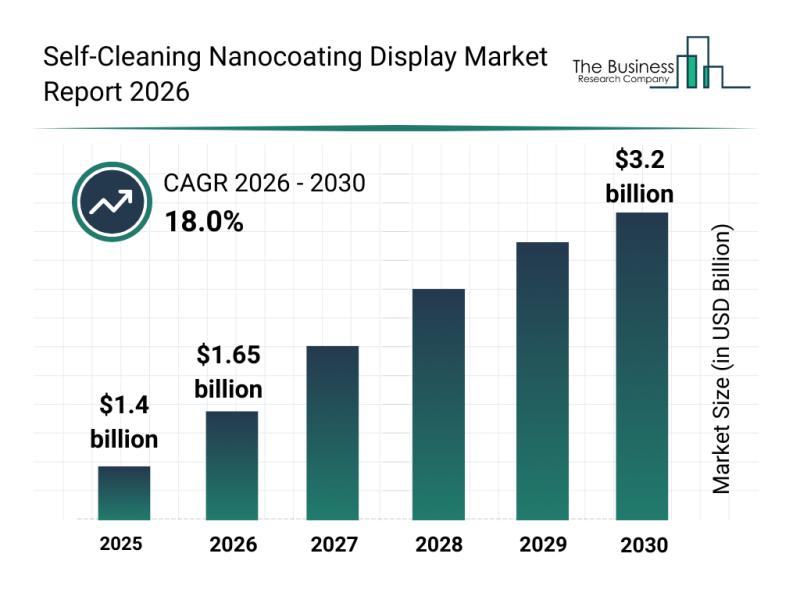

The self-cleaning nanocoating display market is poised for significant expansion, driven by technological breakthroughs and increasing practical applications across various sectors. As demand grows for smarter, more durable, and hygienic display surfaces, this industry is shaping up to be a key player in the future of advanced display technologies. Let's explore the market's size, key drivers, major companies, and leading segments.

Projected Growth and Market Size of the Self-Cleaning Nanocoating Display…

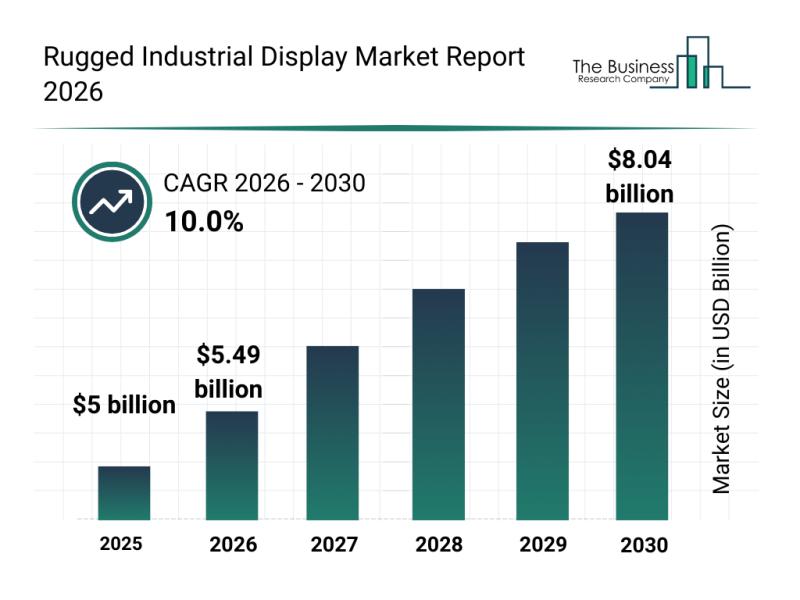

Segment Analysis and Major Growth Areas in the Rugged Industrial Display Market

The rugged industrial display market is poised for impressive expansion over the coming years, driven by technological advancements and increasing demands across various sectors. As industries increasingly rely on durable and reliable display solutions, this market is set to evolve rapidly, presenting numerous opportunities for innovation and growth. Let's explore the current market size, key players, emerging trends, and detailed segmentation to understand the future outlook of this sector.

Projected Market…

Global Trends Overview: The Rapid Evolution of the Robotics and Automation Actua …

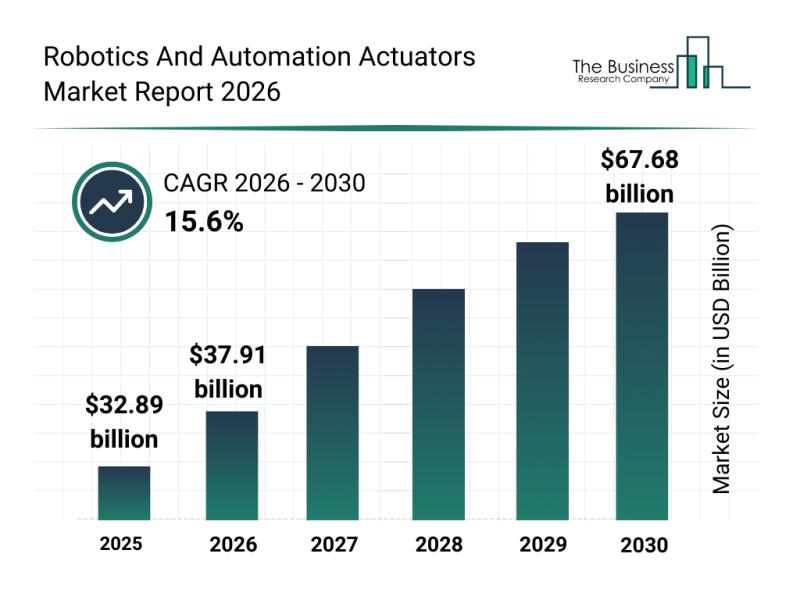

The robotics and automation actuators sector is on the brink of substantial expansion, driven by technological advancements and increasing adoption across multiple industries. As automation becomes more sophisticated, the demand for efficient and intelligent actuation systems is rising steadily, positioning this market for remarkable growth in the near future. Let's explore the current market size, leading players, emerging trends, and the segmentation landscape shaping this evolving industry.

Robotics And Automation Actuators…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…