Press release

Latest Report on Veterinary Imaging Market Report- Is Projected to Reach USD 2.2 Billion by 2025 | GE Healthcare, Carestream Health

The research reports on Veterinary Imaging Market report gives detailed overview of factors that affect global business scope. Veterinary Imaging Market report shows the latest market insights with upcoming trends and breakdowns of products and services. This report provides statistics on the market situation, size, regions and growth factors. Veterinary Imaging Market report contains emerging players analyze data including competitive situations, sales, revenue and market share of top manufacturers.Get FREE PDF Sample of the report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=421298

Top Company Profile Analysis in this Report

GE Healthcare (US), Agfa-Gevaert N.V. (Belgium), Carestream Health, Inc. (US), Esaote S.p.A (Italy), IDEXX Laboratories, Inc. (US), Mindray Medical International Limited (China), Canon Inc. (Japan), Heska Corporation (US), Siemens Healthineers (Germany), FUJIFILM Holdings Corporation (Japan), Konica Minolta (Japan), Samsung Electronics Co. Ltd. (South Korea), E.I. Medical Imaging (US), IMV imaging (UK), SEDECAL (Spain), Clarius Mobile Health (Canada), Shenzhen Ricso Technology Co., Ltd. (China), DRAMIŃSKI S.A. (Poland), EPICA Animal Health (US), and ClearVet Digital Radiography Systems (US).

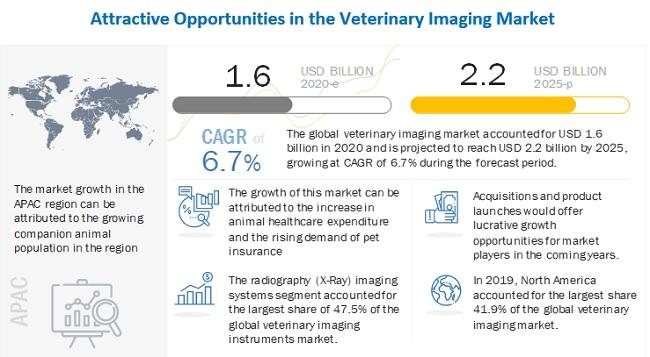

The global veterinary imaging market is projected to reach USD 2.2 billion by 2025 from USD 1.6 billion in 2020, at a CAGR of 6.7% during the forecast period. The growth in this market is majorly driven by the increase in animal healthcare spending and growing pet insurance purchase, the growing companion animals market, increase in the number of veterinary practitioners and their income levels in developed regions, and the launch of advanced products. However, lack of animal healthcare awareness, a severe shortage of skilled veterinarians, and the high cost of imaging instruments in emerging countries are factors expected to restrain the overall market growth, to a certain extent, during the forecast period.

The report analyses the veterinary imaging market and aims at estimating the market size and future growth potential of various market segments, based on products, animal type, therapeutic area, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

The veterinary imaging market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latina America, and the Middle East and Africa. In 2019, North America accounted for the largest share. The large share of North America can primarily be attributed increasing population of companion and livestock animals, rising meat and dairy product consumption, rising veterinary healthcare expenditure, and growth in pet insurance coverage.

Reasons to Buy the Report

Veterinary Imaging Market Report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

Market Penetration: Comprehensive information on the product portfolios of the top players in the veterinary imaging market. The report analyzes this market by product, animal type, therapeutic area, end user, and region

Market Development: Comprehensive information on the lucrative emerging markets, by products, animal type, therapeutic area, end user, and region

Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the veterinary imaging market

Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the veterinary imaging market

Single User License: US $ 4950

Get FLAT 20% Discount on this Report @ https://www.reportsnreports.com/purchase.aspx?name=421298

The break-down of primary participants is as mentioned below:

By Company Type - Tier 1: 32%, Tier 2: 32%, and Tier 3: 36%

By Designation - C-level: 35%, Director-level: 30%, and Others: 35%

By Region - North America: 17%, Europe: 17%, Asia Pacific: 33%, and Rest of the World: 33%

Table Of Contents in this Report-

1 Introduction

1.1 Objectives Of The Study

1.2 Market Definition And Scope

1.2.1 Inclusions & Exclusions

1.2.2 Markets Covered

Figure 1 Global Veterinary Imaging Market

1.2.3 Years Considered For The Study

1.3 Currency

Table 1 Exchange Rates Utilized For The Conversion To Usd

1.4 Limitations

1.5 Stakeholders

1.6 Summary Of Changes

2 Research Methodology

2.1 Research Approach

Figure 2 Research Design

2.1.1 Secondary Sources

Figure 3 Key Data From Secondary Sources

2.1.2 Primary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Key Industry Insights

Figure 6 Breakdown Of Primary Interviews: By Company Type, Designation, And Region

2.2 Market Sizing And Validation

Figure 7 Market Size Estimation: Revenue Share Analysis

Figure 8 Revenue Share Analysis Illustration

Figure 9 Supply-Side Analysis Of The Veterinary Imaging Market

Figure 10 Bottom-Up Approach

Figure 11 Top-Down Approach

2.3 Market Breakdown And Data Triangulation

Figure 12 Market Data Triangulation Methodology

2.4 Market Ranking Analysis

2.5 Assumptions For The Study

3 Executive Summary

Figure 13 Veterinary Imaging Market, By Product, 2020 Vs. 2025 (Usd Million)

Figure 14 Radiography (X-Ray) Imaging Systems Will Continue To Dominate The Veterinary Imaging Instruments Market During The Forecast Period

Figure 15 Veterinary Imaging Market, By Therapeutic Area, 2020 Vs. 2025 (Usd Million)

Figure 16 Veterinary Imaging Market, By Animal Type, 2020 Vs. 2025 (Usd Million)

Figure 17 Veterinary Imaging Market, By End User, 2020 Vs. 2025 (Usd Million)

Figure 18 Geographic Snapshot: Veterinary Imaging Market

4 Premium Insights

4.1 Veterinary Imaging Market Overview

Figure 19 Rising Demand For Pet Insurance And Growth In Animal Healthcare Expenditure Are Key Factors Driving Market Growth

4.2 Asia Pacific: Veterinary Imaging Market, By Product

Figure 20 Instruments Segment Commanded The Largest Share Of The Veterinary Imaging Market In 2019

4.3 Veterinary Imaging Market: Geographic Mix

Figure 21 Apac To Witness The Highest Growth In The Veterinary Imaging Market During The Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 22 Veterinary Imaging Market: Drivers, Restraints, Opportunities, And Challenges

5.2.1 Market Drivers

5.2.1.1 Growth In The Companion Animal Population

Table 2 Pet Population, By Animal, 2012–2018 (Million)

5.2.1.2 Rising Demand For Pet Insurance And Growing Animal Health Expenditure

Figure 23 Us: Pet Industry Expenditure, 2010–2018

5.2.1.3 Growing Number Of Veterinary Practitioners & Their Rising Income Levels In Developed Economies

Table 3 Number Of Veterinarians And Para-Veterinarians In Developed Countries, 2012 To 2018

5.2.1.4 Rising Demand For Animal-Derived Food Products

Table 4 Past And Projected Trends In The Consumption Of Meat And Milk In Developed And Developing Regions

5.2.1.5 Growing Prevalence Of Animal Diseases

Table 5 Market Drivers: Impact Analysis

5.2.2 Market Restraints

5.2.2.1 High Cost Of Veterinary Imaging Instruments

5.2.2.2 Rising Pet Care Costs

Table 6 Market Restraints: Impact Analysis

5.2.3 Market Opportunities

5.2.3.1 Untapped Emerging Markets

Table 7 Market Opportunities: Impact Analysis

5.2.4 Market Challenges

5.2.4.1 Lack Of Animal Healthcare Awareness In Emerging Countries

5.2.4.2 Shortage Of Veterinary Practitioners In Developing Markets

Table 8 Number Of Veterinary Professionals, By Country, 2005 Vs. 2018

Table 9 Market Challenges: Impact Analysis

5.3 Pricing Analysis

Table 10 Regional Pricing Analysis Of Key Diagnostic Imaging Modalities, 2019 (Usd Thousand/Million)

5.4 Value Chain Analysis

Figure 24 Veterinary Imaging Market: Value Chain Analysis

6 Industry Insights

6.1 Introduction

6.2 Industry Trends

6.2.1 Portable, Battery-Powered Imaging Instruments For Point-Of-Care Services

6.2.2 Growing Consolidation In The Veterinary Imaging Market

Table 11 Major Mergers And Acquisitions In The Veterinary Imaging Market

6.2.3 Growing Size Of Veterinary Businesses

6.3 Porter’s Five Forces Analysis

Figure 25 Porter’s Five Forces Analysis

6.3.1 Threat Of New Entrants

6.3.2 Threat Of Substitutes

6.3.3 Bargaining Power Of Suppliers

6.3.4 Bargaining Power Of Buyers

6.3.5 Intensity Of Rivalry

6.4 Strategic Benchmarking

Table 12 Product Portfolio Analysis: Veterinary Imaging Market

7 Veterinary Imaging Market, By Product

7.1 Introduction

Table 13 Global Veterinary Imaging Market, By Product, 2018–2025 (Usd Million)

7.2 Veterinary Imaging Instruments

Figure 26 Radiography (X-Ray) Imaging Systems Dominated The Veterinary Imaging Instruments Market In 2020

Table 14 Global Veterinary Imaging Instruments Market, By Type, 2018–2025 (Usd Million)

Table 15 Global Veterinary Imaging Instruments Market, By Country, 2018–2025 (Usd Million)

7.2.1 Radiography (X-Ray) Imaging Systems

Figure 27 Dr And Cr Systems: Advantages, Disadvantages, Similarities, And Differences

Table 16 Leading Radiography (X-Ray) Imaging Systems Available In The Market (2020)

Table 17 Global Radiography (X-Ray) Imaging Systems Market, By Type, 2018–2025 (Usd Million)

Table 18 Global Radiography (X-Ray) Imaging Systems Market, By Country, 2018–2025 (Usd Million)

Table 19 Global Radiography (X-Ray) Imaging Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.1.1 Computed Radiography Systems

7.2.1.1.1 Computed Radiography Systems Accounted For The Largest Share Of The Veterinary X-Ray Segment In 2019

Table 20 Leading Computed Radiography Systems Available In The Market (2020)

Table 21 Global Computed Radiography Systems Market, By Country, 2018–2025 (Usd Million)

Table 22 Global Computed Radiography Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.1.2 Direct Radiography Systems

7.2.1.2.1 Direct Radiography Systems Are Expected To Be The Fastest-Growing Technology Segment During The Forecast Period

Table 23 Leading Direct Radiography Systems Available In The Market (2020)

Table 24 Global Direct Radiography Systems Market, By Country, 2018–2025 (Usd Million)

Table 25 Global Direct Radiography Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.1.3 Film-Based Radiography Systems

7.2.1.3.1 The Demand For Film-Based Radiography Systems Is High In Emerging Markets Owing To Their Overall Cost-Effectiveness

Table 26 Leading Manufacturers In The Film-Based Radiography Market (2020)

Table 27 Global Film-Based Radiography Systems Market, By Country, 2018–2025 (Usd Million)

Table 28 Global Film-Based Radiography Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.2 Ultrasound Imaging Systems

Table 29 Global Ultrasound Imaging Systems Market, By Type, 2018–2025 (Usd Million)

Table 30 Global Ultrasound Imaging Systems Market, By Country, 2018–2025 (Usd Million)

Table 31 Global Ultrasound Imaging Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.2.1 2d Ultrasound Imaging Systems

7.2.2.1.1 The 2d Ultrasound Segment Accounted For The Largest Share Of The Veterinary Ultrasound Market

Table 32 Leading Manufacturers In The 2d Ultrasound Scanners Market (2020)

Table 33 Global 2d Ultrasound Imaging Systems Market, By Country, 2018–2025 (Usd Million)

Table 34 Global 2d Ultrasound Imaging Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.2.2 Doppler And 3d/4d Ultrasound Imaging Systems

7.2.2.2.1 Color Doppler Is Widely Used In Veterinary Sonography Evaluations—A Key Factor Driving Market Growth

Table 35 Leading Manufacturers In The Doppler Ultrasound Imaging Systems Market (2020)

Table 36 Leading Manufacturers In The 3d/4d Ultrasound Imaging Systems Market (2020)

Table 37 Global Doppler And 3d/4d Ultrasound Imaging Systems Market, By Country, 2018–2025 (Usd Million)

Table 38 Global Doppler And 3d/4d Ultrasound Imaging Systems Market, By Region, 2018–2025 (Thousand Units)

7.2.3 Computed Tomography Imaging Systems

Table 39 Leading Manufacturers In The Computed Tomography Imaging Systems Market (2020)

Table 40 Global Computed Tomography Imaging Systems Market, By Type, 2018–2025 (Usd Million)

Table 41 Global Computed Tomography Imaging Systems Market, By Country, 2018–2025 (Usd Million)

7.2.3.1 Multi-Slice Computed Tomography Systems

7.2.3.1.1 Multi-Slice Ct Systems Segment Accounted For The Largest Share Of The Veterinary Ct Systems Market In 2019

Table 42 Leading Manufacturers In The Multi-Slice Computed Tomography Imaging Systems Market (2020)

Table 43 Global Multi-Slice Computed Tomography Imaging Systems Market, By Country, 2018–2025 (Usd Million)

7.2.3.2 Portable Computed Tomography Systems

7.2.3.2.1 Increasing Adoption Of Portable Ct Systems For Mobile Or Ambulatory Veterinary Diagnosis Is A Key Driver For Market Growth

Table 44 Leading Manufacturers In The Por Table Computed Tomography Imaging Systems Market (2020)

Table 45 Global Portable Computed Tomography Imaging Systems Market, By Country, 2018–2025 (Usd Million)

7.2.4 Video Endoscopy Imaging Systems

7.2.4.1 Recent Technological Advancements In Video Endoscope Imaging To Drive The Growth Of This Segment

Table 46 Leading Manufacturers In The Video Endoscopy Imaging Market (2020)

Table 47 Global Video Endoscopy Imaging Systems Market, By Country, 2018–2025 (Usd Million)

7.2.5 Magnetic Resonance Imaging Systems

7.2.5.1 Lack Of Radiation Exposure And The Rising Demand For Mobile Imaging Are Factors Boosting The Adoption Of Mri Systems

Table 48 Leading Manufacturers In The Magnetic Resonance Imaging Systems Market (2020)

Table 49 Global Magnetic Resonance Imaging Systems Market, By Country, 2018–2025 (Usd Million)

7.2.6 Other Imaging Systems

Table 50 Leading Manufacturers In The Other Imaging Systems Market (2020)

Table 51 Global Other Imaging Systems Market, By Country, 2018–2025 (Usd Million)

7.3 Veterinary Imaging Reagents

Table 52 Global Veterinary Imaging Reagents Market, By Type, 2018–2025 (Usd Million)

Table 53 Global Veterinary Imaging Reagents Market, By Country, 2018–2025 (Usd Million)

7.3.1 X-Ray And Ct Contrast Reagents

7.3.1.1 Growing Need For Neurology Applications Boosting The Demand For X-Ray And Ct Contrast Reagents

Table 54 Global X-Ray And Ct Contrast Reagents Market, By Country, 2018–2025 (Usd Million)

7.3.2 Mri Contrast Reagents

7.3.2.1 Mri Contrast Reagents Enhance The Visibility Of Internal Structures Of A Body During Mri Scans

Table 55 Global Mri Contrast Reagents Market, By Country, 2018–2025 (Usd Million)

7.3.3 Ultrasound Contrast Reagents

7.3.3.1 Ultrasound Contrast Reagents Are Majorly Used To Enhance The Therapeutic Applications Of Ultrasound In Cardiology

Table 56 Global Ultrasound Contrast Reagents Market, By Country, 2018–2025 (Usd Million)

7.4 Veterinary Imaging Software

7.4.1 Improved Productivity And Streamlined Workflows To Drive The Adoption Of Veterinary Software

Table 57 Leading Manufacturers In The Veterinary Imaging Software Market (2020)

Table 58 Global Veterinary Imaging Software Market, By Country, 2018–2025 (Usd Million)

8 Veterinary Imaging Market, By Therapeutic Area

8.1 Introduction

Table 59 Global Veterinary Imaging Market, By Therapeutic Area, 2018–2025 (Usd Million)

8.2 Orthopedics And Traumatology

8.2.1 Increasing Prevalence Of Arthritis, Lameness Diseases, And Joint Disorders In Livestock And Companion Animals To Drive The Adoption Of Technologically Advanced Imaging Modalities

Table 60 Imaging Modalities Available For Veterinary Orthopedics And Traumatology

Table 61 Global Veterinary Imaging Market For Orthopedics And Traumatology, By Country, 2018–2025 (Usd Million)

8.3 Obstetrics & Gynecology

8.3.1 Ultrasound Is Majorly Used For Obstetrics And Gynecological Examinations In Animals

Table 62 Global Veterinary Imaging Market For Obstetrics & Gynecology, By Country, 2018–2025 (Usd Million)

8.4 Oncology

8.4.1 Increasing Prevalence Of Cancer In Companion Animals To Support The Growth Of This Segment

Table 63 Global Veterinary Imaging Market For Oncology, By Country, 2018–2025 (Usd Million)

8.5 Cardiology

8.5.1 Growth In The Aging Pet Population Has Driven The Prevalence Of Cardiovascular Diseases In Animals

Table 64 Global Veterinary Imaging Market For Cardiology, By Country, 2018–2025 (Usd Million)

8.6 Neurology

8.6.1 Increasing Incidence Of Brain Disorders Coupled With Growing Awareness About Companion Animal Health To Drive Market Growth

Table 65 Global Veterinary Imaging Market For Neurology, By Country, 2018–2025 (Usd Million)

8.7 Dentistry

8.7.1 Increasing Prevalence Of Dental Diseases In Animals To Drive The Adoption Of Radiography Systems

Figure 28 Growth In Incidence Of Dental Diseases In The Us, 2005 To 2015

Table 66 Key Veterinary Dental X-Ray Products Available In The Market

Table 67 Global Veterinary Imaging Market For Dentistry, By Country, 2018–2025 (Usd Million)

8.8 Other Therapeutic Areas

Table 68 Global Veterinary Imaging Market For Other Therapeutic Areas, By Country, 2018–2025 (Usd Million)

9 Veterinary Imaging Market, By Animal Type

9.1 Introduction

Table 69 Global Veterinary Imaging Market, By Animal Type, 2018–2025 (Usd Million)

9.2 Small Companion Animals

9.2.1 Rising Population Of Small Companion Animals And Increasing Pet Care Expenditure To Drive Market Growth

Table 70 Population Of Small Companion Animals, By Country, 2012–2018 (Million)

Table 71 Global Veterinary Imaging Market For Small Companion Animals, By Country, 2018–2025 (Usd Million)

9.3 Large Animals

9.3.1 Growing Demand For Accurate Imaging And Diagnosis Of Diseases In Large Animals To Support Market Growth

Table 72 Us: Large Animal Population, 2010-2018 (Million)

Table 73 Global Veterinary Imaging Market For Large Animals, By Country, 2018–2025 (Usd Million)

9.4 Other Animals

Table 74 Global Veterinary Imaging Market For Other Animals, By Country, 2018–2025 (Usd Million)

10 Veterinary Imaging Market, By End User

10.1 Introduction

Figure 29 Veterinary Clinics And Diagnostic Centers To Dominate The Veterinary Imaging Market During The Forecast Period

Table 75 Global Veterinary Imaging Market, By End User, 2018–2025 (Usd Million)

10.2 Veterinary Clinics And Diagnostic Centers

10.2.1 Veterinary Clinics & Diagnostic Centers Were The Largest End Users Of Veterinary Monitoring Equipment In 2019

Table 76 Global Number Of Veterinary Private Clinical Practices (2010 To 2018)

Table 77 Global Veterinary Imaging Market For Veterinary Clinics And Diagnostic Centers, By Country, 2018–2025 (Usd Million)

10.3 Veterinary Hospitals And Academic Institutions

10.3.1 Increase In Pet Care Expenditure Is Expected To Stimulate The Growth Of This Segment

Table 78 Global Veterinary Imaging Market For Veterinary Hospitals And Academic Institutions, By Country, 2018–2025 (Usd Million)

and more..

Corporate Headquarters

Tower B5, office 101,

Magarpatta SEZ,

Hadapsar, Pune-411013, India

+ 1 888 391 5441

sales@reportsandreports.com

ReportsnReports.com is your single source for all market research needs. Our database includes 500,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latest Report on Veterinary Imaging Market Report- Is Projected to Reach USD 2.2 Billion by 2025 | GE Healthcare, Carestream Health here

News-ID: 2110971 • Views: …

More Releases from ReportsnReports

DeviceCon Series 2024 - UK Edition | MarketsandMarkets

Future Forward: Redefining Healthcare with Cutting-Edge Devices

Welcome to DeviceCon Series 2024 - Where Innovation Meets Impact!

Join us on March 21-22 at Millennium Gloucester Hotel, 4-18 Harrington Gardens, London SW7 4LH for a groundbreaking convergence of knowledge, ideas, and technology. MarketsandMarkets proudly presents the DeviceCon Series, an extraordinary blend of four conferences that promise to redefine the landscape of innovation in medical and diagnostic devices.

Register Now @ https://events.marketsandmarkets.com/devicecon-series-uk-edition-2024/register

MarketsandMarkets presents…

5th Annual MarketsandMarkets Infectious Disease and Molecular Diagnostics Confer …

London, March 7, 2024 - MarketsandMarkets is thrilled to announce the eagerly awaited 5th Annual Infectious Disease and Molecular Diagnostics Conference, scheduled to take place on March 21st - 22nd, 2024, at the prestigious Millennium Gloucester Hotel, located at 4-18 Harrington Gardens, London SW7 4LH.

This conference promises to be a groundbreaking event, showcasing the latest trends and insights in diagnosis, as well as unveiling cutting-edge technologies that are revolutionizing the…

Infection Control, Sterilization & Decontamination Conference |21st - 22nd March …

MarketsandMarkets is pleased to announce its 8th Annual Infection Control, Sterilisation, and Decontamination in Healthcare Conference, which will take place March 21-22, 2024, in London, UK. With the increased risk of infection due to improper sterilisation and decontamination practices, the safety of patients and healthcare workers is of paramount importance nowadays.

Enquire Now @ https://events.marketsandmarkets.com/infection-control-sterilization-and-decontamination-conference/

This conference aims to bring together all the stakeholders to discuss the obstacles in achieving…

Breast Augmentation Market Key Players, Demands, Cost, Size, Procedure, Shape, S …

The global Breast Augmentation Market in terms of revenue was estimated to be worth $900 million in 2020 and is poised to reach $1,692 million by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying…

More Releases for Imaging

Mobile Gamma Cameras Market 2018 -- 2028 | By Indication Type (Cardiac Imaging, …

Mobile gamma camera is a portable version of the stationary gamma or angler camera used for nuclear imaging. Nuclear imaging involves injecting a radio nucleotide in the body or organ under study and record the resulting redioactivity by scanning with a gamma camera. Nuclear imaging is performed owing to its better resolution and selectivity than non-nuclear imaging such as MRI and ultrasound.

The mobile gamma camera types include single, dual and…

Holographic Imaging Market Latest Technological Innovations on Holoxica, Zebra I …

Market Study Report Adds Global Holographic Imaging Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Emergence of 3D holographic imaging has revolutionized the medical imaging and surgery. The technology converts the given two dimensional MRI and CT scan imaging data into interactive virtual reality images. Using these images doctors…

Holographic Imaging Market : Eminent Players – EON Reality, Holoxica, Zebra Im …

Holographic Imaging Market size is set to exceed USD 3 billion by 2024; according to a new research study published by Global Market Insights, Inc.

Increasing adoption of holographic imaging in medical education should drive the holographic imaging market size over the forecast years. Medical practitioners and students are widely using holographic techniques to effectively study the human body, since the technology provides surgeons with a detailed view of patient…

Holographic Imaging Market Eminent Players – EON Reality, Holoxica, Zebra Imag …

Holographic Imaging Market size is set to exceed USD 3 billion by 2024; according to a new research study published by Global Market Insights, Inc.

Increasing adoption of holographic imaging in medical education should drive the holographic imaging market size over the forecast years. Medical practitioners and students are widely using holographic techniques to effectively study the human body, since the technology provides surgeons with a detailed view of patient anatomy…

Holographic Imaging Market Projections Reviewed On Holoxica, Zebra Imaging, Oviz …

The newly released research at Market Study Report titled “2017-2024 Global Holographic Imaging Consumption Market Report” provides data, information, brief analysis, company profiles, statistics for past years and forecasts for next few years.

Holographic Imaging Market size is set to exceed USD 3 billion by 2024. U.S. holographic imaging market accounted for significant industry share with expectations to witness healthy growth over coming years. Increasing biomedical research initiatives in holographic image…

Digital Imaging Market,Digital Imaging Industry, Global Digital Imaging Market,D …

Latest industry research report on: Global Digital Imaging Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

This report presents the worldwide Digital Imaging market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry…