Press release

MSME Financing Market Next Big Thing | Major Giants- Federal Bank, Bajaj Finserv, HDFC Bank, ICICI

MSME Financing Market in India 2020 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the MSME Financing Market. Some of the key players profiled in the study are Axis Bank of India, Bajaj Finserv Limited, Central Bank of India, Federal Bank Limited, HDFC Bank Limited, ICICI Limited, Kotak Mahindra Bank Limited, State Bank of India, Union Bank of India, Utkarsh Micro Finance Bank.You can get free access to samples from the report here: https://www.htfmarketreport.com/sample-report/2702876-msme-financing-market

Micro, small and medium enterprises (MSMEs) play a pivotal role in the Indian economy. About 63.38 Mn enterprises operational in various industries have provided employment to more than 111 Mn people. The MSME sector accounts for 30% of the country’s GDP, which is likely to touch 50% in 2025. The industry's financing needs depend on the nature, size, customer segments and stage of development of the different businesses. Financial institutions have limited their lending exposure to the Indian MSME industry due to the high cost of service, small ticket size of loans and limited ability of MSMEs to offer immovable collaterals.

As of 2019, the overall addressable demand for external credit was ~INR 41.64 Tn, while the total supply of fund stood at INR 13.54 Tn.

Therefore, the credit gap in the MSME industry accounted for ~INR 28.10 Tn in 2019.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/2702876-msme-financing-market

Debt demand of the MSME sector in India:

The consolidated debt demand (both short-term and long-term finance) by Indian MSMEs accounted for ~99.39 Tn in 2019. Microenterprise debt demand accounted for INR 13.32 Tn, small enterprise accounted for INR 24.57 Tn, and medium enterprise accounted for INR 3.75 Tn of the total debt demand in the industry. Medium and small firms being more formalized in operations are better at securing collaterals with NBFCs and banks than micro-enterprises.

Credit supply to the MSME sector in India:

The overall credit supply, including both the formal and the informal sectors, is worth INR 86.08 Tn. The formal and the informal sectors contribute ~INR 13.54 Tn and INR 72.54 Tn, respectively to the overall credit supply. Banking and other financial institutions account for ~INR 11.68 Tn of the overall formal finance supply to the Indian MSME industry.

Credit gap in the MSME sector in India:

The overall credit gap is estimated to be ~INR 28.10 Tn, which can be attributed to underserved micro and small units. Further, lack of awareness among entrepreneurs about the various loan products and lack of proper documentation have considerably reduced the supply of debt.

Impact of COVID-19:

Small businesses are the most vulnerable to an unexpected crisis like COVID-19 because of their size, scale of business operation and limited financial management resources. However, the government has announced several policy measures to minimize the losses.

The announcement of a targeted long-term repo operation (TLTRO) of INR 500 Bn, a grant of INR 3 Tn collateral-free automatic loans, INR 200 Bn subordinated debt to stressed MSMEs, and a complete ban on global tenders for procurement of goods and services for up to INR 2 Bn are a few of the crucial policy mandates.

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=2702876

Key Answers Captured in Study are

Which geography would have better demand for product/services?

What strategies of big players help them acquire share in regional market?

Countries that may see the steep rise in CAGR & year-on-year (Y-O-Y) growth?

How feasible is market for long term investment?

What opportunity the country would offer for existing and new players in the MSME Financing market?

Risk side analysis involved with suppliers in specific geography?

What influencing factors driving the demand of MSME Financing near future?

What is the impact analysis of various factors in the MSME Financing market growth?

What are the recent trends in the regional market and how successful they are?

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/2702876-msme-financing-market

Some extract from Table of Contents

• Overview of MSME Financing Market

• MSME Financing Size (Sales Volume) Comparison by Type (2019-2025)

• MSME Financing Size (Consumption) and Market Share Comparison by Application (2019-2025)

• MSME Financing Size (Value) Comparison by Region (2019-2025)

• MSME Financing Sales, Revenue and Growth Rate (2019-2025)

• MSME Financing Competitive Situation and Trends

• Players/Suppliers High Performance Pigments Manufacturing Base Distribution, Sales Area, Product Type

• Analyze competitors, including all important parameters of MSME Financing

• MSME Financing Manufacturing Cost Analysis

• Marketing Strategy Analysis, Research Conclusions

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia or Oceania [Australia and New Zealand].

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release MSME Financing Market Next Big Thing | Major Giants- Federal Bank, Bajaj Finserv, HDFC Bank, ICICI here

News-ID: 2107921 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Precision Medicine Certification Market Hits New High | Major Giants Harvard Med …

The latest study released on the Global Precision Medicine Certification Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Precision Medicine Certification study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

Satellite-powered Classrooms Market May See a Big Move | Major Giants OneWeb, Hu …

The latest study released on the Global Satellite-powered Classrooms Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Satellite-powered Classrooms study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

Floating Schools Innovation Market to Expand Rapidly Over Next Decade| Shidhulai …

The latest study released on the Global Floating Schools Innovation Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Floating Schools Innovation study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

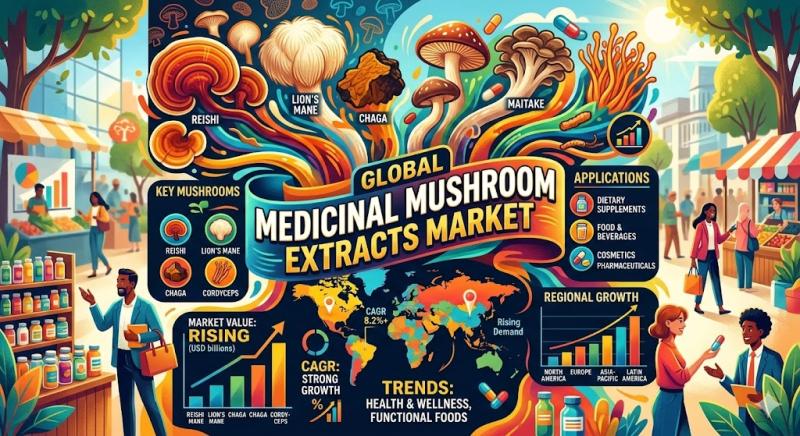

Medicinal Mushroom Extracts Market to Expand Rapidly Over Next Decade| Swanson, …

The latest study released on the Global Medicinal Mushroom Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Medicinal Mushroom study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

More Releases for MSME

Budget 2025-26: Boosting MSME Growth

New Delhi: The Union Budget 2025-2026, which was delivered by Finance Minister Nirmala Sitharaman, places a heavy emphasis on supporting the Micro, Small, and Medium Enterprise (MSME) sector. The budget acknowledges its vital role in creating jobs and promoting economic growth. It presents several initiatives to facilitate MSME registration, improve finance availability, and encourage technological use and innovation.

https://www.corpseed.com/service/msme-registration

Key Highlights:

Revised MSME Definition: The government has raised the investment and turnover thresholds…

Dr. Vikram Chauhan Honored at Emerging Punjab MSME Conclave

November 14, 2024 - Punjab, India - Globally Renowned MD-Ayurveda Expert and Entrepreneur, Dr. Vikram Chauhan, was honored today at the Emerging Punjab MSME Conclave, organized by Zee Punjab, Haryana, Himachal. The event recognized Dr. Vikram Chauhan for his exemplary contributions to the state's development through his pioneering work in Ayurveda, significantly contributing to Punjab's economic growth and elevating it on the global stage.

The award was presented by Shri Tarunpreet…

What is msme loan? Who is eligible for a msme loan, as well?

Miniature, Little, and Medium Undertakings (MSMEs) assume a critical part in driving monetary development and business age around the world. Be that as it may, these undertakings frequently face moves in getting to satisfactory funding to help their development and extension drives. To address this need, monetary foundations offer particular advance items known as MSME loans.

What is a MSME Loan?

A MSME loan is a monetary item explicitly intended to meet…

Johari Digital Healthcare Ltd. Clinches Prestigious "Pharmaceutical & Healthcare …

Johari Digital Healthcare Limited, a leading medical device manufacturing company, has been conferred with the esteemed "Pharmaceutical & Healthcare MSME of the Year" award at the ET MSME Awards 2023. The award ceremony, held in New Delhi, recognized outstanding Micro, Small, and Medium Enterprises (MSMEs) for their exceptional contributions to the economy, marked by significant achievements in business growth, market performance, job creation, and impactful socio-economic initiatives.

The Grand Finale and…

MSME Financing Market in India 2023

HTF Market Intelligence released a new research report of 82 pages on title 'MSME Financing Market in India 2023' with detailed analysis, forecast and strategies. The market Study is segmented by key a region that is accelerating the marketization. The study is a perfect mix of qualitative and quantitative Market data collected and validated majorly through primary data and secondary sources. This section also provides the scope of different segments…

Digitisation to Encourage Online Applications for MSME Loan

According to recent studies, digital lending to MSMEs will witness a 15x growth by 2023, attributed by digitization and influx of last-mile lenders such as digital lending companies and NBFCs. The MSME sector in India is highly underserviced and doesn't have access to formal credit. Over 60% of the MSME sector resort to some sort of informal credit on unfavourable terms and very high interest rates. The advent of fintech…