Press release

Fraud Charges Being Pursued Against Private Money Authority, Inc. Founder and Managers

FOR IMMEDIATE RELEASE, July 29, 2020 - Denver, CO - Fin Sol Group is issuing the following statement today:The Founder of Private Money Authority (PMA), and its Founder Nate Marshall, is now under investigation by the police for his alleged role in a fraud scheme. The charges being pursued include investment fraud, theft, and SEC violations. According to Westminster Police department Nate Marshall was charged with a rental scam in 2011 which is a disclosure he would have had to make by law. Fin Sol Group (FSG)’s CEO Wayne Weisenfluh attests, “No such disclosure was ever made to us.”

In September 2019, FSG bought membership positions into PMA’s fund. On the website https://www.privatemoneyholdings.com/ PMA describes itself as a, “premier investment firm” adding, “Due to our singular focus on the apartment sector and our innovative team approach…At Private Money Authority, Inc. we strive to engage in the investment business with honesty and integrity.”

According to the website https://www.privatemoneyauthority.us/ Private Money Authority, Inc. subsidiaries include: Private Money Holdings LLC, The Private Money Real Estate Opportunity Fund LLC, The Private Money Hemp Opportunity Fund LLC, The Private Money Energy Opportunity Fund LLC, The Private Money Precious Metals Opportunity Fund LLC, and My Private Money Lender

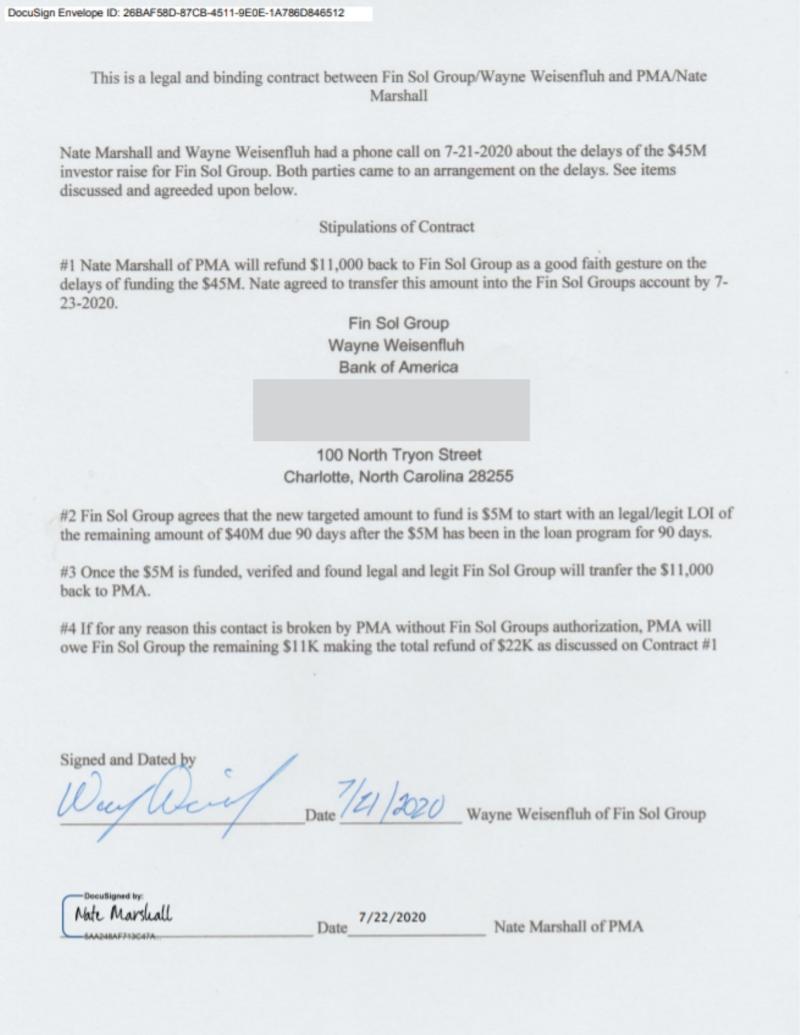

Fin Sol Group (FSG) CEO, Wayne Weisenfluh, confirms, “PMA Founder Nate Marshall and his partners Sean Doolittle and Kevin Knapp breached the terms of multiple contracts signed by Nate Marshall on behalf of PMA with FSG.” On June 6, 2020 the parties signed an amended agreement that stated:

“PMA and Nate Marshall agree to fund Fin Sol Group $45,000,000… The funding deadline submitted by Nate Marshall is July 1, 2020…If for any reason FSG does not agree to or sign off on any of the delays Nate Marshall and PMA must make deposit arrangements of $22,000 on July 1, 2020.” No funding or refund was made, and a second contract was signed amending the terms. It states, “Nate Marshall of PMA will refund $11,000 back to Fin Sol Group as a good faith gesture, on the delays of funding the $45M. Nate agrees to transfer this amount into the Fin Sol Group’s account by 7–23–2020.” These terms were also breached by a failure to pay.

Fin Sol Group COO, Philippa Burgess, confirms, “After making a formal request for our money back in early June 2020, we were met with an initial response that stated funds could only be reimbursed once the fund was funded. Signed agreements confirming a refund are being disregarded by PMA and its managers, and we continue to have to deal with lies, misdirection and shenanigans.”

Related materials: https://drive.google.com/drive/folders/1EmIstNAxjTsmrWL0z2ACx1Egjmf39OzM?usp=sharing

Fin Sol Group

2901 Walnut St.

Denver, CO 80205

Philippa Burgess

philippa@finsolgroup.com

(808) 780-0087

Fin Sol Group is a financial service company located in Denver, CO.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Charges Being Pursued Against Private Money Authority, Inc. Founder and Managers here

News-ID: 2099241 • Views: …

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…