Press release

Investment Banking Market Expected to Witness a Sustainable Growth over 2020-2024 With Major Key Players| Barclays, JP Morgan, Deutsche Bank, Credit Suisse

The research study covers the current scenario and growth prospects of the Investment Banking market (2020-2024) according to the analysis . This study includes a extensive analysis of the key segments of the industry and also the regional analysis that are taken place throughout the country.Global Investment Banking Market Overview:

The report also reveals in-depth details of shifting market dynamics, pricing structures, trends, restraints, limitations, demand-supply variations, growth-boosting factors, and market variations that have been considered the most important factors in the Investment Banking market.

Global “Investment Banking” Market trends analysis report 2020 provides an in-depth analysis of the key player's strategies, market growth, product demand, growth factors, regional outlook, global dynamics which includes drivers, challenges, and opportunities dominant in the industry. The report aims to provide in-depth information on the industry with market overview, key trends, business plans for Investment Banking market forecast period.

The Investment Banking market size involves the current market status with some changing trends that can affect the Investment Banking market growth rate. The report covers the major Investment Banking growth prospect over the coming years. It also comprehends market new product analysis, financial overview, strategies and marketing trends. The report also offers an overview of Investment Banking market revenue, sales, product demand, and supply of data, cost, and growth analysis across the globe.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/270357 .

Market Key Players

The Investment Banking market is highly competitive owing to the presence of several large and small vendors. According to the Investment Banking market analysis research report, the level of competition among the players in this market space is intense and the vendors mainly complete based on factors such as price, user-friendly interface, value-added benefits, and service benefits. To attain a competitive advantage over the other players in the Investment Banking service market, the vendors have the need to develop new ideas and technologies and they should also integrate new technologies in their product portfolio.

Barclays

JP Morgan

Goldman Sachs

Bank Of America Merrill Lynch…more

Segmentations

The Investment Banking market has been sub-grouped into type and application. The report studies these subsets with respect to the geographical segmentation. The strategists can gain a detailed insight and devise appropriate strategies to target specific market. This detail will lead to a focused approach leading to identification of better opportunities.

Product Type Segmentation

Mergers And Acquisitions Advisory

Debt Capital Markets Underwriting

Equity Capital Markets Underwriting

Financial Sponsor/ Syndicated Loans

Industry Segmentation

Bank

Investment Banking Companies

Securities Company

Regional Segmentation

North America (U.S. and Canada)

Latin America (Mexico, Brazil, Peru, Chile, and others)

Western Europe (Germany, U.K., France, Spain, Italy, Nordic countries, Belgium, Netherlands, and Luxembourg)

Eastern Europe (Poland and Russia)

Asia Pacific (China, India, Japan, ASEAN, Australia, and New Zealand)

Middle East and Africa (GCC, Southern Africa, and North Africa)

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Investment Banking Report 2020” @ https://www.businessindustryreports.com/buy-now/270357/single .

Global Industry News:

Barclays : Giggling Squid secures £5m funding from Barclays through the Coronavirus Business Interruption Loan Scheme (CBILS) to help through current crisis

17 June 2020 The country’s leading Thai restaurant group has completed a £5 million loan by accessing the CBIL scheme through Barclays.

With 35 sites across the Midlands and Southern England, Giggling Squid had been performing extremely well going into the crisis, despite the well-publicised headwinds effecting the casual dining sector.

The Barclays loan will cover liquidity needs and ensure the ongoing viability of the business through the pandemic, safeguarding almost 1,000 jobs. As the UK transitions out of lockdown, the funding will enable the business to kick start its operations and ensure it is well placed to avail itself of the opportunity that the new normal will present.

Andrew Laurillard, CEO and Co-founder of Giggling Squid, said: “When the Government mandated Lockdown, we saw our revenues fall from a positive like for like level to zero over 9 days at the end of March 2020. The business urgently needed liquidity to survive the crisis. Barclays could not have been more helpful in supporting us through this awful situation.

“We expect to survive and thrive once the restrictions lift and this is entirely due to the extraordinary assistance of the account team and the bank as a whole, in helping us access the Government aid to the fullest extent.”

Mike Saul, Head of Hospitality & Leisure at Barclays, commented: “Barclays is absolutely committed to supporting all businesses through these uncertain times and we understand the challenges they face. We are working closely with clients like Giggling Squid to provide the vital funding they need to help them come out strongly the other side and we look forward to seeing their restaurants open and operating again.”

Key Points Covered :

The report Investment Banking market provides highlighting new business opportunities and supporting strategic and calculated decision-making. This report recognizes that in this rapidly-evolving and competitive environment, up-to-date marketing information is essential to monitor performance and make critical decisions for growth and profitability. It provides information on trends and developments and focuses on markets capacities and on the changing structure of the Investment Banking. The report highlights powerful factors augmenting the demand in the global Investment Banking market and even those hampering the market on a worldwide scale. The report provides key statistics on the market status of the Investment Banking leading manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/270357 .

Major Points in Table of Contents:

Section 1 Investment Banking Product Definition

Section 2 Global Investment Banking Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Investment Banking Shipments

2.2 Global Manufacturer Investment Banking Business Revenue

2.3 Global Investment Banking Market Overview

2.4 COVID-19 Impact on Investment Banking Industry

Section 3 Manufacturer Investment Banking Business Introduction

3.1 Barclays Investment Banking Business Introduction

3.1.1 Barclays Investment Banking Shipments, Price, Revenue and Gross profit 2014-2019

3.1.2 Barclays Investment Banking Business Distribution by Region

3.1.3 Barclays Interview Record

3.1.4 Barclays Investment Banking Business Profile

3.1.5 Barclays Investment Banking Product Specification

3.2 JP Morgan Investment Banking Business Introduction

3.2.1 JP Morgan Investment Banking Shipments, Price, Revenue and Gross profit 2014-2019

3.2.2 JP Morgan Investment Banking Business Distribution by Region

3.2.3 Interview Record

3.2.4 JP Morgan Investment Banking Business Overview

3.2.5 JP Morgan Investment Banking Product Specification

3.3 Goldman Sachs Investment Banking Business Introduction

3.3.1 Goldman Sachs Investment Banking Shipments, Price, Revenue and Gross profit 2014-2019

3.3.2 Goldman Sachs Investment Banking Business Distribution by Region

3.3.3 Interview Record

3.3.4 Goldman Sachs Investment Banking Business Overview

3.3.5 Goldman Sachs Investment Banking Product Specification

3.4 Bank Of America Merrill Lynch Investment Banking Business Introduction

3.5 Morgan Stanley Investment Banking Business Introduction

3.6 Deutsche Bank Investment Banking Business Introduction ………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Market Expected to Witness a Sustainable Growth over 2020-2024 With Major Key Players| Barclays, JP Morgan, Deutsche Bank, Credit Suisse here

News-ID: 2081262 • Views: …

More Releases from Business Industry Reports

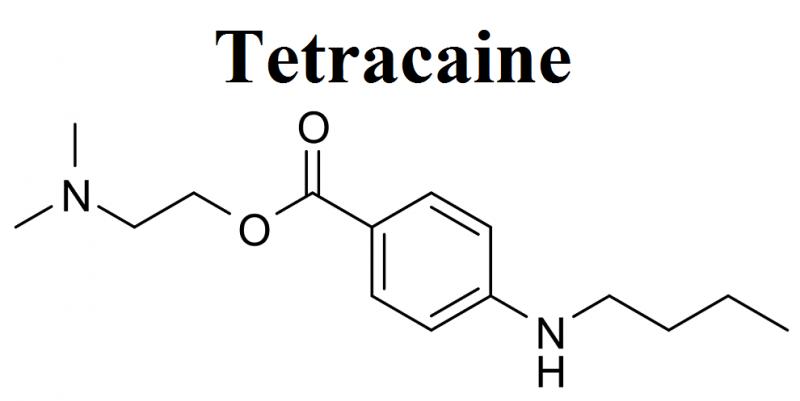

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

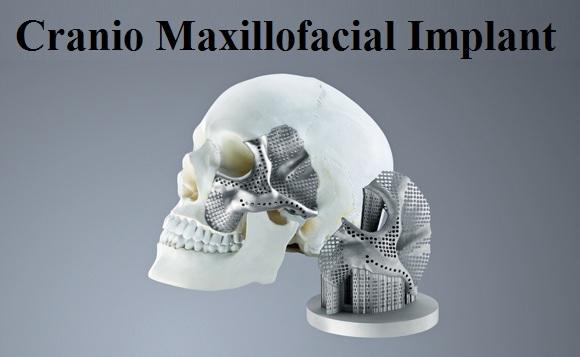

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…