Press release

New Research Study on Accident Insurance Market Predicts Steady Growth Till 2026 | 12.9& CAGR | COVID19-Corona Virus Impact Analysis on Accident Insurance Industry

The Global Accident Insurance Market was valued at US XX Mn in the year 2018 and is expected to reach US$ XX Mn with a CAGR of 12.9% by the year 2026 by 2027.The ripple effect of Coronavirus-COVID19 on the Accident Insurance Market needs to become part of strategy discussions to emerge strong. The Analyst team is meticulously tracking the impact and relevance to all the sectors in the Accident Insurance Market. Key data sets include Revenue Impact analysis, Disruptions and New opportunities in the Supply Chain, Revised Vendor Landscape Mix, New opportunities mapping, and more.

Download Exclusive Free Sample PDF with Top Companies Market Positioning Data

https://www.alltheresearch.com/sample-request/33

Accident insurance is a type of financial product that provides benefits to the beneficiary if the cause of his/her injuries is an accident. This type of accident insurance benefits are added to some life insurance policies. The accident insurance coverage pays for injuries, initial care, treatment, facility care and follow-up care.

AllTheResearch offers a most recent distributed report on GlobalAccident Insurance industry examination and figure 2019-2027conveying key bits of knowledge and giving an upper hand to customers through a point by point report. The report contains XX pages which profoundly displays on current market investigation situation, up and coming just as future chances, income development, evaluating and gainfulness.

Download Sample ToC to understand the COVID19 impact and be smart in redefining business strategies.

https://www.alltheresearch.com/impactC19-request/33

Market Segmentation:

Following Top Key players are profiled in this Market Study:

Dai-ichi Mutual Life Insurance, MetLife Inc., PingAn Insurance, Zurich Financial Services, Allianz SE, Sumitomo Life Insurance, China Life Insurance, Aegon N.V., Aviva plc, Munich Re Group, Nippon Life Insurance, Gerber Life Insurance, American International Group, Inc

By Applications: Enterprises, Personal, Others

Based on applications, the enterprise segment is growing at the fastest pace during the forecast period. The increasing use of accident insurance by enterprises is driving the growth of the segment. Employers offer insurance benefits to workers in order to acquire talented employees and avoid penalties. Enterprises also provide accidental insurance to their employees in order to ensure their wellness.

Ask You Queries | Get 30 Min Free Analyst Call

https://www.alltheresearch.com/speak-to-analyst/33

Regional Analysis:

North America

Europe

Asia Pacific

LATAM

Middle East Africa

Based on regions, North America is growing at the fastest pace owing to an increase in awareness about accident insurance policies in the region. The region is followed by the Asia-Pacific region, owing to an increase in disposable income in the region.

View Complete Report with Different Company Profiles

https://www.alltheresearch.com/report/33/accident-insurance-market

AllTheResearch

Contact Person: Rohit B.

Tel: 1-888-691-6870

Email: contactus@alltheresearch.com

About Us:

AllTheResearch was formed with the aim of making market research a significant tool for managing breakthroughs in the industry. As a leading market research provider, the firm empowers its Global clients with business-critical research solutions. The outcome of our study of numerous companies that rely on market research and consulting data for their decision-making made us realise, that its not just sheer data-points, but the right analysis that creates a difference.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Research Study on Accident Insurance Market Predicts Steady Growth Till 2026 | 12.9& CAGR | COVID19-Corona Virus Impact Analysis on Accident Insurance Industry here

News-ID: 2080225 • Views: …

More Releases from AllTheResearch

Industry Update: Healthcare IT Integration Market will Reach 7.5 Billion by 2027

Healthcare It Integration Market Analysis 2021 covers the global and regional market with an in-depth analysis of the market's overall growth prospects. Global Healthcare It Integration market growth to reach 7.5 Billion USD in 2027 with a CAGR value 12.2% from 2021 to 2027. Projected and forecast revenue values are in constant U.S. dollars, unadjusted for inflation. Product values are estimated based on manufacturers’ revenue and regional markets for Healthcare…

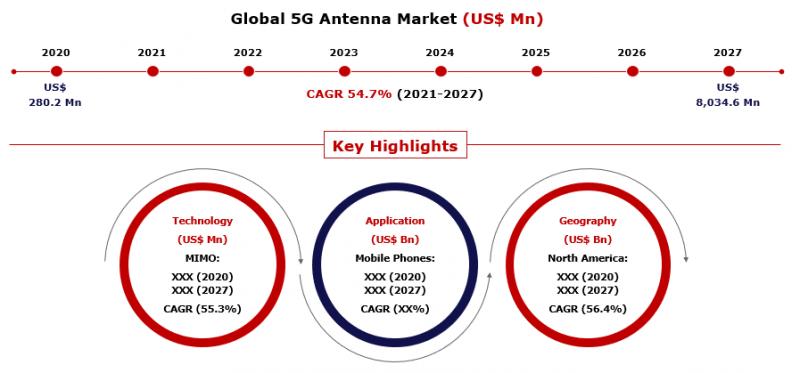

Demand for 5G Antenna Market to Witness Rapid Surge During the Period 2021-2027

5G Antenna Market by Type (Switched Multi-Beam Antenna, Adaptive Array Antenna); by Technology (SIMO, MISO, MIMO); by Application (Mobile Phones, Factory Automation, IoT, Connected Vehicles, Others); and by Region (North America, Europe, Asia Pacific, Latin America, MEA); - Global Forecasts 2021 to 2027

The Global 5G Antenna Market is an emerging market in the present years. The report covers the present and past market scenarios, market development patterns, and is likely…

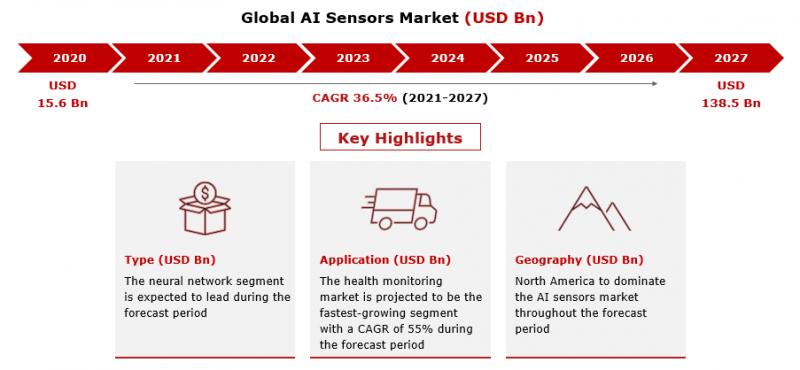

AI Sensors Market to Grow at CAGR of 36.5% Through 2021 to 2027

AI Sensors Market by Type (Case-based Reasoning, Ambient-intelligence, Neural Networks, Inductive Learning, Other); by Application (Biosensor, Health Monitoring, Maintenance and Inspection, Human-computer Interaction, Others); and by Region (North America, Europe, Asia Pacific, Latin America, MEA); - Global Forecasts 2021 to 2027

AI Sensors Market was valued at USD 15.6 Billion in 2020 and is expected to reach USD 138.5 Billion by 2027, with a growing CAGR of 36.5% during the forecast…

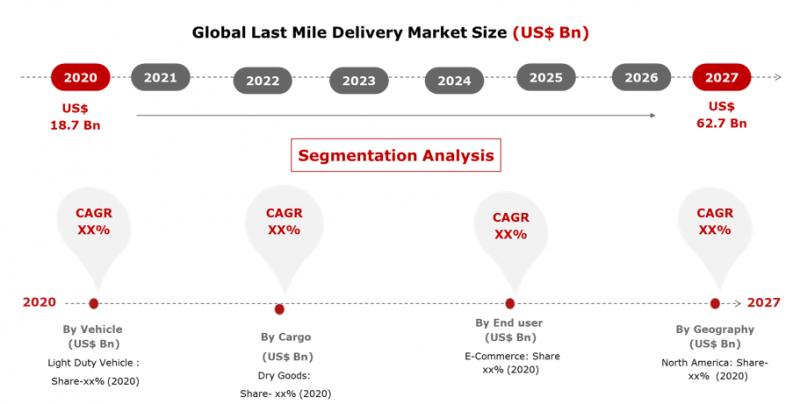

Last Mile Delivery Market Will Expand at CAGR of 18.9% by 2027

Last Mile Delivery Market by Vehicle (Light Duty Vehicle, Medium Duty Vehicle, Heavy Duty Vehicle), by Cargo (Dry Goods, Postal, Liquid Goods), by End User (Chemical, Pharmaceutical and Healthcare, FMCG, E-Commerce) by Region (North America, Europe, Asia-pacific, Rest of the World): Global Forecasts 2021 To 2027.

The global Last Mile Delivery Market was valued at USD 18.7 Bn in 2020, and it is expected to reach USD 62.7 Bn by 2027,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…