Press release

Banking as a Platform Market Will Be Massively Influenced By Macroeconomic Factors 2020-2025 | International Players - Fiserv, Oracle, Urban FT, Kony, Infosys, Alkami, SAP, FIS Global

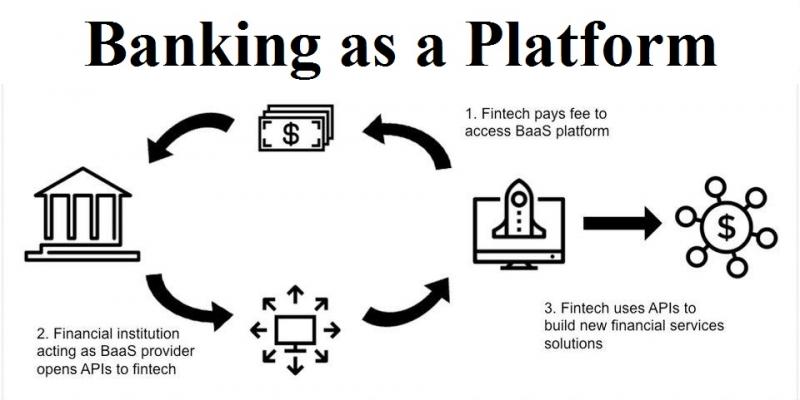

Global Banking as a Platform Market Report 2020-2025 cover detailed competitive outlook including the Banking as a Platform Market share and company profiles of the key participants operating in the global market. The Banking as a Platform Market report provides an in-depth overview of Product Specification, technology, product type and production analysis considering major factors such as Revenue, Cost, Gross and Gross Margin.Overview of Global Banking as a Platform Market:

This report studies the Global Banking as a Platform Market over the forecast period of 2020 to 2025. The Global Banking as a Platform Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2020 to 2025.

Major key factors driving the growth of the Global Banking as a Platform Market are increasing demand among banks to deliver enhanced customer experience, growing adoption of cloud-based platforms to obtain higher scalability, increasing adoption of smartphones and tablets, and the rapid growth in demand for streamlining business processes are some of the most significant factors contributing to the growth of the market.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/269928 .

The Global Banking as a Platform Market is segmented on the basis of Type, Application and Region. Based on the Type, the Global Banking as a Platform Market is sub-segmented into PC, Mobile and others. On the basis of Application, the Global Banking as a Platform Market is classified into Retail Digital Banking, SME Digital Banking, Corporate Digital Banking and others.

In terms of the geographic analysis, The Banking as a Platform Market in North America is expected to grow at the highest CAGR during the forecast period. Moreover, the presence of major players in the Banking as a Platform Market ecosystem results in the increasing adoption of these systems in North America.

Global Banking as a Platform Market Objectives:

1 To provide detailed information regarding key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the Banking as a Platform Market

2 To analyze and forecast the size of the Banking as a Platform Market, in terms of value and volume

3 To analyze opportunities in the Banking as a Platform Market for stakeholders and provide a competitive landscape of the market

4 To define, segment, and estimate the Banking as a Platform Market based on deposit type and end-use industry

5 To strategically profile key players and comprehensively analyze their market shares and core competencies

6 To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

7 To forecast the size of market segments, in terms of value, with respect to main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America

8 To track and analyze competitive developments, such as new product developments, acquisitions, expansions, partnerships, and collaborations in the Banking as a Platform Market

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Banking as a Platform Market Report 2020” @ https://www.businessindustryreports.com/buy-now/269928/single .

Top Leading Key Manufacturers are: Urban FT, Kony, Backbase, Technisys, Infosys, Digiliti Money, D3 Banking Technology, Alkami, Q2 eBanking, Finastra, SAP, Temenos, FIS Global, Fiserv, Oracle, Innofis, Mobilearth and others. New product launches and continuous technological innovations are the key strategies adopted by the major players.

International Business News:

Fiserv (May 19, 2020) - First Data Merchant Services Agrees to Resolution with the Federal Trade Commission - First Data Merchant Services has reached an agreed resolution with the Federal Trade Commission, which relates to isolated business practices by a single U.S.-based wholesale independent sales organization (ISO), its merchants, and affiliates of the ISO that referred merchants to the ISO between 2012 and 2014.

The company said: “This agreed resolution, which relates to a single U.S.-based ISO within the wholesale channel, is in the best interest of First Data Merchant Services, our clients and their customers, and consumers. We remain committed to ensuring that our business partners and merchants operate with integrity, and our enhanced practices will enable us to continue to lead the industry in fraud prevention, and business and consumer protection. Resolving this matter allows us to remain focused on serving our clients and their customers with excellence, and supporting our associates during this critical time.”

The settlement with the FTC calls for payment of $40 million to the FTC, which it will use to provide refunds to consumers who may have been harmed. As part of the agreement, First Data Merchant Services will further enhance its rigorous wholesale ISO compliance and oversight program by putting in place additional oversight and monitoring activities, many of which the company had implemented even before the settlement. In addition, enhanced underwriting and fraud monitoring processes will further protect consumers from merchants who attempt to defraud them. Fiserv, which acquired First Data Merchant Services in July 2019, has increased its investments in areas that improve detection of attempted fraud on its platforms, underwriting requirements, activity reviews and fraud alert protocols. These improvements will further reduce the opportunity for fraudulent merchant activity.

Fiserv has a 36-year record of operating its business with integrity, transparency and a commitment to excellence. The company will continue to demonstrate industry leadership and evolve its processes and procedures to ensure that it, and any companies it may acquire in the future, adhere to the strictest standards of compliance and customer transparency for businesses and consumers.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Banking as a Platform in these regions, from 2013 to 2025 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/269928 .

Major Points in Table of Contents:

Global Banking as a Platform Market Report 2020

1 Banking as a Platform Product Definition

2 Global Banking as a Platform Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Banking as a Platform Shipments

2.2 Global Manufacturer Banking as a Platform Business Revenue

2.3 Global Banking as a Platform Market Overview

2.4 COVID-19 Impact on Banking as a Platform Industry

3 Manufacturer Banking as a Platform Business Introduction

3.1 Urban FT Banking as a Platform Business Introduction

3.2 Kony Banking as a Platform Business Introduction

3.3 Backbase Banking as a Platform Business Introduction

3.4 Technisys Banking as a Platform Business Introduction

3.5 Infosys Banking as a Platform Business Introduction

3.6 Digiliti Money Banking as a Platform Business Introduction

………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is a digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic, and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking as a Platform Market Will Be Massively Influenced By Macroeconomic Factors 2020-2025 | International Players - Fiserv, Oracle, Urban FT, Kony, Infosys, Alkami, SAP, FIS Global here

News-ID: 2076618 • Views: …

More Releases from Business Industry Reports

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

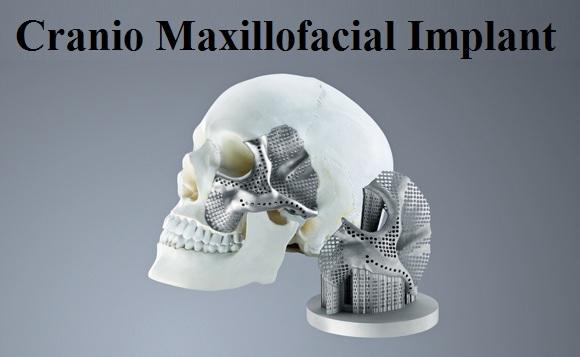

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…