Press release

Leased Asset Management Solutions Market Sales Revenue, Grow Pricing and Industry 2027

Global Leased Asset Management Solutions Market: IntroductionLeased asset management solutions can be defined as fully integrated solutions for the management of lease and underlying assets. Leased asset management solutions ensure that cost and space utilization are factored in for performance management; divisions comply with regulatory requirements; and leases are managed according to the terms of the agreement.

The major advantage of a leased asset management solutions is that it ensures compliance, tracking leased equipment, and lease accounting for payable and receivable. This ensures efficiency in management of assets which a company acquires on rent for a long term basis. Due to multiple advantages of leased asset management solutions, the demand for such solutions is expected to rise in the coming future at a healthy CAGR.

Obtain Report Details @ https://www.transparencymarketresearch.com/leased-asset-management-solutions-market.html

leased asset management solutions market

Are you a start-up willing to make it big in the business? Grab an exclusive PDF Brochure of this report

Global Leased Asset Management Solutions Market - Dynamics

Increasing Focus on Digitization Driving Growth of the Leased Asset Management Solutions Market

Unified leased asset management solutions provide capabilities such as site selection and acquisition, payables lease administration and accounting (lessee), receivables lease administration and accounting (lessor), automation in-site acquisition, compliance fulfilment etc.in a complete package. Unified solutions are highly demanded as it automates and unifies various accounting related features in a common context and experience. As a result, enterprises (especially the large ones) these days require a complete package which offers advanced unified solution features. This is expected to drive the demand for leased asset management solutions.

Increasing Adoption of Digitization for Accounting Functions

Across the globe, adoption of digitized tools to manage accounting functions has increased rapidly. Accounting handling software has considerably increased efficiency as well as reduced the chances of error. SMEs are adopting such tools and software at a sizable rate. The adoption from SMEs for accounting and related administrative work is driving the demand for leased asset management solutions.

For More Details, Request A Sample Report@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=75097

Software Compatibility Issues Restricting the Growth of the Market

Many users find themselves restricted due to compatibility issues. In addition, most leased asset management solutions require to have additional software to function efficiently. Certain viewing software may impose an additional expense on the user. Compatibility and cost of integration is hampering the growth of the leased asset management solutions market.

North America Expected to Dominate the Global Leased Asset Management Solutions Market

In terms of region, the global leased asset management solutions market can be divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa. North America is expected to dominate the global leased asset management solutions market during the forecast period, as the adoption of digitized technology within SMEs in North America is comparatively high compared to other regions.

Contact Us:

Transparency Market Research

State Tower,

90 State Street, Suite 700,

Albany NY - 12207,

United States

Tel: +1-518-618-1030

Transparency Market Research is a global market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for several decision makers. Our experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Leased Asset Management Solutions Market Sales Revenue, Grow Pricing and Industry 2027 here

News-ID: 2063355 • Views: …

More Releases from Transparency Market Research

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

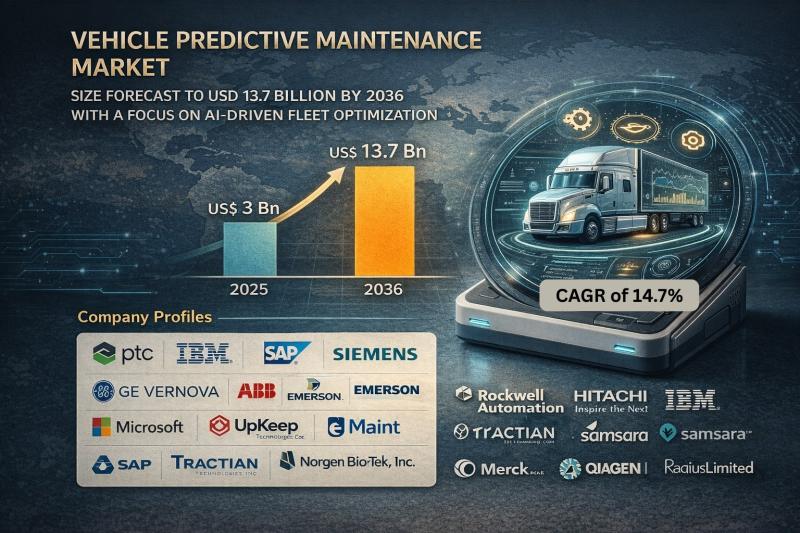

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

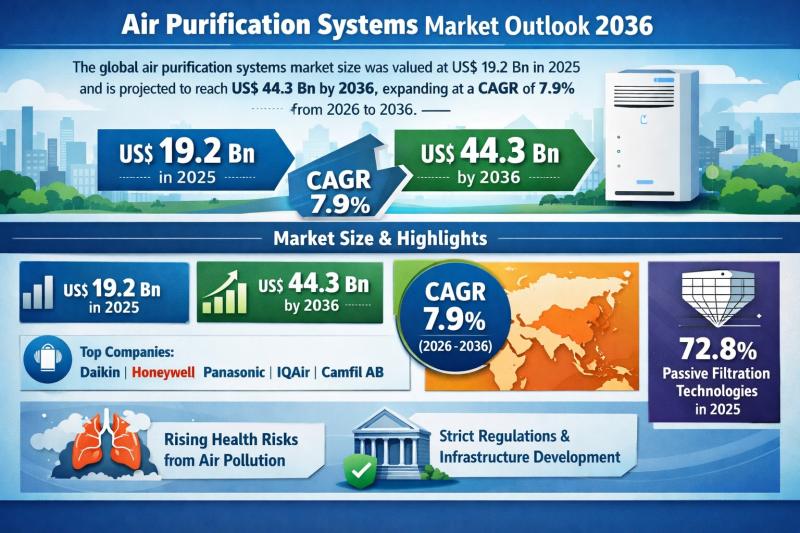

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

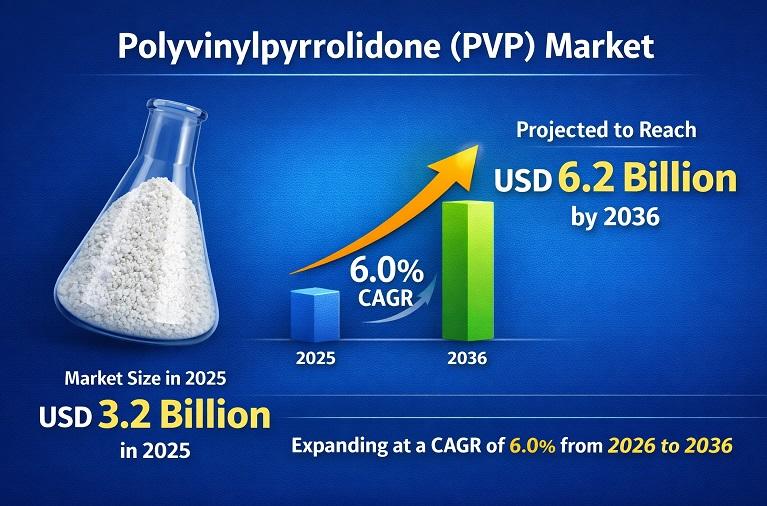

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

More Releases for Leased

The Boulder Group Arranges Sale of Net Leased Indiana Industrial Asset leased to …

The Boulder Group, a net leased investment brokerage firm completed the sale of a single tenant industrial property leased to Renewal by Andersen located at 3633 Miller Drive in Plymouth, Indiana for $4,200,000.

The 25,420 square-foot property is strategically located off US Highway 30, approximately midway between Chicago and Fort Wayne, beneting from high visibility and accessibility. The property is surrounded by tenants including Hershey, Hoosier Tires, Pioneer, Indiana Wheel Company,…

The Boulder Group Arranges Sale of Net Leased Florida C-Store

The Boulder Group, a net leased investment brokerage firm completed the sale of a single tenant Cross America Partners C-Store located at 1698 Main Street in Chipley, Florida for $3,464,000.

The 6,998 square-foot building is located along Main Street (15,800 vehicles per day) and benefits from the proximity to Interstate 10, which experiences over 21,500 vehicles per day. Interstate 10 connects Chipley to Tallahassee, FL and Mobile, AL. The property spans…

The Boulder Group Arranges Sale of Net Leased Chicago Chipotle

The Boulder Group, a net leased investment brokerage firm completed the sale of a single tenant Chipotle located at 2935 West Peterson Avenue, in Chicago, Illinois for $2,631,589.

The 2,160 square-foot building is located along Peterson Avenue which experiences 32,100 vehicles per day and is just two blocks east of Lincoln Avenue (28,100 VPD). The property is positioned in an affluent northern neighborhood with more than 427,000 residents within a three-mile…

The Boulder Group Arranges Sale of Net Leased Springfield Clinic

Randy Blankstein and Jimmy Goodman of The Boulder Group represented the seller in the transaction. The buyer is a commercial real estate investment firm located in Utah. The seller is a private investor located in New Jersey.

The Boulder Group, a net leased investment brokerage firm, completed the sale of a single tenant Springfield Clinic property located at 1000 W Morton Avenue in Jacksonville, IL for $1,342,588.

The 7,000-square-foot building benefits from…

What is a Leased Bank Guarantee and Standby Letter of Credit?

Aim Spa Deutschland GmbH is proud to offer our clients the opportunity to work with prime rated banks and enjoy the benefits of Financial Instruments. We have the experience, the expertise, and the resources to help our clients achieve their goals and secure their financial future. We are committed to providing the best service and the best results for our clients.

A Bank Guarantee or Standby Letter of Credit is a…

Leased Line Pricing Website Launched by hSo:compare

MPLS network provider hSo has launched a UK-wide price comparison tool that provides a direct best market pricing for connectivity in real-time.

London, UK, February 13, 2012 -- The carrier-independent MPLS network provider, hSo, has launched a new tool to help businesses pricing up their networks to budget their IT and telecoms expenditure.

A beta version of the hSo:compare website has been running for over 12 months, and has already provided thousands…