Press release

How is Increasing Number of Surgical Procedures Driving Surgical Glue Market?

The number of surgical procedures all across the world is rising rapidly on account of the growing prevalence of diseases and surging geriatric population. As per the World Bank, every year, more than 13,900 and 1,300 surgeries per 100,000 people are conducted in Brazil and Mexico, respectively.Request Sample Copy of Report : https://www.psmarketresearch.com/market-analysis/surgical-glue-market/report-sample

Similarly, the number of surgical procedures in China per 100,000 people is over 2,700. While various diseases can be cured with just medicines, several serious cases need surgical intervention. In addition to this, since aged people are more susceptible to chronic diseases, they account for a large number of surgical procedures that are performed.

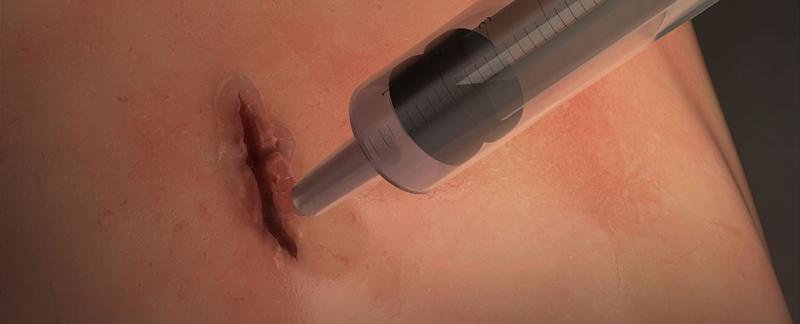

Because of this growing number of surgical procedures, the demand for surgical glue is growing swiftly as well. Surgeries are performed by making incision on the body; therefore, one of the essential steps in a surgical procedure is wound closure. Conventionally, different types of suture were utilized for wound closure purposes during a surgery; however, these products have several disadvantages.

The process can be traumatic and can cause addition pain, and more often than not, the removal of sutures requires a second procedure. In order to overcome these problems, various surgeons are now making use of surgical glue for closing wounds after surgeries.

Attributed to these factors, the global surgical glue market is predicted to attain a value of $6,936.5 million by 2023, growing from $3,810.5 million in 2017, progressing at a 10.6% CAGR during the forecast period (2018-2023).

Make Enquiry : https://www.psmarketresearch.com/send-enquiry?enquiry-url=surgical-glue-market

Different types of surgical glues include hydrogel, glutaraldehyde glue, collagen-based compound, cyanoacrylate, and fibrin sealant. Out of these, fibrin sealant was the most in demand in the past, which is owing to its natural origin and wide applications. This surgical glue is derived from animal or human blood cells and therefore is more compatible with the human body.

Contact:

P&S Intelligence

Toll-free: +1-888-778-7886 (USA/Canada)

International: +1-347-960-6455

Email: enquiry@psmarketresearch.com

Web: https://www.psmarketresearch.com

About P&S Intelligence

P&S Intelligence is a provider of market research and consulting services catering to the market information needs of burgeoning industries across the world. Providing the plinth of market intelligence, P&S as an enterprising research and consulting company, believes in providing thorough landscape analyses on the ever-changing market scenario, to empower companies to make informed decisions and base their business strategies with astuteness

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How is Increasing Number of Surgical Procedures Driving Surgical Glue Market? here

News-ID: 2062304 • Views: …

More Releases from P&S Intelligence

Modular Automation Market Poised for Robust Growth Amid Industry 4.0 Transformat …

According to the latest market research study published by P&S Intelligence, the global modular automation market is on an impressive growth trajectory, expected to generate USD 6.3 billion in 2024 and expand at a CAGR of 8.7% to reach USD 12.1 billion by 2032. This surge is driven by rising demand for flexible, cost-efficient manufacturing solutions and the accelerating integration of Industry 4.0 technologies.

As manufacturing landscapes evolve with rapid changes…

U.S. ESG Investments Market Set to Skyrocket: $16 Trillion by 2032

According to the latest market research study published by P&S Intelligence, the U.S. Environmental, Social, and Governance (ESG) investments market is experiencing a significant surge, with projections indicating an increase from $6.5 trillion in 2024 to an estimated $16.0 trillion by 2032. This represents a robust compound annual growth rate (CAGR) of 12.1% over the forecast period.

According to a comprehensive analysis by P&S Intelligence, the market's expansion is driven…

Facility Management in the U.K. Booms with 14.1% CAGR as Demand Soars Across Sec …

According to the latest market research study published by P&S Intelligence, the U.K. facility management market is poised for significant growth, with projected revenues reaching USD 2,743.3 million in 2024 and expected to soar to USD 6,038.4 million by 2030, reflecting a robust CAGR of 14.1% during the forecast period.

This expansion is fueled by a surge in demand across both public and private sectors. According to the RICS U.K.…

Point-of-Sale Software Market in the U.S. Set to Grow by 9.7% CAGR, Boosted by O …

According to the latest market research study published by P&S Intelligence, the U.S. point-of-sale (POS) software market, valued at USD 4.7 billion in 2024, is poised for significant growth over the coming years, with projections estimating it will reach USD 9.8 billion by 2032, expanding at a compound annual growth rate (CAGR) of 9.7%. This growth is attributed to rapid technological advancements, a surge in mobile and cloud-based POS systems,…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…