Press release

How COVID-19 Impacting Fraud Detection & Prevention Market Globally?

Post COVID-19 Impact on Fraud Detection & Prevention MarketWith the emergence of the COVID-19 crisis, the world is fighting a health pandemic as well as an economic emergency, almost impacting trillions of dollars of revenues.

Research Dive' group of skilled analysts provide a solution to help the companies to survive and sustain in this economic crisis. We support companies to make informed decisions based on our findings resulting from the comprehensive study by our qualified team of experts.

Our study helps to acquire the following:

o Long-term and short-term impact of Covid-19 on the market

o Cascading impact of Covid-19 on Fraud Detection & Prevention Market, due to the impact on its extended ecosystem

o Understanding the market behaviour Pre- and Post-COVID-19 pandemic

o Strategy suggestions to overcome the negative impact or turn the positive impact into an opportunity

We'll help you fight this crisis through our business intelligence solutions.

Connect with Our Analyst to Contextualize Our Insights for Your Business: https://www.researchdive.com/connect-to-analyst/174

Pre COVID-19 Analysis on Fraud Detection & Prevention Market

Fraud detection & prevention market is predicted to grow with a CAGR of 26.5% by generating a revenue of $123,391.8 million by 2026.

Porter's Five Forces Analysis for Fraud Detection & Prevention Market:

o Bargaining Power of Suppliers: The switching cost from one supplier to another is projected to be low. The bargaining power of suppliers is very low.

o Bargaining Power of Consumers: In this market, due to the presence of large number of buyers, the concentration of buyers is high. The bargaining power of consumers is high.

o Threat of New Entrants: Huge initial investments are essential to start a new fraud detection & prevention market. The threat of new entrants is low.

o Threat of Substitutes: This market has numerous alternatives of products; moreover, technology also offers high switching costs for clients. The threat of substitutes is high.

o Competitive Rivalry in the Market: The fraud detection & prevention market has only major players to sell their products and it becomes difficult for small and medium enterprises and local manufacturers to get into the market. The competitive rivalry in the industry is high.

Artificial intelligence and machine learning is considered to create a huge opportunity for the fraud detection & prevention market investors @ https://www.researchdive.com/purchase-enquiry/174

North America Fraud Detection & Prevention Market Overview

North America market is predicted to grow with a CAGR of 25.3% by generating a revenue of $40,102.3 million by 2026. The market in thisregion is predicted to grow with the rise in relevant companies across the region and the government initiatives to control fraud in various industries.

How Asia-PacificFraud Detection & Prevention Market will be till 2026

Asia-Pacific market is predicted to grow with a CAGRof 27.0% by generating a revenue of $35,660.2 million by 2026. The market in this region is predicted to grow due to a shift in the major companies' operational work in this region due to the cheap labor and other overhead costs across the region.

Rise in the use of electronic device and digital payment methods are predicted to drive the growth of fraud detection & prevention market @ https://www.researchdive.com/download-sample/174

The major players in the fraud detection & prevention market are:

IBM Corporation (NYSE: IBM)

Oracle Corporation (NYSE: ORCL)

NCR limited (NYSE: NCR)

Fair IssacCorporation (NYSE: FICO)

ACI Worldwide (NASDAQ: ACIW)

Lavastorm

SAP SE

SAS Institute Inc.

Fraud prevention technology has made an immense change in securing the files andminimized the possibility of any hacking incidences. Moreover with the rise in the use of artificial intelligence and machine learning, fraud prevention technology is predicted to be the most used to secure data of the enterprise in a most cost-effective manner.

Fraud Detection & Prevention Market Segmentation by Type

o External

o Internal

The rise in cyber-attack and data breach in various verticals is predicted to be the major driving factor for the growth of thefraud detection & prevention market in the projected period. Many organizations are adopting fraud detection & prevention tools and software to get protected to their confidential data of their organization, as the numbers of hackers are rising at a steeper rate across the globe. So as to protect the data from the hackers, many organizations have adopted fraud detection & prevention tools and software, which ispredicted to boost the overall fraud detection & prevention Market in the forecast period. Moreover, growing use of electronic transaction is also predicted to be the major driving factor for the growth of thefraud detection & prevention market.

Fraud Detection & Prevention Market Segmentation by Component

o Solution

o Services

With the rise in the adoption of fraud detection & prevention tools and software, the unavailability of skilled labor in the respective field is considered to be the biggest restraint for the growth of the market in the forecast period. In addition, the cost involved for setting up fraud detection & prevention tools and software is very high which is predicted to hinder to the growth of the fraud detection & prevention market in the forecast period.

Fraud Detection & Prevention Market Segmentation by Application

o Money Laundering

o Credit & Debit Fraud

o Mobile Fraud

o Identity Threat

o Electronic Fraud

External type segment is predicted to grow with a CAGR of 25.2% by generating a revenue of $70,456.7million by 2026.Most organizationsdeal with the large amount of sensitive data and there are high chances of security breach.To avoid such situations and secure the data from being hacked, the organization is adopting external sources to secure their data, which is predicted to boost the external type segment of the market in the projected period.

Fraud Detection & Prevention Market Segmentation by End User

o Banking

o Insurance

o Government

o Healthcare

o E-Commerce

o Education

o Others

Get Access to Full Report (TOC, Figures, Chart, etc.) @ https://www.researchdive.com/174/fraud-detection-and-prevention-market

Service component is predicted to grow with a CAGR of 25.4% by generating a revenue of $60,462.0million by 2026.Most organizations are adopting various services for preserving data. For instance, Cloud services help the organizationin cutting the costs related to software, storage, and securingdata. Due to the theseseveral reasons the service component in fraud detection & prevention market is predicted to grow over the forecast period.

Credit & Debit fraud category in the applications segmentis predicted to grow with a CAGR of 25.4% by generating a revenue of $34,549.7 millionby 2026. Fraud cases have increased significantlydue to the use of debt and credit facilities in the banking sector, which has led to the adoption of fraud detection & prevention as a measure,resultingin the growth of the credit & debit category in the applications segment in the forecast period.

Insurance end use is predicted to grow with a CAGR of 27.1% by generating a revenue of $14,066.7 million by 2026.Insurance end use is predicted to grow due to the increasing use of fraud detection & prevention tools and software, which plays an important role in finding the root cause of the insurance frauds.Moreover, predictive modeling and advanced analytics with the help of fraud detection & prevention is predicted to boost the insurance end use segment in the forecast period.

Contact us:

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York

NY 10005 (P)

+ 91 (788) 802-9103 (India)

+1 (917) 444-1262 (US)

Toll Free: +1-888-961-4454

E-mail: support@researchdive.com

LinkedIn: https://www.linkedin.com/company/research-dive/

Twitter: https://twitter.com/ResearchDive

Facebook: https://www.facebook.com/Research-Dive-1385542314927521

Blog: https://www.researchdive.com/blog

Follow us: https://marketinsightinformation.blogspot.com/

About Us:

Research Dive is a market research firm based in Pune, India. Maintaining the integrity and authenticity of the services, the firm provides the services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive deliver the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How COVID-19 Impacting Fraud Detection & Prevention Market Globally? here

News-ID: 2048658 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

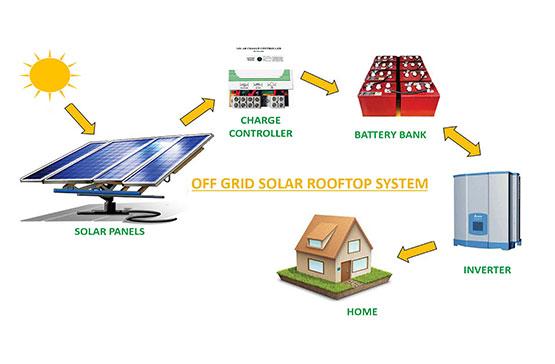

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…