Press release

Asset Performance Management Market Expected to Grow $6.7 billion by 2025

According to a research report "Asset Performance Management Market by Component (Solutions and Services), Solution (Asset Strategy Management, Asset Reliability Management, Predictive Asset Management), Deployment Type, Organization Size, Vertical, and Region - Global Forecast to 2025", published by MarketsandMarkets, The global Asset Performance Management (APM) market size is projected to grow from USD 3.3 billion in 2020 to USD 6.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 15.1% during the forecast period.The major factors driving the growth of the market include the rising need for risk-based maintenance, the need to maximize economic return on assets, and increasing adoption of cloud-based applications.

Browse 109 market data Tables and 36 Figures spread through 147 Pages and in-depth TOC on "Asset Performance Management Market - Global Forecast to 2025"

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/asset-performance-management-market-72801714.html

Large enterprises segment to hold a larger market size during the forecast period

The use of traditional reactive maintenance leads to higher costs, low asset availability, and lack of reliability. It has become very important for large enterprises to adopt APM solutions that leverage proactive maintenance and advanced analytics. APM solutions offers large enterprises with components, such as condition-based monitoring, scenario modelling, and predictive analytics solutions to make more proactive decisions. This adoption results in reduced costs, and reduced unplanned downtime, enabling companies to focus on more business-critical assets leading to better productivity.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=72801714

Cloud deployment type to record a faster growth rate during the forecast period

Cloud technology is being widely adopted by businesses, owing to its various benefits, such as increased storage, scalability, flexibility, portability, and compliance. Small and Medium-sized Enterprises (SMEs), in particular, are adopting the cloud deployment type largely due to its cost-effectiveness and ability to produce advanced results. Asset-intensive organizations prefer cloud-deployed solutions, as this type offers scalability and agility in organizations and provides more functions than on-premises solutions at an affordable cost.

Asia Pacific to be the fastest growing region during the forecast period

Asia Pacific (APAC) comprises the fastest growing economies, such as China, India, and Singapore and technologically advanced countries, such as Japan and Australia. The region is expected to gain traction in the APM market, due to benefits, such as improved asset utilization, extended asset life, and reduction in maintenance costs. Many emerging economies in the APAC region are likely to adopt APM solutions because of their high demands, specifically in the oil and gas, transportation and logistics, healthcare, and energy and utilities verticals.

Speak to Our Expert Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=72801714

Market Players

Some prominent players across all service types profiled in the APM market study are ABB (Switzerland), SAP (Germany), GE Digital (US), IBM (US), AVEVA (UK), OSIsoft (US), Bentley Systems (US), Siemens (Germany), Oracle (US), Infor (US), AspenTech (US), DNV GL (Norway), eMaint (US), Nexus Global (US), Accruent (US), Aptean (US), Operational Sustainability (US), Rockwell Automation (US), ARMS Reliability (Australia), IPS (Germany) and Uptake Technologies (US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets(TM) INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

sales@marketsandmarkets.com

About MarketsandMarkets(TM)

MarketsandMarkets(TM) provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets(TM) for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets(TM) are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets(TM) now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets(TM) is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Performance Management Market Expected to Grow $6.7 billion by 2025 here

News-ID: 2042356 • Views: …

More Releases from MarketsandMarkets(TM)

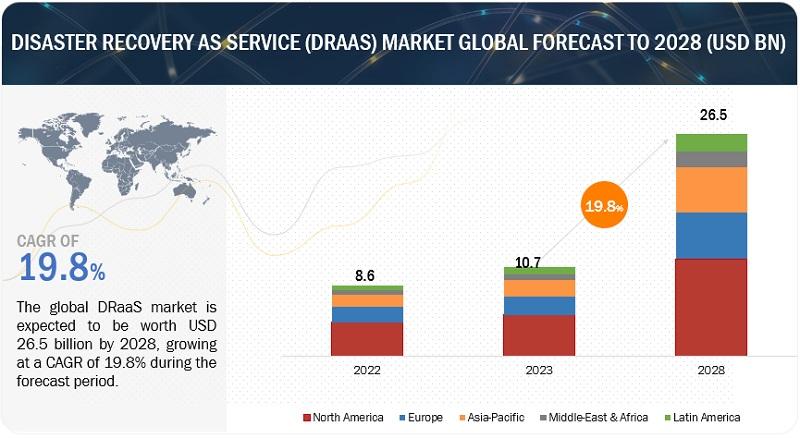

Disaster Recovery as a Service (DRaaS) Market Trends, Drivers, Strategies, Appli …

According to a research report "Disaster Recovery as a Service (DRaaS) Market by Service Type (Backup & Restore, Real-Time Replication, Data Protection), Deployment Mode (Public Cloud, Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the DRaaS market size is expected to grow from USD 10.7 billion in 2023 to USD 26.5 billion by 2028 at a compound annual growth rate (CAGR) of 19.8%…

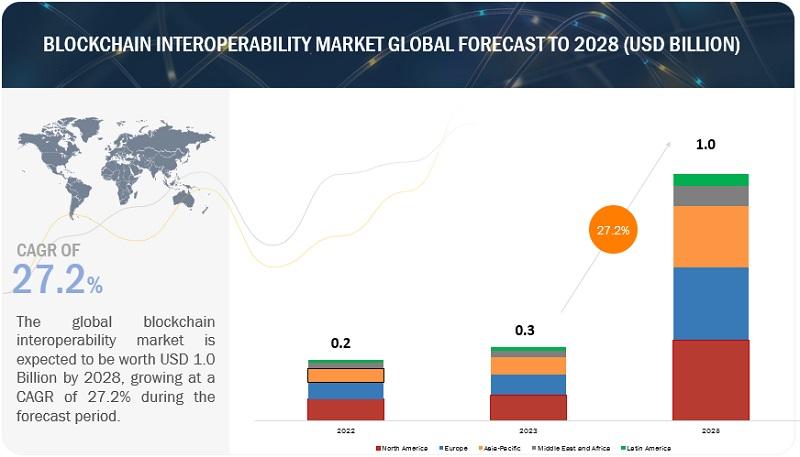

Blockchain Interoperability Market Size to Witness a Pronounce Growth by 2028

According to a research report "Blockchain Interoperability Market by Solution (Cross-chain Bridging, Cross-chain APIs, Federated or Consortium Interoperability), Application (dApps, Digital Assets/NFTs, Cross-chain Trading & Exchange), Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the global blockchain interoperability market size is projected to grow from USD 0.3 billion in 2023 to USD 1.0 billion by 2028 at a CAGR of 27.2% during the forecast period.

Download PDF Brochure…

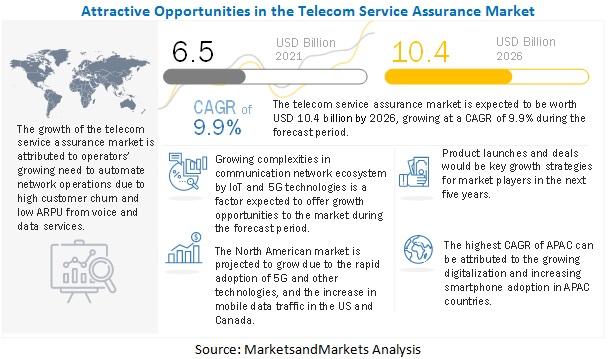

Telecom Service Assurance Market Growth, Opportunities Business Scenario, Share, …

According to a research report "Telecom Service Assurance Market Trends by Component (Solutions (Fault and Event Management, Performance Management, and Quality and Service Management) and Services), Operator Type, Deployment Type, Organization Size, and Region - Global Forecast to 2026" published by MarketsandMarkets, the global Telecom service assurance Market size to grow from USD 6.5 billion in 2021 to USD 10.4 billion by 2026, at a Compound Annual Growth Rate (CAGR)…

Casino Management Systems Market predicted to obtain $13.7 billion by 2025

According to a new market research report "Casino Management Systems Market by Component (Solutions and Services), Application (Accounting, Security and Surveillance, Player Tracking, Hotel and Hospitality, Analytics, and Digital Content Management), End User, and Region - Global Forecast to 2025" published by MarketsandMarkets™, the market size projected to grow from USD 6.4 billion in 2020 to USD 13.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 16.4%…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…