Press release

Covid-19 Impact: Banks See Spike in Digital Banking Adoption by Corporates

It takes less than five minutes to transfer funds, make bill payments or even open a new bank account through mobile phones or net banking. But the corporate world operates in a different realm, where physical (paper-based) transactions still rule the roost.For instance, a simple fund transfer or a fixed deposit placement requires manual letter instructions signed by two or more authorised persons of the company. The instruction is then faxed, mailed or couriered to the banks for processing. The more advanced a transaction, more are the paperwork and procedures.

The global digital banking market size is projected to grow at a CAGR of 8.9% by generating a revenue of $1,610.0 billion by 2027. The global digital banking market has seen major growth, owing to increasing utilization of mobile phones, tablets, and online banking platforms. In addition, due to constantly rising internet penetration and digitally literate population is expected to drive the growth of the global digital banking market. A large number of players are increasing their business around the globe, due to enhanced effective operations, the increased customer base and product portfolios, and extended geographical area. This is projected to strengthen the demand for the digital banking during the forecast period.

Connect with Analyst to Reveal How COVID-19 Impacting On Digital Banking Market: https://www.researchdive.com/connect-to-analyst/53

The cost and the user friendliness of digital banking and increased use of electronic devices and easy adoption to the internet facilities are the digital banking market drivers in the estimated period. The technical development in the integration of blockchain is an additional strengthening for the global digital banking market. Whereas the rising threat related to data breach and cyber-attacks may hinder the growth of the digital banking market.

Digital banking market trends lead to the increasing use of smart phones, internet usage and the government initiative is considered to be the opportunity for the market. As rising population is being inclining towards the technology the banks are also heading their segment towards digital channels to deliver their services with one touch to the customer. The initiative taken by the government related to digital banking globally and promoting cashless where the government and the customer can have accountability on each and every person regarding their financials

Based on type, the market is segmented into consumer banks, co-operative banks, credit unions. The consumer banks accounted for the highest share in the digital banking market. These growths in the consumer banks are due to the rising top line revenue, moderating risk and cost reduction. North America is the largest segment in the consumer banks digital banking market, the digital banking market for consumer bank will reach $1,166.1 billion by 2027 with a CAGR of 9.0%.

For More Detail Insights, Download Sample Copy of the Report at: https://www.researchdive.com/download-sample/53

Based on the services the market is segmented into digital payments and digital sales. The focus of government of various emerging countries to become cashless has led to the initiation of numerous policies which boosts and promotes different merchants to integrate digital payments. The digital payments segment is projected to reach $402.5 billion by 2027 at a CAGR of 9.3%.

Based on the region the North America is anticipated to have the highest market share globally. It is estimated that the North America will generate a revenue of $721.3 billion by 2027 with a CAGR of 8.3%. Many banks in this region focuses on preserving the customer by adopting various developmental strategies to preserve the customer and the customer data. Asia-Pacific regional market was valued at $69.9 billion in 2019, and is projected to reach $153.0 billion by 2027. Due to the increasing use of smartphones and various initiatives where they educate the customer through media promotions for mobile banking have given rise in Asia-Pacific region.

The global digital banking market players include Bank of America, Wells Fargo, Agricultural Bank of China, Bank of China Limited, Industrial and Commercial Bank of China Limited, China Construction Bank, JPMorgan Chase & Co., HSBC Group, China Merchants Bank., and Citi Group.

View out Trending Reports with the Impact of COVID-19: https://www.researchdive.com/covid-19-insights

The major players operating in the global market have adopted key strategies such as acquisition, and product development to strengthen their market outreach and sustain the stiff competition in the market. For instance, in 2019, Alliant Credit Union introduces a new online vehicle service program for its members. In 2019, twelve Hong Kong-based banks established Trade Connect, which is a blockchain-based trade finance platform. Similarly, in 2017, BNP Paribas planned to spend nearly $3bn in an aspiring plan to speed up the digital transformation of the bank in order to meet the changing needs of its customers.

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York

NY 10005 (P)

+ 91 (788) 802-9103 (India)

+1 (917) 444-1262 (US) Toll

Free : +1 -888-961-4454

Email: support@researchdive.com

LinkedIn: https://www.linkedin.com/company/research-dive

Twitter: https://twitter.com/ResearchDive

Facebook: https://www.facebook.com/Research-Dive

Blog: https://www.researchdive.com/blog

Follow us on: https://covid-19-market-insights.blogspot.com

About Us:

Research Dive is a market research firm based in Pune, India. Maintaining the integrity and authenticity of the services, the firm provides the services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive deliver the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Covid-19 Impact: Banks See Spike in Digital Banking Adoption by Corporates here

News-ID: 2040466 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

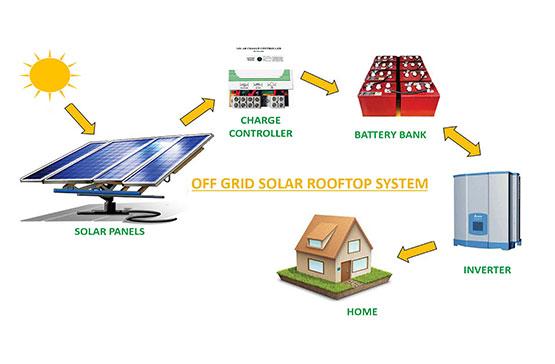

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…