Press release

Insurance (Providers, Brokers and Re-Insurers) Market Expected to Grow $6840.7 Billion By 2023 | Covid 19 Impact And Recovery

The Business Research Company offers "Insurance (Providers, Brokers And Re-Insurers) Global Market Report 2020-30: Covid 19 Impact And Recovery" in its research report store. It is the most comprehensive report available on this market and will help gain a truly global perspective as it covers 60 geographies. The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by region and by country. It also compares the market's historic and forecast growth, and highlights important trends and strategies that players in the market can adopt.The global insurance (providers, brokers and re-insurers) market is expected to decline from $5939.5 billion in 2019 to $5807.3 billion in 2020 at a compound annual growth rate (CAGR) of -2.3%. The decline is mainly due to economic slowdown across countries owing to the COVID-19 outbreak and the measures to contain it. The market is then expected to recover and grow at a CAGR of 6% from 2021 and reach $6840.7 billion in 2023.

Place a DIRECT PURCHASE ORDER of The Entire 140+ Pages Report @ https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=1887

The insurance market consists of sales of insurance by entities (organizations, sole traders and partnerships) that engage in insurance and related activities such as underwriting (assuming the risk and assigning premiums) policies, insurance brokerage and reinsurance. The insurance industry is categorized on the basis of the business model of the firms present in the industry. Some insurance firms may offer other services financial or otherwise. Contributions and premiums are set on the basis of actuarial calculations of probable payouts based on risk factors from experience tables and expected investment returns on reserves. The value of the market is based on the premiums paid by those insured, both commercial and personal as well as the fees or commissions paid to brokers.

The global payments industry has witnessed rapid increase in the adoption of EMV technology. This growth is driven by a higher level of data security offered by EMV chip and PIN cards as compared to traditional magnetic stripe cards. EMV is a security standard for various payment cards including debit, credit, charge and prepaid cards. The chip carries data of the cardholder and the account, which is protected using both hardware and software security measures. According to global technical body EMVCo, the number of EMV chip payment cards across the world reached 4.8 billion by the end of 2015. In line with the rest of the world, the adoption rate of EMV chip payment cards has steadily grown across various regions in world, reaching 71.7% in Canada, Latin America and the Caribbean region, 61.2% in Africa and the Middle East region, and 32.7% in Asia-Pacific region.

Insurance (Providers, Brokers and Re-Insurers) Market Segmentation: -

By Type

Insurance Providers

Insurance Brokers & Agents

Reinsurance Providers

By Mode

Online

Offline

By End-User

Corporate

Individual

Browse Complete Report @ https://www.thebusinessresearchcompany.com/report/insurance-providers-brokers-and-reinsurers-global-market-report-2020-30-covid-19-impact-and-recovery

Few Points From Table Of Content

1. Executive Summary

2. Report Structure

3. Insurance(Providers, Brokers and Re-Insurers) Market Characteristics

4. Insurance(Providers, Brokers and Re-Insurers) Market Product Analysis

5. Insurance(Providers, Brokers and Re-Insurers) Market Supply Chain

.......

20. Insurance(Providers, Brokers and Re-Insurers) Market Competitive Landscape

21. Key Mergers And Acquisitions In The Insurance(Providers, Brokers and Re-Insurers) Market

22. Market Background: Financial Services Market

23. Recommendations

24. Appendix

25. Copyright And Disclaimer

The report covers the trends and market dynamics of the Insurance(Providers, Brokers and Re-Insurers) Market in major countries - Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA. The report also includes consumer surveys and various future opportunities for the market.

Request for a Sample Copy of This Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=1887&type=smp

Some of the key players involved in the Insurance(Providers, Brokers and Re-Insurers) Market are Unitedhealth Group; AXA; Munich Re; Allianz; Generali

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on Blog: http://blog.tbrc.info/

About US:

The Business Research Company has published over 1000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets after WHO declared COVID-19 as a pandemic.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance (Providers, Brokers and Re-Insurers) Market Expected to Grow $6840.7 Billion By 2023 | Covid 19 Impact And Recovery here

News-ID: 2040203 • Views: …

More Releases from The Business research company

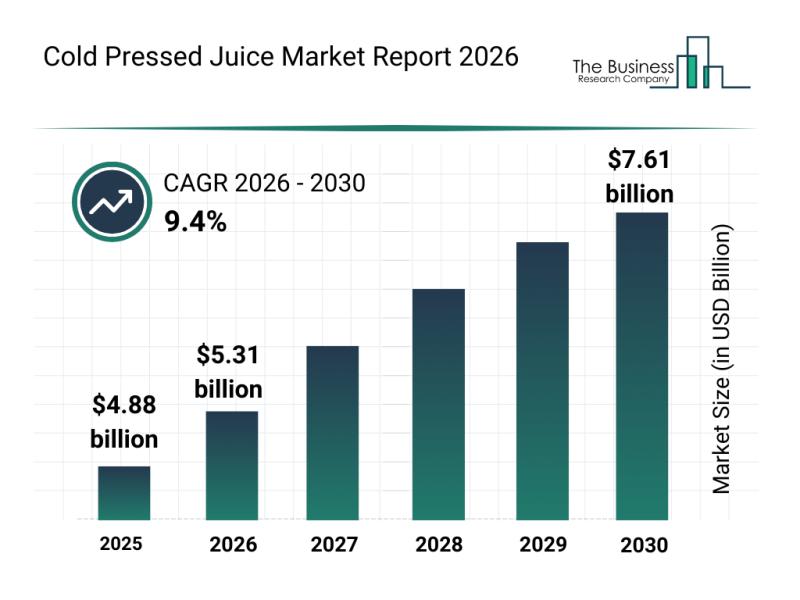

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

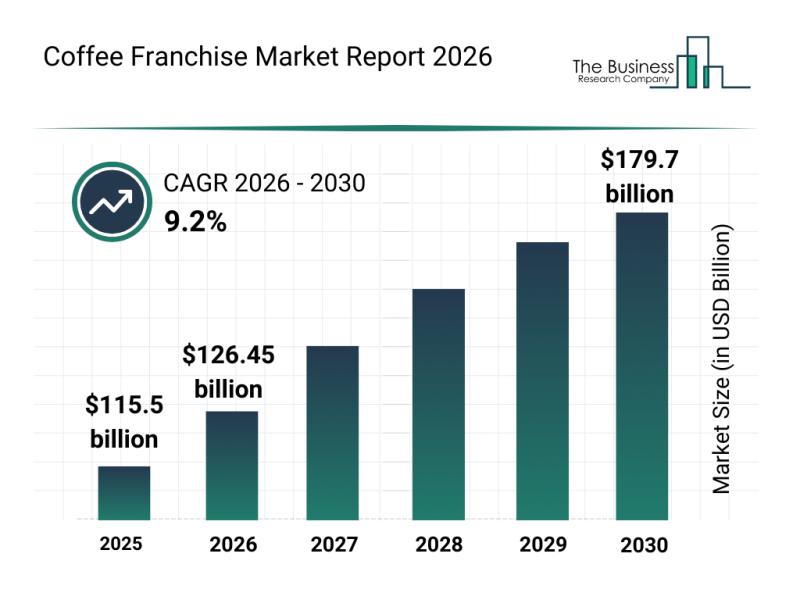

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

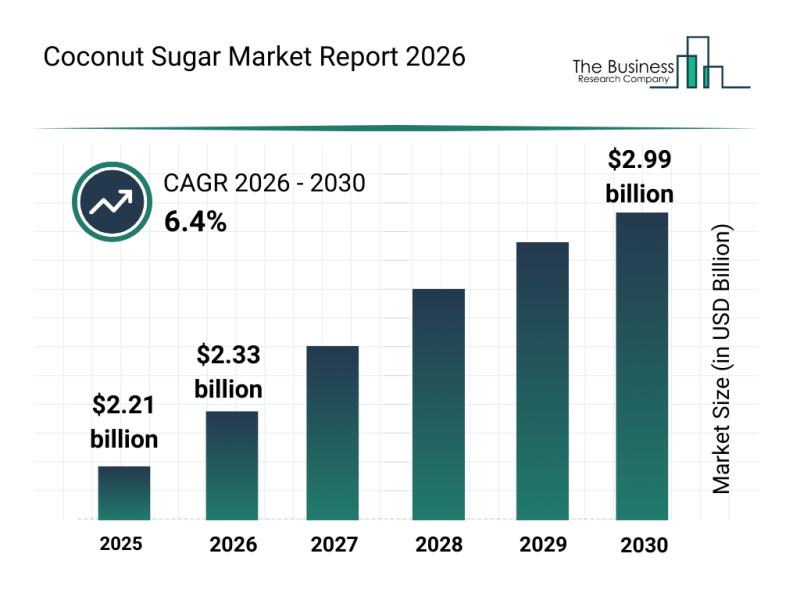

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

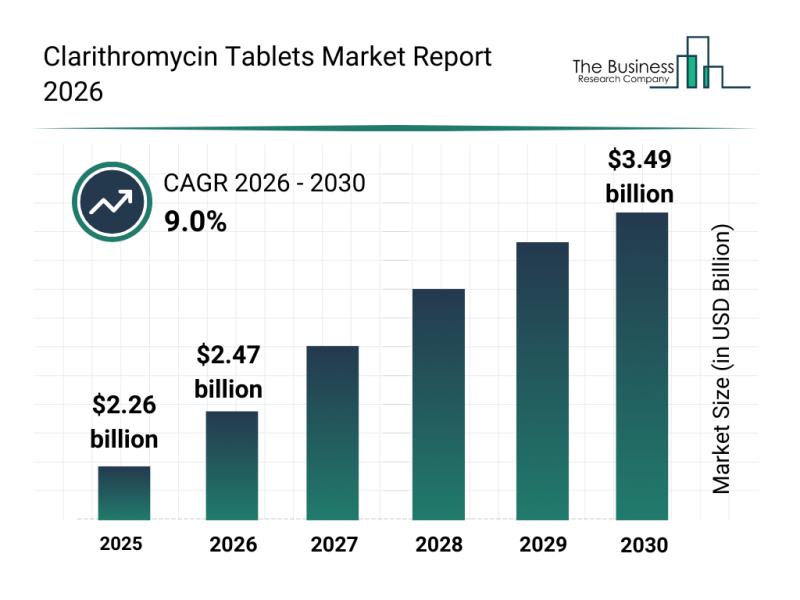

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…