Press release

Impact of COVID-19: Health Insurance Market is Thriving Worldwide | Cigna, Prudential Financial, Kaiser Permanente, Allianz Group, Aetna and New York Life Insurance Company

ReportCrux Market Research has published a new report titled "Health Insurance Market by Provider (Public Providers, and Private Providers); by Insurance Type (Medical Insurance, Income Protection Insurance, and Disease Insurance); by Coverage Type (Term Coverage, and Lifetime Coverage); by Network (Point of Service (POS), Exclusive Provider Organizations (EPOs), Preferred Provider Organizations (PPOs), and Health Maintenance Organizations), by Demographics (Adult, Minor, and Senior Citizens); and by Region: Global Industry Trends, Dynamics, Competitive Insights and Forecast Analysis, 2020 - 2027".According to the report, global demand for health insurance market was valued at approximately USD 2,095.0 Billion in 2019 and is expected to generate revenue of around USD 2,934.0 Billion by end of 2027, growing at a CAGR of around 4.3% between 2020 and 2027.

Request for sample Report https://www.reportcrux.com/get-sample/Health-Insurance-Market

Major players in health insurance market are Cigna, Prudential Financial, Kaiser Permanente, Allianz Group, Aetna and New York Life Insurance Company

Health insurance provides financial protection on medical costs to the policyholders while they are hospitalized. Healthcare costs are incurred due to any type of sickness, accident, and other mental & physical disability due to medical referral fees and care. The health plan provides coverage for these medical costs in return for a monthly fee. The insurer is obligated to cover the policyholder's medical costs before the policy's term. The coverage can vary depending on the policy for numerous factors including age groups, illnesses, government policies and others. Rising GDP and increasing healthcare spending are beneficial for the growth of this business as people are investing enough on their healthcare spending.

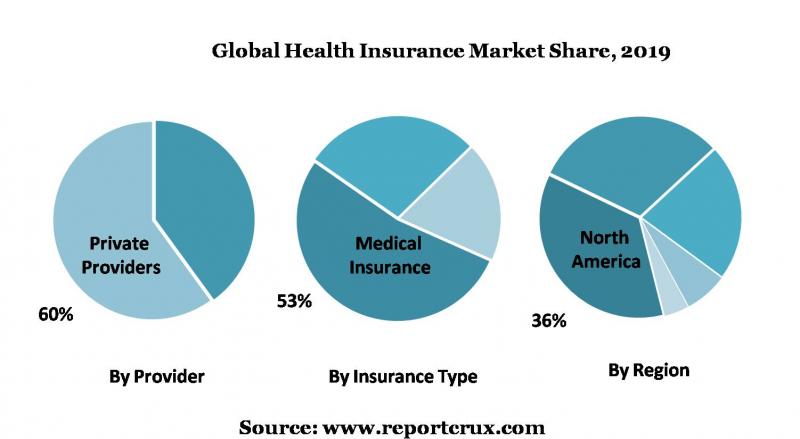

The global market for the health insurance is segmented into provider, insurance type, coverage type, network, demographics, and region. Based on provider, the market is segmented into public providers, and private providers. The private providers segment held almost 60% share of the market in 2019 as these measures shield families from unforeseen medical problems. In addition, private insurance also provides choice to the patients to opt for services and doctors through private insurance.

Based on insurance type, the market is categorized into on medical insurance, disease insurance, and income protection insurance. The market for medical insurance held almost 53% share of the market in 2019; however, the market for income protection insurance is likely to grow at high CAGR in the forecast period. Income security insurance offers benefits such as support overseas, childcare coverage, compensation on permanent illness and elective and accident surgery. In addition, income security insurance also covers costs related to recovery thus driving its adoption globally.

Based on the coverage type, the global market for health insurance is segmented into term coverage, and lifetime coverage. From this, lifetime coverage market accounted for almost 65% share of the market in 2019. The life insurance schemes benefits include lifetime coverage and assured benefit after death. Investing in life insurance also helps working people save some amount of income tax along with these advantages.

Based on network, the market is categorized into exclusive provider organizations (EPOs), preferred provider organizations (PPOs), point of service (POS), and health maintenance organizations (HMO). The market in health maintenance organizations (HMO) is likely to grow at high CAGR in the forecast period. Patients should have a primary care doctor who will help them deal with minor health related problems. It decreases hospital visits, which ultimately lowers hospitalization costs, which are expected to stimulate growth of this sector in the market. PPOs provide well-managed healthcare plans and provide patients with greater flexibility.

Based on demographics, the market is categorized into adult, minor, and senior citizens. The market in minor sector is likely to grow at high CAGR in the forecast period. The minor section comprises population in the 0-18 year group. Health insurance companies are creating child specific plans. Some of these child health insurance plans are available at lower premium rates and provide additional benefits such as cashless hospitalization that is elevating their adoption and fostering growth in the forecast period.

Regionally the market is segmented into Asia Pacific, North America, Europe, Latin America and Middle East & Africa. North America held almost 36% share of the overall market. This regional growth can be attributed to increased awareness of health insurance plans in combination with high GDP. In addition, the availability in the U.S. of leading policy providers like Medicare is helping businesses grow. Asia Pacific is likely to grow at high CAGR of almost 4.8% in the forecast period due to growing prevalence of chronic illnesses. This scenario is good for the growth of industry as it raises demand for healthcare policy makers to properly reimburse healthcare services.

Top Key Players Analysis: Cigna, Prudential Financial, Kaiser Permanente, Allianz Group, Aetna and New York Life Insurance Company

Ask Discount @ https://www.reportcrux.com/check-discount/Health-Insurance-Market

Report Highlights

Comprehensive pricing analysis on the basis of product, application, and regional segments

The detailed assessment of the vendor landscape and leading companies to help understand the level of competition in the global HEALTH INSURANCE market

Deep insights about regulatory and investment scenarios of the global HEALTH INSURANCE market

Analysis of market effect factors and their impact on the forecast and outlook of the global HEALTH INSURANCE market

A roadmap of growth opportunities available in the global HEALTH INSURANCE market with the identification of key factors

The exhaustive analysis of various trends of the global HEALTH INSURANCE market to help identify market developments

Table of Contents (TOC)

1. Global HEALTH INSURANCE Market Introduction

1.1. Definition and Taxonomy

1.2. Research Scope

2. Research Methodology

3. Executive Summary

3.1. Global Market Overview and Key Findings by Major Segments

4. Market Dynamics and Industry Trend Analysis

4.1. Market Dynamics

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. SWOT Analysis

4.3. PESTLE Analysis

4.4. Porter's Five Forces Analysis

4.5. Market Growth Attractiveness Analysis by Key Segments and Region

5. Competitive Landscape and Market Share Analysis by Manufacturers

5.1. Market Competition Scenario

5.2. Manufacturer Market Share

5.3. Manufacturer Intensity Map

5.4. Opportunity Orbits

5.5. Strategic Market Developments

6. Global HEALTH INSURANCE Market Value (USD Million), Share (%), Comparison by Key Segments

7. Global HEALTH INSURANCE Market Value (USD Million), Share (%), Comparison by Region

7.1. North America

7.1.1. North America Regional Market Size and Trend Analysis

7.1.1.1. U.S.

7.1.1.2. Canada

7.1.1.3. Rest of North America

7.2. Europe

7.2.1. Europe Regional Market Size and Trend Analysis

7.2.1.1. Germany

7.2.1.2. UK

7.2.1.3. France

7.2.1.4. Italy

7.2.1.5. Spain

7.2.1.6. Russia

7.2.1.7. Rest of Europe

7.3. Asia Pacific

7.3.1. Asia Pacific Regional Market Size and Trend Analysis

7.3.1.1. China

7.3.1.2. Japan

7.3.1.3. India

7.3.1.4. Australia

7.3.1.5. Southeast Asia

7.3.1.6. Rest of Asia Pacific

7.4. Latin America

7.4.1. Latin America Regional Market Size and Trend Analysis

7.4.1.1. Brazil

7.4.1.2. Mexico

7.4.1.3. Rest of Latin America

7.5. Middle East and Africa

7.5.1. Middle East and Africa Regional Market Size and Trend Analysis

7.5.1.1. Saudi Arabia

7.5.1.2. South Africa

7.5.1.3. UAE

7.5.1.4. Rest of Middle East and Africa

8. Company Profiles of Key Manufacturers

8.1. Company Basic Information

8.2. Company Overview

8.3. Financial Highlights

8.4. Product Portfolio

8.5. Business Strategy

8.6. Recent Market Developments

Instant View our Full Report Analysis: https://www.reportcrux.com/summary/2854/Health-Insurance-Market

Report Crux is a global market intelligence aggregator and publisher of market research reports, business information reports, economic and equity reports. We cater a diverse range of industrial sectors along with niche domains and sub-domains within the industry. We offer exclusive blend of cutting-edge market insights for the critical business needs. We have an experienced/professional team of researchers, analysts and consultants that are engaged in gathering and analyzing business information to offer best in class industry report for competitive business needs.

Contact Us:

ReportCrux Market Research

Kemp House 152 - 160 City Road London EC1V 2NX

phone Number: +91 895 615 7215

website: https://www.reportcrux.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Impact of COVID-19: Health Insurance Market is Thriving Worldwide | Cigna, Prudential Financial, Kaiser Permanente, Allianz Group, Aetna and New York Life Insurance Company here

News-ID: 2033074 • Views: …

More Releases from ReportCrux Market Research

Fluorescence In Situ Hybridization (FISH) Imaging Systems Market 2022 Size, Anal …

Global Fluorescence In Situ Hybridization (FISH) Imaging Systems market report professionals study based on market drivers, market restraints and its future Aspects with growth trends, various stakeholders like investors, suppliers, SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. Fluorescence In Situ Hybridization (FISH) Imaging Systems market report study covers the global and regional market with an in-depth analysis of the overall growth prospects in the market.

Fluorescence in…

Commercial Vehicle Telematics Market Size: Top Countries Segmented by Applicatio …

Global Commercial Vehicle Telematics market report 2022 experts contribute the global and regional market with an in-depth analysis of the overall growth prospects in the market. Commercial Vehicle Telematics report offers detailed data of leading companies encompassing their successful marketing strategies, market contribution, and recent developments in both historic and present contexts about Expected Market Status, Market Opportunity and Market Growth in the next five years.

Commercial Vehicle Telematics Market is…

Heat Not Burn Products Market 2022 Analysis by Current Industry Status & Grow …

Global "Heat Not Burn Products market" 2022 report provides Comprehensive report with top key players/manufacturers, suppliers, distributors, traders, customers, investors and major types as well as applications and forecast period for value chain analysis. The Heat Not Burn Products market report provides potential market opportunities for evaluating the Overall Market, underlining opportunities, and supporting strategic and tactical decision-making. The report further offers a dashboard overview of leading companies encompassing their…

Global Foot and Ankle Device Market 2022 Size, Share, Competition, Scope, Status …

Global "Foot and Ankle Device market" 2022 provides a comprehensive analysis of the business models, key strategies, and respective market shares of some of the most prominent players in this countryside. Along with an in-depth explanation on the key influencing factors, market statistics in terms of revenues, segment-wise data, region-wise data, and country-wise data are offered in the full study. This study is one of the most detailed documentation that…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…