Press release

Mobile Banking Market 2020: Soaring Demand Assures Motivated Revenue Share by 2025 | Analysis by Atom Bank, Simple Finance Tech, Fidor, Ubank, Monzo Bank, MyBank

All information provided in the report is derived from trusted industrial sources. Global Mobile Banking Market research reports finds market figures between 2020 and 2025. The market will exhibit remarkable CAGRs in the aforementioned period.Global Mobile Banking Market Overview:

This report studies the Global Mobile Banking Market over the forecast period of 2020 to 2025. The Global Mobile Banking Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2020 to 2025.

Mobile banking is an online system provided on mobile phones where customers are offered by banking services. In addition, rapid growth in the number of smartphone users, mobile banking subscribers are also expected to grow in millions, having banks shift their focus to customer mobile transactions. It is both preferable and comfortable for users to conduct transactions using their smartphones, giving banks an opportunity to gain a competitive leverage over others and position themselves better in the market. M-banking also facilitates mapping, recording and studying customers' financial transactions and behavior and offer customized services accordingly; allowing banks to gain customer loyalty.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/241176 .

The Global Mobile Banking Market is segmented on the basis of Type, Application and Region. Mobile Banking market is cover distinctive segment market estimate, both volume and value, also cover diverse businesses customers' data, which is imperative for the makers.

Based on the Type, the Global Mobile Banking Market is sub-segmented into Neo Bank, Challenger Bank and others. On the basis of Application, the Global Mobile Banking Market is classified into Business, Personal and others.

In terms of the geographic analysis, The Mobile Banking Market in North America is expected to grow at the highest CAGR during the forecast period. Moreover, the presence of major players in the Mobile Banking Market ecosystem results in the increasing adoption of these systems in North America.

Global Finance Industry News:

Simple Finance Technology (March 10, 2020) - Simple Announces Launch of Tax Refund Feature to Automate Savings for Customers - Simple has introduced a Tax Refund feature ahead of tax season. The feature helps customers build savings by designating a portion or all of their anticipated tax refund automatically moves into their high-yield checking accounts.

The tax refund feature is one of a series of integrated and automated budgeting and banking tools designed to help customers manage their money more confidently and more effectively to achieve their financial goals.

"We know from ongoing conversations with our customers that they don't save as much as they'd like," said David Hijirida, Simple CEO. "We are continually looking for ways to make the savings process as simple, painless and automatic as possible for them. This new feature does that, by moving a portion of their tax refund out of their checking account and into a separate account that earns a higher rate of interest."

Simple customers learned about the new Tax Refund feature through emails and in-app communications in late February, well in advance of most tax refunds. Customers who have their tax refunds direct-deposited into a Simple account and opt-in to the feature are eligible to participate. When a tax refund from the IRS is direct-deposited to a customer's account, the predetermined percentage is automatically transferred to the customer's Protected Goals Account.

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on "Global Mobile Banking Market Report 2020" @ https://www.businessindustryreports.com/buy-now/241176/single .

Top Leading Key in Players Global Mobile Banking Market: Atom Bank, Movencorp, Simple Finance Technology, Fidor Group, N26, Pockit, Ubank, Monzo Bank, MyBank (Alibaba Group), Holvi Bank, WeBank (Tencent Holdings Limited), Hello Bank, Koho Bank, Rocket Bank, Soon Banque, Digibank, Timo, Jibun, Jenius, K Bank, Kakao Bank, Starling Bank, Tandem Bank and others. New product launches and continuous technological innovations are the key strategies adopted by the major players.

With the presence of a large pool of participants, the Global Mobile Banking Market is displaying a highly competitive business landscape, finds a new research report by Business Industry Reports (BIR). Atom Bank, Movencorp, Simple Finance Technology, Fidor Group, N26, Pockit, Ubank, Monzo Bank, MyBank (Alibaba Group), Holvi Bank, WeBank (Tencent Holdings Limited), Hello Bank, Koho Bank, Rocket Bank, Soon Banque, Digibank, Timo, Jibun, Jenius, K Bank, Kakao Bank, Starling Bank, Tandem Bank are some of the key vendors of Mobile Banking across the world. These players across Mobile Banking Market are focusing aggressively on innovation, as well as on including advanced technologies in their existing products.

Region segment: Mobile Banking Market report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Mobile Banking in these regions, from 2013 to 2025 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/241176 .

Major Points in Table of Contents:

Global Mobile Banking Market Report 2020

1 Mobile Banking Product Definition

2 Global Mobile Banking Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Mobile Banking Shipments

2.2 Global Manufacturer Mobile Banking Business Revenue

2.3 Global Mobile Banking Market Overview

3 Manufacturer Mobile Banking Business Introduction

3.1 Atom Bank Mobile Banking Business Introduction

3.2 Movencorp Mobile Banking Business Introduction

3.3 Simple Finance Technology Mobile Banking Business Introduction

3.4 Fidor Group Mobile Banking Business Introduction

3.5 N26 Mobile Banking Business Introduction

3.6 Pockit Mobile Banking Business Introduction

................... Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is a digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined - we want to help our clients envisage their business environment so that they are able to make informed, strategic, and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune - India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Banking Market 2020: Soaring Demand Assures Motivated Revenue Share by 2025 | Analysis by Atom Bank, Simple Finance Tech, Fidor, Ubank, Monzo Bank, MyBank here

News-ID: 2030217 • Views: …

More Releases from Business Industry Reports

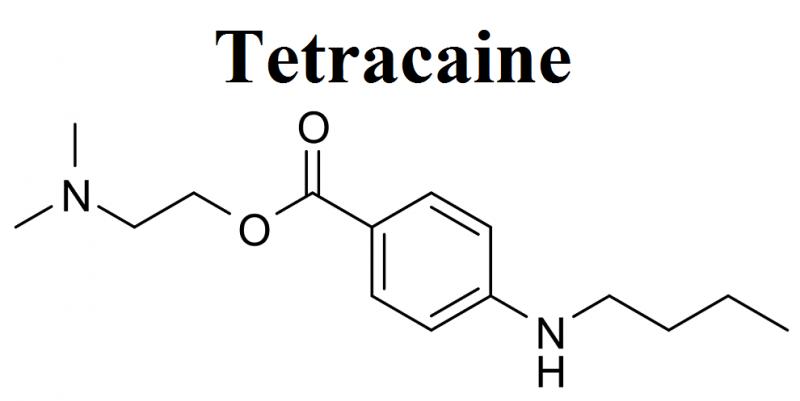

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

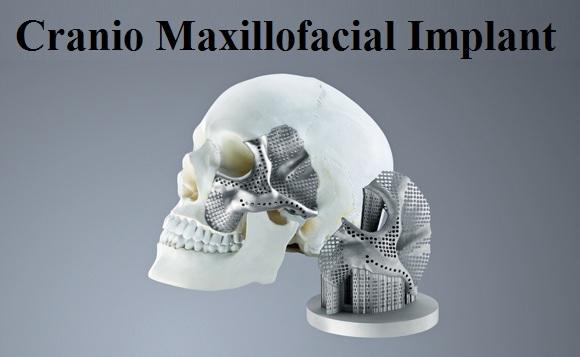

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…