Press release

Growing Demand for Insurance Fraud Detection Market at 17.8% of CAGR Through 2026 | Know the Impact Analysis of Corona-virus/COVID19

The Global Insurance Fraud Detection Market was valued at USD 2.3 Billion in 2018 and is expected to reach USD 8.8 Billion in 2026, growing at a CAGR of 17.8% during the forecast period.The ripple effect of Coronavirus-COVID19 on the Insurance Fraud Detection Market Ecosystem needs to become part of strategy discussions to emerge strong. The Analyst team is meticulously tracking the impact and relevance to all the sectors in the Insurance Fraud Detection Market. Key data sets include Revenue Impact analysis, Disruptions and New opportunities in the Supply Chain, Revised Vendor Landscape Mix, New opportunities mapping, and more.

Download Sample ToC to understand the COVID19 impact and be smart in redefining business strategies.

https://www.alltheresearch.com/impactC19-request/227

Company Profiles and Competitive Intelligence:

The major players operating in the global insurance fraud detection market are SAP SE, IBM Corporation, BAE Systems, SAS Institute, Fair Isaac Corporation, FRISS, Experian Information Solutions, Inc., LexisNexis Risk Solutions Inc., iovation Inc., and Simility, Inc., among others.

The deployment of cloud-based insurance fraud detection solutions includes software, infrastructure, platforms, devices, and other resources, that are provided as services on a pay-per-use basis by consumers. The rise in adoption of cloud computing services with increasing security issues will motivate the organizations to shift their attention towards the cloud security. IBM is one of the key players in cloud security. The company offers a wide range of enterprise-grade security services to safeguard an organization's cloud environments.

Identity theft occurs in stealing personal identifying information including name, address, banking account number, ID number, username or password to commit fraud. According to the Council On Foreign Relations, Brazil ranks second in the world for online banking fraud and financial malware. The number and intensity of cyber-attacks have risen at a very fast pace over the past few years and this will augment the market in the near future. Moreover, the rate at which online banking increased has affected the security of their transactions. The attackers have been continuously trying to attack the bank and its customers to create either financial or data loss. Recently, in 2017, Lloyds Banking Group reported a 48-hour online attack in which cybercriminals attempted to block access to 20 Billion UK accounts.

By Application: Claims Fraud, dentity Theft, Payment and Billing Fraud, Money Laudering and more...

Download Exclusive Free Sample PDF with Top Companies Market Positioning Data

https://www.alltheresearch.com/sample-request/227

Key Findings of Insurance Fraud Detection Market:

?Based on the component, the solutions segment is expected to dominate the market with nearly 65% share in the Global Insurance Fraud Detection Market in 2018.

?Based on the deployment mode, the on-premise segment accounts for the largest share in the Insurance Fraud Detection Market and is expected to grow at a CAGR of 21% during the forecast period.

?Based on the application, the payment and billing fraud segment is expected to dominate the market during the forecast period.

?North America accounted for nearly 44% share of The Global Insurance Fraud Detection Market in 2018.

View Complete Report with Different Company Profiles

https://www.alltheresearch.com/report/227/insurance-fraud-detection-market

Contact:

AllTheResearch

Contact Person: Rohit B.

Tel: 1-888-691-6870

Email: contactus@alltheresearch.com

About Us:

AllTheResearch was formed with the aim of making market research a significant tool for managing breakthroughs in the industry.

As a leading market research provider, the firm empowers its global clients with business-critical research solutions.

The outcome of our study of numerous companies that rely on market research and consulting data for their decision-making made us realise, that its not just sheer data-points, but the right analysis that creates a difference.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growing Demand for Insurance Fraud Detection Market at 17.8% of CAGR Through 2026 | Know the Impact Analysis of Corona-virus/COVID19 here

News-ID: 2027682 • Views: …

More Releases from AllTheResearch

Industry Update: Healthcare IT Integration Market will Reach 7.5 Billion by 2027

Healthcare It Integration Market Analysis 2021 covers the global and regional market with an in-depth analysis of the market's overall growth prospects. Global Healthcare It Integration market growth to reach 7.5 Billion USD in 2027 with a CAGR value 12.2% from 2021 to 2027. Projected and forecast revenue values are in constant U.S. dollars, unadjusted for inflation. Product values are estimated based on manufacturers’ revenue and regional markets for Healthcare…

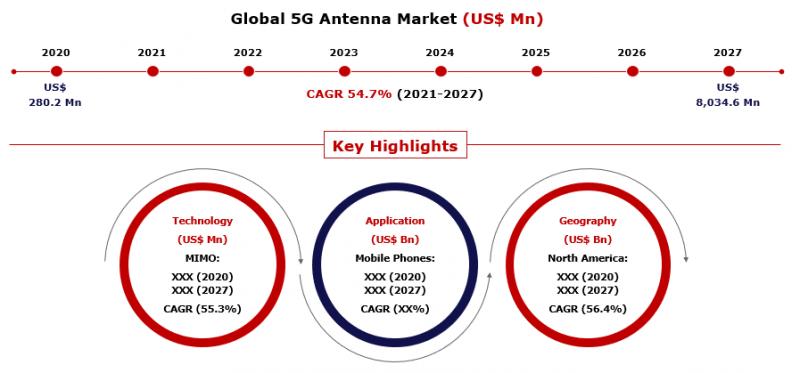

Demand for 5G Antenna Market to Witness Rapid Surge During the Period 2021-2027

5G Antenna Market by Type (Switched Multi-Beam Antenna, Adaptive Array Antenna); by Technology (SIMO, MISO, MIMO); by Application (Mobile Phones, Factory Automation, IoT, Connected Vehicles, Others); and by Region (North America, Europe, Asia Pacific, Latin America, MEA); - Global Forecasts 2021 to 2027

The Global 5G Antenna Market is an emerging market in the present years. The report covers the present and past market scenarios, market development patterns, and is likely…

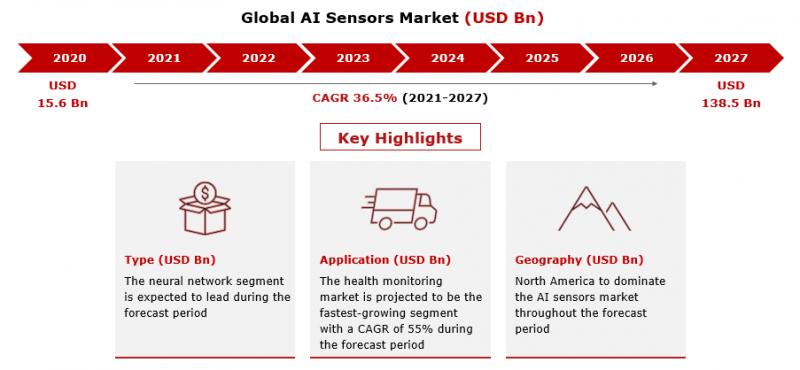

AI Sensors Market to Grow at CAGR of 36.5% Through 2021 to 2027

AI Sensors Market by Type (Case-based Reasoning, Ambient-intelligence, Neural Networks, Inductive Learning, Other); by Application (Biosensor, Health Monitoring, Maintenance and Inspection, Human-computer Interaction, Others); and by Region (North America, Europe, Asia Pacific, Latin America, MEA); - Global Forecasts 2021 to 2027

AI Sensors Market was valued at USD 15.6 Billion in 2020 and is expected to reach USD 138.5 Billion by 2027, with a growing CAGR of 36.5% during the forecast…

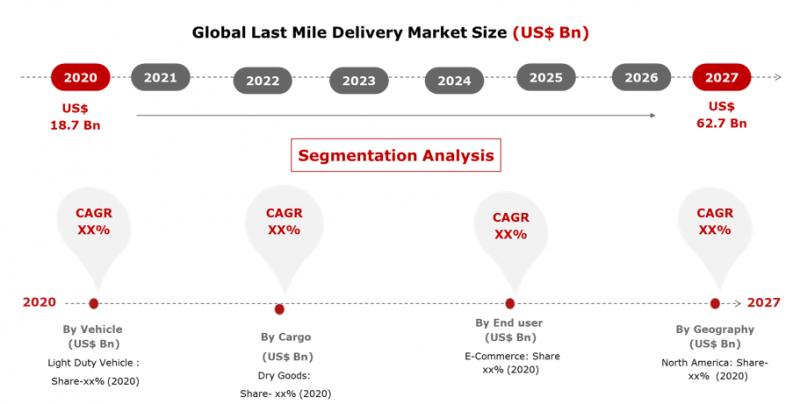

Last Mile Delivery Market Will Expand at CAGR of 18.9% by 2027

Last Mile Delivery Market by Vehicle (Light Duty Vehicle, Medium Duty Vehicle, Heavy Duty Vehicle), by Cargo (Dry Goods, Postal, Liquid Goods), by End User (Chemical, Pharmaceutical and Healthcare, FMCG, E-Commerce) by Region (North America, Europe, Asia-pacific, Rest of the World): Global Forecasts 2021 To 2027.

The global Last Mile Delivery Market was valued at USD 18.7 Bn in 2020, and it is expected to reach USD 62.7 Bn by 2027,…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…