Press release

Contactless Payments in the Age of Covid-19

In the next few months as we, hopefully, return slowly to "business as usual", the usage in contactless payments will continue to rise. Contactless payments made by mobile devices will soon follow, as the CVM limit is less of an issue there. It seems quite safe to say that the exceptions of today will become the standards of tomorrow.According to a study of Research Dive,the global contactless payment market forecast will surpass $20,340.3 million by 2026, increasing at a healthy CAGR of 11.2%.

The incredible growth in internet users mainly because of strong internet performance is one an impetus for the contactless payment market growth, over the forecast period. Also, with digital transformation in developed as well as developing countries, popularity for contactless transactions is extensively increasing as it provides convenience and advanced security. For instance, in India, UPI's (unified payments interface) popularity has grown tremendously; moreover, the transaction volumes have enormously grown from $4,05,371.8 in August 2016 to $24,71,29,87,950.0 in October 2019. These key factors may boost the growth of the global contactless payment market, during the forecast period.

Download Exclusive Sample Copy of the Report at: https://www.researchdive.com/download-sample/181

Moreover, the biggest smartphone companies are providing services of contactless payment methods such as Google pay, Apple pay and Samsung Pay.These advancements are projected to drive the demand for the contactless payment market, during the forecast period. Furthermore,improved loyalty, faster transaction,enhanced customer experience,and satisfaction are driving the growth of the contactless payment market, during the forecast period.

Market Restraint:

On the other hand, the high cost of deploying contactless payment technologies is expected to obstruct the growth of the contactless payment market. The digital transformation in the banking sector is anticipated to generate a noticeable revenue for the contactless payment market.

Also, enormously rising popularity for smartphones and smartwatches, coupled with contactless debit/credit cards are offering convenience and easier payment methods to the clients. Furthermore, the digital economy has shown a great influence on the local as well as global transactions. These factors may lead to create lucrative opportunities for the growth of the contactless payment market.

The mobile handsets for contactless payment market are anticipated to have the largest market share, and it shall generate a revenue of $5,288.5 million by 2026, increasing at a CAGR of 11.7%, over the projected period. The significance of contactless smartphone payment is that it offers greater security when the transaction is made with phones. In contactless mobile payment, a hacker can't get access to the card details. The card information is either stored in the cloud, or in the secure elements of the smartphone.

The NFC chips shall experience positive growth in the market and this category is expected to generate a revenue of $3,824.0 million by 2026, increasing at a healthy CAGR of 11.8%. This is mainly because NFC chip-based devices are enabled with the tokenization facility which creates a token (unique code) that is sent from the customer's device to the merchant's NFC-enabled device. This entire transaction process is highly secured; thus, its usage in retail sectors has grown significantly.

Connect with Analyst to Reveal How COVID-19 Impacting On Contactless Payments Market: https://www.researchdive.com/connect-to-analyst/181

The BFSI (banking, financial services, and insurance) segment will witness a significant growth in the global market and it is anticipated to surpass $1,827.0 million by 2026, rising at a healthy rate of 10.6%. This is mainly because the contactless payment platform for the banking sector ensures safety for the customers' bank information. This system has the highly advanced fraud monitoring tools which help banks to decrease their fraud losses by tracking and detecting any suspicious card activities. Furthermore, this platform offers key advantages like real-time monitoring, quick identification of fraud &fast implementation, and fraud reduction by using 3D Secure service and SMS alerts.

The retail sector has experienced major growth, during the forecast period, in the global market. This sector is expected to generate a revenue of $4,088.4 million by 2026, increasing at a healthy CAGR of 10.6%. This is mainly because market leaders are emphasizing more to make secure contactless payments. contactless payment is also involved with processes at the point of transaction, like collection and redemption of loyalty points. The impact of contactless mobile is significant in the retail sector also it offer new customer experiences like displaying special offers in the store. These key factors may boost the demand for the contactless payment system into the global retail sector.

Regional Insights:

North America has a major share, during the projected period, in the global market. This region is anticipated to register a revenue of $6,712.3 million by 2026, growing at a rate of 10.4%. The strong presence of market leaders like Discover, American Express, STAR, Visa, and MasterCard, along with their heavy investment to protect the personal financial information of the clients is projected to surge the growth of this region in the global market. Moreover, this platform offers multilayered protection for security of the traditional debit and credit payment systems. Furthermore, security measures are used to authorize online payments to curb risks and detect real-time fraudulent activities, which are also some of the key factors for the growth of this region.

Major Players in Contactless Payment Market:

The major contactless payment market playersare VERIMATRIX,Ingenico Group., Paycor, Inc,VeriFone, Inc., Castles Technology,On Track Innovations LTD., Alcineo,SumUp Inc., Infineon Technologies AG,and C.Bitel.To elaborate more on the competitive landscape analysis of market players, the porter's five force model is explained in this report.

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York

NY 10005 (P)

+ 91 (788) 802-9103 (India)

+1 (917) 444-1262 (US) Toll

Free : +1 -888-961-4454

Email: support@researchdive.com

LinkedIn: https://www.linkedin.com/company/research-dive

Twitter: https://twitter.com/ResearchDive

Facebook: https://www.facebook.com/Research-Dive

Blog: https://www.researchdive.com/blog

About Us:

Research Dive is a market research firm based in Pune, India. Maintaining the integrity and authenticity of the services, the firm provides the services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive deliver the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Contactless Payments in the Age of Covid-19 here

News-ID: 2027259 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

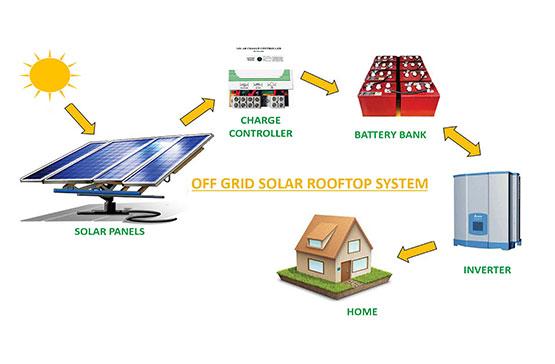

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…