Press release

Short Term Insurance Market 2020: Intelligence Report Includes Market Revenue and Top Key Players (AIG, UnitedHealthcare, National General, Aviva, USAA, Chubb, CPIC) | Foreseen Till 2025

The exclusive research report on the Global Short Term Insurance Market 2020 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Short Term Insurance Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.Overview of Global Short Term Insurance Market:

The report spread across 90 pages is an overview of the Global Short Term Insurance Market Report 2020. The analytical examination is proposed to give immense clarity on the market size, share and growth rate crosswise over various regions. The significant information and broad examination of the patterns from the days of old and future goes for offering the stakeholders, product owners, and marketing work force an aggressive edge over others working in the Short Term Insurance Market for the figure forecast period 2020 - 2025.

This report studies the Global Short Term Insurance Market over the forecast period of 2020 to 2025. The Global Short Term Insurance Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2020 to 2025.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/263417 .

The Global Short Term Insurance Market is segmented on the basis of Type, Application and Region. Based on the Type, the Global Short Term Insurance Market is sub-segmented into Household Insurance, Vehicle Insurance, Personal Liability Insurance and others. On the basis of Application, the Global Short Term Insurance Market is classified into Individual, Group and others.

In terms of the geographic analysis, The Short Term Insurance Market in North America is expected to grow at the highest CAGR during the forecast period. Moreover, the presence of major players in the Short Term Insurance Market ecosystem results in the increasing adoption of these systems in North America.

Global Short Term Insurance Market Objectives:

1 To provide detailed information regarding key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the Short Term Insurance Market

2 To analyze and forecast the size of the Short Term Insurance Market, in terms of value and volume

3 To analyze opportunities in the Short Term Insurance Market for stakeholders and provide a competitive landscape of the market

4 To define, segment, and estimate the Short Term Insurance Market based on deposit type and end-use industry

5 To strategically profile key players and comprehensively analyze their market shares and core competencies

6 To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

7 To forecast the size of market segments, in terms of value, with respect to main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America

8 To track and analyze competitive developments, such as new product developments, acquisitions, expansions, partnerships, and collaborations in the Short Term Insurance Market

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on "Global Short Term Insurance Market Report 2020" @ https://www.businessindustryreports.com/buy-now/263417/single .

Top Leading Key Manufacturers are: UnitedHealthcare, OUTsurance, National General, The IHC Group, Cuvva, Aviva, PSG Konsult, State Farm, National Health Insurance Company, SBI Holdings, Santam, USAA, Lidwala Insurance, Liberty Mutual, Chubb, CPIC, AIG, VIVA VIDA, Aeon Life and others. New product launches and continuous technological innovations are the key strategies adopted by the major players.

Latest Insurance Industry News:

American International Group (AIG) (March 13, 2020) - AIG Announces Adjustments to Warrant Exercise Price and Shares Receivable upon Warrant Exercise - American International Group, Inc. today announced that in accordance with the terms of the outstanding warrants expiring January 19, 2021 (CUSIP number 026874156) (the "Warrants") to purchase shares of AIG Common Stock, par value $2.50 per share, the Warrant exercise price will be reduced to $42.7176 per share from $42.9413 per share and the number of shares of AIG Common Stock receivable upon Warrant exercise will increase to 1.055 from 1.050. Each of these adjustments will be effective at the close of business on March 16, 2020. Any Warrant exercised on or prior to March 16, 2020 will not be entitled to these adjustments.

These adjustments resulted from the declaration by the Board of Directors of AIG on February 12, 2020 of a dividend of $0.32 per share on AIG Common Stock. The dividend is payable on March 30, 2020 to stockholders of record at the close of business on March 16, 2020.

Further information on the Warrants and the adjustments to the Warrant exercise price and number of shares of AIG Common Stock receivable upon Warrant exercise, including the U.S. Federal income tax treatment of these adjustments, will be available in the Investors section of AIG's website.

American International Group, Inc. (AIG) is a leading global insurance organization. AIG member companies provide a wide range of property casualty insurance, life insurance, retirement solutions, and other financial services to customers in more than 80 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock Exchange.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Short Term Insurance in these regions, from 2013 to 2025 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/263417 .

Major Points in Table of Contents:

Global Short Term Insurance Market Report 2020

1 Short Term Insurance Product Definition

2 Global Short Term Insurance Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Short Term Insurance Shipments

2.2 Global Manufacturer Short Term Insurance Business Revenue

2.3 Global Short Term Insurance Market Overview

3 Manufacturer Short Term Insurance Business Introduction

3.1 UnitedHealthcare Short Term Insurance Business Introduction

3.2 OUTsurance Short Term Insurance Business Introduction

3.3 National General Short Term Insurance Business Introduction

3.4 The IHC Group Short Term Insurance Business Introduction

3.5 Cuvva Short Term Insurance Business Introduction

3.6 Aviva Short Term Insurance Business Introduction

................... Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined - we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune - India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Short Term Insurance Market 2020: Intelligence Report Includes Market Revenue and Top Key Players (AIG, UnitedHealthcare, National General, Aviva, USAA, Chubb, CPIC) | Foreseen Till 2025 here

News-ID: 2024981 • Views: …

More Releases from Business Industry Reports

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

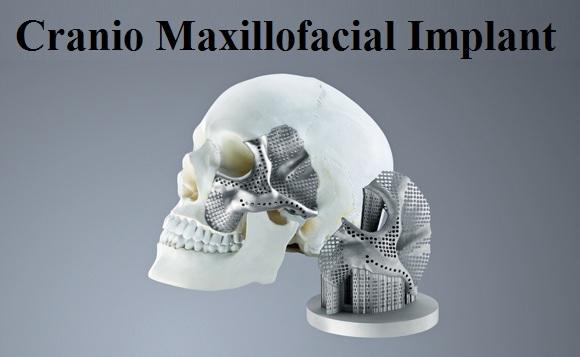

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…