Press release

Tally - Protecting the value of your money and keeping it safe. In an actual safe.

London, 17 Apr 2020:We all know these are difficult and unprecedented times, with the vast majority of people working from home and accepting limits on basic personal freedoms that would have been unthinkable only a month ago. The government has been forced to create ("print") an extraordinary amount of money, 350 billion pounds and growing, to support individuals and businesses through this crisis. Called Quantitative Easing ("QE" for short), this step, though necessary in the short term, takes a long time (if ever) to reverse and can have ongoing ramifications for a generation.

Most people are familiar with the notion of inflation, where the prices of the goods and services you buy periodically increase in price. Most people don't give too much thought to this and accept it as a way of life, even a good thing - since we're told it indicates the economy is 'growing' and 'healthy'.

But most people don't naturally connect why this devaluation happens. When more money is created by a government's central bank, the value of the money already out there (like savings in your bank account) is diluted. And that causes prices of things to noticeably increase. We see the increase in asset prices (eg the housing market and the stock market), which makes us feel good if we've got these assets (at least until a correction occurs), but when it starts increasing the prices of everyday goods and services, more people start to lose confidence in their money maintaining its purchasing power, which in turn can lead to significantly higher (hyper) inflation. The consequences of all this QE in the UK are starting to be discussed in the mainstream British media, and people are worried about protecting the value of their money. But how can they hold their money in a way that is protected from devaluation by inflation? There is an answer.

Some might suggest holding your savings in cryptocurrencies, but many are suspicious of cryptocurrencies such as Bitcoin due to ongoing negative press and confusion about how it is valued and how to access and spend the digital tokens.

Gold is great for protecting the long term value of your savings. Whilst the price of gold can fluctuate (up and down) against fiat currency in the short term, historically it is proven to hold its value over time. But gold can be costly to purchase, particularly in smaller quantities and a pain to store and insure. It's also inconvenient and costly to sell when you need some cash. Not to mention there's the matter of what you actually own - is it physical gold or just a paper instrument like an ETF or futures contract? Money is made up of three key elements and gold is a great store of value, but not a great medium of exchange nor a great unit of account.

The safety and protected value of gold - with the usability of money.

There is very little good news arising from the current state of affairs, and very few winners apart from select online retailers. But amongst all this, there lay a positive solution that is ready for people right now to protect the value of their money and savings.

Tally provides all the benefits of gold without the hassle; combined with instant liquidity and use as money in a banking account.

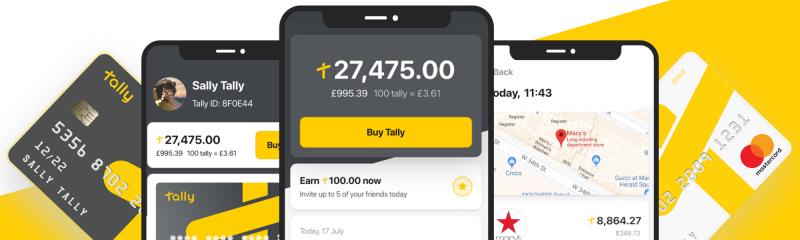

What makes Tally groundbreaking, is that it offers individual everyday banking accounts using monetised real, physical gold, locked in a real vault. Customers have an individual banking account with a debit card (not a pre-paid top up card where their savings are held in a pooled customer account). And important to note, Tally is not a cryptocurrency.

Tally delivers the UK's first banking app to offer everyday banking accounts for non-government money, delivering seamless, instant depositing, spending and transfers of asset-based money. Unlike a traditional bank account, Tally gives consumers full ownership and control of their money as Tally is physical gold held outside the banking system, whilst seamlessly working with it. And the value of Tally being the gold price means customers' savings are protected from inflation and bank lending risk, and insulated from political and economic uncertainty. And Tally is a full-reserve banking system so customer deposits are not lent out - their money stays put.

One Tally is one milligram of physical gold ethically sourced and held in a globally accredited high security vault in Switzerland. When customers make a deposit from their traditional bank account, their GBP or Euros instantly convert into Tally at the global gold spot price. Customers can transfer Tally from their individual banking account to their pounds or euro account, and spend via their contactless Tally debit Mastercard?. Tally is accepted anywhere in the world that accepts Mastercard, and there are no transaction costs and no FX mark-ups. And free ATM withdrawals - which is important for when we're allowed to travel again.

There are none of the purchase, storage or insurance costs that you get with buying gold. Just a simple single monthly subscription fee of 0.1% of the average monthly holding (i.e. 1.2% per annum), which covers storage, security, insurance and operational costs. For note, the value of pounds sterling has decreased relative to gold at an average rate of 7.8% per year over the past 20 years.

Cameron Parry, co-Founder and CEO of Tally, said:

"We are living through unprecedented times and people have rightly been prioritising their family's health, but it's also important they focus on their family's financial wellbeing. With 'whatever it takes' amounts of new money being created out of thin air by governments, it's never been more relevant to look at what type of money is available to the mainstream public.

Tally may be relatively new to the UK digital banking sector, but we are the only one addressing the real problem in banking - the money itself. The underlying asset of the money held in a Tally account is proven and sought after and considered valuable the world over. And since its launch only months ago, the purchasing power of Tally has already increased significantly when compared to pounds sterling and other G7 currencies.

Tally was designed to protect the value of our customers' savings, insulate their deposits from bank risk and safeguard their access to their money. (We also set about making the Tally banking app engaging and easy to use.)

Now that it's available to us, we should all be holding some of our cash in a self-contained back-up account that is protected from the risks of traditional banking. It's time we upgrade our money."

Tally is available for download on the App Store and Google Play Store.

For more information on Tally go to www.tallymoney.com.

The small print.

Tally relative to GBP (?) can rise or fall due to fluctuations in the global gold price.

This card is issued by Cornercard UK Limited pursuant to a license by Mastercard International. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

TallyMoney Ltd is an Electronic Money Directive Agent (Financial Conduct Authority Reference Number 902059) of the FCA-licensed E-Money Institution, PayrNet Limited (FCA Reg. No. 900594).

22 NW WORKS

QUEENS PARK

NW66RJ

press@tallymoney.com

Tally uses the latest innovations in financial technology to create an independent monetary platform and hard-asset currency that sits outside of the existing banking system, while seamlessly operating with it.

Tally is the name of the platform and also the name of the currency. 1 Tally = 1 milligram of vaulted gold. Using gold as the 100% physical reserve means the value of customers' money is protected from inflation and systemic bank risks associated with the fiat currency-based fractional reserve banking model, while offering the familiar usability of a personal bank account and contactless debit card.

For the first time, people have a choice and can hold a banking account with a physical asset money that is independent, insulated and innovative -- giving ultimate control and certainty back into the hands of the consumer.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tally - Protecting the value of your money and keeping it safe. In an actual safe. here

News-ID: 2015412 • Views: …

More Releases for Mastercard

Authority.inc Selected for Mastercard Lighthouse Program

We are thrilled to announce that Authority.inc has been selected for the prestigious Mastercard Lighthouse FINITIV program. This highly competitive partnership initiative - "born in the Nordics and Baltics" and designed to help startups "scale new heights in fintech and beyond" - is dedicated to discovering the next wave of fintech innovation. Being chosen for Mastercard's Lighthouse program is a significant milestone for Authority.inc, reflecting a strong vote of confidence…

Crypto Credit Card Market Key Players Analysis - Nexo Mastercard, BlockFi Visa C …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Crypto Credit Card Market - (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."

According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at USD 1.6 billion in 2024, and it…

Crypto Credit Card Market Top Companies Study - Nexo Mastercard, BlockFi Visa Ca …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Crypto Credit Card Market - (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at US$ 10.1 billion in 2023, and it…

Crypto Credit Card Market Key Players Analysis - Nexo Mastercard, BlockFi Visa C …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Crypto Credit Card Market - (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at US$ 10.1 billion in 2023, and it…

B2B Money Transfer Market By Key Players : VocaLink (Mastercard), Fexco, Optal, …

Industry Overview of B2B Money Transfer Market:

B2B payments for exporters. Save time and money on international B2B payments with your own virtual IBAN in Europe with direct access to SEPA countries. Whilst traditional banks still facilitate the vast bulk of B2B cross-border transactions, new technologies, such as virtual accounts, e-invoicing, and blockchain technology will aid in driving businesses to solutions which provide savings in time and transparency.

The fundamental purpose of…

Prepaid Card MARKET 2017- Visa, MasterCard, UnionPay

Apex Research, recently published a detailed market research study focused on the "Prepaid Card Market" across the global, regional and country level. The report provides 360° analysis of "Prepaid Card Market" from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global Prepaid Card industry, and estimates the future trend of Prepaid Card market…